January 2025

Off-road Vehicles Market (By Product Type: All-Terrain Vehicle, Utility Terrain Vehicle, Snowmobile, Three-Wheeler; By Application: Utility, Sports, Recreation, Military; By Propulsion Type: Gasoline, Diesel, Electric) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

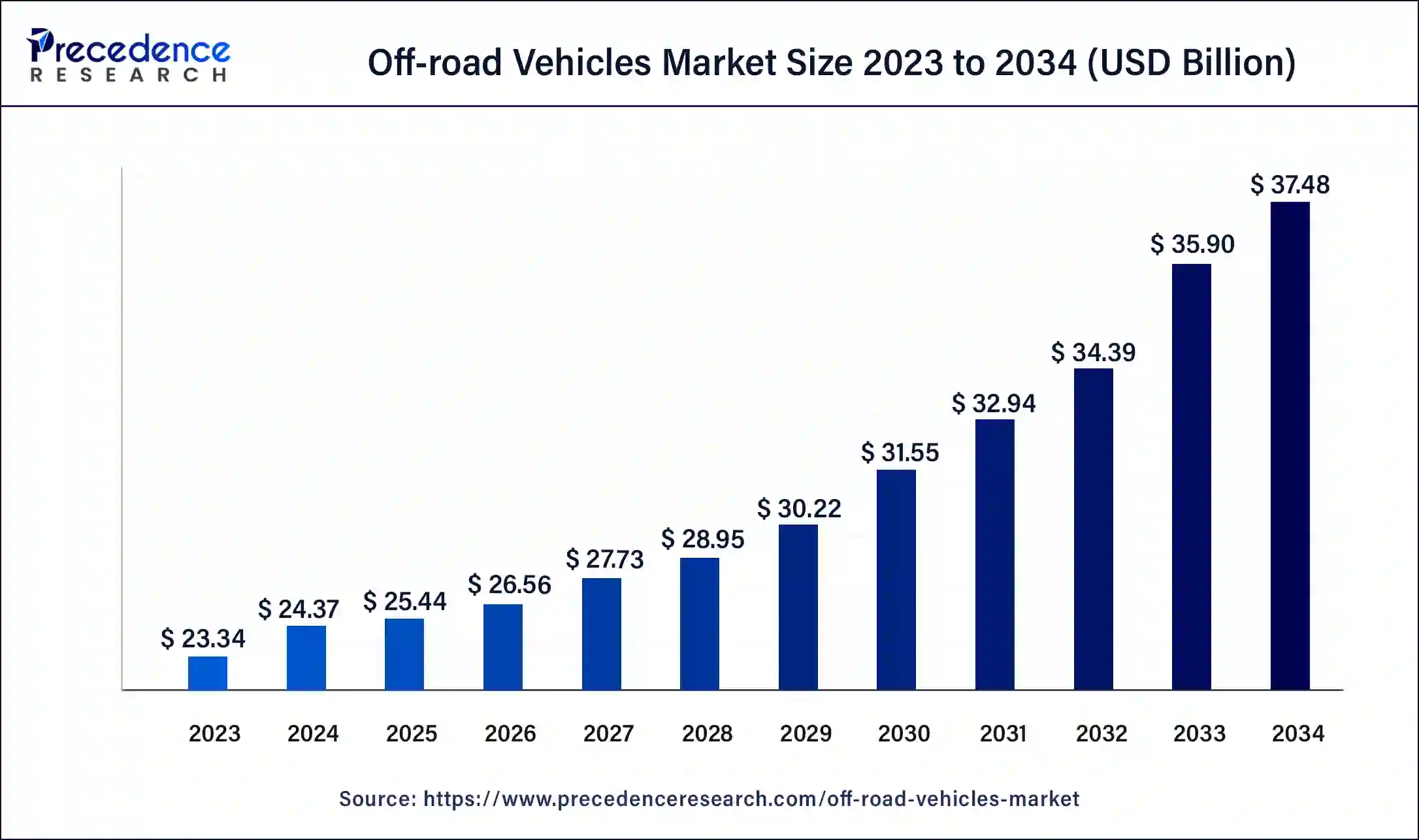

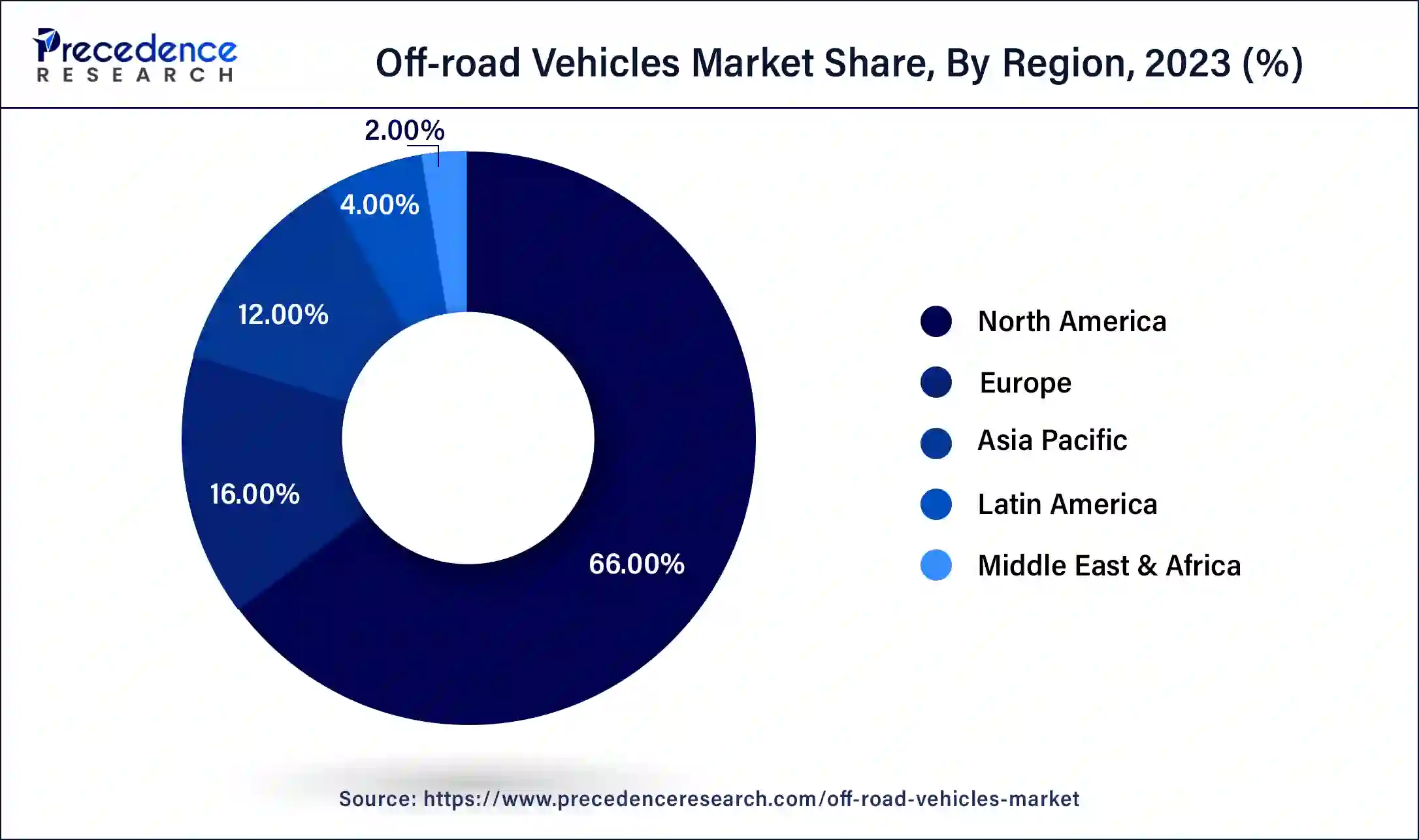

The global off-road vehicles market size was USD 23.34 billion in 2023, accounted for USD 24.37 billion in 2024, and is expected to reach around USD 37.48 billion by 2034, expanding at a CAGR of 4.4% from 2024 to 2034. The North America off-road vehicles market size reached USD 15.40 billion in 2023. The off-road vehicles market is driven by increasing interest in off-road sports events.

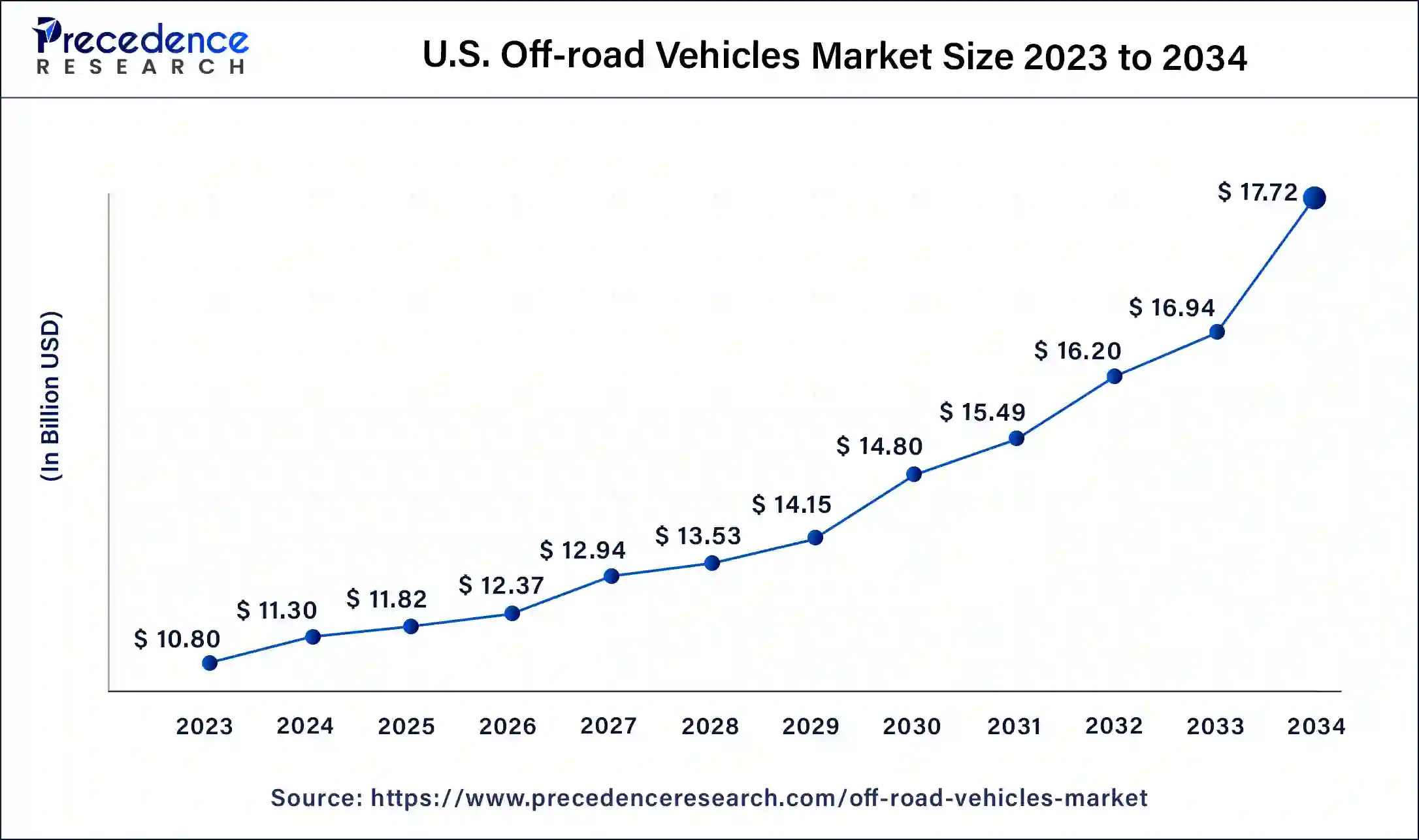

The U.S. off-road vehicles market size was estimated at USD 10.80 billion in 2023 and is predicted to be worth around USD 17.72 billion by 2034, at a CAGR of 4.6% from 2024 to 2034.

North America has its largest market share in 2023 in the off-road vehicles market, the region is also observed to see a significant growth throughout the predicted timeframe. Global agriculture is a primary business that uses various off-road vehicle types. The United States of America has many natural landscapes, unpaved roads, and large farms and ranches dispersed across the country. Because of stronger cars and larger clearance zones, off-road vehicles can even access trails and forest roads with less traction and irregular terrain. Off-road vehicles are also utilized for utility and military applications.

Out of all industries, the sports sector in North America has the most significant market share for off-road vehicles. Off-roading is a well-liked leisure activity in the United States, contributing to the high demand for eORVs. Many American businesses, including GMC, Bollinger, and Rivian, work on electric off-road vehicles (eORVs).

Europe is observed to be the fastest growing off-road vehicles market during the forecast period. Throughout the forecast period, the European market for off-road electric vehicles is anticipated to develop due to rising infrastructure investments and legislation controlling diesel emissions from heavy equipment. Over the past few years, the German government has continuously invested in top-notch infrastructure. Due to Germany's fast-growing infrastructure market, which is especially strong in roads, highways, and transportation infrastructure, other markets for concrete and road machinery may rise significantly.

While Europe is highly urbanized, there's still a strong inclination towards outdoor activities and recreation. Off-roading has become a popular leisure activity, driving the demand for off-road vehicles. Europe has stringent emissions regulations, pushing manufacturers to produce more environmentally friendly off-road vehicles. This has led to the development of electric and hybrid off-road vehicles, catering to consumers' increasing concern for the environment.

Asia-Pacific shows a significant growth in the off-road vehicles market during the forecast period. India is an off-roader's heaven with its vast and varied topography. Plenty of places to discover and embark on adventures include wildlife sanctuaries, forest paths, snow-capped mountains like the Himalayas, the Thar desert, and unpaved motorable roads. There will be exclusive locations in the nearby steep areas only accessible off-road. Leading off-road cars in India include the Isuzu D-Max V-Cross, Force Gurkha, Mahindra Scorpio N, Maruti Suzuki Jimny, and Mahindra Thar.

The off-road vehicles market refers to the segment of the automotive industry that deals with vehicles designed and built for off-road use. These vehicles are specifically engineered to navigate rough terrain, such as dirt trails, rocky paths, sand dunes, and other challenging landscapes. Off-road vehicles are manufactured for use in rocky environments. They are mainly used in construction and agricultural activities. They often feature sizeable tires with open, deep treads and flexible suspension.

Off-road vehicles are becoming more accessible to a broader range of consumers due to advancements in technology and manufacturing processes. This accessibility includes a wider range of price points, making off-road vehicles more attainable for a larger demographic. Off-road vehicles are versatile and can serve multiple purposes. They can be used for recreational activities, but also for practical purposes like agriculture, construction, or military applications. This versatility increases their appeal to various market segments.

| Report Coverage | Details |

| Global Market Size in 2023 | USD 23.34 Billion |

| Global Market Size in 2024 | USD 24.37 Billion |

| Global Market Size by 2034 | USD 37.48 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.4% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product Type, By Application, and By Propulsion Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The best-performing vehicles are off-road ones. With the utmost precision, they can move several cubic meters of earth, operate in challenging areas, and carry big loads. Simultaneously, there is an increase in demand for fuel efficiency, comfort, ease of use, and environmental sustainability. Autonomous and self-driving vehicles are being used in more job operations. It is difficult to test these functions at an early stage, yet maximizing efficiency and safety is essential. The vehicle and any attached trailer or accessory can be immediately evaluated with a virtual prototype, which also helps to streamline the vehicle development process. Thereby, the rising adoption of off-road vehicles for agricultural activities promotes the growth of the off-road vehicle market.

Rain, snow, and strong winds can cause havoc on the landscape and raise the danger of rollovers, slides, and losing control. A flaw in the vehicle can rapidly and severely cause a driver to lose control, regardless of experience level, whether they have been off-roading for years and know the vehicle inside and out or are total novices. This has a detrimental effect on the market and impedes expansion. Thereby, the factor associated with the concerns acts as a major restraint for the off-road vehicles market.

One of the most enjoyable pastimes available to people is off-roading. Nothing is more exhilarating than leisurely driving through one of the world's most diverse communities. Age, gender, or restrictions do not apply to the love of off-roading, which spans from 18 years old to retired veterans. There are various off-road activities, including rally racing, overlanding, weekend excursions, off-road excursions, and off-road trails. It is available in every size and shape.

People are naturally adventurous and love to take risks and try new things. This is the exact reason we enjoy off-roading so much. What was formerly a luxury for a select few is now a popular pastime. Traveling the less-traveled route to reach the most remote and unconventional places on the globe might be difficult. But the fun comes along with the trials. The difficulties, uncertainty, and sense of achievement create a singular experience. This is what distinguishes off-road driving.

Off-road driving requires competence, technique, intelligence, patience, and presence of mind. Such abilities must be developed, and this takes experience. In the end, this presents a chance for the off-road vehicles market.

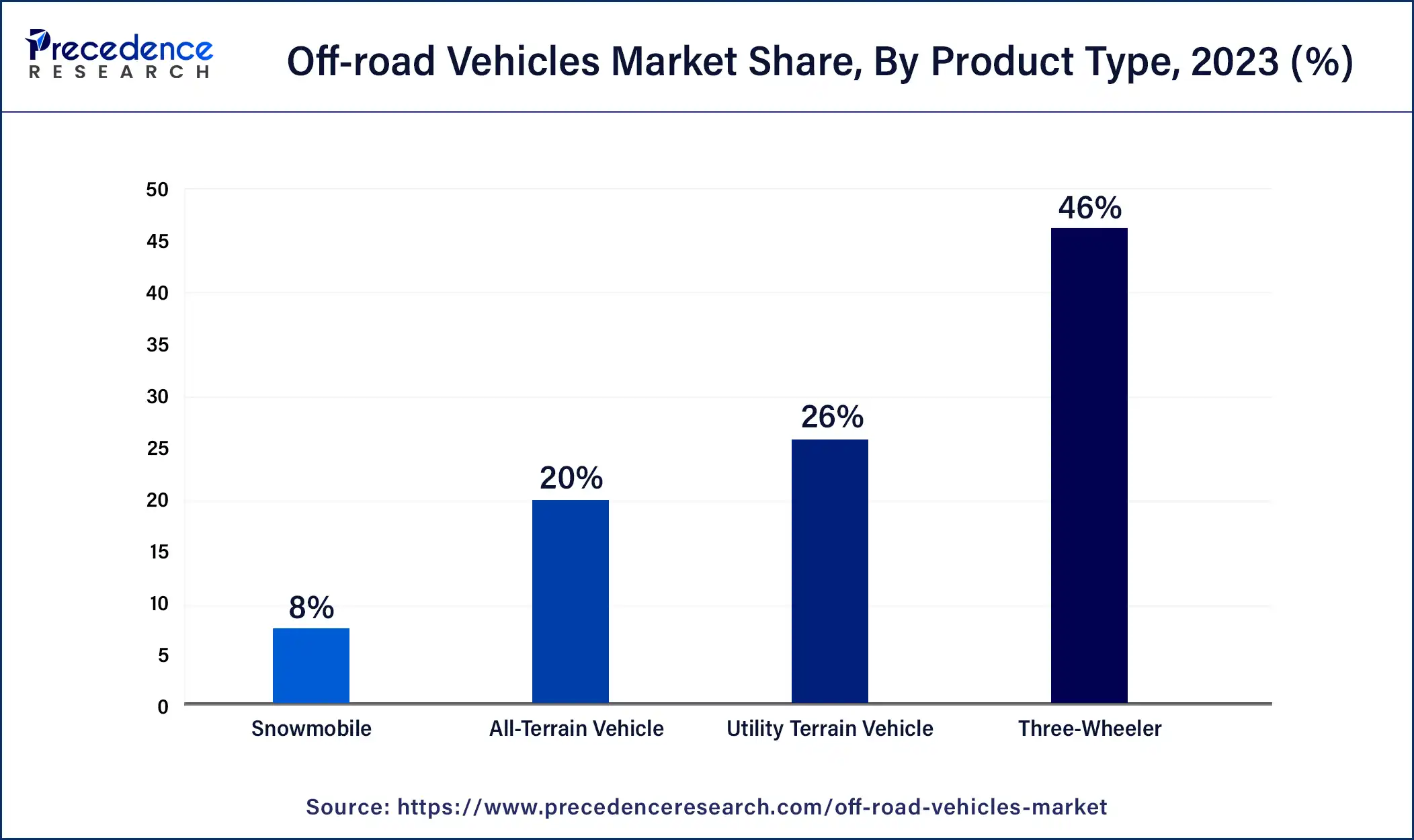

The three-wheeler segment dominated the off-road vehicles market in 2023. In commercial settings, three-wheelers are usually used for both passenger and freight transportation. Three-wheeled mobility is contingent upon cost, door-to-door delivery, and maneuverability. In many developing countries, three-wheelers are the most cost-effective and speedy option for cargo and public transportation, making them the ideal choice for meeting the demand.

The all-terrain vehicle segment shows a significant growth in the off-road vehicles market during the forecast period. Three- or four-wheeled motorized vehicles with big, soft tires and a somewhat elevated center of gravity are known as all-terrain vehicles (ATVs). They are mainly utilized for off-road activities. Like motorcycles, ATVs have handlebars that allow one person to straddle the vehicle's body. Some weigh up to 600 lbs. and top speeds of 50 mph.

Segments Covered in the Report

By Product Type

By Application

By Propulsion Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

July 2024

February 2025

January 2025