January 2025

IT Services Market (By Approach: Reactive IT Services, Proactive IT Services; By Type: Design and Implementation, Operations and Maintenance; By Application: Systems and Network Management, Data Management, Application Management, Security and Compliance Management, Others; By Technology: AI and Machine Learning, Big Data Analytics, Threat Intelligence, Others; By Deployment: On-premises, Cloud) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

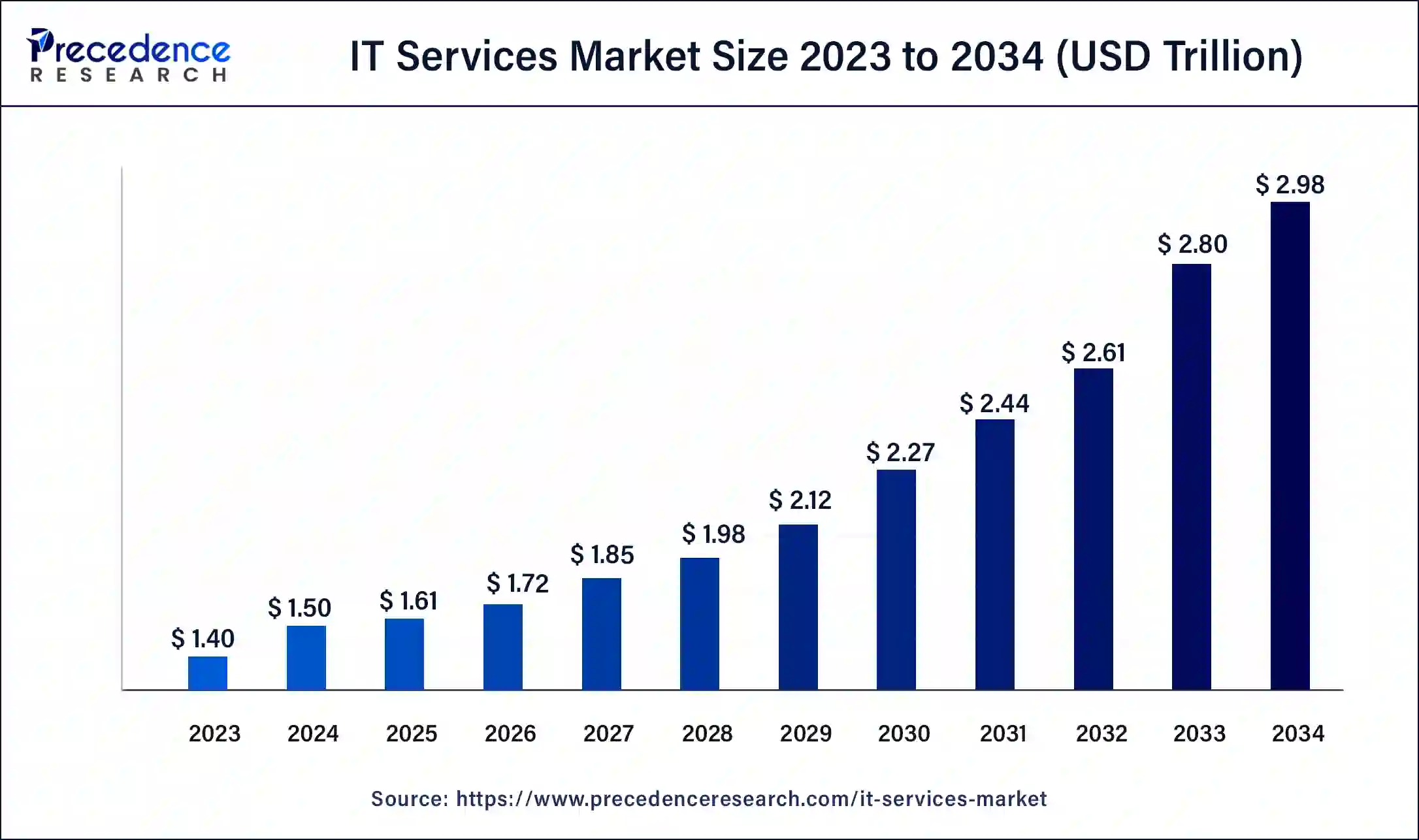

The global IT services market size was USD 1.40 trillion in 2023, calculated at USD 1.50 trillion in 2024 and is expected to reach around USD 2.98 trillion by 2034, expanding at a CAGR of 7.1% from 2024 to 2034. The IT services market size reached USD 520 billion in 2023. The IT services market is driven by the broad usage of cloud computing.

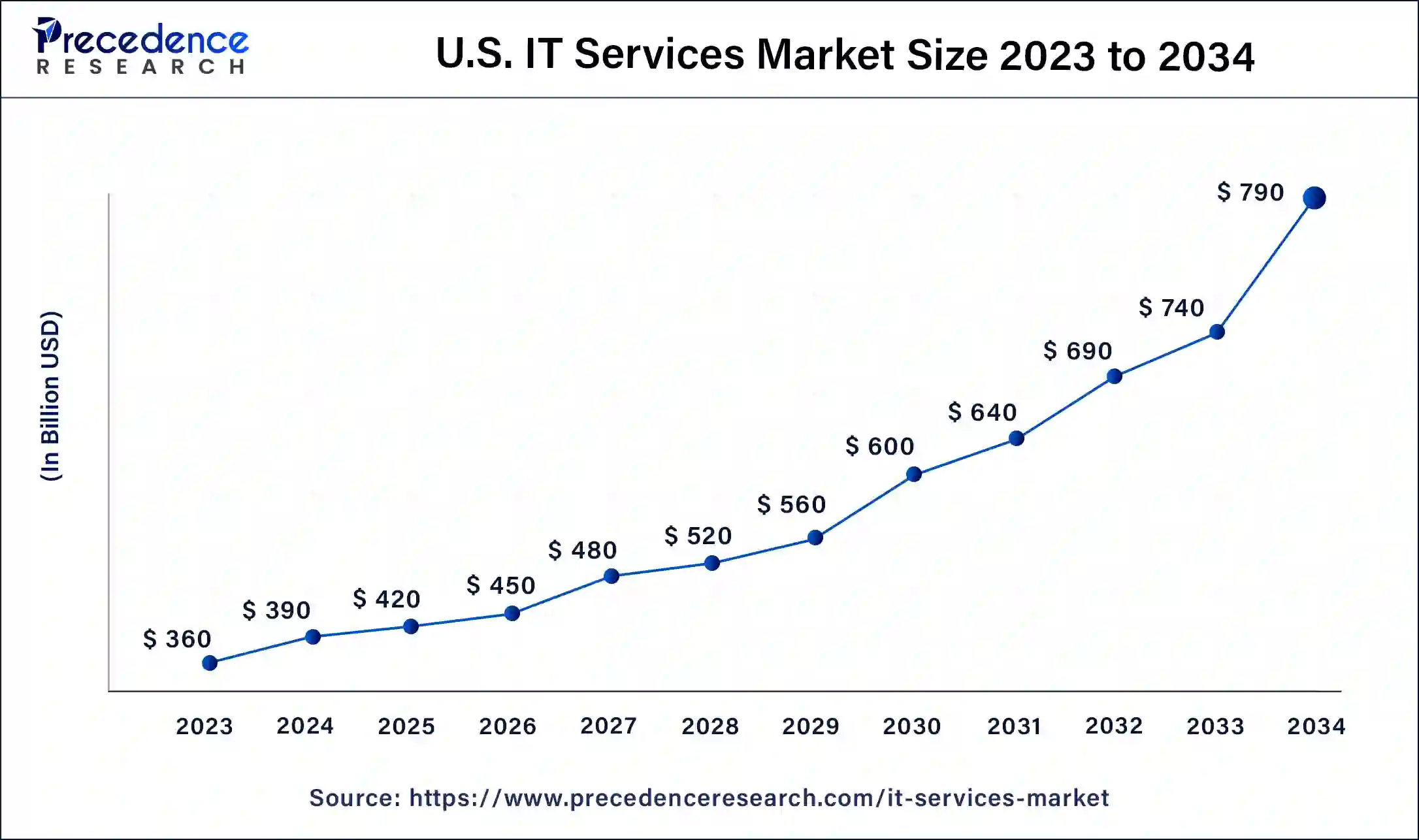

The U.S. IT services market size was estimated at USD 360 billion in 2023 and is predicted to attain USD 790 billion by 2034, at a CAGR of 7.30% from 2024 to 2034.

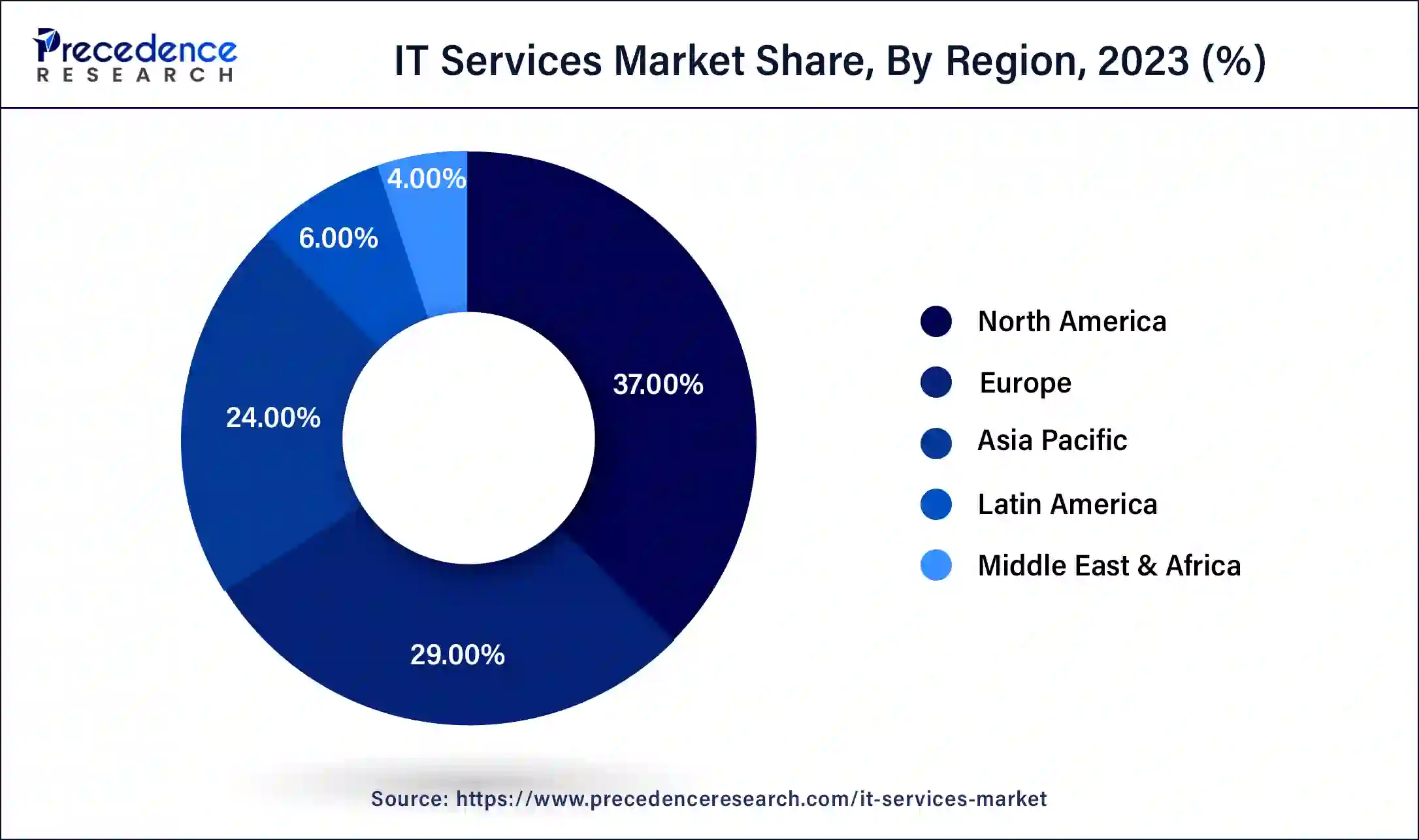

North America has its largest market share in 2023 and is observed to sustain its position in the IT services market throughout the predicted timeframe. Silicon Valley in California and other tech hotspots like Seattle and Boston have promoted an atmosphere of entrepreneurship and funding for cutting-edge technologies. Top talent is drawn to this environment, which also fosters industry-academia collaboration. In addition to well-established businesses, this area supports a thriving startup and tech community.

These elegant and creative businesses upend established business models, drive innovation across the industry, and provide specialized solutions, all of which significantly impact the IT services market. The existence of tech incubators, accelerators, and venture capital firms contributes to the expansion of the IT industry.

U.S.

Canada

China

Japan

India

IT services are the application of technical and business knowledge to help firms establish, manage, and optimize business processes and information or to make those processes easier to access. The abilities used to deliver the service (design, construct, run) can be used to segment the market for IT services. Services can also be divided into infrastructure, applications, and business processes.

| Report Coverage | Details |

| Global Market Size by 2034 | USD 2.98 Trillion |

| Global Market Size in 2023 | USD 1.40 Trillion |

| Global Market Size in 2024 | USD 1.50 Trillion |

| Growth Rate from 2024 to 2034 | CAGR of 7.1% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Approach, Type, Application, Technology, Deployment, Enterprise Size, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing concerns regarding data security and privacy protection

In terms of data security and privacy, there are opportunities and difficulties arising from the fast use of advanced technologies such as artificial intelligence (AI), the Internet of Things (IoT), and big data analytics. Strong security measures are needed for these technologies to protect private information, stop illegal access, and lessen algorithmic bias, data breaches, and privacy violations. IT service providers provide specialized solutions to ensure ethical data use, secure AI/ML models, and integrate IoT security policies.

High demand for data analytics & big data solutions

Data analytics and big data solutions greatly aid risk management and regulatory compliance. Sophisticated analytics are essential to the financial, healthcare, and cybersecurity industries to spot irregularities, stop fraud, and ensure industry rules are followed. These solutions support businesses in proactively reducing risks and preserving the security and integrity of their data.

Cost concerns over product customization

Proficient IT specialists, including developers, designers, and project managers, are needed for customization projects. When resources are dedicated to a customized project, they become unavailable for other jobs or projects. This can affect an IT services provider's overall productivity and resource usage. A balanced resource allocation is necessary to prevent overcommitting or underutilizing important skills.

Growing adoption of digital technologies

Cybersecurity has become an organization's top concern as corporate operations and data become more digital. IT providers provide cybersecurity services like vulnerability assessments, threat detection and response, security consulting, and managed security services. They support customers in protecting their digital assets, adhering to rules, and reducing cyberthreats such as ransomware assaults, insider threats, and data breaches. The necessity for strong defenses and the increasing complexity of cyber threats are driving demand for cybersecurity services.

The reactive IT services segment dominated the IT services market in 2023. Even though they are reactive, contemporary IT service providers in this market use sophisticated analytics and monitoring tools to identify problems early on or anticipate possible failures. Reactive IT services can occasionally detect and resolve problems before they become severe interruptions by proactively monitoring systems and examining data patterns.

The operations & maintenance segment dominated the IT services market in 2023. The IT environment changes due to new trends, technologies, and difficulties. The operations and maintenance sector invests in innovation and technological know-how to stay ahead of the curve. This entails keeping up with the most recent security patches, software updates, and industry best practices. By utilizing cutting-edge equipment and techniques, this sector may provide excellent services and assist companies in maintaining their competitiveness.

The application management segment held the largest share in the IT services market in 2023. Application management services are a comprehensive enterprise-wide initiative offering governance to guarantee that applications operate as effectively as possible, from end-user experience to interaction with back-office business operations. Productivity increases when effective management techniques minimize the person's hours spent in meetings. As fewer and fewer application problems arise, effective application management techniques can also reduce the need to hire costly outside consultants and lower total operating costs.

If contemporary apps appropriately address business functions, business process solutions can be launched more swiftly, cheaply, and efficiently. When applications are handled effectively, more IT resources are available to concentrate on novel business difficulties and competitive issues.

The data management segment shows a significant growth in the IT services market during the forecast period. Data management is known for safeguarding, arranging and preserving an organization's data to be examined for business choices. Data management solutions are crucial for making sense of the massive volume of data enterprises create and consume at previously unheard-of speeds. Organizations can eliminate redundancies and confusion created by various conflicting data sources by making a single source of truth for enterprise data through data management.

For instance, data management guarantees that the company won't try to reach out to customers with outdated and current contact information when their information changes for sales or marketing purposes.

The AI & machine learning segment dominated the IT services market in 2023. It becomes difficult to maintain smooth operations when multiple databases and apps run independently. Time-consuming and ineffective manual procedures are utilized to find and fix problems. Identifying significant situations and responding to them quickly and efficiently becomes challenging. Businesses use artificial intelligence (AI) in their IT operations to solve these obstacles.

Artificial Intelligence has drawn attention due to its ability to improve decision-making, stimulate creativity, and optimize operations. AI is revolutionizing IT by enabling businesses to improve cybersecurity, optimize operations, and glean insightful insights from large data sets.

The big data analytics segment shows a significant growth in the IT services market during the forecast period. Discovering patterns, trends, and correlations in more significant amounts of unprocessed data is the goal of big data analytics, which aids in making data-driven decisions. With more modern technologies, these procedures use well-known statistical analytic techniques, such as regression and clustering, to create larger datasets. Big data analytics techniques are now coupled with emerging technologies like machine learning to find and scale more sophisticated insights.

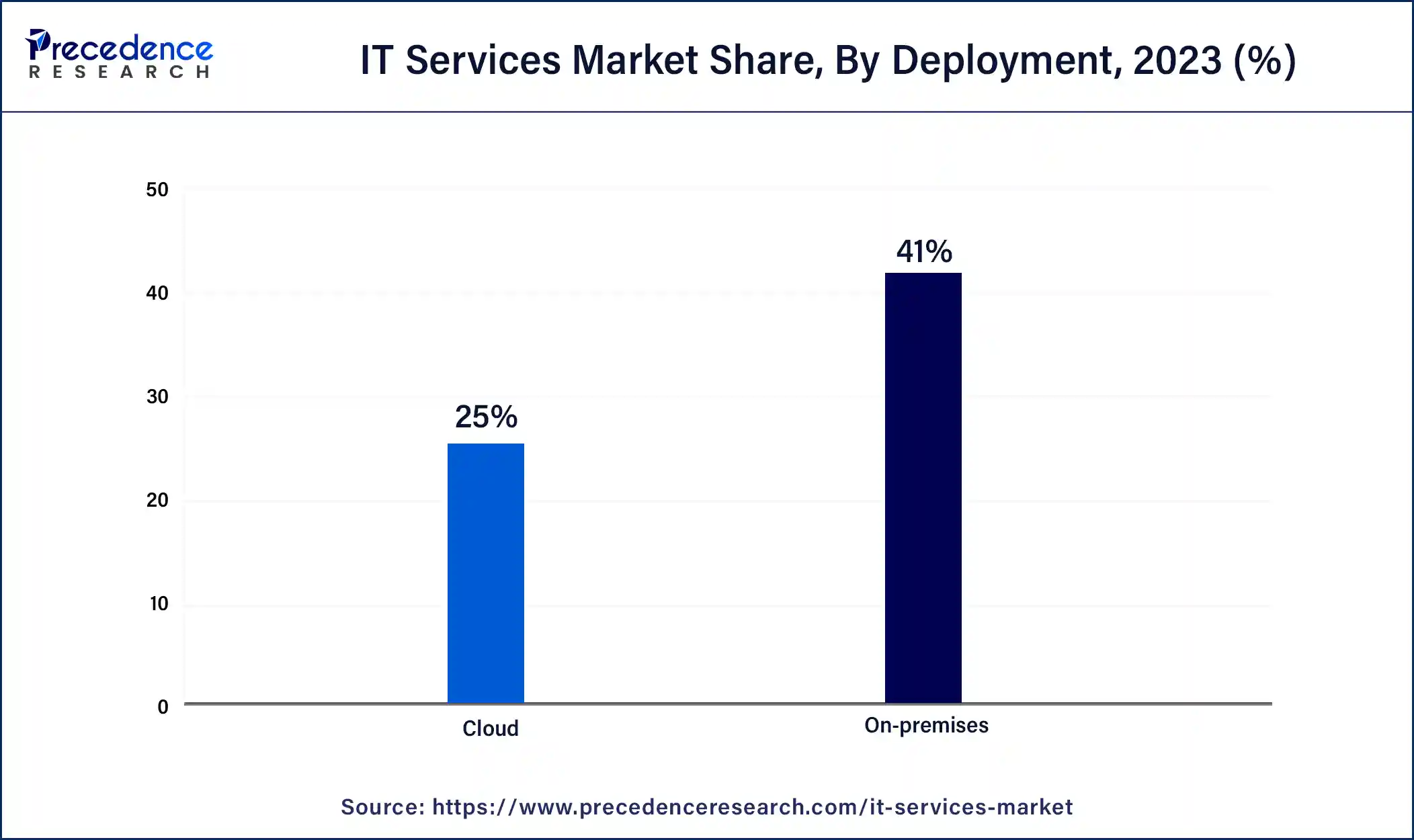

The cloud segment shows a substantial growth in the IT services market during the forecast period. Cloud-based services deliver information technology (IT) as a service via the Internet or a dedicated network, with usage-based billing and on-demand delivery. Virtual desktops, servers, storage, and whole applications and development platforms are all examples of cloud-based services.

In contrast to a conventional IT setup, where departmental funds are allocated beforehand for software and infrastructure, which takes months to implement, cloud-based services provide IT resources within minutes or hours and match costs to real consumption. Organizations are, therefore, more flexible and able to handle costs more effectively.

The large enterprise segment held the largest share in the IT services market in 2023. Due to their scale, large enterprises typically have complex and diverse IT needs. These organizations often operate in multiple geographic locations, have numerous departments, and manage large volumes of data. As a result, they require a wide range of IT services, such as network infrastructure management, cybersecurity, cloud computing, software development, and enterprise resource planning (ERP) solutions.

The IT & telecom segment held the largest share in the IT services market in 2023. Telecom operators obtain meaningful insights into customer behavior, network efficiency, and market trends by utilizing IT-driven analytics and company intelligence solutions. Telecom firms may maximize service offerings, boost customer happiness, and discover new revenue streams using big data analytics, machine learning methods, and predictive modeling techniques. The telecommunications business has undergone a transformation thanks to the incorporation of information technology, which has enabled operators to provide users globally with faster, more dependable, and more innovative communication services.

The retail segment shows significant growth in the IT services market during the forecast period.

The IT industry's specialty in retail-oriented solutions, including the most recent advancements, radio frequency technologies, computers, and the Internet, has made using cutting-edge technology in retail viable. Data visualization, predictive modeling, and advanced analytics are some of the IT solutions available to the retail sector. Retailers may stay competitive by optimizing inventory management, gaining a deeper understanding of customer behavior, and making well-informed strategic decisions by utilizing these services.

Segments Covered in the Report

By Approach

By Type

By Application

By Technology

By Deployment

By Enterprise Size

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

July 2024

August 2024

April 2024