October 2024

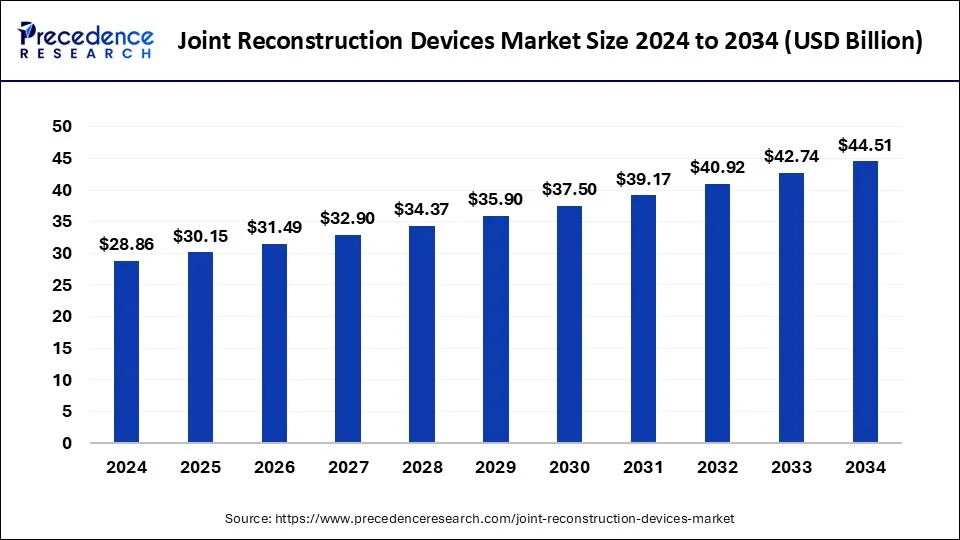

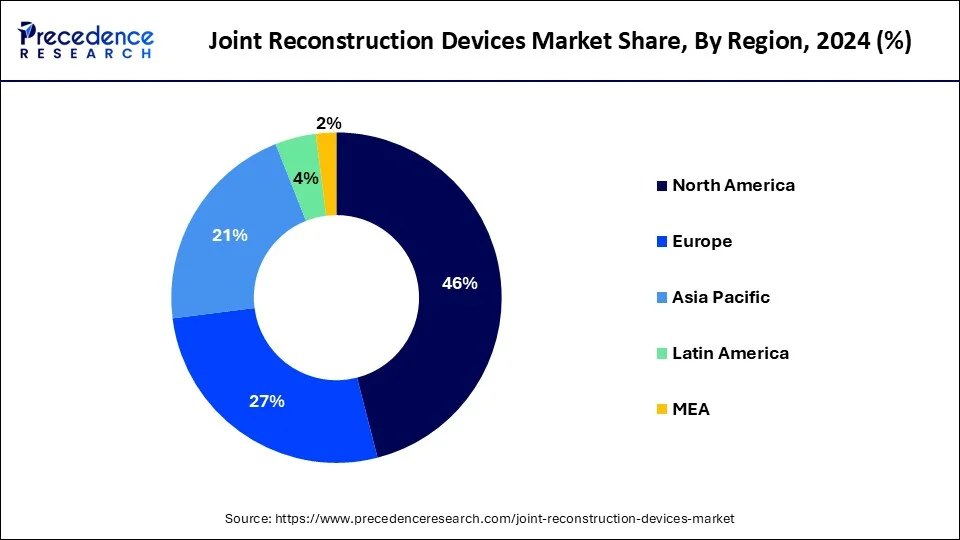

The global joint reconstruction devices market size is calculated at USD 30.15 billion in 2025 and is forecasted to reach around USD 44.51 billion by 2034, accelerating at a CAGR of 4.43% from 2025 to 2034. The North America joint reconstruction devices market size surpassed USD 13.28 billion in 2024 and is expanding at a CAGR of 4.54% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global joint reconstruction devices market size was estimated at USD 28.86 billion in 2024 and is predicted to increase from USD 30.15 billion in 2025 to approximately USD 44.51 billion by 2034, expanding at a CAGR of 4.43% from 2025 to 2034.

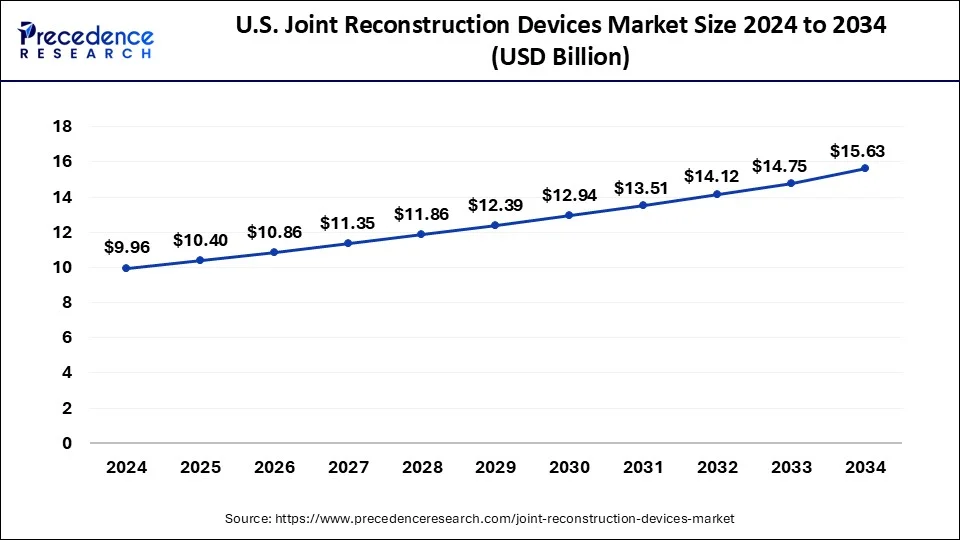

The U.S. joint reconstruction devices market size reached USD 9.96 billion in 2024 and is predicted to be worth around USD 15.63 billion by 2034 at a CAGR of 4.61% from 2025 to 2034.

North America, in 2024, emerged as a dominant force in the joint reconstruction devices market, showcasing significant growth and innovation within the healthcare industry. With a robust healthcare infrastructure and advanced medical research capabilities, the region leads the way in antibody therapy advancements, driving the development and adoption of cutting-edge treatments for various diseases. Furthermore, arthroplasties, particularly knee and hip replacements, represent some of the most common surgeries performed in North America.

The establishment of the American Joint Replacement Registry further solidifies North America's leadership in arthroplasty monitoring and research. With data from over 2.8 million hip and knee procedures across 1,250 institutions, the registry serves as a comprehensive resource for monitoring device performance, assessing cost-effectiveness, and enhancing patient safety in hip and knee replacement procedures.

The region witnesses a steady rise in the number of total knee and hip replacements, with approximately 518,000 total knee arthroplasties and 193,000 total hip arthroplasties performed annually. Projections indicate a significant surge in these numbers, with an expected total of 4 million procedures by 2030, as reported by the American Academy of Orthopaedic Surgeons (AAOS).

The joint reconstruction devices market offers services and solutions aimed at addressing arthritic or damaged joints by replacing them with metal, plastic, or ceramic prosthetic devices. These devices are meticulously designed to emulate the movement and functionality of a healthy joint. While hip and knee replacements constitute the majority of procedures, other joints such as the ankle, wrist, shoulder, and elbow can also undergo replacement surgery.

The joint reconstruction devices market emerges as a dynamic sector within the medical industry. With a focus on developing and supplying prosthetic devices for joint replacement surgeries, this market encompasses a wide range of stakeholders, including medical device manufacturers, healthcare providers, and investors. The market's growth is driven by demographic factors such as an aging population and an increasing prevalence of musculoskeletal disorders.

Technological advancements play a pivotal role in shaping the market dynamics. Innovations in materials, surgical techniques, and prosthetic design contribute to improving patient outcomes and expanding the market reach. Strategic partnerships and collaborations between industry players and research institutions fuel innovation and drive market expansion.

The joint reconstruction devices market presents lucrative opportunities for stakeholders, underpinned by the rising demand for effective orthopedic solutions and advancements in medical technology.

| Report Coverage | Details |

| Market Size in 2024 | USD 28.86 Billion |

| Market Size in 2025 | USD 30.15 Billion |

| Market Size by 2034 | USD 44.51 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.43% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technique, Joint Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Robotic-assisted joint replacement surgery

The joint reconstruction devices market experiences significant momentum fueled by the advancements in robotic-assisted joint replacement surgery. This innovative approach not only aids in restoring mobility and alleviating long-term pain but also enhances surgical precision and patient outcomes. With studies confirming the superior accuracy and security of prosthetic implant insertion compared to traditional methods, robotic assistance has become a preferred choice, particularly for larger joints like hips and knees. As patients increasingly seek improved quality of life through joint replacement procedures, the integration of robotic technology continues to drive market growth, offering promising solutions for enhanced surgical outcomes and patient satisfaction.

Advancements in biomaterials and implant design for joint reconstruction

The joint reconstruction devices market is propelled by breakthroughs in biomaterials and implant design technology, particularly aimed at catering to younger, more physically active patients, as well as the aging population. With the average age of joint replacement surgery patients now under 70 years, innovative biomaterials offer longevity, durability, and improved functionality, meeting the evolving demands of orthopedic care. Biocompatible metals with multifunctional bioactive coatings promise tailored medication release, addressing patient-specific needs while extending implant lifespan, thus driving market expansion in response to the unprecedented aging demographic.

Potential complications in surgery

Despite its efficacy, the joint reconstruction devices market faces limitations due to potential complications such as bleeding, infection, blood clots, and prosthetic loosening. Moreover, injury to nerves or blood vessels may lead to weakness or numbness, while inadequate pain relief or incomplete functionality restoration post-surgery can hinder market growth for joint reconstruction devices. These complications underscore the importance of continued innovation and risk mitigation strategies within the orthopedic industry.

Advancement of 3D printing technology in orthopedics

The burgeoning adoption of 3D printing technology in orthopedics presents a significant opportunity for the joint reconstruction devices market. Despite concerns regarding cost-effectiveness, particularly within publicly funded healthcare systems, the potential benefits of 3D printing are substantial. Specifically, the utilization of 3D-printed metal implants through techniques such as electron beam melting (EBM) and selective laser melting (SLM) offers precise, computer-controlled additive manufacturing fabrication.

This layer-by-layer production method allows for the customization of materials according to computer-aided designs, promising enhanced functionality and fit for joint reconstruction devices. To fully capitalize on this opportunity, further investment in randomized controlled trials and the accumulation of long-term clinical data are essential to validate the efficacy and cost-effectiveness of 3D printing in orthopedics, thereby driving growth and innovation in the joint reconstruction devices market.

Integration of Artificial Intelligence (AI) in orthopedic surgery

The integration of artificial intelligence (AI) systems in medicine and orthopedic surgery presents a promising opportunity for the joint reconstruction devices market. This trend is propelled by the exponential growth in computer processing power, cloud-based computing infrastructure, and the refinement of medical-task-specific software algorithms. With technologies like medical imaging playing a pivotal role in orthopedic disorder management, AI-based integration of imaging studies offers enhanced sensitivity, specificity, and prognostic value.

Furthermore, advancements in software and hardware technologies, including graphic processing units and cloud computing, have facilitated faster processing speeds and the storage of vast amounts of data.

The joint replacement segment, in 2024, dominated the joint reconstruction devices market, fueled by technological advancements that offer transformative benefits to patients. Joint replacement surgery provides significant pain relief, enabling individuals to resume normal activities and enjoy a better quality of life. Moreover, it improves mobility, particularly for those living with limited movement due to joint damage, thereby enhancing independence and enabling individuals to perform daily tasks autonomously.

With post-surgery reports citing reduced pain, improved mobility, and increased independence, joint replacement surgery emerges as a life-altering experience for patients. The transformative impact of joint replacement surgery, it's crucial to recognize the associated risks and prepare for post-operative care.

Despite the challenges of decision-making and recovery, joint replacement surgery remains a life-saving and life-changing intervention for many individuals. By significantly enhancing mobility and alleviating pain and discomfort, joint replacement surgery offers a promising solution for those suffering from severe joint conditions.

The knee segment has held the largest joint reconstruction devices market share in 2024, offering innovative solutions to address knee-related ailments and improve patient outcomes. This surgical intervention entails replacing damaged or worn-out parts of the knee joint with artificial components made of metal and plastic, thereby alleviating pain and enhancing knee functionality. Commonly performed to mitigate arthritis-related discomfort, knee replacement surgery targets individuals experiencing difficulties in walking, climbing stairs, and performing daily activities due to joint degeneration.

As technological advancements continue to drive innovation in the field of joint reconstruction devices, knee replacement surgery stands at the forefront of transformative developments. From enhanced implant materials to innovative surgical techniques, the evolution of knee joint replacement surgery holds promise for improving patient outcomes and restoring quality of life.

By leveraging cutting-edge technologies and refined surgical approaches, the joint reconstruction devices market is poised to meet the growing demand for effective knee joint replacement solutions, catering to the diverse needs of patients and orthopedic surgeons alike.

By Technique

By Joint Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

February 2025

April 2025

January 2025