June 2024

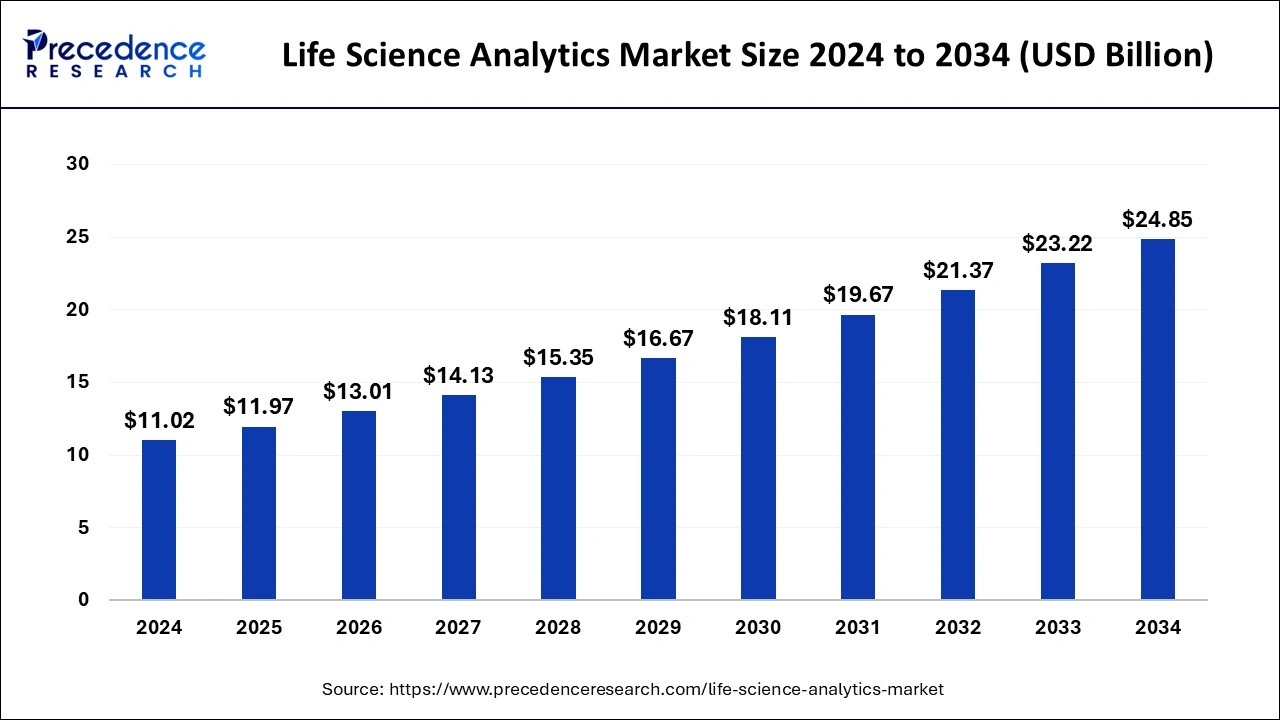

The global life science analytics market size is accounted at USD 11.97 billion in 2025 and is forecasted to hit around USD 24.85 billion by 2034, representing a CAGR of 8.47% from 2025 to 2034. The North America market size was estimated at USD 5.84 billion in 2024 and is expanding at a CAGR of 8.50% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global life science analytics market size was calculated at USD 11.02 billion in 2024 and is predicted to reach around USD 24.85 billion by 2034, expanding at a CAGR of 8.47% from 2025 to 2034. The rising healthcare and pharmaceutical industries due to chronic conditions and the geriatric population are driving the life science analytics market.

Biotechnology, pharmaceutical, and healthcare research and development are being revolutionized by artificial intelligence (Al) in life science analytics, which uses machine learning (ML), deep learning, and data analytics. The healthcare and life sciences sectors stand to gain greatly from the application of AI to life science analytics, which might transform research, enhance patient outcomes, and optimize operations. As technology advances, it is expected that Al will further revolutionize data analysis and usage in these vital domains. AI is used in life science analytics to enhance healthcare outcomes and operational efficiency. Additionally, there is a lot of room for growth in the artificial intelligence market for life science analytics in the drug research and development sector.

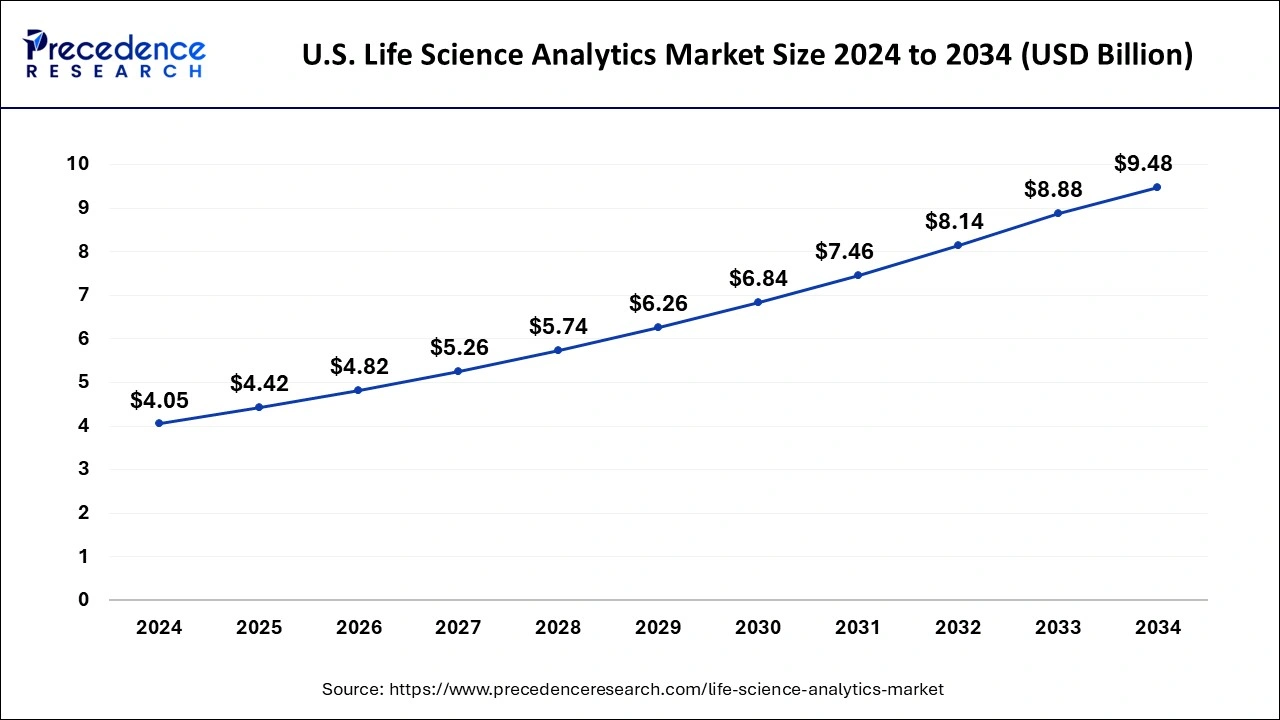

The U.S. life science analytics market size was exhibited at USD 4.05 billion in 2024 and is projected to be worth around USD 9.48 billion by 2034, growing at a CAGR of 8.88% from 2025 to 2034.

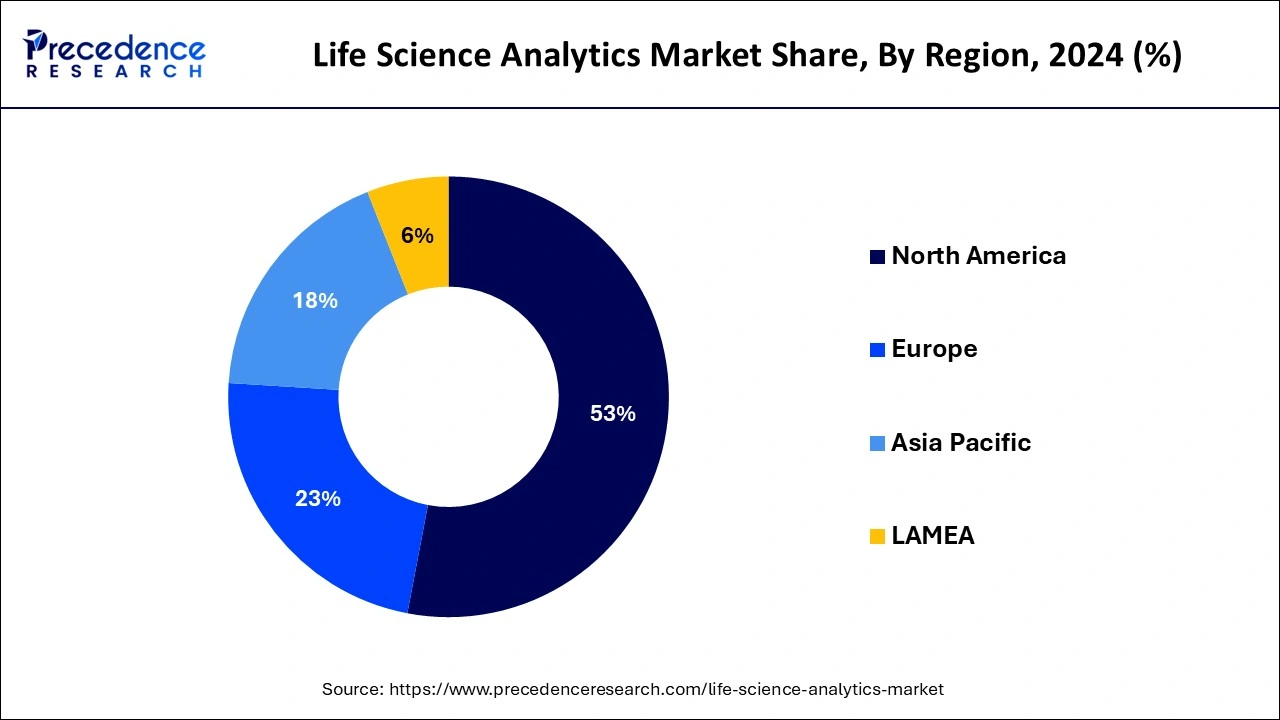

North America, Europe, Asia Pacific, Latin America and Middle East and Africa are the most common five region covered in the report of life science analytics market. North America is the appeared as dominant regional market among others. The North America region accounted largest revenue share of around 52.14%.

On the other hand, Asia Pacific is expanding at a CAGR of 10.5% over the forecast period. Major players of North America are looking towards the Asia Pacific for their future growth and development. Bulking loads of chronic disorders in the region like North America and Europe is also considered as one of the major driving factors which helps the growth of the global life science analytics market.

The way pharmaceutical and healthcare companies use data to spur innovation and enhance patient outcomes is being completely transformed by life science analytics. Businesses can now handle large datasets to speed up drug discovery, improve clinical trials, and allow precision medicine at scale thanks to sophisticated data analytics for the life sciences. Organizations that successfully handle this massive amount of data may turn unprocessed data into insightful knowledge that advances medication research, enhances clinical trials, and improves patient outcomes. This potential is further enhanced by the integration of analytics platforms with contemporary life sciences CRM systems, which offer a comprehensive understanding of the patient experience and market dynamics.

| Report Highlights | Details |

| Market Size in 2025 | USD 11.97 Billion |

| Market Size by 2034 | USD 24.85 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.47% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Component, Delivery Model, Application, and End Users |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Different types of analytics assessed in this report are descriptive, predictive, diagnostic, discovery, and prescriptive. The descriptive segments held the majority of the market shares in the year 2024. Life science analytics always deals with the description methods to deals with the life sciences queries. For a better explanation and interpretations about the incidence and past trend data, the descriptive analytics provide overviews of the subjects. It is also observed that predictive health analytics proved to be more complex when compared with descriptive analytics. Most healthcare organizations aim to investigate the performance gap and allow the space for preparing the better strategies needed for the organization. Firm preference for descriptive analytics is due to its form or presentation like simple graphs with explanations. The discovery analytics used to discover or determine the different scientific facts. For instance, Centers for Medicare and Medicaid Services (CMS) used analytics to reduce hospital readmission rates.

The predictive analysis is registering growth at a CAGR of 9.2% over the forthcoming years.

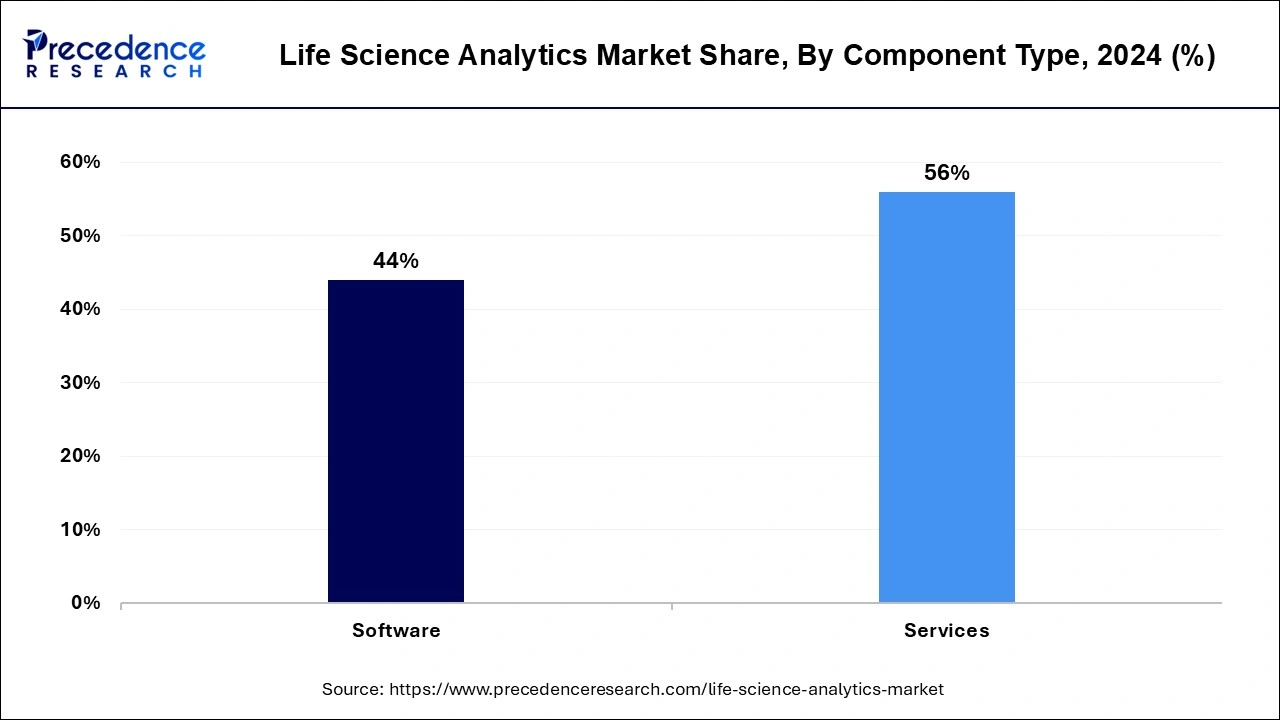

Based on the type of component the market is fragmented into, software and services. In 2023, the services segment garnered for a revenue share of around 56%. Service provided by skilled professionals and cloud management services are costlier. These services are mostly provided by companies like Microsoft, clodera and others. The efficient running of the analytics services plays a major role in its execution. The services segment is poised to reach at a CAGR of 8.3% over the forecast period.

By Application, the market is classified into research & development, supply chain optimization, clinical trials, sales & marketing, regulatory compliance, preclinical trials, and pharmacovigilance. The sales and marketing segment dominated the life science analytics market and garnered a revenue share of 31.4% in 2024.

Sales and marketing showed noticeable improvement in recent years and the same will grow at the considerable CAGR within the forecast period. Marketing campaigns and post-marketing surveys become important for the healthcare firm. Market surveillance is also assisted in boosting the life sciences analytics market. The research and development is expected to hit at a CAGR of 9.9% over the forecast period.

On the basis of end-users, the market is classified into pharmaceutical & biotechnology companies, medical device companies, research centers, and third-party administrators. The pharmaceutical and bio-technology are the biggest end-users both in terms of revenue generation and consumption volume. In the year 2023, the same segment held the maximum market share 47%. Life science analytics is used to accelerate the process of discovery and development of the drugs, to optimize the efficacy of clinical trials, to focus on a specific population of the patients, to see the effect of the drug, to analyze the patient behavioral activities over healthcare outcome, and to further manage the patient's safety and risk management. For instance, The Johnson and Johnson Company is looking for the data to assist the pharmaceutical and biotechnological firm for making decision-based process easier.

Biotechnology companies are anticipated to reach at a CAGR of 8.8% over the forthcoming years.

By Type

By Component Type

By Delivery Model

By Application Type

By End Users Type

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

June 2024

September 2024

October 2024

January 2025