April 2025

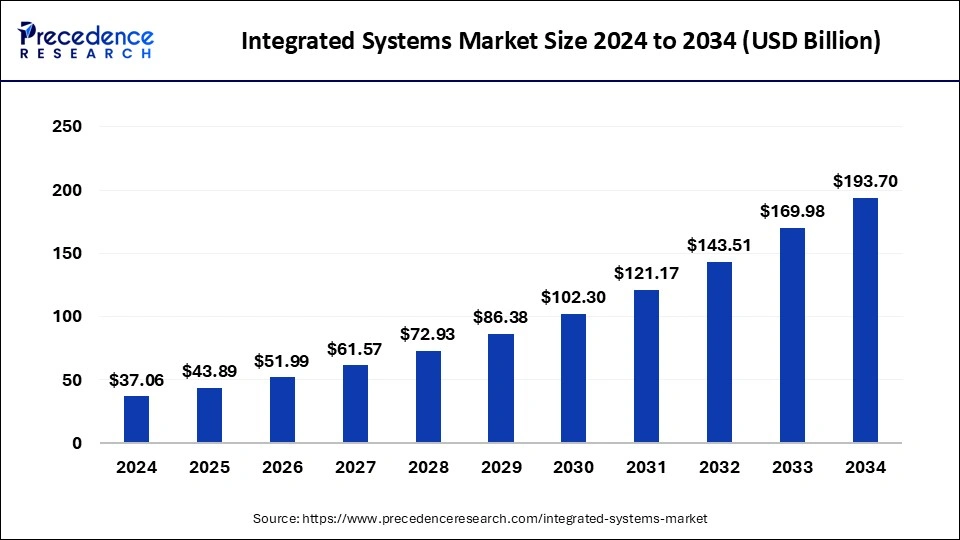

The global integrated systems market size is calculated at USD 43.89 billion in 2025 and is forecasted to reach around USD 193.70 billion by 2034, accelerating at a CAGR of 17.98% from 2025 to 2034. The North America integrated systems market size surpassed USD 13.34 billion in 2024 and is expanding at a CAGR of 18.03% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global integrated systems market size was estimated at USD 37.06 billion in 2024 and is predicted to increase from USD 43.89 billion in 2025 to approximately USD 193.70 billion by 2034, expanding at a CAGR of 17.98% from 2025 to 2034. The integrated systems market is expecting growth considerably as consumers trade single module performance for integrated service delivery and trending a phase change in data center infrastructure.

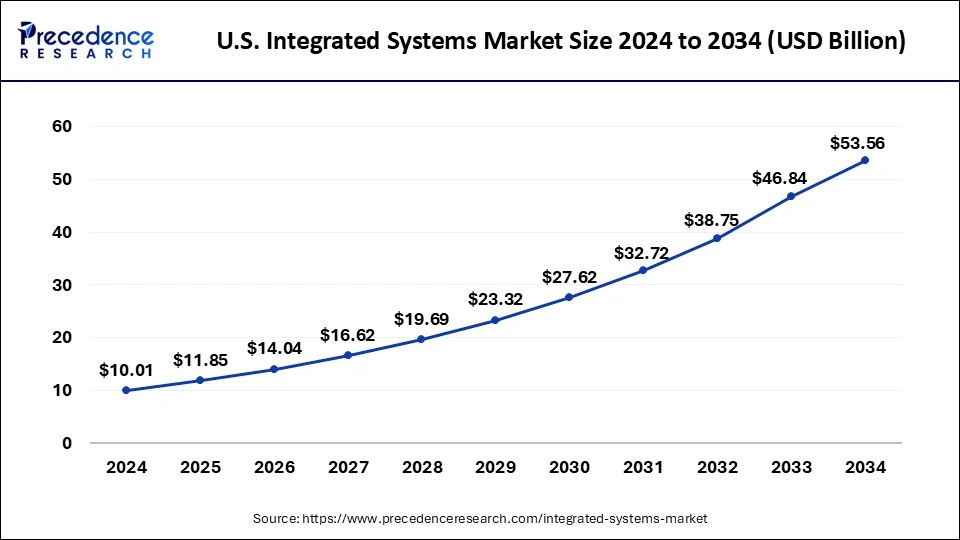

The U.S. integrated systems market size surpassed USD 10.01 billion in 2024 and is projected to attain around USD 53.56 billion by 2034, poised to grow at a CAGR of 18.26% from 2025 to 2034.

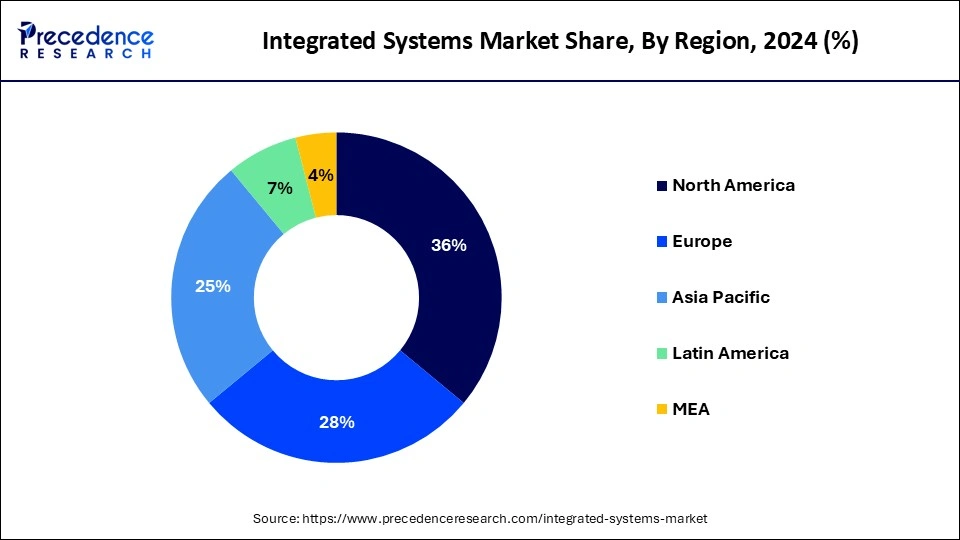

North America dominated the integrated systems market in 2024. Due to the increasing use of IoT in industrial automation and the growing adoption of cloud-based services by large organizations, the market is expected to grow in this region. Furthermore, Technical advancements and the strong market presence of integrated systems indicate that North America will likely become the primary regional market. The presence of companies like Facebook and Amazon, which have effectively utilized Integrated Systems architecture, may drive regional demand for Integrated Systems in the forecast period.

Asia Pacific is anticipated to host the fastest-growing integrated systems market during the forecast period. This can be largely attributed to the data center transformation projects and rapid development of IT infrastructure in this region. As major economies worldwide have gradually improved in recent years, buyer confidence in implementing integrated systems initiatives is expected to show significant demand, albeit with less enthusiasm.

Integrated systems are a type of data center solution that utilizes a pre-integrated stack to combine server, network, and shared storage devices. These systems manage networking, storage, computing, and data center applications. Various storage, server, and networking providers now offer services that enhance infrastructure efficiency in highly virtualized environments through Integrated Systems.

As consumers increasingly seek streamlined deployments and fewer standalone solutions, major players in networking, storage, management, and systems are expected to gain a significant market share. However, integrated systems require substantial investments in technology, channel partnerships, service delivery, and integration.

| Report Coverage | Details |

| Market Size by 2034 | USD 193.70 Billion |

| Market Size in 2025 | USD 43.89 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 17.98% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Service, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing adoption of cloud computing

The adoption of cloud computing is accelerating rapidly, with cloud-specific spending outpacing general IT spending. This trend significantly contributes to market growth. Cloud providers are enhancing native optimization capabilities to help organizations choose cost-effective architectures that deliver the necessary performance, hence boosting the market CAGR for the system integration industry. Additionally, the increasing demand for advanced deployment techniques and modern application development is driving the integrated systems market.

Complex integration process and need for expertise

Advanced skills and expertise often come with a high price tag, as they may require hiring or contracting IT professionals with integration expertise, resulting in higher expenses. Moreover, the complexity and knowledge needed for integration can encourage many organizations, significantly smaller businesses, or those with limited IT resources, to implement these systems. As a result, this reduces the potential customer base and restricts the growth of the integrated systems market. Consequently, the overall cost of adopting these systems may be too high for some organizations.

Massive end-user industries

Integrated Systems are employed across various industries, including defense, healthcare, education, and retail. The digitization and centralization of business operations have created the adoption of advanced ecosystems. Furthermore, technological advancements such as cloud computing and virtual technologies are expected to influence the integrated systems market positively.

Integrated systems enable organizations to retrieve and visualize data simultaneously, which aids in better decision-making. Hence, the demand for improving the efficiency of existing systems, the growing preference for automation technologies, and the expansion of broadband infrastructure are key factors driving the integrated systems market.

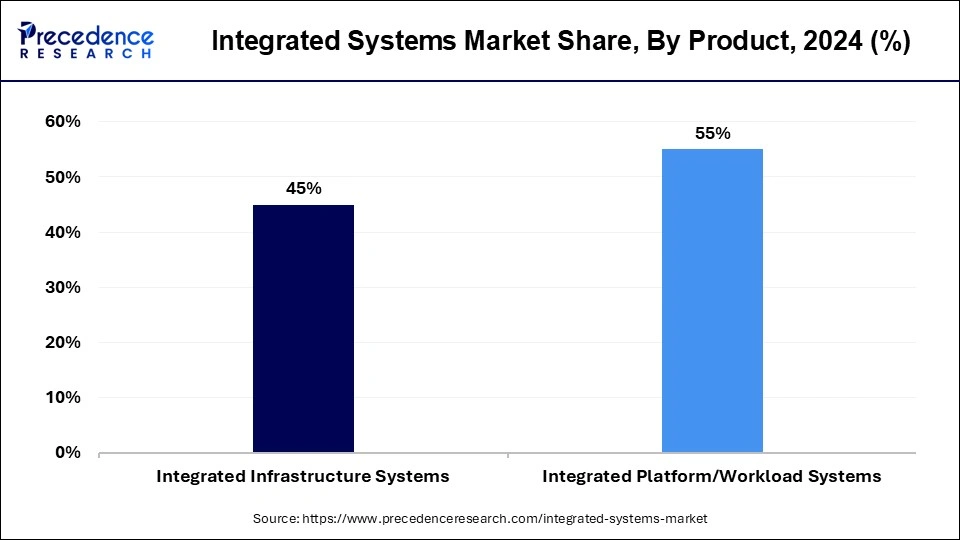

The integrated platform/workload systems segment dominated the integrated systems market in 2024. Integrated platform/workload systems merge hardware, software, and management tools into a single, pre-configured solution, simplify deployment, reduce complexity, and accelerate time-to-value for businesses. Designed for optimized performance on specific workloads, these systems are highly scalable and allow organizations to expand their infrastructure as needed. This scalability is especially advantageous for data-intensive tasks. These benefits are anticipated to drive demand in this segment.

The integrated infrastructure systems segment is expected to witness the fastest growth in the integrated systems market over the forecast period. Integrated infrastructure combines storage, server, and network resources to deliver a shared computing environment. This market has the potential to surpass the broader integrated systems industry. Moreover, increasing concerns about road safety and the need to reduce accidents and fatalities have led governments and regulatory bodies to advocate for the adoption of integrated systems technologies to enhance road safety.

The integration & installation segment dominated the integrated systems market in 2024. Installation and integration services involve implementing and merging various organizational components, such as servers, storage facilities, and networking, with existing infrastructure to improve enterprise IT performance. This segment is expected to grow rapidly in the coming years due to strong demand from small, medium, and large-scale businesses.

The consulting segment is expected to expand rapidly in the integrated systems market during the forecast period. Consulting services involve understanding user requirements and developing a plan to build and operate integrated systems that meet various IT needs of an organization. Maintenance and support services encompass after-sales support and annual or preventive maintenance contracts. These services are anticipated to drive demand in the integrated systems market over the forecast period.

The BFSI segment dominated the integrated systems market in 2024. The BFSI sector has experienced significant digital transformation in recent years. Traditional banking processes and financial services are quickly moving to digital platforms. This shift needs the integration of various systems, such as core banking, payment processing, and customer relationship management, to provide clients with a seamless and unified experience.

The healthcare segment is projected to witness the fastest growth in the integrated systems market over the forecast period. This can be attributed to the increasing demand for data security and privacy in the healthcare industry, which is propelling market growth. Integrated systems provide advanced security features and compliance measures to protect sensitive patient information. With the rise in cyber threats and stringent data protection regulations, healthcare organizations are adopting integrated systems to ensure the confidentiality, integrity, and availability of patient data.

By Product

By Service

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

January 2025

January 2025

November 2024