August 2024

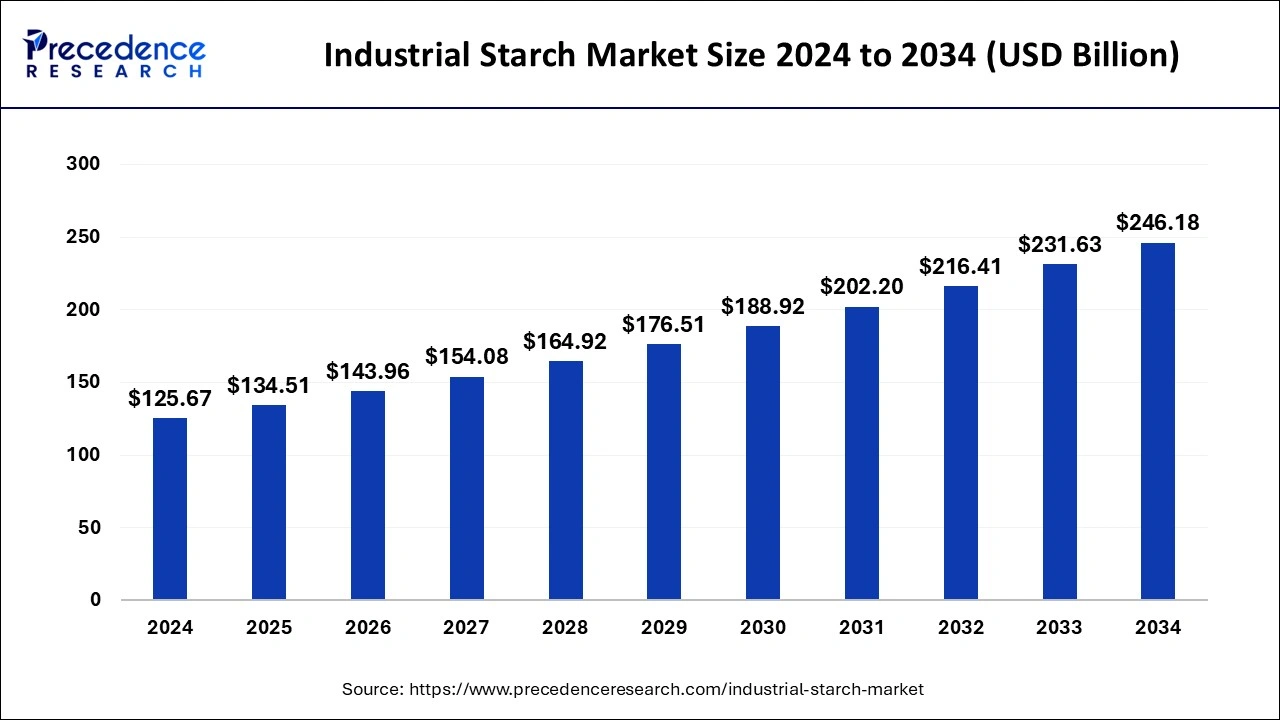

The global industrial starch market size is calculated at USD 134.51 billion in 2025 and is forecasted to reach around USD 246.18 billion by 2034, accelerating at a CAGR of 6.96% from 2025 to 2034. The North America industrial starch market size surpassed USD 59.06 billion in 2024 and is expanding at a CAGR of 6.97% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global industrial starch market size was estimated at USD 125.67 billion in 2024 and is predicted to increase from USD 134.51 billion in 2025 to approximately USD 246.18 billion by 2034, expanding at a CAGR of 6.96% from 2025 to 2034. The growing application of industrial starch as a thickening, stabilizing, and gelling agent, binder, diluent, and excipient is anticipated to generate high demand for the product over the forecast period.

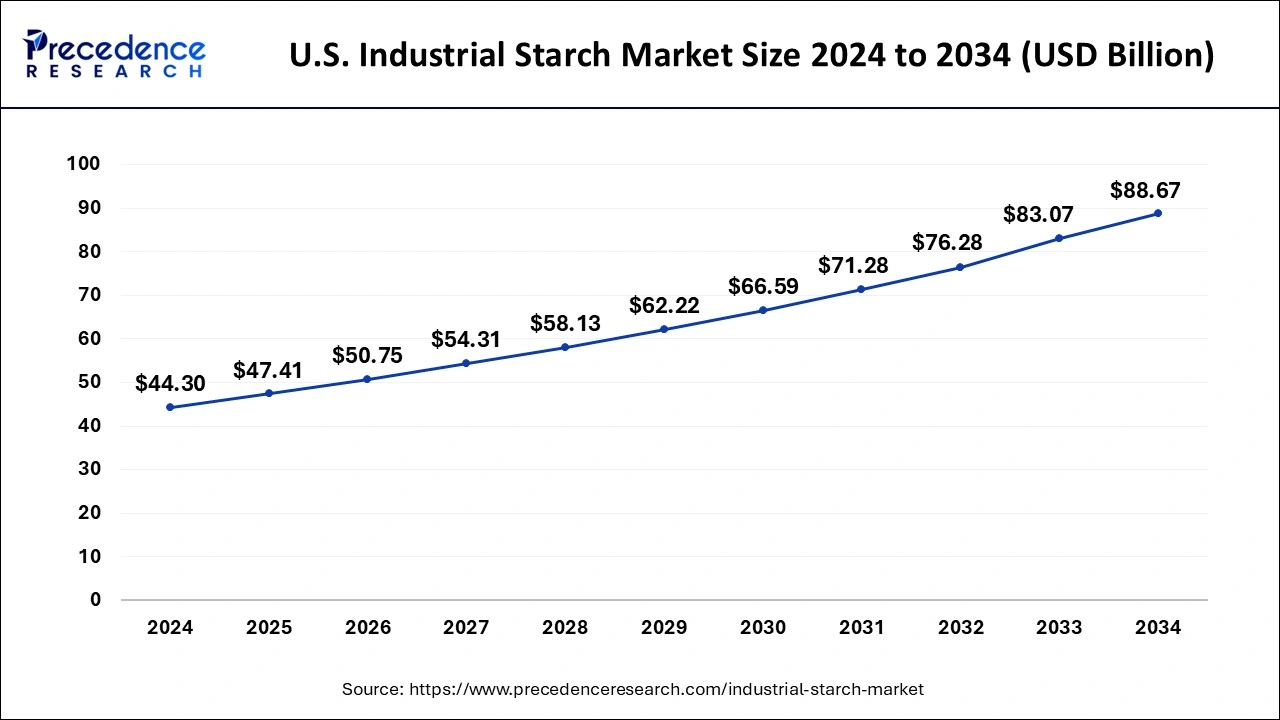

The U.S. hemophilia treatment market size was exhibited at USD 44.30 billion in 2024 and is projected to be worth around USD 88.67 billion by 2034, poised to grow at a CAGR of 7.19% from 2025 to 2034.

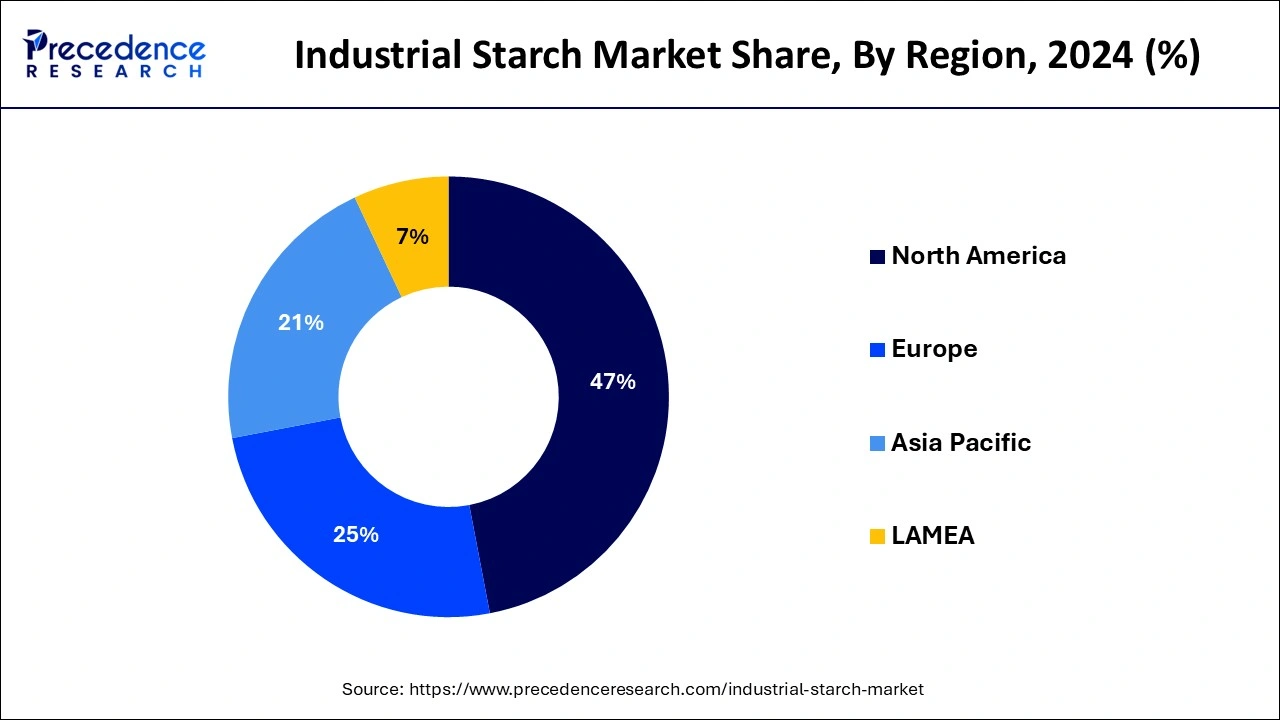

North America led the industrial starch market by region in 2024. The region's strong demand for industrial starch is fueled by the presence of numerous international food manufacturing and processing companies. The United States, as the world's top maize producer, allocates a substantial portion of its production to starch manufacturing and other uses. This dominance in the industrial starch industry is reinforced by the country's well-developed manufacturing sector.

Asia Pacific is expected to host the fastest-growing industrial starch market during the forecast period. The large-scale production of raw materials is expected to facilitate easy access to industrial starch, positively impacting the market in this region. Moreover, rising per capita income and increasing consumer demand for a diverse range of manufactured and food products that incorporate starch in their production are likely to drive market growth. China held the largest market share in the region, while India was the fastest-growing market for industrial starch.

Synthesized by various parts of a plant, starch is a polymer composed of glucose that is stored in the form of carbohydrates in seeds, tubers, and roots. Industrial starch is widely used for its adhesive properties in various industries.

Starch that is derived from its original sources is known as native starch, while starch that has been physically, chemically, or enzymatically treated to change its properties and improve its performance for different applications is known as modified starch. Derived from sources like cassava, potato, and wheat, starch is essential not only in the food sector but also in non-food industries such as paper, textiles, mining, and construction materials.

To increase their market share, companies in the industrial starch market are adopting strategies like expansions, investments, product launches, and mergers and acquisitions. Firms in the industrial corn starch market are focusing on cost-effective solutions for applications in frozen foods and dairy products. Meanwhile, companies dealing with cassava starch are expanding through new product developments.

| Report Coverage | Details |

| Market Size by 2034 | USD 246.18 Billion |

| Market Size in 2025 | USD 134.51 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.96% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source, Product, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expanding the food and beverage industry worldwide

The rising demand for the industrial starch market is mainly driven by the expanding global food and beverage industry. As the consumption of frozen, packaged, and convenience foods increases, the need for industrial starch as a binder, diluent, thickening, stabilizing, gelling agent, and excipient also grows. This trend is especially evident in developing countries, where the demand for such food products is rapidly increasing. The important role of industrial starch in manufacturing these food products significantly contributes to its high demand and market growth.

High cost of raw materials

The cost of raw materials, which depends on their source, production, and availability, can impact the growth and profitability of the industrial starch market. For new entrants, the high initial costs of extracting and producing starch derivatives may be a deterrent. Additionally, market saturation and competition can create challenges that could hinder the expansion of the industrial starch market.

Increase in R&D to expand applications

Starch has long been a vital food item and biomaterial, and it continues to be widely used in various applications globally. Research and development have led to its increasing use in industrial sectors such as agriculture, construction, textiles, paper, chemicals, and healthcare, although demand from the food industry remains the highest. Most of the world's starch production comes from maize, which is essential for making food products like thickeners, stabilizers, water retainers, and colloidal gelling agents. This growing demand for maize starch is expected to drive the MEA starch market during the forecast period by contributing to the growth of the industrial starch market.

The corn segment dominated the industrial starch market in 2024. Corn starch is a cost-effective choice favored across various industries. Its biodegradable nature meets the rising demand for sustainable and natural ingredients. Corn starch is widely used in food and beverage, pharmaceutical, paper, textile, and beer industries, where it aids fermentation and enhances product quality.

The wheat starch segment is projected to experience rapid growth in the industrial starch market during the forecast period. Wheat starch is extensively utilized in the paper industry as an adhesive for surface coating and in the production of corrugated boards. The strength, texture, and clarity of wheat starch paste are similar to corn starch, although it has less thickening power. Wheat starch is also used in cotton finishing and laundry sizing, providing an excellent finish.

The industrial starch market was dominated by the native starch & starch derivatives segment in 2024. Native starch refers to unmodified starch directly sourced from natural origins. The increasing consumer demand for natural, clean-label ingredients and a growing preference for organic and non-GMO products are driving the demand for native starch. This type of starch possesses essential functional properties and serves as a natural thickening, gelling, and binding agent across various industries. It is primarily utilized in the food and beverage industry, especially in organic and natural products.

The acid-modified starch segment is expected to witness the fastest growth in the industrial starch market during the forecast period. This segment includes starches that have been physically or chemically modified to enhance their functional properties for specific uses. Modified starch provides numerous benefits, such as better heat resistance, improved binding capacity, improved stability, increased viscosity, and improved texture. These qualities make modified starch highly desirable in industries such as food and beverage, papermaking, and pharmaceuticals.

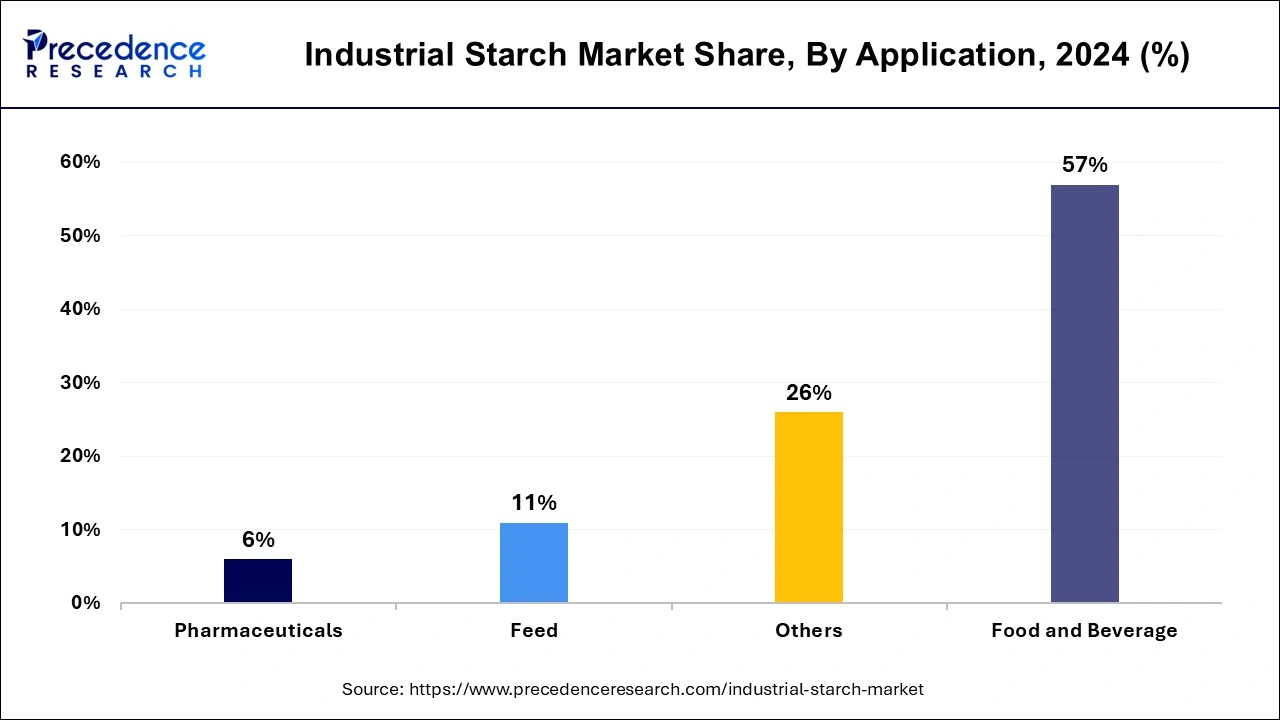

The food & beverages segment dominated the industrial starch market in 2024. During the forecast period, the rising use of industrial starch in the bakery and confectionery industry is expected to positively impact market growth. This segment is anticipated to be driven by the increasing demand from the young and working population for various on-the-go beverages and food products.

The pharmaceutical segment is projected to show significant expansion in the industrial starch market over the forecast period. In the pharmaceutical industry, corn starch is utilized as a disintegrant, diluent, binder, glidant, and lubricant. Its swelling properties make it an effective disintegrant in tablets, also they break down and dissolve easily, facilitating smooth drug release. Corn starch is also listed as a generally recognized safe (GRAS) food substance by the FDA.

By Source

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

January 2025

August 2024

October 2024