January 2025

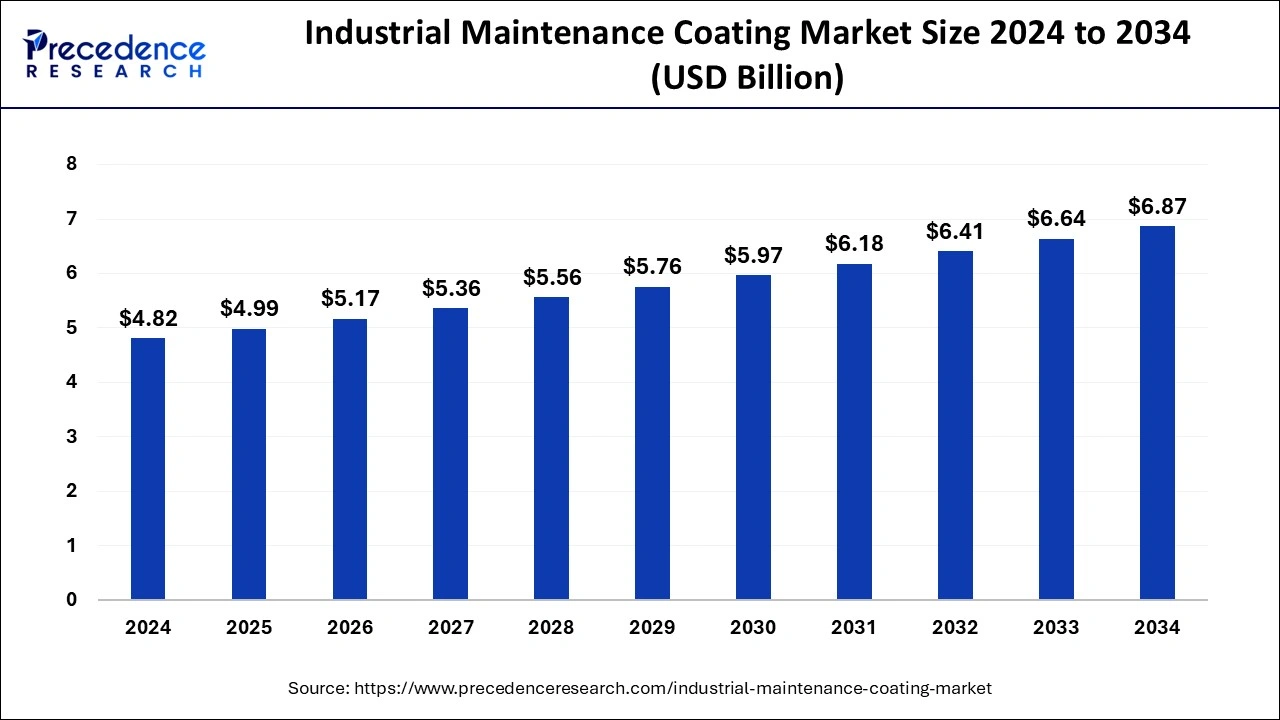

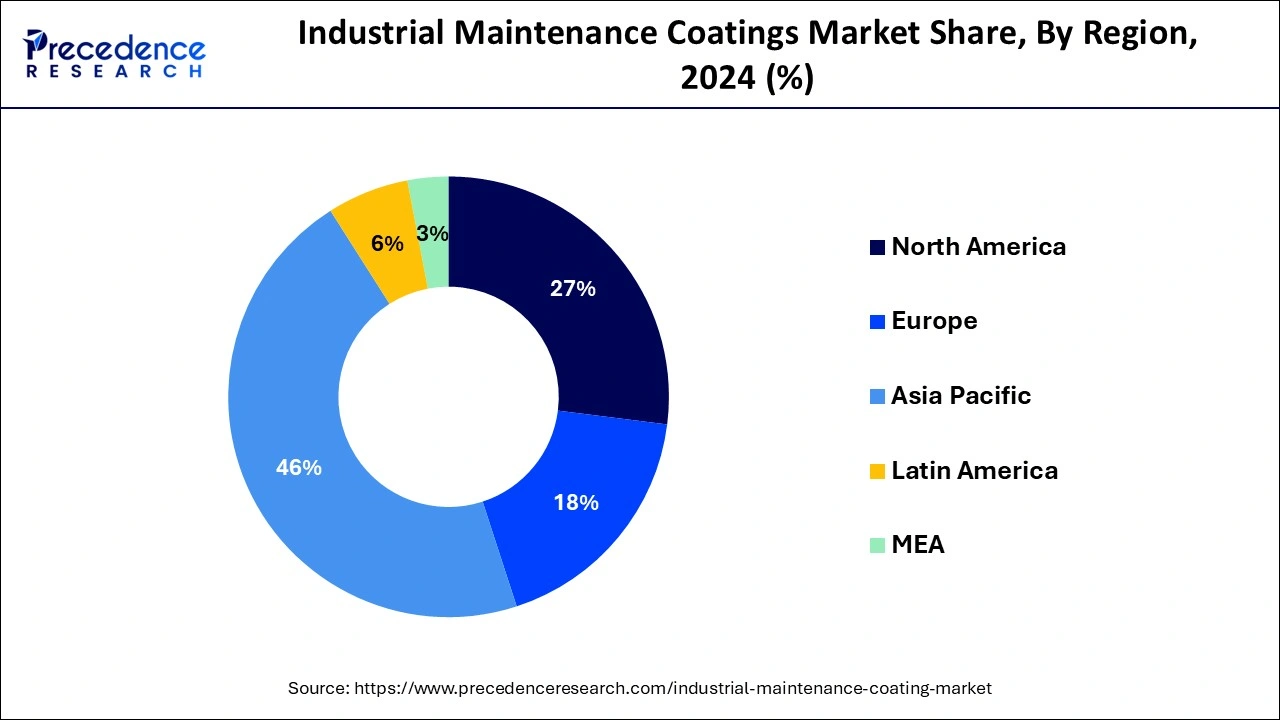

The global industrial maintenance coatings market size is calculated at USD 4.99 billion in 2025 and is forecasted to reach around USD 6.87 billion by 2034, accelerating at a CAGR of 3.60% from 2025 to 2034. The Asia Pacific industrial maintenance coatings market size surpassed USD 2.25 billion in 2025 and is expanding at a CAGR of 3.73% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global industrial maintenance coatings market size was estimated at USD 4.82 billion in 2024 and is predicted to increase from USD 4.99 billion in 2025 to approximately USD 6.87 billion by 2034, expanding at a CAGR of 3.60% from 2025 to 2034. The rising awareness about the benefits of industrial maintenance coatings can boost the industrial maintenance coatings market.

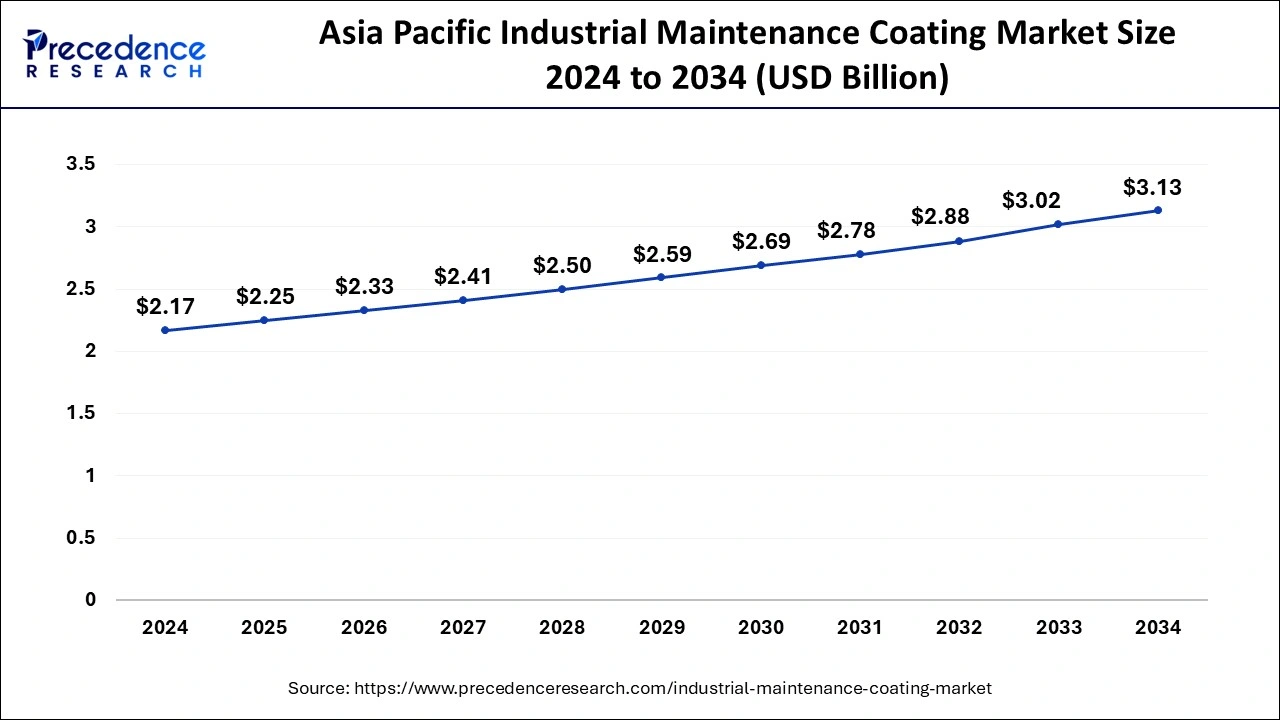

The Asia Pacific industrial maintenance coatings market size was valued at USD 2.17 billion in 2024 and is predicted to be worth around USD 3.13 billion by 2034, at a CAGR of 3.73% from 2025 to 2034.

Asia Pacific dominated the industrial maintenance coatings market in 2024. Asia Pacific is rapidly becoming an industrialized region, especially in China, India, Japan, and South Korea countries. The need for industrial maintenance coatings to safeguard machinery, infrastructure, and equipment is driven by the growth of sectors, including manufacturing, automotive, construction, aerospace, and marine.

The area is making significant investments in the construction of roads, bridges, railroads, ports, airports, and utilities. There is a growing need for maintenance coatings in civil engineering and construction projects since they are crucial for maintaining and extending the life of infrastructure assets. With a substantial manufacturing of automobiles and automotive components, Asia Pacific is a vital center for the automotive industry. The need for industrial coatings is fueled by the necessity of preserving automobile parts, components, and structures from corrosion, wear, and environmental elements.

North America is expected to grow at the highest CAGR in the industrial maintenance coatings market during the forecast period. The industrial infrastructure of North America is vast and well-developed, and it consists of factories, refineries, facilities for processing chemicals, and power plants. The need for industrial maintenance coatings in the area is driven by these industries' need for durable maintenance coatings to safeguard their machinery, buildings, and equipment. The area is renowned for having strict safety and environmental laws.

Industries must follow regulations pertaining to emissions, dangerous materials, worker safety, and environmental protection. Meeting these criteria requires the use of high-performance maintenance coatings, which has led to a strong demand for them in North America. The technical advancements in coatings and materials are centered in North America. The application of advanced coatings in industrial settings has increased dramatically due to their development, which has resulted in improved performance, durability, and environmental sustainability.

The industrial maintenance coatings market refers to the industrial maintenance coating as a protective coating used on equipment and structures in the industrial sector to stop environmental factors from causing corrosion, wear, and deterioration. These coatings are crucial for maintaining the longevity of industrial assets and guaranteeing their effective and safe operation.

The typical uses consist of steel construction, concentrate surfaces, and machinery manufacturing equipment such as pumps, machines, and valves. The ability to stick to a variety of substrates, high durability, resistance to chemicals, moisture, and temperature extremes are all important qualities of industrial maintenance coatings. Epoxy, polyurethane, zinc-rich primers, and acrylics are some of the coating types that are utilized. The effectiveness of the coatings depends on proper surface preparation and applications.

The industrial maintenance coatings market is fragmented with multiple small-scale and large-scale players, such as Kansai Paint Company, Ltd, PPG Industries, Sika AG, Sir Industrials Limited, DuPont de Nemours, Inc, Valspar Corporation, Hempel A/S, Jotun AS, Inc., Sherwin-Williams Company, Wacker Chemie AG, AkzoNobel N.V., BASF SE.

| Report Coverage | Details |

| Market Size by 2034 | USD 6.87 Billion |

| Market Size in 2025 | USD 4.99 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 3.60% |

| Largest Market | Asia- Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Technology, End-use Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising popularity of UV protective coating in industries

The rising popularity of UV protective coating in industries can boost the industrial maintenance coatings market. The UV protective coatings provide a layer of defense against UV radiation's harmful effects on surfaces. These coatings save industrial machinery and buildings from deteriorating due to UV light.

Because of their greater endurance, UV protection coatings are a wise investment because they require less frequent and expensive maintenance. The materials can degrade, fade, and break as a result of UV exposure. UV protection coatings preserve industrial assets' structural integrity and visual appeal. This is critical for sectors like aircraft, automotive, and construction, where performance and appearance are paramount.

Rising industrialization

The rising industrialization grows the demand for the industrial maintenance coatings market. The building of factories, plants, warehouses, and other industrial buildings is on the rise as industrialization advances. In order to guarantee durability, resilience to external influences, and visual attractiveness, these structures need to be coated with protective materials.

The integrity of these structures must be preserved, and maintenance coatings are crucial for that. The industries frequently work in challenging conditions where infrastructure and machinery are subjected to heat, dampness, chemicals, and other stresses. Protective coatings for industrial maintenance offer an essential shield against wear, rust, and corrosion, ensuring the productivity and security of industrial processes.

Environmental concerns

The environmental concern may slow down the industrial maintenance coatings market. The demand for sustainable and environmentally friendly products is rising in all sectors of the economy. Examining conventional industrial maintenance coatings with toxic chemicals is making a move toward water-based, low-volatile organic compounds (VOC) and biodegradable substitutes.

Because of the requirement for R&D and manufacturing process retooling, the adoption of these eco-friendly coatings may take some time. It can cost more to develop and produce ecologically friendly coatings than conventional coatings.

Development of advanced materials

The development of advanced materials for industrial maintenance coatings can grow the market. When made with advanced materials, industrial maintenance coatings can function better and last longer. These coatings' exceptional resistance to abrasion, corrosion, chemicals, and high temperatures can increase the longevity of industrial machinery and buildings. Because of their endurance, modern coatings are very appealing to industries since they require less regular maintenance and replacement.

The epoxy coatings segment dominated the industrial maintenance coatings market in 2024. Epoxy coatings are well known for their exceptional toughness and resilience against several chemical and environmental stresses. Their superior resistance to corrosion, abrasion, and chemical spills makes them perfect for use in challenging industrial settings. Because of this high degree of protection, industrial buildings and equipment last longer and require less frequent maintenance and replacements. The epoxy coatings provide excellent adherence to a variety of substrates, such as composites, metals, and concrete. Because of its excellent adherence, the coating will stay effective and undamaged over time, even in difficult situations. Epoxy coatings' durability and dependability are valued by several industries, which helps explain their market dominance. The epoxy coatings' adaptability makes them useful in a variety of sectors, including automotive, aerospace, marine, construction, and manufacturing.

The acrylic coatings segment is expected to grow at the highest CAGR in the industrial maintenance coatings market during the forecast period. When compared to other coating types, acrylic coatings usually contain lower amounts of volatile organic compounds (VOCs). They are now more in line with strict environmental rules and more ecologically friendly. The need for low-VOC and environmentally friendly coatings like acrylics is predicted to increase as companies work to lessen their impact on the environment. The acrylic coatings are incredibly adaptable and work well on a variety of substrates, such as concrete, metal, wood, and plastic. Because of their adaptability, they may be used in a wide range of industries, including the maritime, construction, and automotive sectors. Their market expansion is fueled by their capacity to serve many industries. The acrylic coatings are perfect for outdoor applications where exposure to the environment is a concern because of their exceptional resistance to weathering and ultraviolet (UV) rays.

The solvent-borne segment dominated the industrial maintenance coatings market in 2024. Superior durability, hardness, and resistance to chemicals, corrosion, and abrasion are just a few of the outstanding performance qualities that solvent-borne coatings usually provide. These characteristics are crucial for industrial maintenance applications, where durability and resistance to extreme conditions are paramount. Temperatures as low as freezing can be achieved by applying solvent-borne coatings in a variety of environmental circumstances. They are a favored option in areas with diverse climates and in sectors that cannot afford seasonal slowdown because of their adaptability, which enables year-round use. When comparing water-borne and solvent-borne coatings, the latter often offer less adherence to a wider range of surfaces. Industrial equipment and buildings are reliably protected by the coating's high adherence, which guarantees its long-term effectiveness.

The waterborne coatings segment is expected to grow at the highest CAGR in the industrial maintenance coatings market during the forecast period. Waterborne coatings are considered to be more ecologically friendly than solvent-borne coatings due to their lower levels of volatile organic compounds (VOCs) and hazardous air pollutants (HAPs). Industries are moving toward more sustainable solutions as a result of tighter restrictions pertaining to VOC emissions and a growing emphasis on environmental preservation on a worldwide scale. The adoption of aqueous coatings is significantly influenced by this regulatory pressure. The waterborne coatings improve worker safety and health by lowering exposure to dangerous chemicals and fumes. Waterborne technology use is rising as a result of businesses placing a greater priority on safer working conditions. The performance qualities of aqueous coatings have been markedly enhanced by advancements in their formulation. These days, aqueous coatings can match solvent-borne coatings in terms of longevity, adhesion, and chemical and corrosion resistance.

The energy & power segment dominated the industrial maintenance coatings market in 2024. Power plants, gas and oil refineries, and renewable energy installations are examples of energy and power facilities that operate in very severe settings. They are subjected to a variety of environmental stresses, including as high temperatures, humidity, and chemicals, which can cause corrosion and deterioration. In order to safeguard machinery and infrastructure against these severe environments and guarantee their lifetime and dependability, maintenance coatings are crucial. The energy and power industry's infrastructure is essential to both economic stability and national security. It is crucial to guarantee the uninterrupted functioning of power plants and energy facilities. High-performance maintenance coatings provide the vital infrastructure and the defense it needs to withstand malfunctions and last longer. The strict regulations pertaining to operating efficiency, environmental preservation, and safety apply to the energy and electricity sectors. The maintenance coatings assist in adhering to these rules.

The metal processing segment is expected to grow at the highest CAGR in the industrial maintenance coatings market during the forecast period. The raw and finished metals that are susceptible to oxidation and corrosion are handled extensively by the metal processing industries. In order to prolong the life of metal items and machinery, maintenance coatings are essential for shielding metal surfaces from the elements, chemical reactions, and moisture. The structures and equipment used in metal processing operate longer and are more reliable, thanks to advanced maintenance coatings. These coatings guarantee that metal processing facilities run smoothly and without frequent breakdowns by offering resistance to abrasion, heat, chemicals, and mechanical wear. Protective coatings are required in metal processing facilities by strict environmental and safety standards in order to reduce emissions, manage contamination, and guarantee worker safety. The need for high-performance maintenance coatings that adhere to regulatory requirements is driven by compliance with these laws.

By Type

By Technology

By End-use Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

September 2024

October 2024