January 2025

Infectious Disease Molecular Diagnostics Market (By Product: Instruments, Reagents, Services; By End-use: Hospitals, Clinics, Diagnostics Laboratories, Research Institutes; By Technology: Polymerase chain reaction, In Situ Hybridization, Isothermal Nucleic Acid Amplification Technology, Chips and Microarrays, Mass Spectrometry, Sequencing, Transcription Mediated Amplification, Others; By Application) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

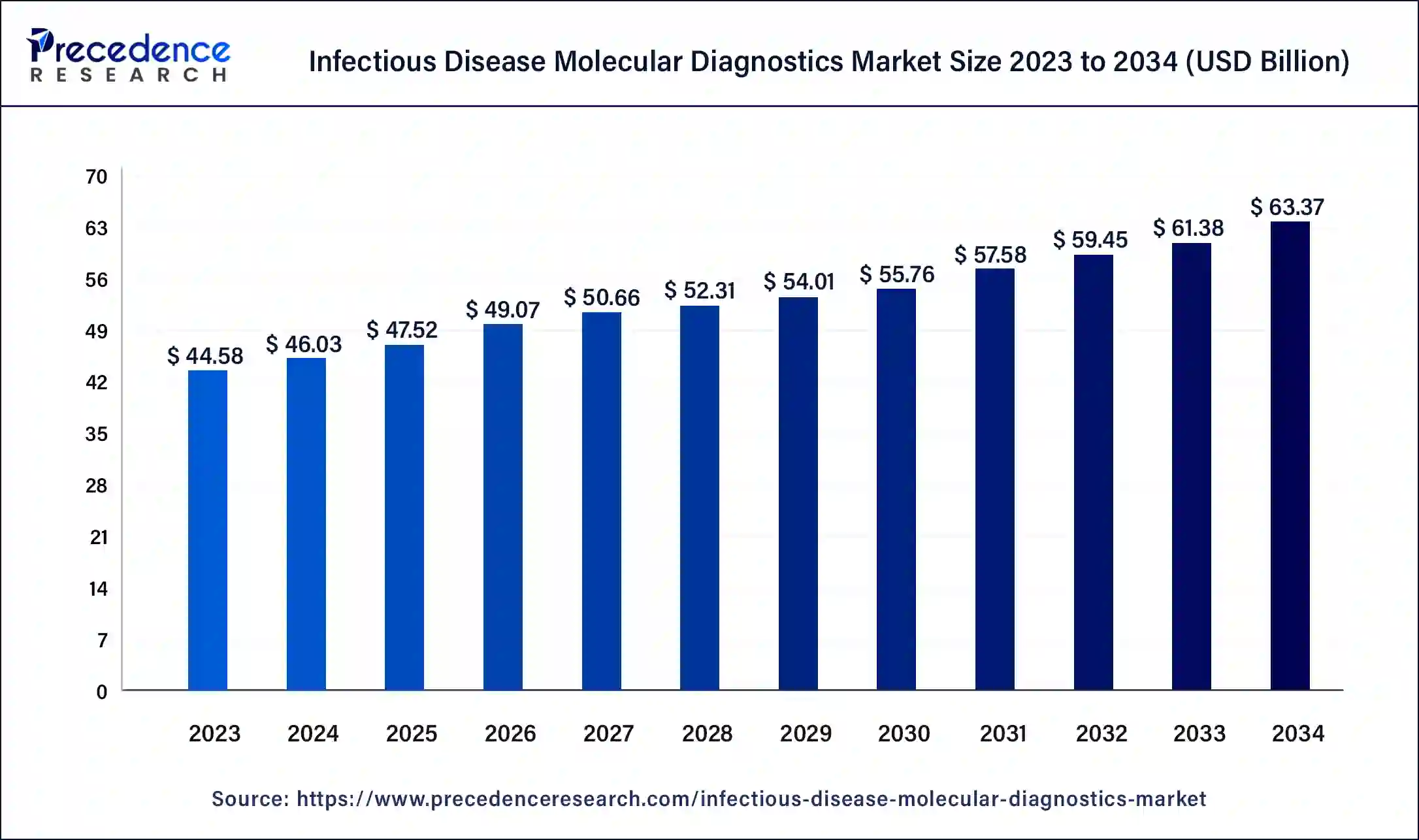

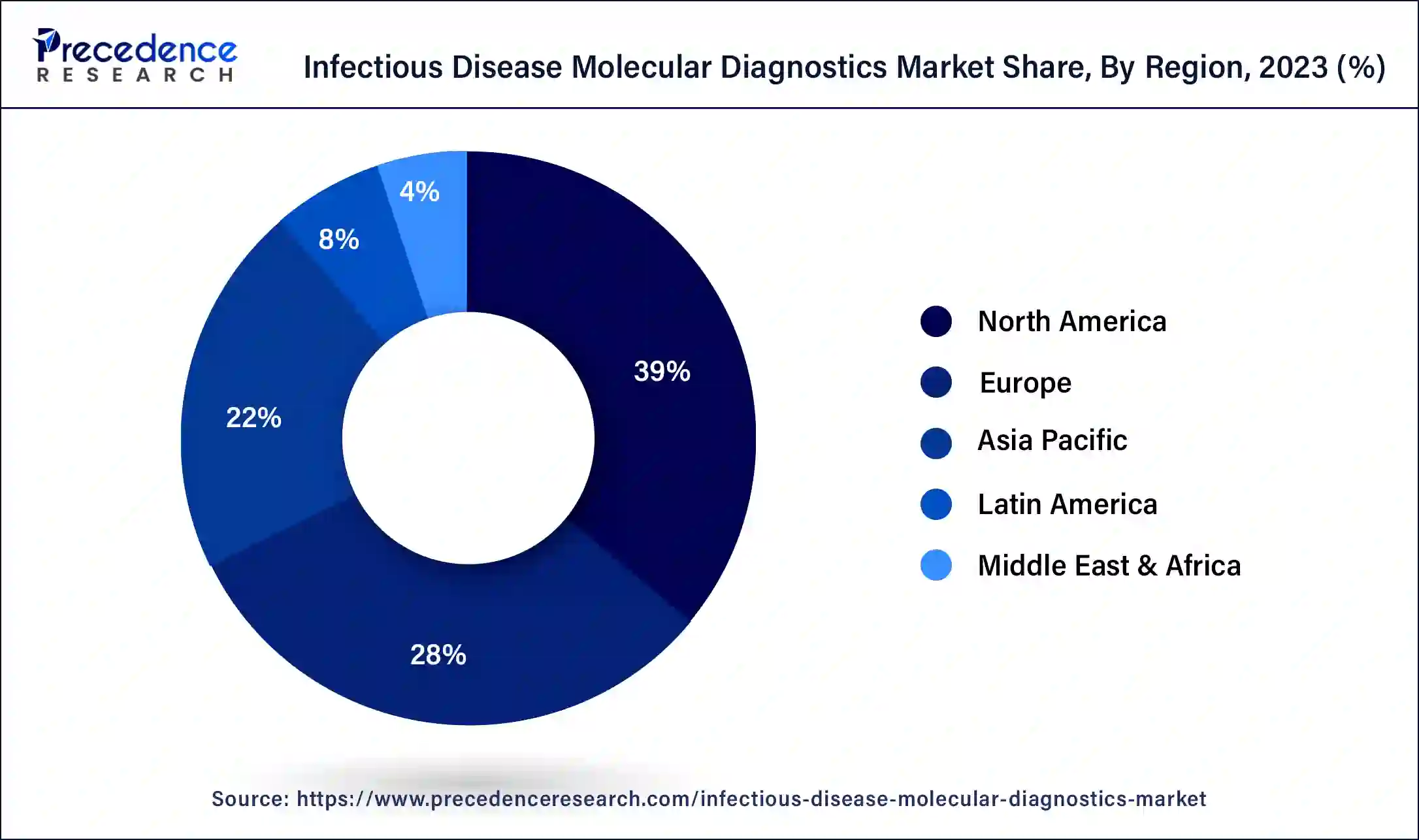

The global infectious disease molecular diagnostics market size was USD 44.58 billion in 2023, calculated at USD 46.03 billion in 2024 and is expected to reach around USD 63.37 billion by 2034, expanding at a CAGR of 3.25% from 2024 to 2034. The North America infectious disease molecular diagnostics market size reached USD 17.39 billion in 2023. It helps in the identification and detection of infectious agents like parasites, fungi, bacteria, and viruses.

The global molecular diagnostics market size accounted for USD 44.68 billion in 2024 and is expected to be worth around USD 61.29 billion by 2033.

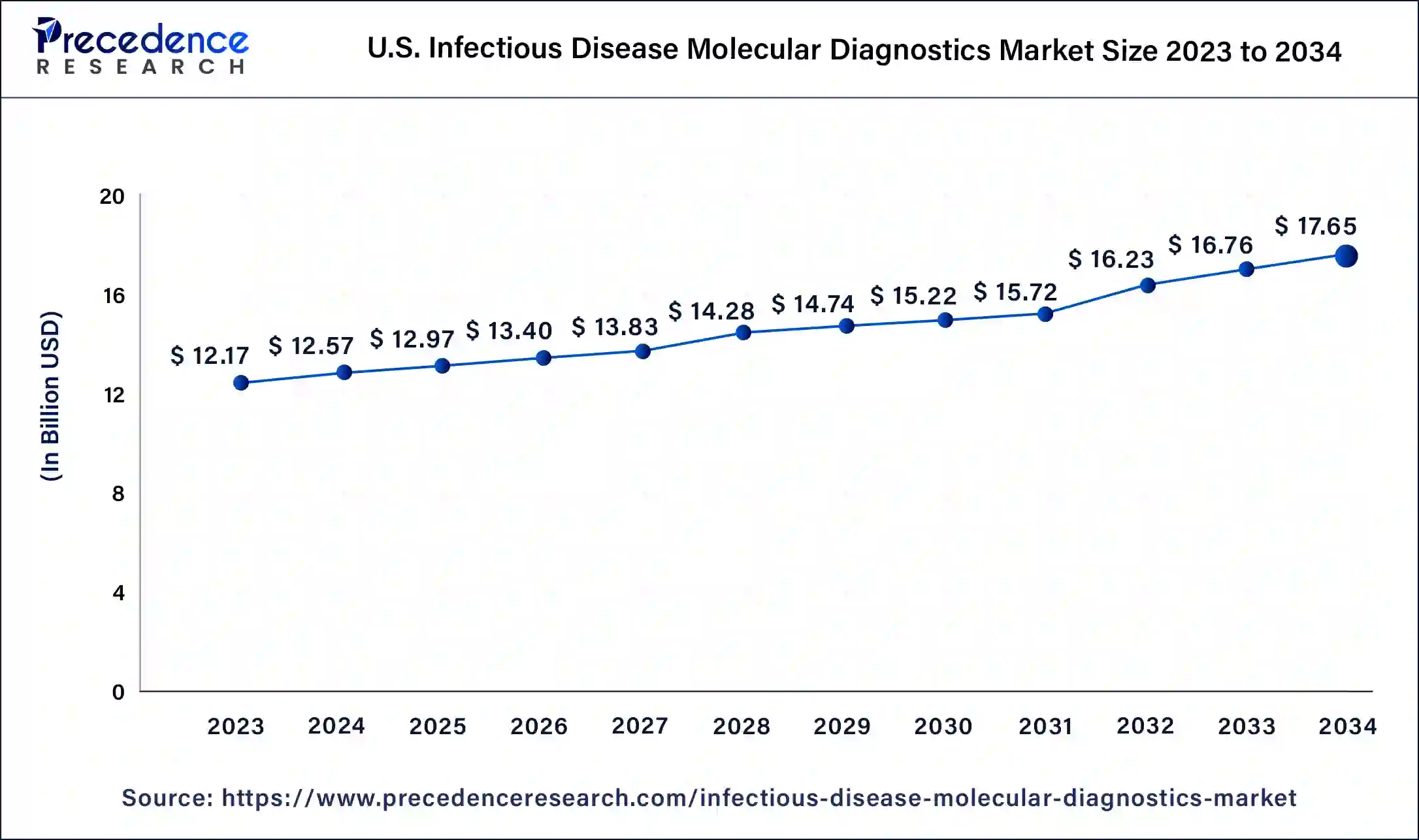

The U.S. infectious disease molecular diagnostics market size was exhibited at USD 12.17 billion in 2023 and is projected to be worth around USD 17.65 billion by 2034, poised to grow at a CAGR of 3.43% from 2024 to 2034.

North America dominated the infectious disease molecular diagnostics market in 2023. Rising investment in diagnostics and increasing regulatory support help to the growth of the market. Increasing cancer cases and infectious diseases in the United States leads to the growth of the growth of the market.

Asia Pacific is estimated to be the fastest-growing during the forecast period of 2024-2033. The rising prevalence of infectious diseases, increasing investments, high-end medical treatments, rising awareness among people, government healthcare benefits, etc., help the growth of the infectious disease molecular diagnostics market in the Asia Pacific region.

The infectious disease molecular diagnostics market deals with research institutes, diagnostics laboratories, clinics, and laboratories for the applications of infectious diseases, drug-resistance diseases, sepsis, sexually transmitted infections, HPV, gastrointestinal tract infections, meningitis, tuberculosis, respiratory diseases, etc. Infectious disease molecular diagnostics devices include specialized platforms or instruments designed for the identification and detection of infectious agents like parasites, fungi, bacteria, and viruses by molecular methods. Molecular diagnostics technology offers an effective solution for infectious disease diagnostics because it is flexible, agile, and fast. Health systems that regularly use molecular diagnostics will obtain economies of scale, quickly reply to new threats, and maximize limited expertise. These factors help to the growth of the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 63.37 Billion |

| Market Size in 2023 | USD 44.58 Billion |

| Market Size in 2024 | USD 46.03 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.25% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, End-use, Technology, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising prevalence of cancer and infectious diseases

The rising prevalence of cancer and infectious diseases can help the growth of the market. Infectious disease molecular diagnostics are important for infectious diseases and cancers in less resource settings. In settings with a wide range of possible etiologies and limited resources, infectious disease molecular diagnostics technologies offer an effective solution for cancer and infectious disease diagnostics because they are flexible, agile, fast, sustained, and workable. These factors help to the growth of the infectious disease molecular diagnostics market.

Limitations of infectious disease molecular diagnostics

Limitations of infectious disease molecular diagnostics include infection caused by new or rare pathogens, narrow detection spectrum of pathogens, low sensitivity, and long detection cycles. It also includes difficulties in validating orphan testing; it may produce false positive or false negative results, which can hamper the growth of the market. High costs of molecular diagnostics tests have limited access to low and middle-income nations and high costs of consumables, equipment, and reagents. These factors may restrict the growth of the infectious disease molecular diagnostics market.

Future scope of infectious disease molecular diagnostics

Rapid molecular testing, reimbursement concerns of syndromic panels, clinical metagenomics, and next-generation sequencing can be opportunities in the future for infectious disease molecular diagnostics. With increasing infectious diseases, there is a need for new therapeutics and resistance mechanisms. These factors help to the growth of the infectious disease molecular diagnostics market.

The reagents segment dominated the infectious disease molecular diagnostics market in 2023. In infectious disease molecular diagnostics, PCR reagents are highly used. It also includes assays such as fluorescence in situ hybridization or PCR-ELISA, INAAT, INAAT, sequencing, mass spectrometry, etc. These reagents help to detect a molecule that may be in low concentrations that is a risk in the sample or marker of disease taken from a patient. Reagents provide reliability, sensitivity, and specificity in target analytes detection. Control reagents ensure the validity and accuracy of diagnostics assays by acting as quality control materials, positive & negative controls, and calibrators. These factors help to the growth of the reagents segments and contribute to the growth of the infectious disease molecular diagnostics market.

The instruments segment is estimated to be the fastest-growing during the forecast period. Instruments used in infectious disease molecular diagnostics include PCR, in-situ hybridization, INAAT, chips & microarrays, mass spectroscopy, mass spectrometry, sequencing, transcription-mediated amplification, etc. PCR instrument is used to detect the etiologic agents of diseases from clinical samples, and there is no need for culture. It is useful in fastidious microorganisms’ detection or rapid detection of unculturable microorganisms. Sequencing analysis of amplified microbial DNA enables better characterization and identification of pathogens. These factors help the growth of the instruments segment and contribute to the growth of the infectious disease molecular diagnostics market.

The PCR segment dominated the infectious disease molecular diagnostics market in 2023. PCR technology is the most well-developed molecular diagnostics technique and has a high range of already fulfilled, potential clinical applications of the PCR technique, including antimicrobial resistance profiling, early detection of biothreats, surveillance, evolution of emerging new infections, and specific or broad-spectrum pathogen detection. These factors help to the growth of the PCR segment and contribute to the growth of the market.

The human papillomavirus (HPV) segment dominated the infectious disease molecular diagnostics market in 2023. The infectious disease molecular diagnostics method is used for the identification of several different types of high-risk HPV that may lead to better diagnosis and treatment plans for patients. In the prevention of cervical cancer, infectious disease molecular diagnostics play an important role in the detection of HPV. These factors help the growth of the human papillomavirus (HPV) segment and contribute to the growth of the infectious disease molecular diagnostics market.

The drug-resistant disease segment is expected to grow significantly during the forecast period. In the drug-resistant disease, infectious disease molecular diagnostics play an important role. The drug-resistant TB is a high risk to worldwide TB control. Rapid infectious disease molecular diagnostic tests are important for improved treatment outcomes, enhanced retention in care, shortened time to treatment initiation, and earlier diagnosis. These factors help the growth of the drug-resistant disease segment and contribute to the growth of the infectious disease molecular diagnostics market.

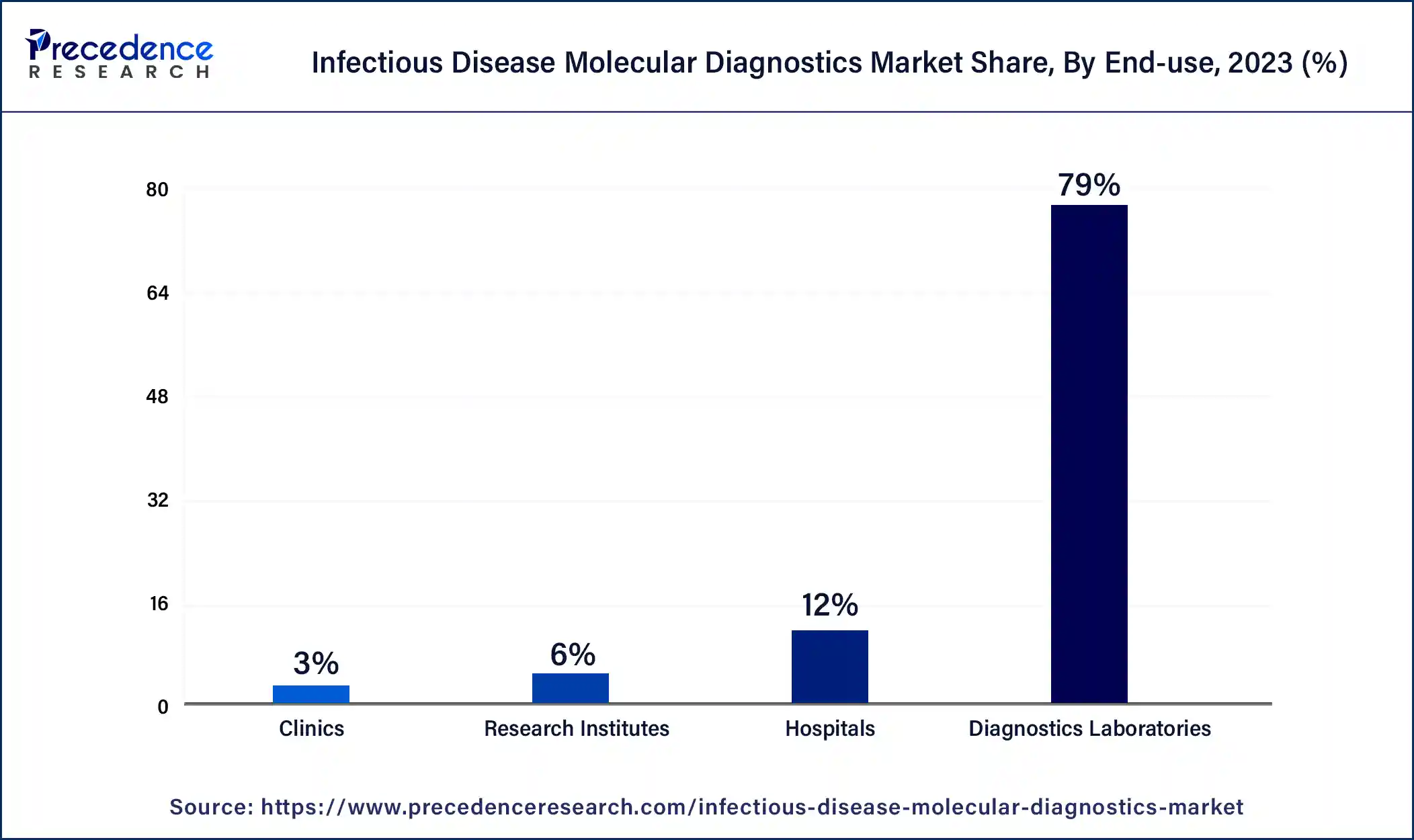

The diagnostic laboratories segment dominated the infectious disease molecular diagnostics market in 2023. The benefits of diagnostics laboratories include satisfaction with the services provided, reduced requirements for re-testing by saving money and time, confidence in personnel performing tests, and the surety of genuine reports from accurately calibrated testing. These factors help to the growth of the diagnostic laboratories segment and contribute to the growth of the market.

The clinics segment is estimated to be the fastest-growing during the forecast period. The benefits of clinics include effective disease management, being ideal for effective care, having experienced staff, being less expensive, providing immediate assistance, etc. These factors help the growth of the clinics segment and contribute to the growth of the infectious disease molecular diagnostics market.

Segments Covered in the Report

By Product

By End-use

By Technology

By Application

Respiratory Diseases

Tuberculosis

Meningitis

Gastrointestinal Tract Infections

Sexually Transmitted Infections

Sepsis

Drug Resistance Disease

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

July 2024

October 2024