January 2025

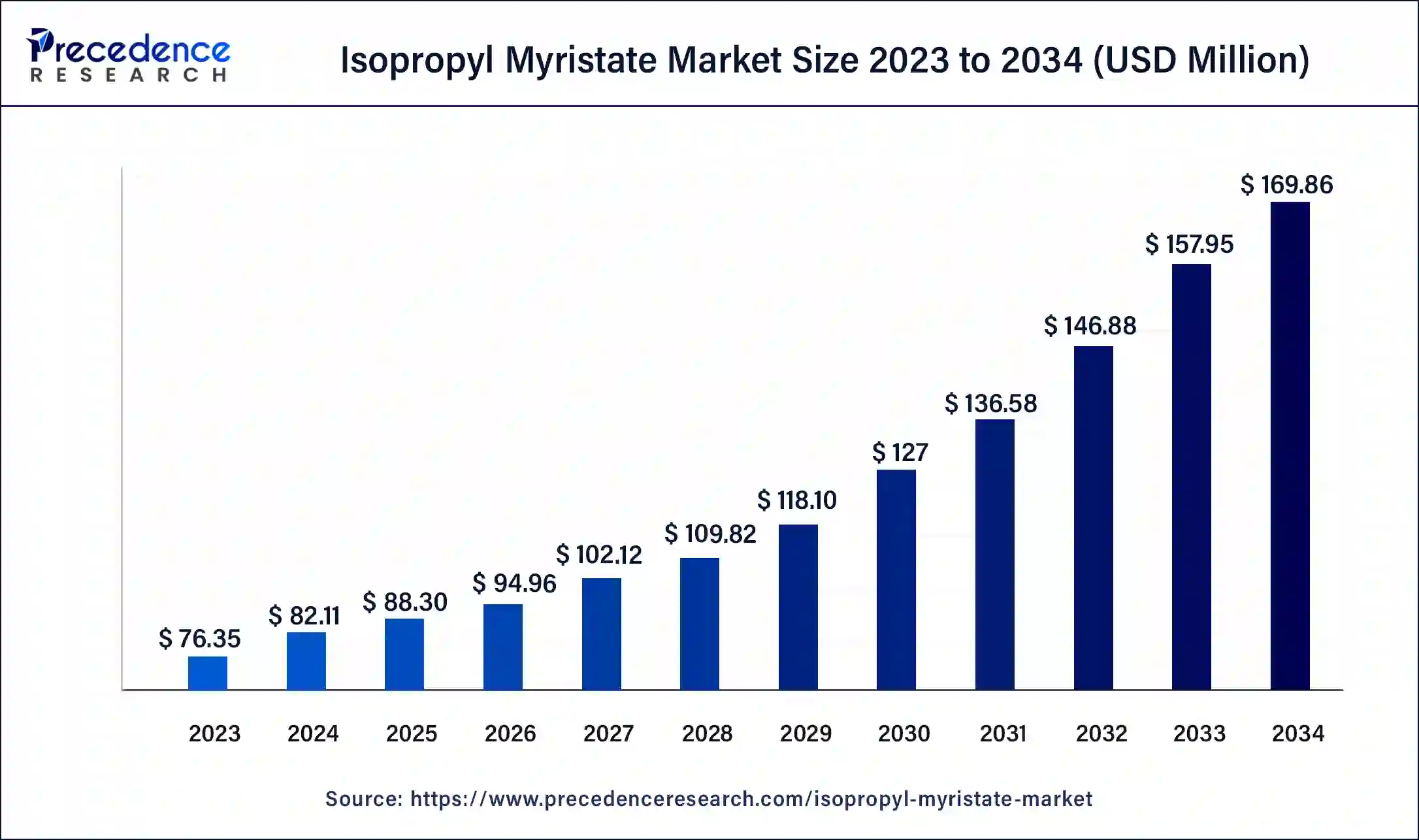

The global isopropyl myristate market size was USD 76.35 million in 2023, calculated at USD 82.11 million in 2024 and is expected to be worth around USD 169.86 million by 2034. The market is expanding at a solid CAGR of 7.54% between 2024 and 2034.

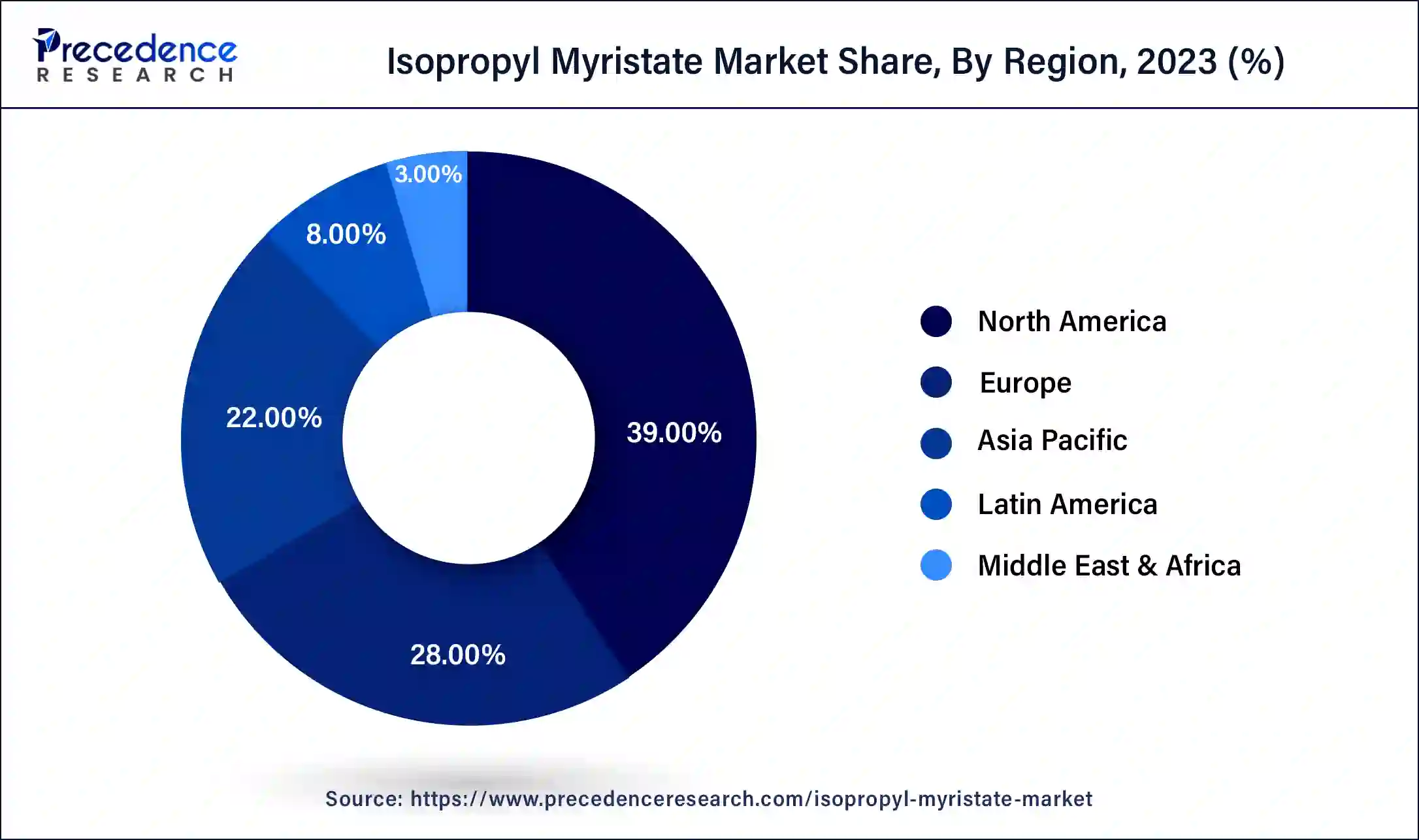

The global isopropyl myristate market size is expected to be valued at USD 82.11 million in 2024 and is predicted to reach around USD 169.86 million by 2034, expanding at a CAGR of 7.54% over the forecast period 2024 to 2034. The North America isopropyl myristate market size reached USD 29.78 million in 2023 Due to its exceptional emollient qualities, which improve the spreadability of creams and lotions, isopropyl myristate (IPM) is frequently employed in cosmetic compositions. Thus, driving the isopropyl myristate market.

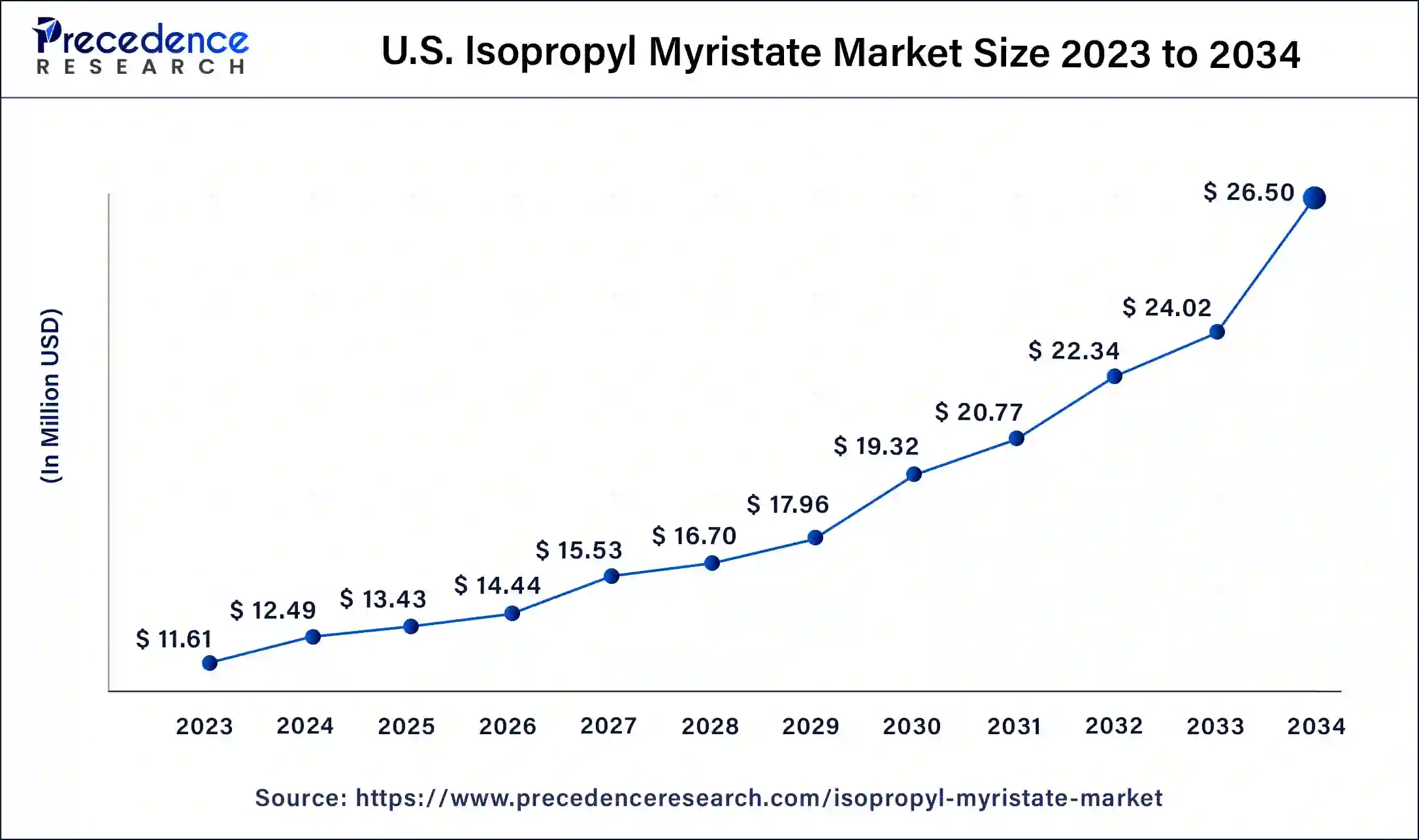

U.S. Isopropyl Myristate Market Size and Growth 2024 to 2034

The U.S. isopropyl myristate market size was exhibited at USD 11.61 million in 2023 and is projected to be worth around USD 26.50 million by 2034, poised to grow at a CAGR of 7.79% from 2024 to 2034.

North America held the largest share of the isopropyl myristate market in 2023. The personal care and cosmetics business uses isopropyl myristate extensively as a moisturizer, thickening agent, and emollient. One major driver is the rising demand in North America for skincare, haircare, and cosmetic products. The demand for products containing isopropyl myristate has increased as a result of growing consumer awareness of the importance of utilizing high-quality personal care products and the health of their skin. The expansion of e-commerce platforms has facilitated customers' access to a vast array of personal care and cosmetic products, hence contributing to the growth of the industry. Businesses are concentrating on environmentally friendly packaging options since they are starting to stand out in the marketplace.

Asia Pacific is expected to host the fastest-growing isopropyl myristate market during the forecast period. In the cosmetic and personal care sectors, isopropyl myristate is frequently utilized as a moisturizer, thickening agent, and emollient. The market is greatly boosted by the rising middle class and increased awareness of personal grooming in Asia Pacific, which is driving up demand for skincare and cosmetic products. In topical drug formulations, isopropyl myristate serves as a solvent and penetration enhancer. The growing demand for topical medications and the developing pharmaceutical industry in the Asia Pacific is driving market expansion. Market demand is driven by the usage of isopropyl myristate as a plasticizer and lubricant in a variety of industrial applications, including the manufacture of rubber and plastics.

The manufacturing, distribution, and retail of isopropyl myristate, a chemical substance that is frequently employed as an emollient, thickening agent, and penetration enhancer in a variety of personal care, pharmaceutical, and cosmetic goods, are collectively referred to as the isopropyl myristate market. This market includes a wide range of applications, such as industrial, medicinal, skincare, and hair care. The need for personal care and cosmetic products, improvements in pharmaceutical formulations, and the expansion of associated industries as a whole are important factors driving the isopropyl myristate market. IPM is used in a variety of industrial contexts, such as in the textile sector as a lubricant and in other chemical formulations as a solvent.

The wide range of applications for the isopropyl myristate market in industrial, pharmaceutical, and skincare goods drives the growth of the global market for this commodity. IPM's non-greasy texture and capacity to improve the penetration of active ingredients into the skin make it a popular choice for emollient, thickening, and moisturizing purposes in skincare formulations. Because of its lubricating qualities and capacity to dissolve other materials, IPM finds use in the textile, coating, and lubricant industries. Leads in terms of both production and consumption as a result of the existence of important manufacturers and the expanding demand from the pharmaceutical and cosmetics industries. Formulations, including IPM, are being influenced by consumers' growing preferences for natural and sustainable products.

| Report Coverage | Details |

| Market Size by 2034 | USD 169.86 Million |

| Market Size in 2023 | USD 76.35 Million |

| Market Size in 2024 | USD 82.11 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.54% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expanding industrial applications

IPM's propensity to give a smooth and silky feel makes it a popular emollient in personal care products such as lotions, creams, and hair care products. It improves the absorption of medicinal substances through the skin and is utilized in the manufacture of transdermal patches and topical pharmaceuticals. IPM is a plasticizer that increases the workability and flexibility of polymers and plastics during manufacture. Because of its non-toxic, non-greasy, and non-irritating qualities, isopropyl myristate is quite versatile in various applications and can be used as an appropriate constituent in a variety of industrial products. The need for the isopropyl myristate market is anticipated to rise as businesses continue to innovate and create new goods, hence increasing the scope of its industrial applications.

Competition from alternatives

The main application of the isopropyl myristate market in pharmaceutical and cosmetic compositions is as an emollient. Caprylic/capric triglyceride, isopropyl palmitate, and other natural oils (almond, jojoba, and other oils) are substitutes that have comparable effects for moisturizing and enhancing product texture. The increasing inclination of consumers towards natural and organic products may prompt manufacturers to choose natural emollients derived from plants rather than synthetic ones, like isopropyl myristate. Among the ingredients that are popular in this trend are coconut oil, shea butter, and argan oil. The acceptance of alternatives may be influenced by their affordability and the accessibility of their raw materials. Natural oils have the potential to become a serious rival to isopropyl myristate if they become more widely available and reasonably priced.

Growing awareness of sustainable ingredients

Manufacturers are implementing greener methods as a result of growing consumer interest in sustainable and environmentally friendly products. Customers are becoming more aware of how their purchases including the substances in cosmetics and pharmaceuticals impact the environment. Businesses incorporate sustainable practices into their CSR plans. Consequently, they are making investments in the isopropyl myristate market in an effort to improve their brand's reputation and draw in eco-aware customers. Researchers and manufacturers are investigating novel approaches to developing sustainable IPM formulations. This entails raising production process efficiency and lowering IPM production's environmental impact. Companies are differentiating their products by promoting the use of sustainable chemicals, particularly sustainable IPM, to attract consumers as the market for pharmaceutical and personal care products grows more competitive.

The cosmetic grade segment held the largest share of the isopropyl myristate market in 2023. IPM is a component in many cosmetic formulations, such as serums, lotions, and creams. It improves these products' texture and absorption by acting as an emollient, solvent, and skin-conditioning agent. The demand for IPM may be impacted by the growing trend for natural and organic cosmetics, depending on where the product comes from and how it is processed. The demand for cosmetic-grade IPM may be impacted by developments in formulation technology and new product advancements in the cosmetics sector. IPM is being used more often in emerging countries in the Asia Pacific as a result of the region's developing middle class and cosmetics sector. Higher demand for premium ingredients like IPM is driven by consumers' growing interest in anti-aging goods.

The industrial grade segment is expected to grow at the fastest rate in the isopropyl myristate market over the forecast period. Applications, where IPM is utilized as a solvent or carrier in different industrial processes, are usually included in the industrial-grade sector. Because it can improve the feel of the product and increase skin absorption, IPM is utilized as a solvent in the formulation of creams, lotions, and other personal care products. IPM is a solvent used in drug delivery systems and topical formulations in the pharmaceutical industry that improves the absorption of active substances. IPM can be used as a solvent for flavors and essential oils in the food and beverage sector, albeit it is less prevalent. To increase the potency of the active components in agricultural formulations, such as pesticides or herbicides, integrated pest management can be applied.

The personal care & cosmetics segment held the largest share of the isopropyl myristate market in 2023. Because it can improve the penetration of active substances and provide a smoother application and more comfortable sensation on the skin, IPM is employed in many skin care products. Sunscreens, serums, and moisturizers frequently include it. IPM is used in cosmetics to improve their stability and spreadability. It is used to enhance texture and performance in foundations, lipsticks, and other cosmetic formulas. IPM aids in the dissolution and stabilization of scent components by acting as a carrier and solvent in colognes and fragrances. IPM is a well-liked option in anti-aging formulations due to its emollient qualities, which enhance the product's efficacy and application.

The pharmaceutical segment is expected to grow at the fastest rate in the isopropyl myristate market during the forecast period. Topical medicinal preparations frequently contain isopropyl myristate to promote skin penetration and active ingredient delivery. It functions as a solvent in transdermal patches to improve the drug's ability to penetrate the skin. Isopropyl myristate can be employed as an emulsifier or solvent in certain oral formulations, albeit it is not as prevalent. It could be a part of ophthalmic formulations to help stabilize and solubilize some active components. Because of its emollient qualities, isopropyl myristate is mostly used in medicinal applications but is also used in cosmeceutical products. Because of its capacity to increase the solubility of medications that are not very soluble in water, boost skin absorption, and serve as a carrier for active substances, isopropyl myristate is frequently chosen in these applications.

Segment Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024