July 2024

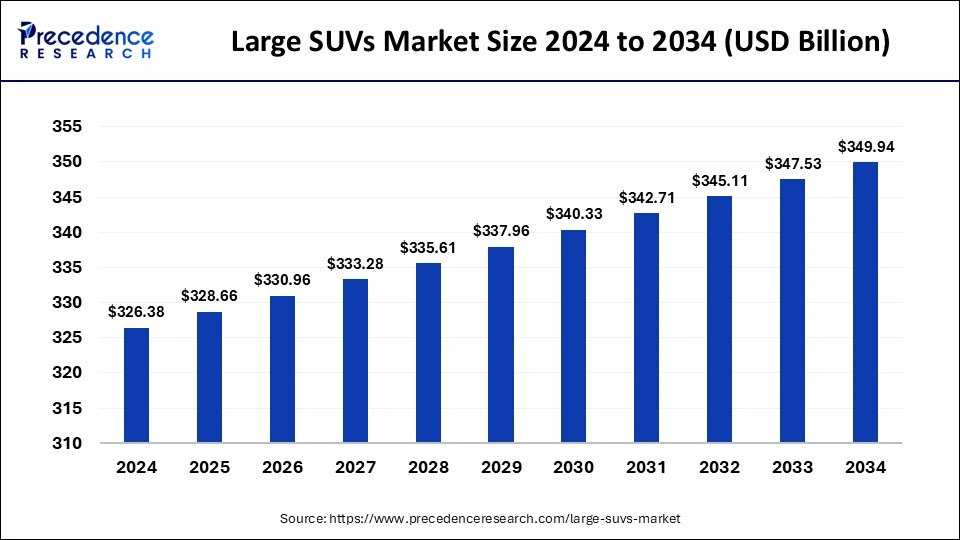

The global large SUVs market size is calculated at USD 328.66 billion in 2025 and is forecasted to reach around USD 349.94 billion by 2034, accelerating at a CAGR of 0.70% from 2025 to 2034. The North America large SUVs market size surpassed USD 169.72 billion in 2024 and is expanding at a CAGR of 0.73% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global large SUVs market size was estimated at USD 326.38 billion in 2024 and is predicted to increase from USD 328.66 billion in 2025 to approximately USD 349.94 billion by 2034, expanding at a CAGR of 0.70% from 2025 to 2034. The market is majorly driven by the increasing demand from the Middle East and Europe, attributed to the rising popularity of sports utility vehicles.

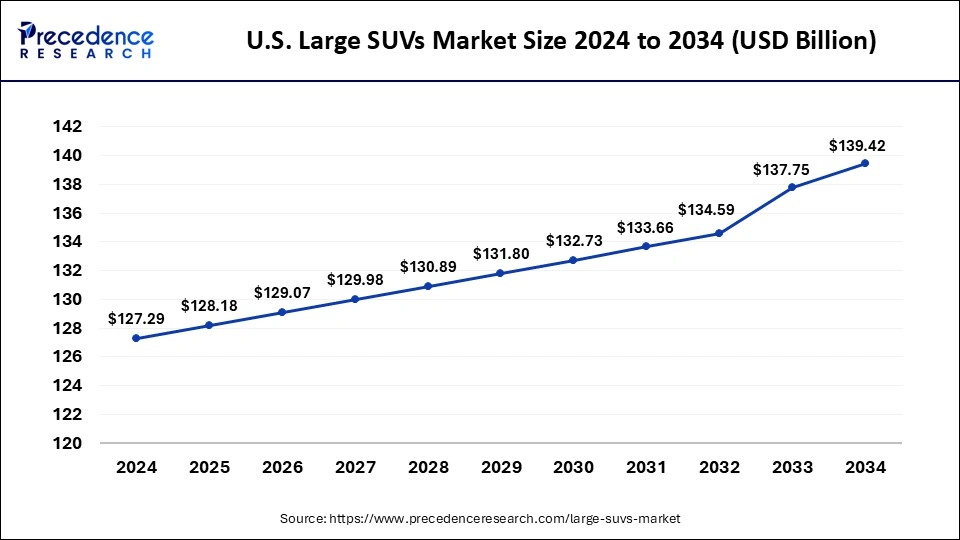

The U.S. large SUVs market size was valued at USD 127.29 billion in 2024 and is expected to be worth around USD 139.42 billion by 2034 with a CAGR of 0.91% from 2025 to 2034.

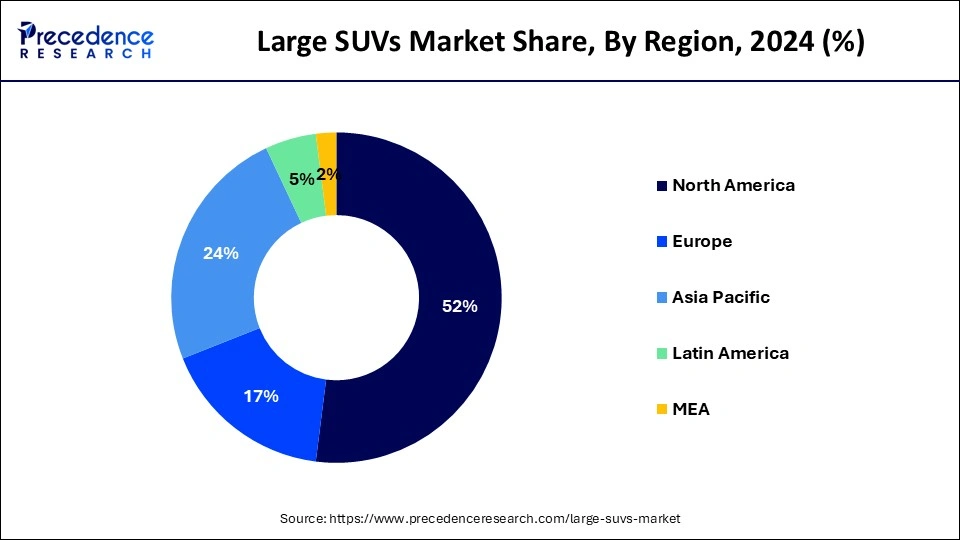

North America held the largest share of the large SUVs market in 2024. The high market share of large SUVs can be attributed to their immense popularity, the strong presence of major manufacturers in the region, significant spending on passenger vehicles, and higher purchasing power. According to the International Energy Agency, the robust demand and sales rates in the U.S. substantially contribute to North America's share in the global large SUVs market. Moreover, the growing popularity and shifting consumer preference towards large SUVs have led to the discontinuation of models such as sedans.

Asia Pacific is expected to grow at the fastest rate in the large SUVs market during the forecast period. This growth is primarily driven by rising consumer preference towards more convenient and robust vehicles. As rapid urbanization in the region is supported by the growing net spending by consumers and disposable income, consumers are attracted to the growing arrays of modes released by market players.

Europe is expected to expand at a notable rate in the large SUVs market over the projected period. The demand for large SUVs continues to rise, driven by stringent government regulations aimed at reducing carbon emissions. Europe, mirroring trends in the United States and China, has seen a surge in SUV popularity. Recent estimates indicate that SUVs have become the top-selling vehicle segment in Europe. Therefore, these factors are expected to boost the demand for large SUVs in the European large SUVs market in the future.

The large SUVs market includes a variety of automobiles designed to provide versatility, comfort, and capability in various driving conditions and terrains. They typically have higher ground clearance and sturdy chassis and often come with all-wheel or four-wheel drive options, making them suitable for both city driving and off-road adventures. These vehicles cater to diverse consumer needs, serving as spacious family transportation or providing rugged performance for outdoor enthusiasts. Large SUVs offer flexibility for urban commutes and off-road journeys, with multiple seating configurations to accommodate different passenger and cargo requirements. Leading manufacturers in this market segment include Toyota, BMW, Ford, and Chevrolet.

| Report Coverage | Details |

| Market Size by 2034 | USD 349.94 Billion |

| Market Size in 2025 | USD 328.66 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 0.70% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Fuel Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising consumer demand

Automobile manufacturers have successfully marketed SUVs by emphasizing the lifestyle and status associated with owning one. The large SUVs market is diversified to cater to various segments, including luxury, mid-range, and compact options. Changes in regulations and emissions standards may encourage the development and adoption of electric or hybrid SUVs, supporting the overall growth of the large SUVs market. Additionally, demand for SUVs is rising in emerging nations, driven by the desire for larger vehicles with more advanced features.

Fluctuating fuel prices

Achieving this balance requires significant investment in research and development to produce lightweight materials, aerodynamic designs, and efficient powertrains. One of the main challenges for manufacturers in the large SUVs market is finding the right balance between fuel efficiency and performance. This is especially important because consumers are placing more emphasis on environmental concerns and fuel economy. In addition, fluctuating fuel prices and government regulations on emissions and fuel efficiency standards make it difficult to meet consumer expectations while also complying with regulations.

Rapid development of electric and hybrid SUVs

The rapid growth of electric and hybrid SUVs is a key trend in the large SUVs market, reflecting a shift towards more sustainable transportation. These vehicles offer emission-free driving by reducing greenhouse gas emissions, while hybrid models combine internal combustion engines with electric power, enhancing fuel efficiency and minimizing the environmental impact. This trend is fueled by growing consumer awareness of environmental issues, along with government incentives and advancements in electric vehicle infrastructure.

The global large SUVs market in 2024 was dominated by the petrol segment. In recent years, many manufacturers have stopped producing diesel vehicles due to their higher pollution levels. This shift has led to an increased preference for petrol vehicles among consumers. Petrol SUVs are popular due to their better fuel efficiency, easier maintenance, and widespread availability. On the other hand, electric vehicles are not as widely available and tend to be more expensive.

The electric segment is expected to grow at a faster rate in the large SUVs market over the forecast period. Electric vehicles (EVs) are powered by electricity rather than a gasoline-fueled internal combustion engine. As such, they are seen as potential replacements for current-generation vehicles to address issues like rising pollution, global warming, and dwindling natural resources. The primary driver of the electric segment in the large SUVs market revenue is the increasing fuel prices. Additionally, key trends in the global electric large SUVs market include the growing demand for high-performance vehicles that are fuel-efficient and low-emission and the rising preference for SUVs and MUVs, which can propel segment growth further.

By Fuel Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024