January 2025

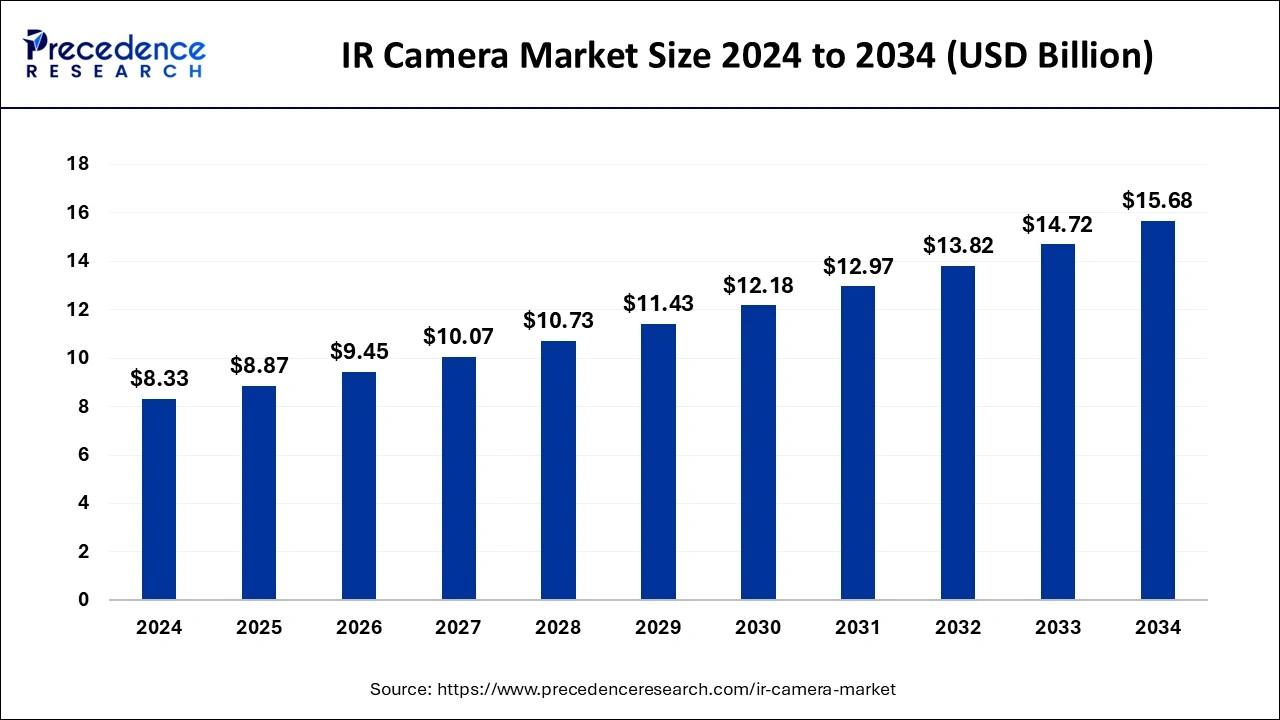

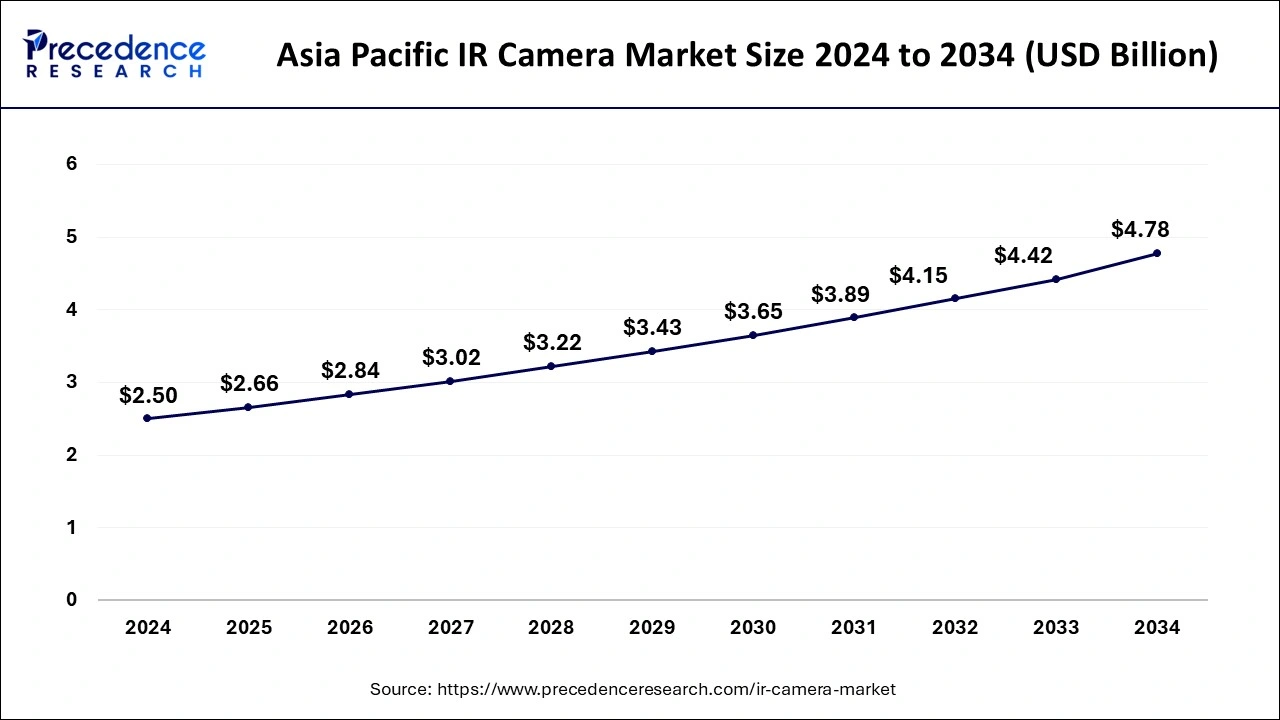

The global IR camera market size was evaluated at USD 8.33 billion in 2024, grew to USD 8.87 billion in 2025 and is anticipated to reach around USD 15.68 billion by 2034. The market is expanding at a CAGR of 6.53% between 2025 and 2034. The Asia Pacific IR camera market size is calculated at USD 2.50 billion in 2024 and is expected to grow at a notable CAGR of 6.70% during the forecast year.

The global IR camera market size was accounted for USD 8.33 billion in 2024 and is expected to exceed around USD 15.68 billion by 2034, growing at a CAGR of 6.53% from 2025 to 2034. Ongoing advancements in detector technology are the key factor driving the growth of the market. Also, increasing investments by homeowners and the government coupled with the high image quality given by these cameras can fuel the IR camera market growth soon.

The integration of artificial intelligence is transforming the IR camera market significantly. Algorithms enhance the whole image processing abilities, enabling more precise predictive analytics and temperature measurements. Furthermore, AI in IR imaging enabled innovative pattern recognition and defect detection, which is necessary for measuring optimal performance and avoiding equipment failures.

The Asia Pacific IR camera market size was exhibited at USD 2.50 billion in 2024 and is projected to be worth around USD 4.78 billion by 2034, growing at a CAGR of 6.70% from 2025 to 2034.

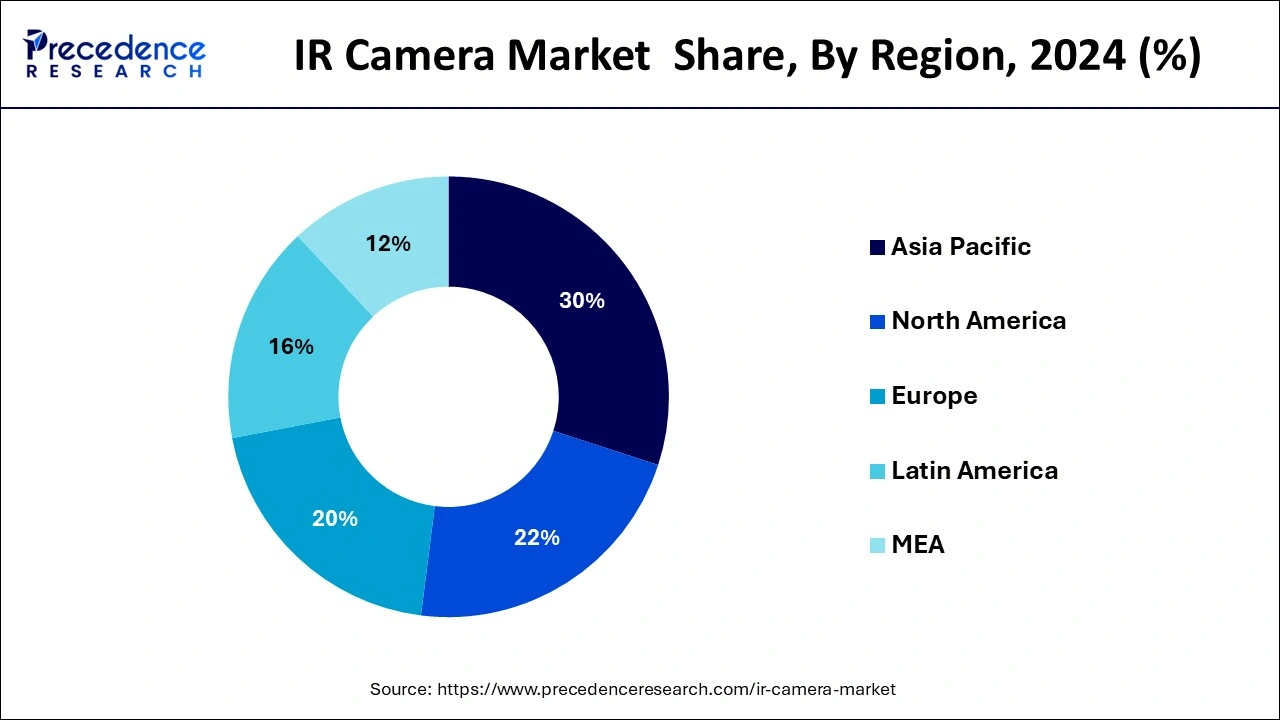

Asia Pacific dominated the global IR camera market in 2024. This dominance can be attributed to the region's technological advancements and developments in infrared imaging technologies, including innovative image processing algorithms. Moreover, in Asia Pacific, India is showing rapid growth owing to increasing population densities and expanding urban areas.

North America is expected to show the fastest growth in the IR camera market over the studied period. The growth of the region can be linked to the increase in the application of IR cameras in industrial, residential, and commercial applications. In North America, the U.S. led the market due to a surge in the semiconductor industry and advancements in power transfer and data processing.

Infrared cameras identify infrared radiation and transform it into an electronic signal. Later, this signal is used to create a thermal image on the monitor. The thermal energy sensed by IR cameras is then quantified and measured to manage heat performance and detect heat-related problems. The latest industry trends are ongoing innovations in detector technology and the addition of built-in visual imaging technology.

| Report Coverage | Details |

| Market Size by 2024 | USD 8.33 Billion |

| Market Size in 2025 | USD 8.87 Billion |

| Market Size in 2034 | USD 15.68 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.53% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Material, Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing adoption of IR cameras in quality control and inspection

The IR camera market is gaining traction in process control and quality assurance monitoring. Process control measures the accurate temperature data and decides the product's shape on a manufacturing line. In addition, this data enhances and controls the process so that product shapes and temperatures are desired to meet the specifications. Also, various automobile manufacturers are utilizing IR for quality control.

High maintenance cost

The high cost of IR cameras and lack of accuracy are the major factors that constrain the IR camera market growth. IR cameras are costly, particularly in developing nations. However, the installation, and monitoring of these cameras are generally high, impacting the overall technology's cost.

Rising demand for surveillance

The demand for the IR camera market in surveillance has grown across different applications, such as military, energy, defense, and commercial spaces. An increasing need for continual and rigorous surveillance in the military is anticipated to expand the market. Furthermore, rising investment in the designing of high-performance IR cameras and the rising utilization of these cameras for object identification.

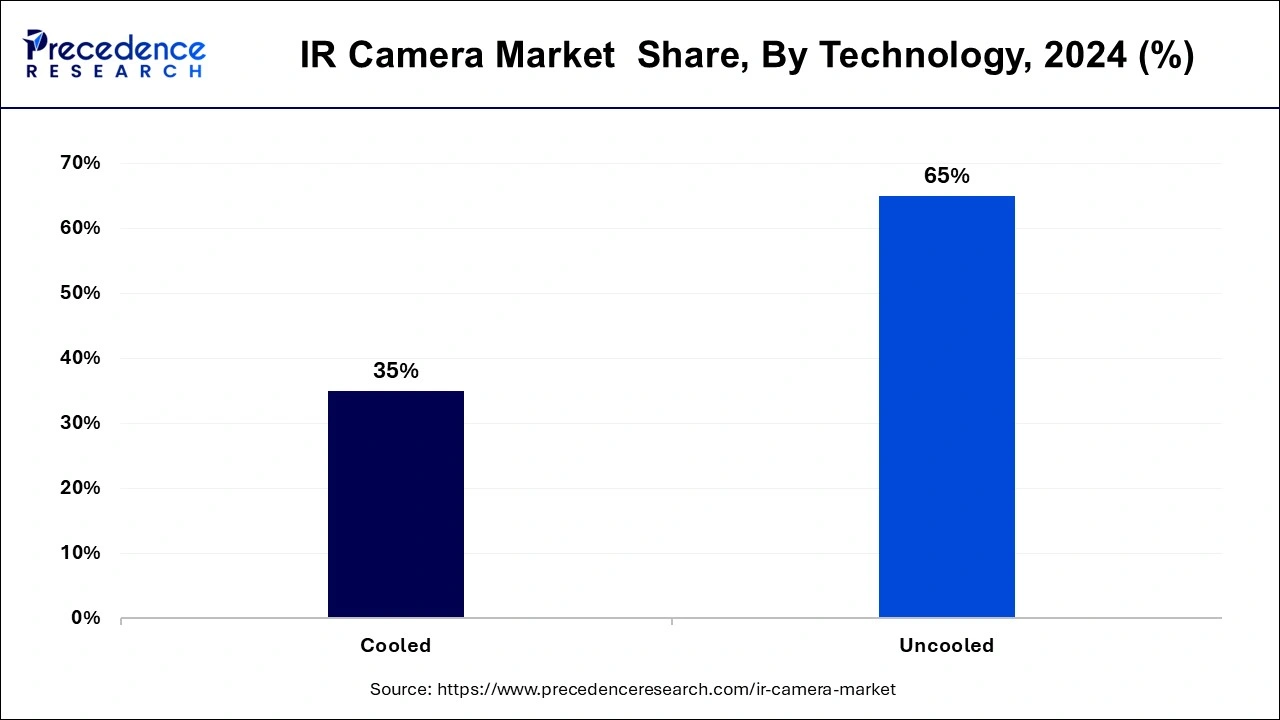

The uncooled IR cameras segment led the IR camera market in 2024. The dominance of the segment can be attributed to the increasing adoption of this camera across various sectors. These cameras use microbolometer sensors which don't need any cryogenic cooling like traditional cooled IR cameras. Additionally, these sensors are more reliable and efficient, hence they enable the development of high-performance IR cameras.

The cooled IR cameras segment is expected to grow at the fastest rate in the IR camera market over the forecast period. The growth of the segment can be linked to their ability to decrease the temperature of the infrared detectors, substantially improving their image and sensitivity quality. Also, these cameras are necessary for challenging military operations, such as surveillance, reconnaissance, and acquisition.

The Germanium segment dominated the IR camera IR camera market in 2024. The dominance of the segment can be driven by the high transmission capabilities of the germanium in the IR spectrum. Germanium is a crucial material for IR camera optical components and lenses. In addition, it has low absorption rates and a high refractive index which helps it to produce high-quality thermal images.

The sapphire segment is anticipated to grow at the fastest rate over the forecast period. The growth of the segment is due to the superior qualities of sapphire, including hardness, excellent IR transmission rate, and high thermal conductivity, especially in the short-wave infrared (SWIR) spectrum. Sapphire windows and lenses provide exceptional IR light transmission.

The long-wavelength IR-type segment shows the fastest growth during the projected period. The growth of the segment is linked to the increasing use of LWIR cameras in defense and military sectors. LWIR cameras are specially used to detect heat signatures in a dark environment and through obscurants such as fog, smoke, and dust. This makes it important for civilian security and military operations.

The commercial segment led the global IR camera market in 2024. The dominance of the segment is due to the increasing investment by organizations and businesses in efficient security systems to safeguard assets and protect property from future threats. Furthermore, with the growing instances of theft, retail environments, commercial properties, and office buildings need improved security measures.

The industrial sector is expected to grow at the fastest rate during the studied period. The growth of the segment can be credited to the growing adoption of IR cameras in industries to detect heat anomalies, including mechanical wear, electrical faults, and overheating components. Also, IR cameras can significantly reduce maintenance costs, expand equipment lifespan, and minimize downtime.

By Technology

By Material

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

February 2025

January 2025