February 2025

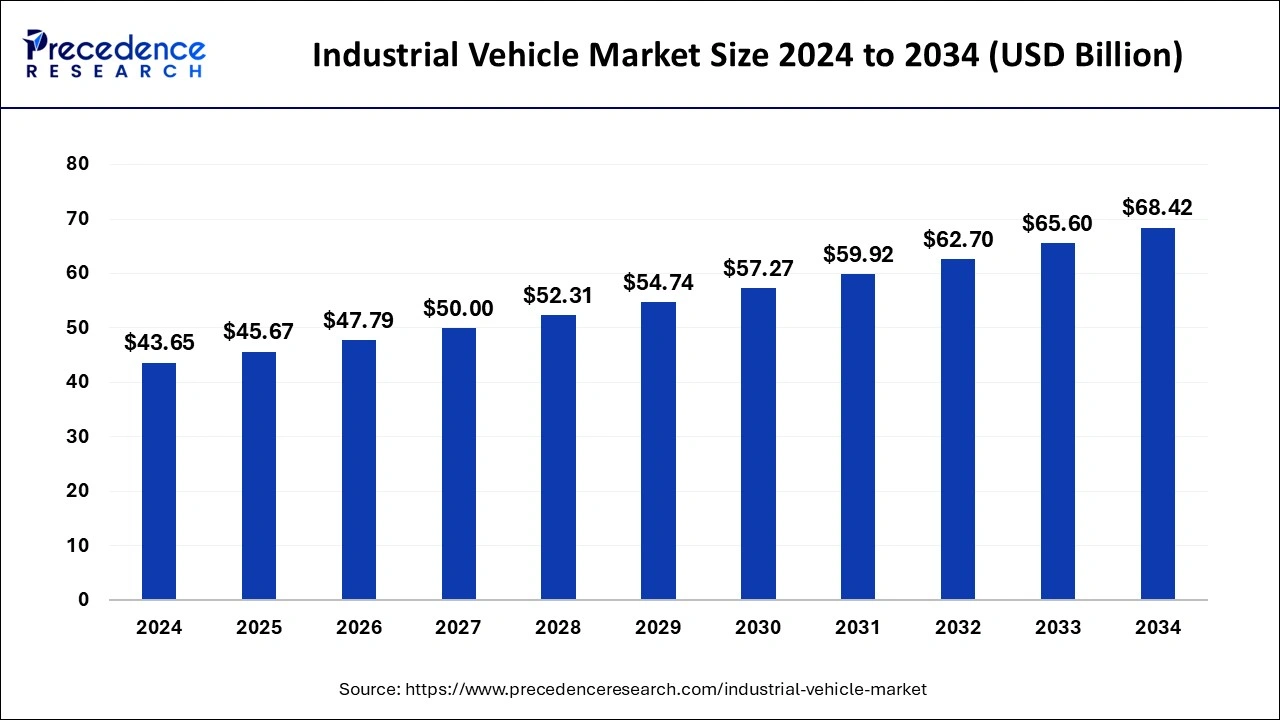

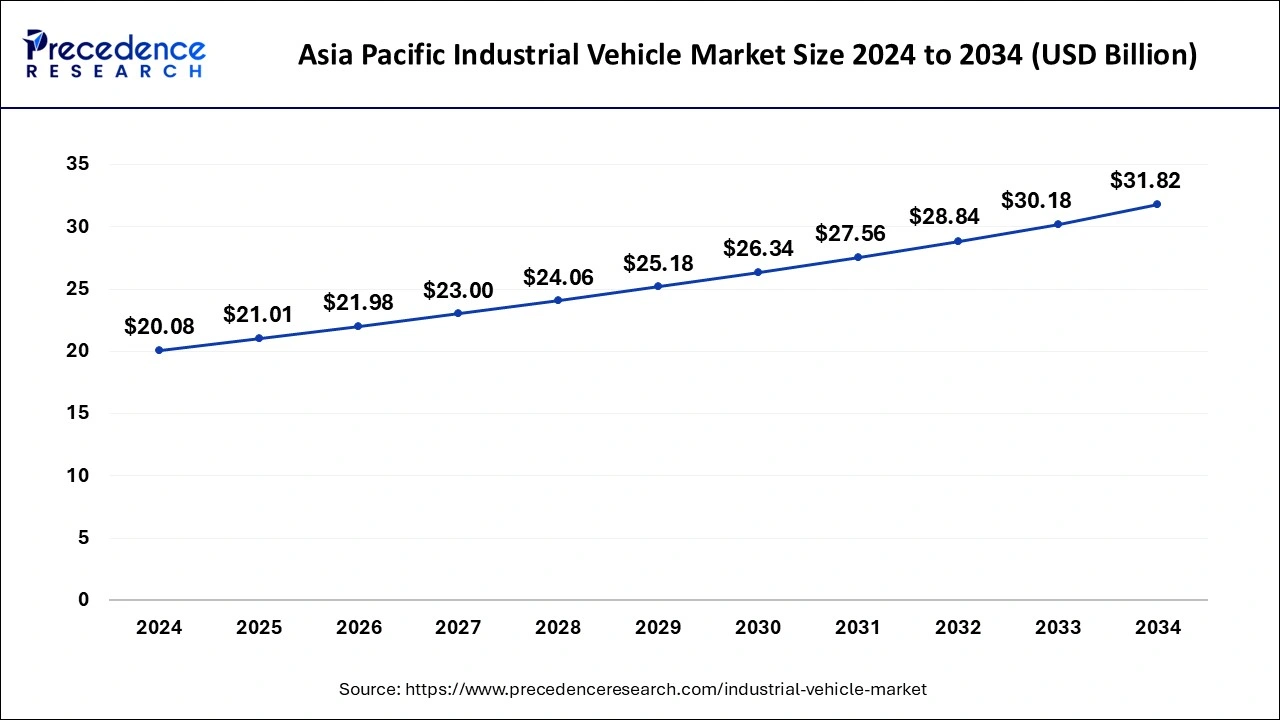

The global industrial vehicle market size is calculated at USD 45.67 billion in 2025 and is forecasted to reach around USD 68.42 billion by 2034, accelerating at a CAGR of 4.60% from 2025 to 2034. The Asia Pacific industrial vehicle market size surpassed USD 21.01 billion in 2025 and is expanding at a CAGR of 4.71% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global industrial vehicle market size was estimated at USD 43.65 billion in 2024 and is predicted to increase from USD 45.67 billion in 2025 to approximately USD 68.42 billion by 2034, expanding at a CAGR of 4.60% from 2025 to 2034.

The Asia Pacific industrial vehicle market size was estimated at USD 20.08 billion in 2024 and is predicted to be worth around USD 31.82 billion by 2034 at a CAGR of 4.71% from 2025 to 2034.

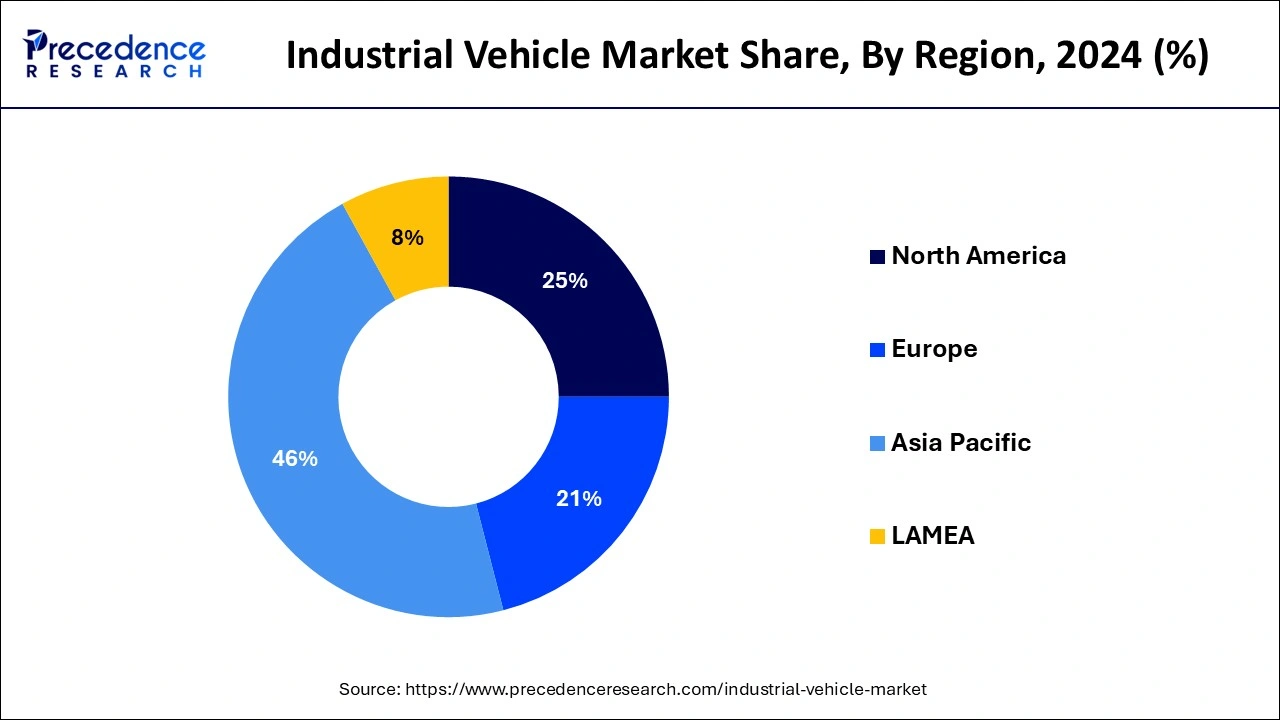

Asia Pacific held the dominant share of the industrial vehicle market in 2024. The region is observed to sustain the position during the forecast period. The growth of the region is mainly attributed to rapid industrialization, advancement in technology, adoption of Industry 4.0, stringent emission regulations, and growing demand for battery-operated industrial vehicles. The fastest-developing economies in the region such as China, India, Japan, and South Korea are the major contributors to the market.

The demand in developing countries is anticipated to increase for industrial vehicles owing to the presence of major industrial vehicle manufacturers, rising adoption of Industry 4.0, and rising manufacturing activities. Such factors have led to an increase in industrial vehicle production volumes over the years, with Original Equipment Manufacturers (OEMs) catering to both domestic and overseas demand.

Additionally, key market players are making significant investments that focus on the development of new products and the expansion of distribution networks, which are projected to boost innovation and fuel the expansion of the market in the coming years. Furthermore, the ongoing rapid advancements in technology and materials used in the manufacturing process of Industrial Vehicles have spurred their demand in the global market.

North America is observed to expand at a rapid pace during the forecast period. The North American’s region growth is driven by the presence of sophisticated industrial infrastructure, rapid implementation of automation at large-scale industries, and increasing investment in the development of advanced technology. The rapid expansion of e-commerce businesses that require precise supply chain management equipment creates a supportive factor for the industrial vehicle market to grow in North America.

Industrial vehicles are driver-controlled and self-propelled for transportation, load-carrying, and others. Industrial vehicles are widely mainly used to transport raw materials, finished goods, and production materials within the industrial area. Industrial vehicles usually come in different sizes for the movement of different types of materials and goods to the desired location. Industrial vehicles are designed to serve various industrial purposes including lifting, loading, and movement of loads. This vehicle assists in reducing the workload of manpower.

During transportation within short-distance, manual or semi-powered carts are extensively used, and they are only capable of moving one load at a time from one source to another. During transportation within medium-distance, powered vehicles are preferred such as lift trucks, where the load is batched in parts in either a pallet or a container. Multiple load transporters can move more than one load at a time, from one place to another.

| Report Coverage | Details |

| Market Size in 2025 | USD 45.67 Billion |

| Market Size by 2034 | USD 68.42 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.60% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Drive Type, By Level of Autonomy, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rapid industrialization

The rapid industrialization is expected to accelerate the growth of the industrial vehicle market. Self-driving industrial vehicles are becoming popular due to the implementation of automation and the adoption of Industry 4.0 in manufacturing processes. Industrial vehicles including cranes, tractors, forklifts, delivery trucks, and other specialized industrial vehicles are widely used for the movement of goods to meet the requirements of a particular industry.

A variety of jobs is carried out by industrial vehicles within industrial environments such as manufacturing plants, warehouses, logistics facilities, and others. To improve warehouse operations and distribution networks increase the demand for industrial vehicles. Therefore, such automobiles boost productivity and reduce expenses associated with labor.

High cost

The high cost associated with the maintenance of industrial vehicles is anticipated to projected to hamper the industrial vehicle market’s growth. The high maintenance cost of industrial vehicles often discourages organizations from purchasing due to budget constraints. In addition, several safety issues related to the use of industrial vehicles may limit the adoption and expansion of the global industrial vehicle market.

Increasing demand for electric and battery-operated industrial vehicles

The rising demand for electric and battery-operated industrial vehicles is expected to drive the growth of the global industrial vehicle market during the forecast period. The market has witnessed an increasing adoption of electric and battery-operated industrial vehicles across various sectors to improve productivity, operational efficiency, and reduced periods. The electric and battery-operated industrial vehicles come with improved performance to carry out various tasks within the industrial area. Additionally, the government's stringent emission regulations have led to an increasing use of electric and battery-operated industrial vehicles during the forecast period.

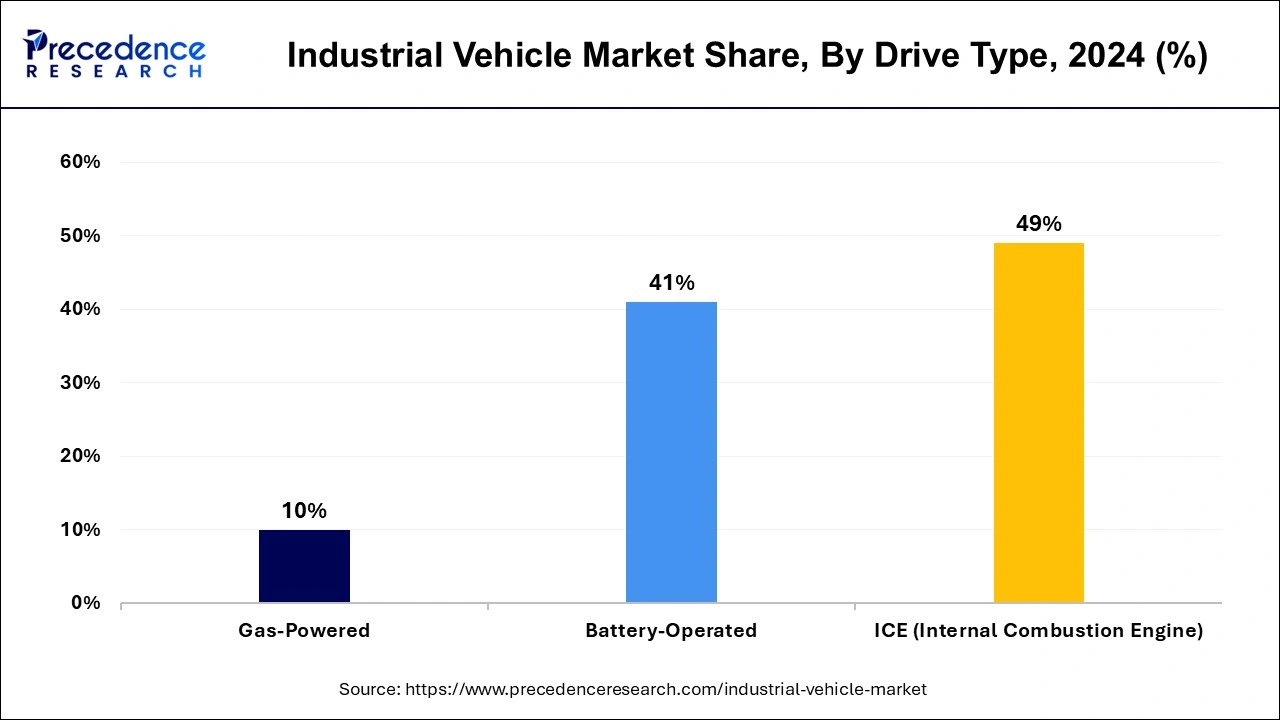

The ICE segment held the largest share of the industrial vehicle market in 2024. ICE vehicles, particularly those with diesel engines, are known for their high torque output, which is essential for heavy-duty industrial applications such as construction, mining, and agriculture. They often offer superior power and performance compared to alternative technologies. ICE technology has been around for over a century and is well understood by manufacturers, operators, and maintenance personnel. This familiarity breeds trust and confidence in its reliability and performance.

The battery-operated segment is observed to witness a significant rate of growth in the industrial vehicle market during the forecast period. Battery-operated industrial vehicles are widely used across various industries. Battery-operated industrial vehicles are gaining momentum due to their eco-friendly nature and produce lower emissions, making them suitable for several industrial projects. Rechargeable batteries are used in battery-operated industrial vehicles to power respective vehicles. Battery-operated industrial vehicles have better emission control and are more affordable than ICE industrial vehicles. These vehicles meet Tier 4 emission requirements and produce no in-plant emissions. Several companies around the world are manufacturing eco-friendly industrial vehicles in response to emission and energy efficiency preferences.

The gas-powered segment is expected to witness a notable growth rate during the forecast period owing to the increasing use of gas forklift trucks for both outdoor and indoor work. LPG is a clean alternative for a powerful truck. LPG forklift trucks offer smooth running and are ideal for covering long distances. Such factors drive the segment’s growth.

The non/semi-autonomous segment held a significant share of the industrial vehicle market in 2023 owing to the increasing demand within manufacturing operations. The segment’s growth is driven by the increasing need for safer and more efficient movement of goods. Semi-autonomous industrial vehicles can perform specific tasks without human intervention including adaptive cruise control or lane-keeping assist. However, these vehicles still require some human input for overall better control and decision-making.

The autonomous segment is observed to grow at a notable rate in the industrial vehicle market during the forecast period of 2024-2033, the segment is expected to sustain the position throughout the forecast period. Automated Guided Vehicles (AGVs) are self-driving vehicles that are designed for the movement of goods. These vehicle uses a combination of sensors, cameras, and mapping software to navigate the warehouse and avoid obstacles. These vehicles are widely used to transport goods from one source to another, such as from the receiving dock to a storage area, or to pick orders and transport them to a packing station. Automated industrial vehicles can operate 24/7 without human intervention.

The manufacturing segment held the largest share of the industrial vehicle market in 2024. The market has witnessed the increasing adoption of industrial vehicles in the manufacturing processes to retrieve and store inventory for the production line in several industries such as automotive, chemical, food and beverages, pharmaceuticals, and others, which is projected to accelerate the growth of manufacturing segment during the forecast period. These vehicles assist in cost savings, reducing downtime, and improving the overall efficiency of the process.

The warehousing segment is expected to grow fastest during the forecast period. The use of industrial vehicles in warehouses helps to store and retrieve products rapidly and accurately, enabling the company to meet its high demand while reducing the work for manual labor. Industrial vehicles are widely adopted in warehouses with high-density storage systems. Industrial vehicles have reshaped the warehousing landscape, bringing high levels of efficiency and productivity to logistics operations. Warehouses are now capable of operating with high speed, reliability, and accuracy which results in significant cost savings and enhanced customer satisfaction.

By Drive Type

By Level of Autonomy

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

March 2025

January 2025

January 2025