June 2024

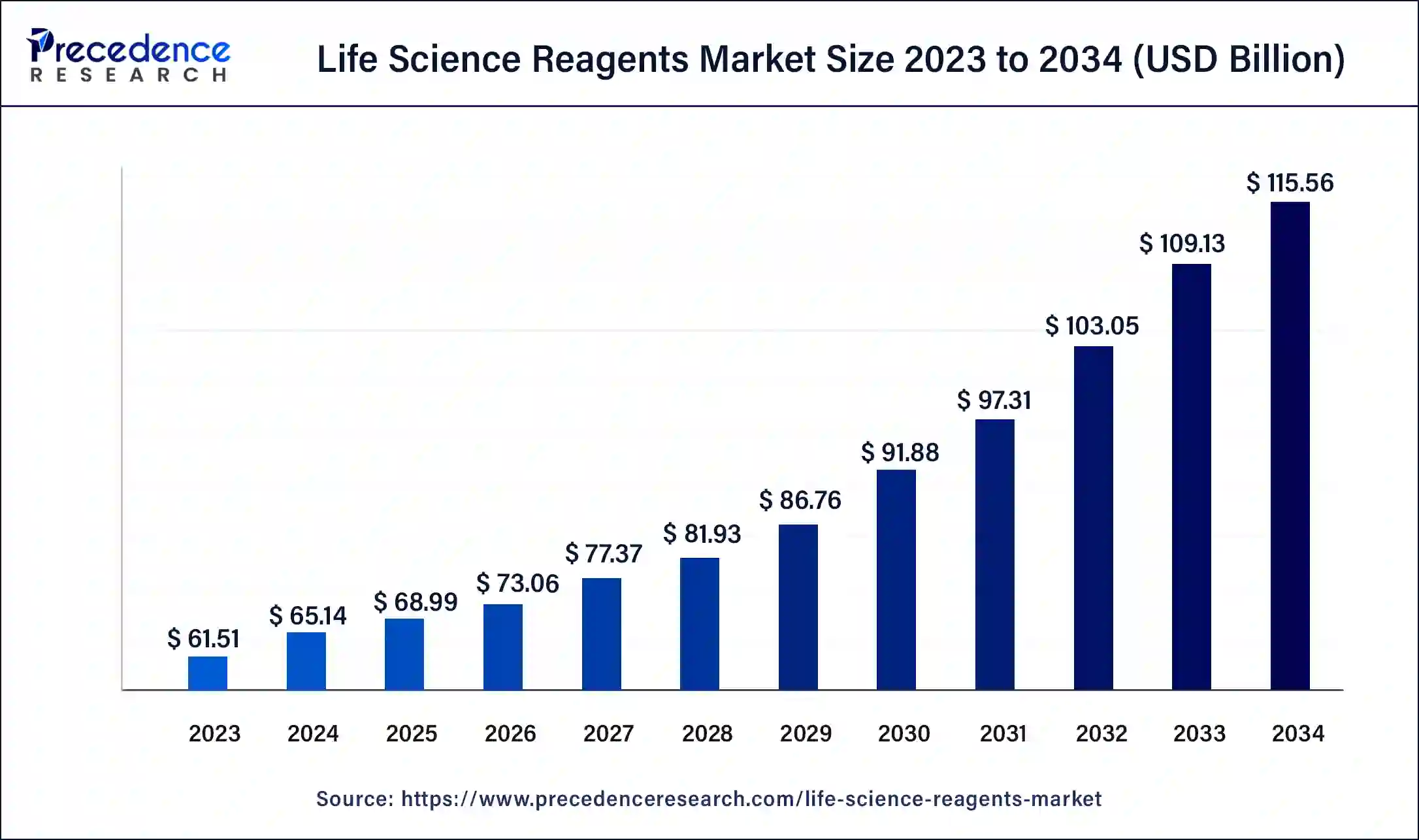

The global life science reagents market size was USD 61.51 billion in 2023, calculated at USD 65.14 billion in 2024 and is projected to surpass around USD 115.56 billion by 2034, expanding at a CAGR of 5.9% from 2024 to 2034.

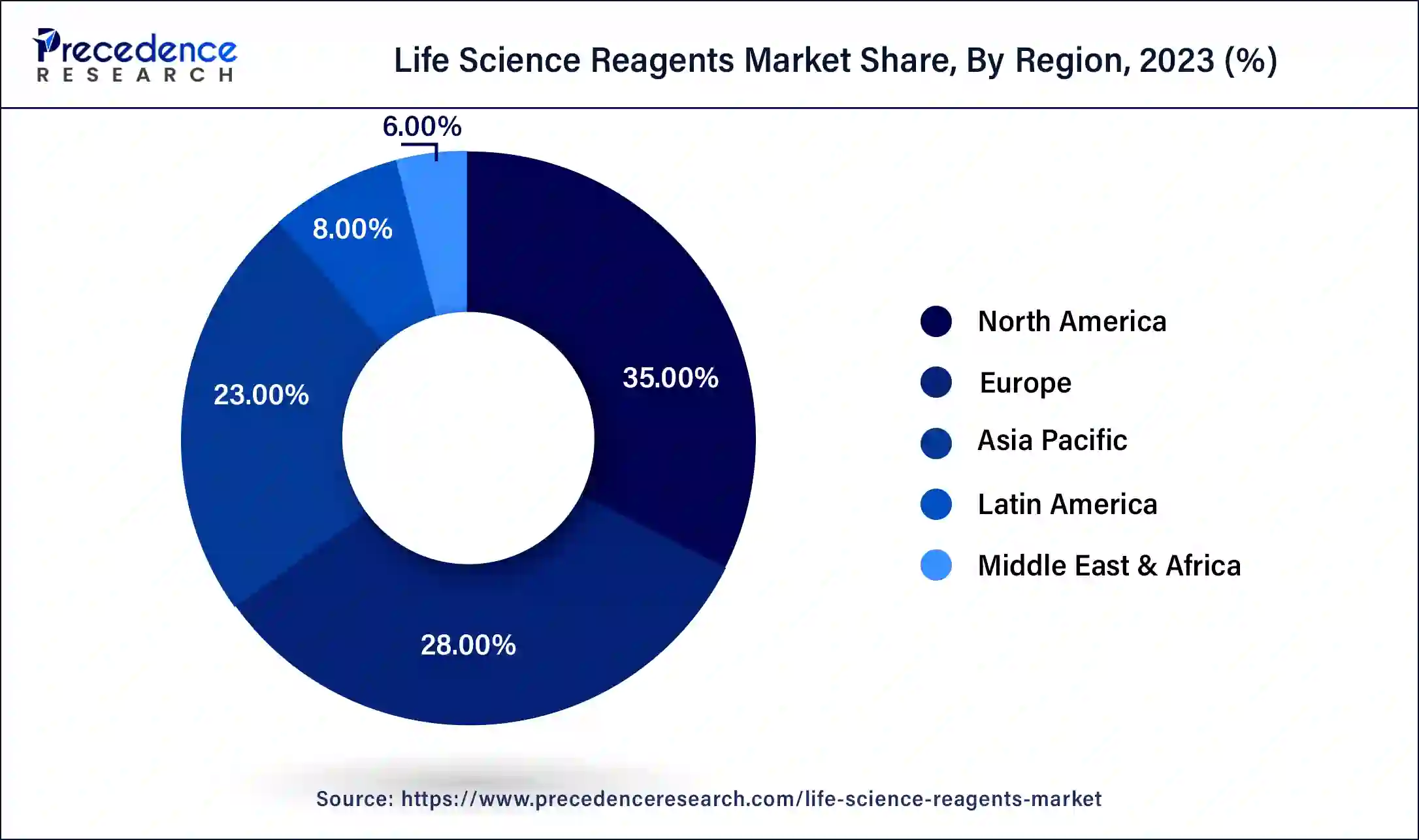

The global life science reagents market size accounted for USD 65.14 billion in 2024 and is expected to be worth around USD 115.56 billion by 2034, at a CAGR of 5.9% from 2024 to 2034. The North America life science reagents market size reached USD 21.53 billion in 2023.

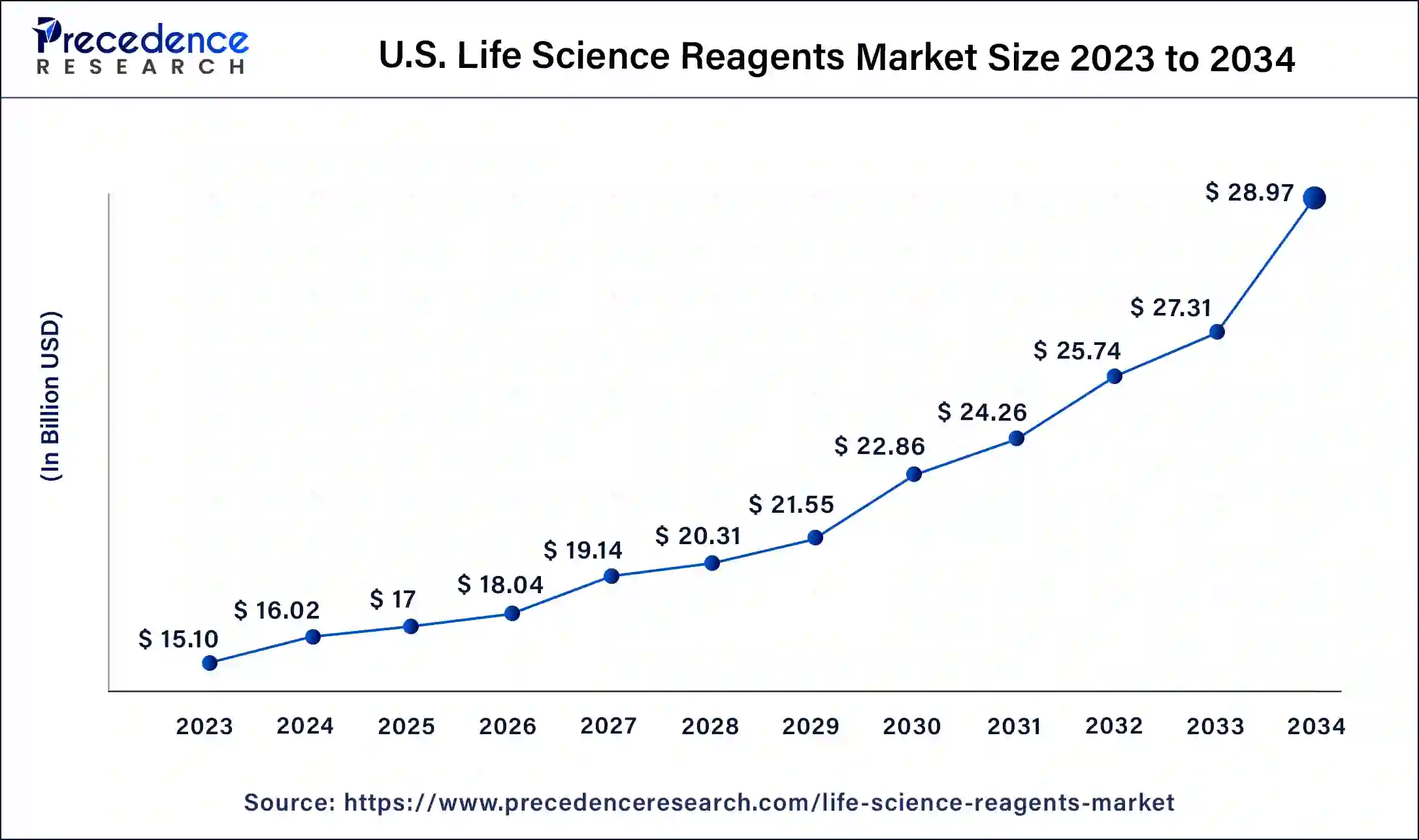

The U.S. life science reagents market size was estimated at USD 15.10 billion in 2023 and is predicted to be worth around USD 28.97 billion by 2034, at a CAGR of 6.1% from 2024 to 2034.

Based on region, North America accounted for the largest revenue share in 2023. North America is witnessing a rapid growth of the biopharmaceutical industry and rising penetration and growth of contract research organizations, which is a major cause of the increased consumption of the life science reagents. Furthermore, rising government support to develop the biopharmaceutical industry is a major factor that is expected boost the demand for the life science reagents. The rising prevalence of chronic diseases and increased demand for the latest diagnostics and medicines in US has huge contributions in the growth of the North America market.

On the other hand, Asia Pacific is estimated to be the most opportunistic market during the forecast period. Asia Pacific is characterized by the presence of numerous big CROs and CMOs. The rapidly growing biotechnology companies and growing number of diagnostic laboratories in the region is expected to boost the consumption of the life science reagents. The rising government initiatives to attract FDIs is propelling the pharmaceutical companies to expand their production facilities in the region, which will drive the life science reagents market during the forecast period.

The global life science reagents market is primarily driven by various factors such as rising prevalence of infectious diseases, rising investments in the research & development by the biotechnology company, rapidly growing biotechnology industry, technological upgradations in the life science filed, and rapidly growing biopharmaceutical industry across the globe. Micro-organisms such as bacteria, virus, and parasites may result in the infectious diseases. This type of diseases can be easily transmitted to others. The rising prevalence of various infectious diseases such as Hepatitis A virus, HIV, Zika, and Dengue has resulted in the increased demand for the life science reagents. According to the Journal of Infectious Diseases and Therapy 2019, around 1.5 million clinical cases of Hepatitis A Virus is reported across the globe each year. Zika Virus was declared an endemic in Africa. According to the World Health Organization, more than 31,000 confirmed cases of Zika Virus had been reported in Americas in 2018. Further, dengue is the most critical mosquito-borne disease, which is spreading rapidly across the globe. As per the WHO, the cases of dengue fever increased rapidly from 505,430 cases in 2000 to 4.2 million in 2019, all over the globe. Therefore, the rapidly rising prevalence of various infectious diseases among the global population is the most important driver of the life science reagents market.

The outbreak of the COVID-19 pandemic had a positive effect on the market and it spiked the demand for the life science reagents across the globe. The demand for the life science among the diagnostic centers and hospital rapidly surged for the growing need for testing the patients. Furthermore, all the research organizations became active and demanded the life science reagents to conduct their study on the new COVID-19 virus that became a pandemic all over the globe. Thus, the COVID-19 positively impacted the market growth in 2020.

| Report Highlights | Details |

| Market Size in 2023 | USD 61.51 Billion |

| Market Size in 2024 | USD 65.14 Billion |

| Market Size by 2034 | USD 115.56 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.9% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Application, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Based on product, the immunoassay segment accounted largest revenue share in 2023 and is projected to sustain its dominance during the forecast period. This can be attributed to the increased demand for the immunoassay reagents among the diagnostic labs and the hospitals. Moreover, the biotechnology and the pharmaceutical industries are the major consumers of the immunoassay reagents owing to the increased research activities like new drug development and novel test assay development.

On the other hand, the in-vitro diagnostic is estimated to be the most opportunistic segment. The shift in the paradigm from traditional to advanced diagnostics, which analyzes the gene due to the inclusion of various technologies like gene testing, next generation sequencing, and molecular diagnostic is fostering the segment growth. Moreover, the rising prevalence of various chronic diseases like coronary heart disease among the population is expected to drive the demand for the in-vitro diagnostics. According to the World Heart Federation, around 3.4 million women and 3.8 million men dies each year due to the coronary heart diseases.

Based on application, the hospitals & diagnostic labs segment dominated the global market in 2023, in terms of revenue. In 2023, the demand for the life science reagents suddenly spiked due to the rapid spread of the COVID-19 virus. Diagnostic labs and hospitals were increasingly using the life science reagents to test their patients. Moreover, the life science reagents in the molecular diagnostics are extensively used for extracting nucleic acid, human leukocyte antigens typing, and detection of mutations. Further, the growing prevalence of various chronic diseases among the global population is boosting the consumption of life science reagents for the diagnostic purposes, which boosts the growth of this segment significantly.

On the other hand, the contract research organizations are expected to be the fastest-growing segment during the forecast period. This is attributed to the increased investment by various biotechnology and pharmaceutical companies in the research activities. The rising penetration of various contract research organizations in the developed and developing nations and their activities related to new drug development and new diagnostic tests is expected to foster the demand for the life science reagents across the globe.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

In May 2020, Meridian Bioscience, Inc. one of the leading life science reagents raw material provider and diagnostic test solutions, acquired the FDA approval of SARS-CoV-2 antigens.

The various developmental strategies like acquisition, partnerships, mergers, and government policies fosters market growth and offers lucrative growth opportunities to the market players.

Segments Covered in the Report

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

June 2024

January 2025

October 2024

January 2025