December 2024

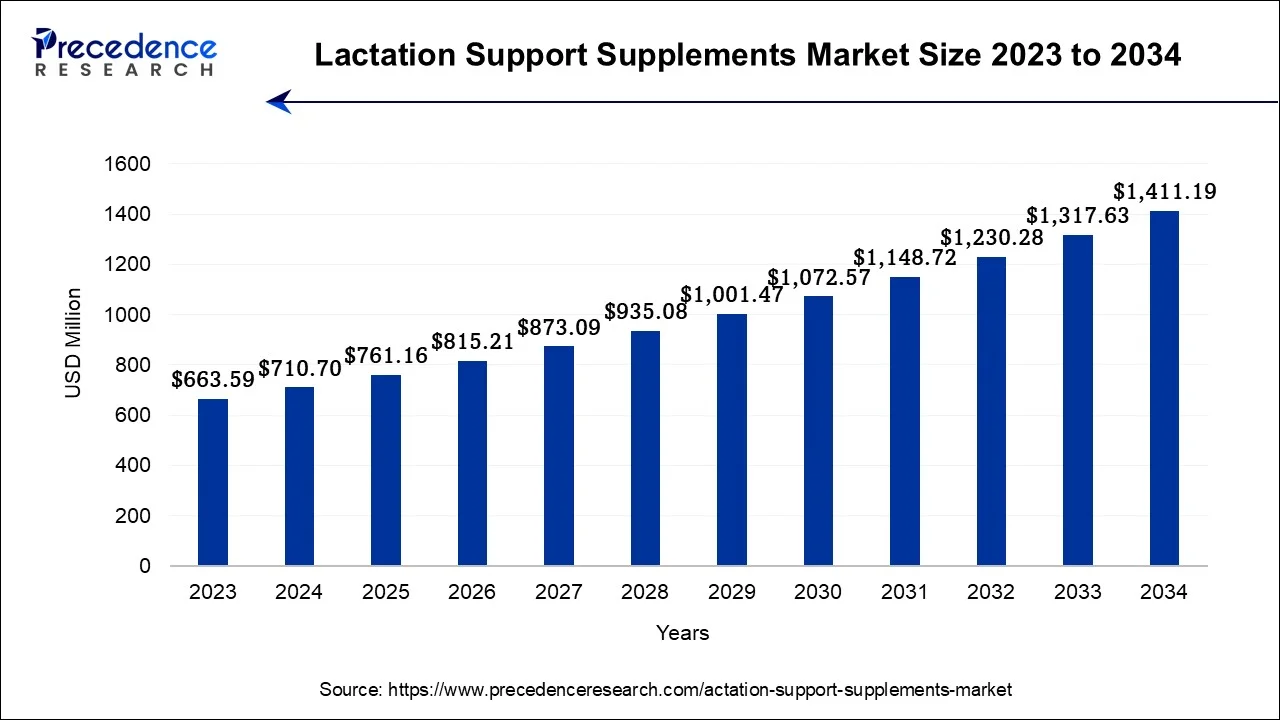

The global lactation support supplements market size is estimated at USD 710.7 million in 2024, grew to USD 761.16 million in 2025 and is predicted to surpass around USD 1,411.19 million by 2034, expanding at a CAGR of 7.10% between 2024 and 2034.

The global lactation support supplements market size accounted for USD 710.7 million in 2024 and is anticipated to reach around USD 1,411.19 million by 2034, growing at a CAGR of 7.10% between 2024 and 2034.

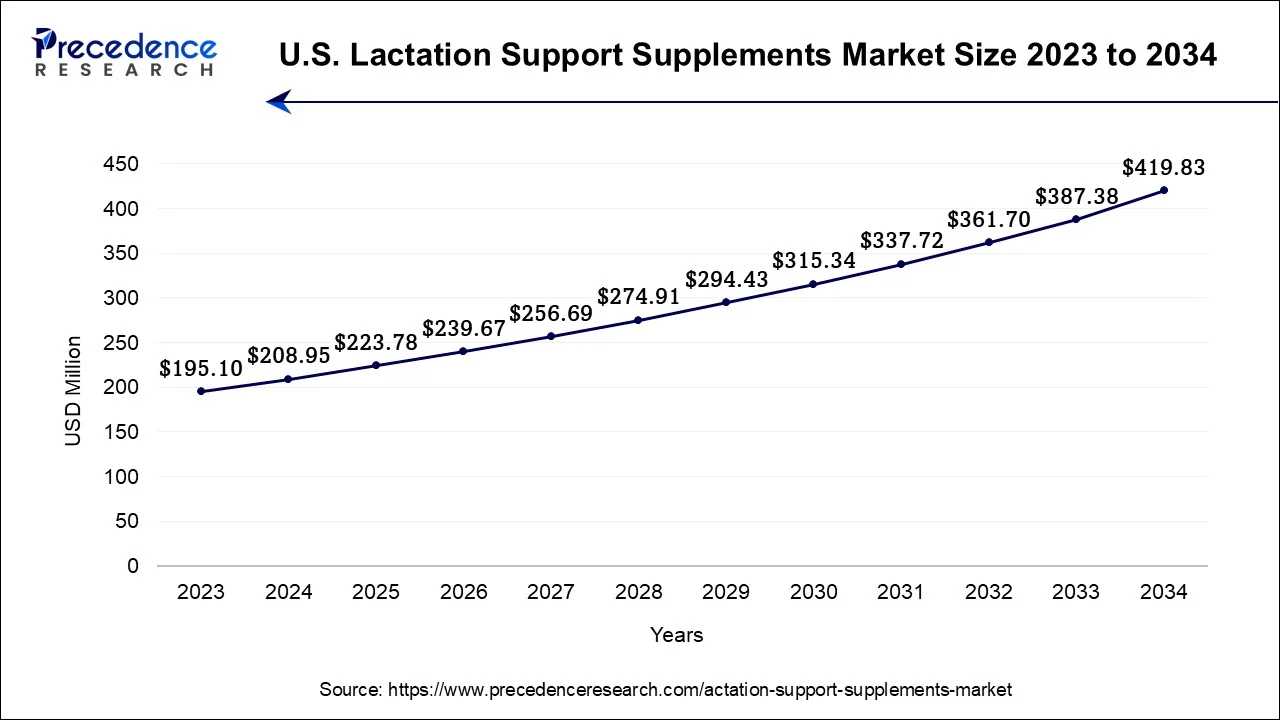

The U.S. lactation support supplements market size is estimated USD 208.95 million in 2024 and is expected to be worth around USD 419.83 million by 2034, at a CAGR of 7.23% from 2024 to 2034.

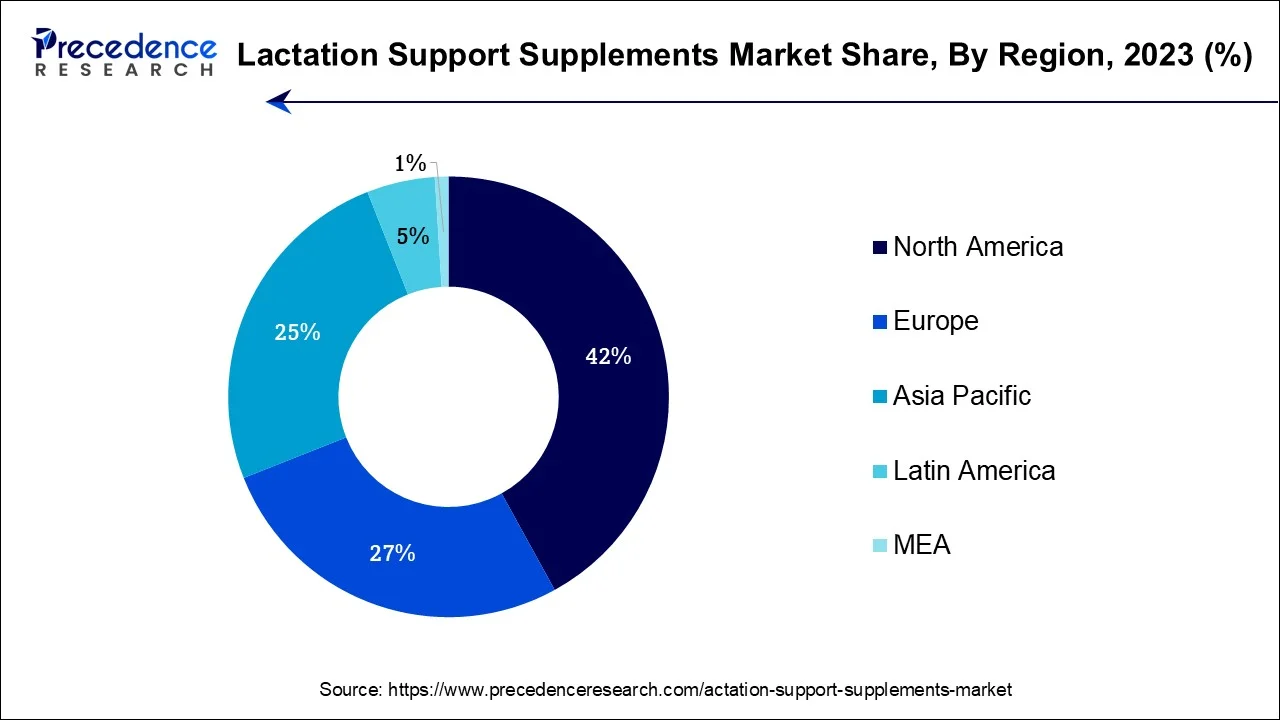

North America held the largest revenue share 42% in 2023. In North America, the lactation support supplements market is characterized by several noteworthy trends. Firstly, there is a growing emphasis on maternal and infant health, with a heightened awareness of the importance of breastfeeding. Secondly, the region witnesses a surge in demand for natural and herbal lactation support supplements, aligning with a broader trend of health-conscious consumer choices. Moreover, e-commerce platforms have become a popular channel for product accessibility. Collaborations between supplement manufacturers and healthcare professionals further drive market growth, as recommendations from healthcare experts hold significant influence in North America's healthcare landscape.

Asia-Pacific is estimated to observe the fastest expansion In the Asia-Pacific region, the lactation support supplements market is witnessing notable trends. Rising awareness of maternal and infant health benefits is driving demand, particularly in populous countries like India and China. E-commerce's growing influence has made lactation support supplements more accessible, catering to a tech-savvy consumer base. Collaborations between supplement manufacturers and local healthcare professionals are fostering trust and recommendations. Additionally, cultural factors and societal support for breastfeeding are further propelling the market's growth in the Asia-Pacific region as more mothers seek effective lactation support solutions for their breastfeeding journeys.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 7.1% |

| Market Size in 2024 | USD 710.7 Million |

| Market Size by 2034 | USD 1,411.19 Million |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Ingredient Type, Formulation, Sales Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Breastfeeding challenges significantly surge the market demand for lactation support supplements. Issues like low milk supply, engorgement, or latch difficulties can hinder breastfeeding success. Mothers facing such challenges seek effective and safe solutions to ensure optimal nutrition for their infants. Lactation support supplements, formulated with ingredients known to enhance milk production, address these concerns, offering a convenient and accessible means to overcome breastfeeding obstacles.

As the awareness of these supplements grows, they become a valuable resource for mothers striving to provide the best start for their babies, driving market demand. Moreover, the increase in the number of working mothers is a significant driver surging the market demand for Lactation Support Supplements. As more mothers balance their professional careers with breastfeeding, they often encounter challenges in maintaining the milk supply.

Lactation support supplements offer a convenient and effective solution to enhance lactation, ensuring an adequate milk flow while managing work responsibilities. This growing demographic of working mothers seeks reliable and safe options to support breastfeeding, making these supplements a vital resource in their breastfeeding journey, thus driving market demand.

Product quality is a critical restraint on the market demand for lactation support supplements. Ensuring consistent quality and safety is paramount, and any lapses can lead to consumer distrust and potential harm. Reports of substandard or ineffective supplements can deter new users and erode brand trust. Maintaining rigorous quality control measures throughout the manufacturing process is essential. The need for stringent quality assurance can increase production costs, which may affect product pricing and market accessibility, further challenging market demand.

Moreover, regulatory compliance represents a restraint on the market demand for lactation support supplements. Meeting stringent regulatory requirements for dietary supplements, including substantiating health claims and ensuring product safety, demands substantial resources and time. Navigating these complex regulations can be challenging for manufacturers, potentially delaying product launches and increasing compliance costs. Consequently, regulatory hurdles may hinder market growth, as companies must invest significantly in regulatory processes, which can impact pricing and market accessibility, affecting consumer trust and demand.

Clinical validation significantly surges market demand for lactation support supplements. Rigorous clinical trials demonstrating the safety and efficacy of these supplements instill trust among healthcare providers and consumers. Positive clinical findings provide evidence of their effectiveness in enhancing milk production, which is particularly crucial for mothers facing lactation challenges.

As healthcare professionals increasingly recommend and prescribe these validated supplements, consumer confidence grows, resulting in heightened demand. Clinical validation not only boosts credibility but also ensures that lactation support supplements effectively address the needs of breastfeeding mothers, making them a preferred choice in the market.

Moreover, partnerships with healthcare professionals play a pivotal role in surging market demand for lactation support supplements. Collaborations with lactation consultants, midwives, and healthcare providers enhance product credibility and recommendations. Healthcare professionals' endorsements and guidance instill trust among breastfeeding mothers, encouraging them to choose these supplements. This synergy between the supplement industry and healthcare experts not only raises awareness but also facilitates informed purchasing decisions. As breastfeeding support becomes more personalized and reliable, the demand for lactation support supplements grows, driven by the assurance of healthcare professionals' expertise and endorsement.

Impact of COVID-19

The COVID-19 pandemic had a multifaceted impact on the lactation support supplements market. Initially, panic buying, and supply chain disruptions led to temporary shortages of these supplements. However, as the pandemic progressed, there was a surge in demand for lactation support supplements. The lockdowns and restrictions prompted more mothers to breastfeed, increasing the need for effective lactation support. Additionally, the pandemic underscored the importance of maternal and infant health, leading to greater awareness of breastfeeding's benefits. As healthcare services shifted toward telehealth, healthcare professionals recommended supplements remotely, further boosting demand. E-commerce and online platforms became preferred channels for purchasing these supplements, ensuring their availability.

According to the Ingredient Type, the Fenugreek segment held a 32.1% revenue share in 2023. Fenugreek, a herb known for its lactogenic properties, is a key ingredient in lactation support supplements. It has gained prominence due to its historical use as a natural galactagogue, believed to boost milk production in breastfeeding mothers. In recent trends, fenugreek remains a popular choice in supplement formulations, reflecting the market's preference for natural and herbal ingredients. Its inclusion aligns with the growing demand for safe and effective lactation support options, appealing to mothers seeking natural solutions to enhance their breastfeeding experience and infant nutrition.

The oatmeal segment is anticipated to expand at a significant CAGR of 9.1% during the projected period. Oatmeal, a key ingredient in lactation support supplements, is known for its galactagogue properties that promote milk production in breastfeeding mothers. It's a natural source of nutrients and dietary fiber, contributing to overall maternal health. In recent trends, oatmeal-based lactation supplements have gained popularity due to their natural and wholesome appeal. They align with the growing consumer preference for clean and plant-based ingredients. Oatmeal's inclusion reflects a broader trend of using trusted and nutritionally rich components in lactation support supplements, resonating with health-conscious mothers seeking safe and effective options.

Based on the formulation, capsules/tablets held the largest market share of 59% in 2023. In the lactation support supplements market, capsules and tablets are two common formulations. Capsules are typically made of gelatin or plant-based materials and contain powdered or liquid supplements. Tablets are compressed formulations, offering convenience. Trends indicate a preference for capsules due to their ease of ingestion and faster absorption. Plant-based and vegetarian capsules align with growing dietary preferences. However, tablets with slow-release mechanisms are also gaining popularity, ensuring a sustained nutrient release. The market caters to diverse consumer choices, offering formulations that combine efficacy, convenience, and dietary considerations.

On the other hand, the Liquid segment is projected to grow at the fastest rate over the projected period. Liquid lactation support supplements refer to a formulation of dietary supplements designed to enhance lactation in breastfeeding mothers. These supplements are typically in liquid form, offering a convenient and fast-absorbing option for mothers seeking to boost milk production. Trends in the lactation support supplements market indicate a growing preference for liquid formulations due to their ease of consumption and perceived effectiveness. Liquid supplements are often perceived as more convenient, and their popularity is rising among busy mothers looking for quick and efficient ways to support their breastfeeding journey.

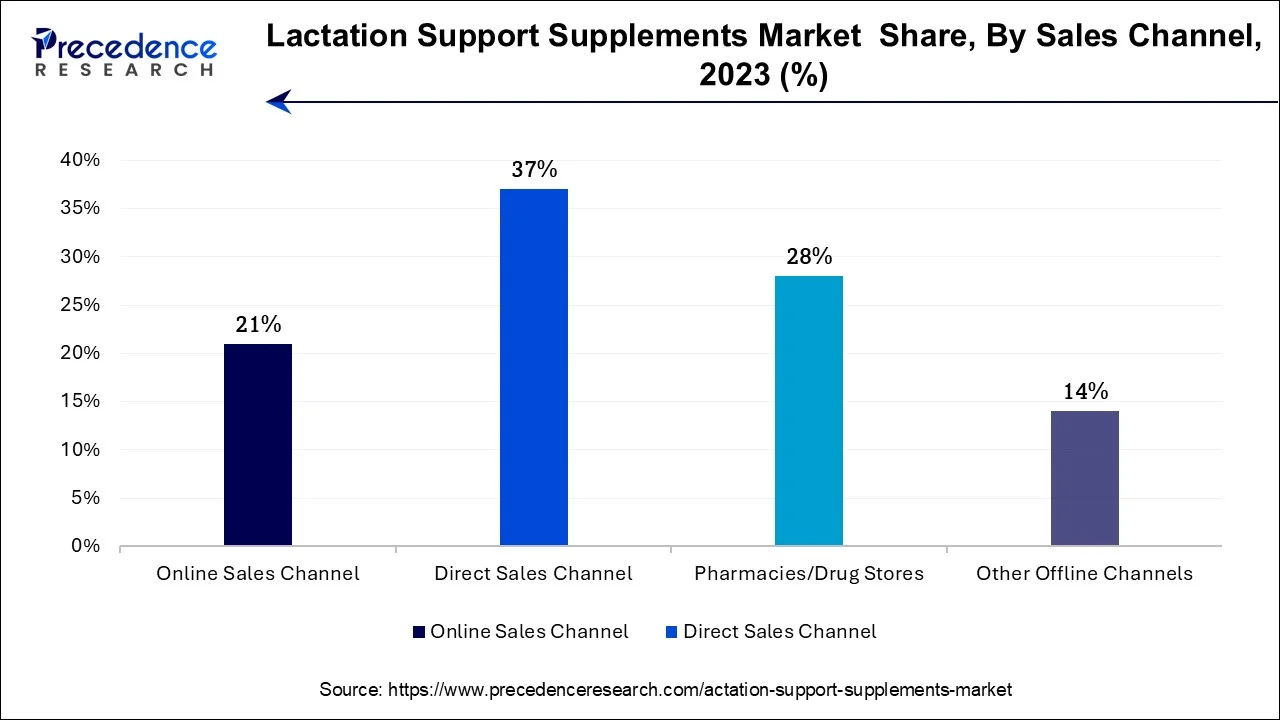

In 2023, the direct sales segment had the highest market share of 37% on the basis of the sales channel. Direct sales in the lactation support supplements market refer to the distribution model where manufacturers sell their products directly to consumers without intermediaries. This often involves online sales through the manufacturer's website or physical stores owned by the manufacturer. Direct sales have gained momentum due to the convenience and accessibility offered by e-commerce platforms. Manufacturers are increasingly leveraging their online presence to reach a broader customer base. Manufacturers are also providing educational content and personalized recommendations through their websites, enhancing the direct-to-consumer experience and fostering brand loyalty.

Online sales is anticipated to expand at the fastest rate over the projected period. Online sales in the lactation support supplements market refer to the purchase of these supplements through e-commerce platforms and digital marketplaces. Consumers can conveniently browse, compare, and order lactation support supplements online, often benefiting from a wide product selection, user reviews, and home delivery.

The trend of online sales for lactation support supplements has surged, particularly due to the COVID-19 pandemic. E-commerce platforms have become the preferred channel for consumers to access these products, driven by the convenience, safety, and extensive information available online. This trend is expected to continue, with digital marketing strategies, influencer endorsements, and product diversification contributing to further growth in online sales of lactation support supplements.

Segments Covered in the Report:

By Ingredient Type

By Formulation

By Sales Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

November 2024

February 2025

January 2025