January 2025

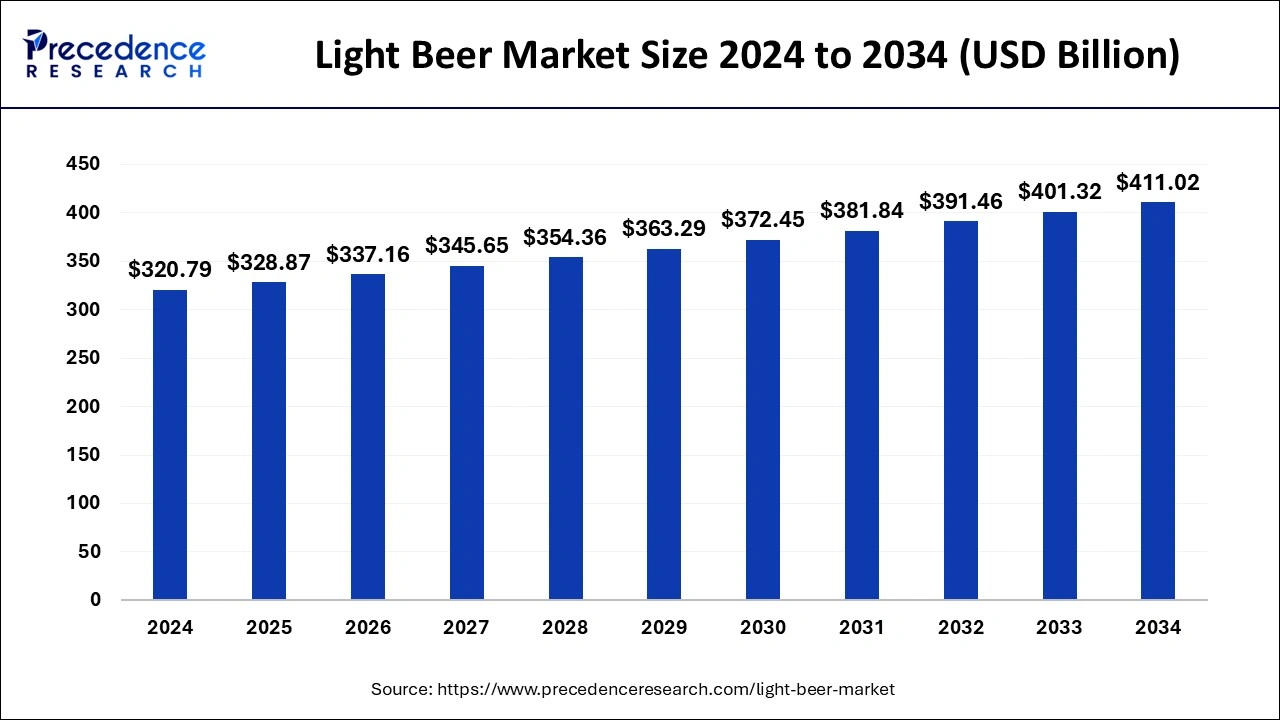

The global light beer market size is calculated at USD 328.87 billion in 2025 and is forecasted to reach around USD 411.02 billion by 2034, accelerating at a CAGR of 2.51% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global light beer market size was estimated at USD 320.79 billion in 2024 and is predicted to increase from USD 328.87 billion in 2025 to approximately USD 411.02 billion by 2034, expanding at a CAGR of 2.51% from 2025 to 2034. The primary reason behind this market's growth is a rise in fitness awareness among beer consumers.

Beer is an extremely ancient popular drink. After water and tea, it is the third most consumed drink. Beer is made up of brewing and fermenting starches of cereal grains like barley, wheat, maize, rice, or oats. Beer tastes bitter because it is brewed with hops. Fruits or herbs are used to add flavors as well. The beer industry is huge, and beer is distributed in bottles or cans. It is a global business with several active players worldwide, and there are several players operating at a small scale as well. Normally, beer has a 6-8% alcohol content by volume.

Light beer, however, is a beer with a low alcohol content by volume. Light beer is made in order to reduce the calorie content in the beer and the inebriating effect while maintaining its taste. Light beer is available in different flavors and styles. They are manufactured by reducing the carbohydrate and alcohol content. Alcohol content and carbohydrates both contribute to the caloric content of beer. Light beers are less flavorful than regular beers, as they are more diluted. Advertisers advertise the quality of their light beers by highlighting that their beers have better retention of taste and flavor. Light beer usually does not have any age limit, and it is also popular among teenagers who have not reached the legal age of drinking.

| Report Coverage | Details |

| Market Size in 2025 | USD 328.87 Billion |

| Market Size by 2034 | USD 411.02 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 2.51% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Production, Package, Distribution Channel, Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising preference for low-calorie intake

Light beers have very little alcohol content. It can be consumed by teetotalers (those who don’t consume alcohol) but want a taste of beer. It can also be consumed by those who have not achieved the legal age of drinking. People are also health conscious these days and prefer consuming low-calorie foods or beverages. Regular beer has a higher calorie content, and these are just empty calories. So, drinking this beer means that one is consuming sugary foods. This can lead to obesity, and hence, people prefer drinking light beer, which has a lower calorie content. This is preferred by GenZ consumers and those under the legal age of drinking.

Proper marketing and innovations in breweries

Many market players, like Kingfishers or Budweiser, are leading producers of beer and other alcoholic beverages. They even package the light beer in such a way that one can get the actual feel of drinking beer. The bottles are made the same as regular beer bottles, and the company also writes ‘non-alcoholic beverage’ on the bottle or can.

The breweries are constantly innovating their products, and new ways of brewing are coming up. Tasty flavors are added to beer, and the bitterness of the product is controlled as well. This gives consumers a broad range of options. There are several restaurants and bars that have their own brewery in the restaurant itself, which attracts customers.

Regular beer is a tough competitor

Light beers are good for health because they are low in calorie and alcohol content. However, they are in tough competition with regular beers. Regular beers give a proper ‘feel’ to the consumers that they have drank beer. However, in the case of light beer, one might have to consume more beer to get that feeling of ‘fullness.’ Light beers have poor taste, and consumers find them to be more diluted than regular beers.

Light beers cannot be as expensive as other soft drinks. Other soft drinks have a high content of sugar, and it has been found that the sugar content generates the craving for those drinks among people. So people who like other soft drinks won’t buy these light beers, which have a bitter taste and are expensive as well. There are also rising trends towards health consciousness, and people prefer healthier beverages over beer.

Overall growth in the beverage market

The light beer market will help in the overall growth of the beverage market. Light beer producers can tie up with other soft drink companies to bring innovations in the beverage industry and make them more popular among consumers. There is a rising awareness among the people, and several social media influencers are making people aware of the contents of packaged beverages. Hence, companies should take this in a positive way and reduce the calorie content in light beers as much as possible while maintaining their taste and quality. New and better-tasting flavors can be introduced in the market to ensure that a wider range of consumers prefer them. This will help in increasing the popularity of light beers further and grow this market on a global scale.

The craft brewery segment dominated the light beer market in 2024. Craft beer has a better taste. There is a variety of choices when it comes to craft beers. Craft beer contains antioxidants, protein, and vitamin B complex, and hence, these beers offer health benefits as well. Craft beer also happens to be cheaper in price and offers a high-quality taste because of the high-quality ingredients being used. For these reasons, craft beer dominates the light beer market.

The microbrewery segment is expected to witness the fastest growth in the light beer market during the forecast period. Microbrewery beers offer a strong taste. There is a wide variety of flavors available, and hence, users have a choice. It is customized and tastier. Microbrewery beer is fresh, and this adds to its taste. Microbreweries produce a limited amount of beer, and there is no mass production. Hence, the producers don't have to use a lot of preservatives for it. While offering high quality, microbrewery light beer has low pricing because there are no extra costs of branding the product by hiring celebrities or no expenditure in packaging, as this beer is directly served to the consumers.

The pet bottle segment accounted for the largest share of the light beer market in 2024. Pet bottles are lightweight, contribute to less greenhouse emissions, offer a high strength, and can be recycled many times. The cost of recycling and producing pets is low. These bottles can offer a good seal and avoid leakage of the product. These bottles have an advantage over glass bottles in that they cannot crack or break. Pets also have a high level of flexibility, and hence, these bottles can be molded in any desired shape after recycling. For these reasons, the pet bottle segment dominates the light beer market.

The glass segment will show the rapid expansion in the light beer market over the forecast period. Glass bottles are better than plastic bottles because they extend the shelf life of beer and protect it from sunlight. The flavor of light beer is retained better in glass bottles, which are also recyclable.

The hypermarkets & supermarkets segment dominated the light beer market in 2024. Supermarkets and hypermarkets have a wide variety of beers, and there is a dedicated section for beers in these places. Multiple customers can be targeted. People can shop for light beers while shopping for their groceries. Supermarkets are the places where top-quality brand beers can be sold, and hence, they also help in marketing. Buyers get high discounts if they buy from supermarkets. While billing, information about the users is also collected, and hence, the sellers can understand the age of the consumer while selling the light beer. Hence, specific age groups can be targeted.

The specialty stores segment is projected to witness rapid growth during the forecast period. Specialty stores take beer selling to a niche level, and they can be called liquor supermarkets. Light beers can have a dedicated section where users can buy the brands they like. A large variety of beers can be made available in a specialty store, and hence, it is favored by many people. Usually, people who are connoisseurs and take a deep interest in trying out a variety of beers or light beers favor the specialty stores. Specialty stores can have not only top brands but also local brands, and hence, it also benefits small-scale brewers.

North America dominated the light beer market in 2024. Light beer, and beer in general, is gaining popularity among the younger generation. Consumers demand better taste and variety, and the key players in the market are ensuring that the quality and taste are being delivered. Microbreweries choose the products that are the most popular and ensure that their production is high in quality and quantity. Hence, consumers are getting more homogenous and a better-quality light beer. Packaged light beers in bars and restaurants are being sold in large amounts, and this, too, contributes to the growth of the light beer market in North America.

Asia Pacific is expected to show significant growth in the light beer market during the forecast period. There have been changes in the lifestyle of a large population, and this is helping in the growth of the light beer market in Asia Pacific. People are earning better incomes and have also become health conscious. Hence, they are also spending a good amount of money on light beers. Social media is helping to increase the popularity of light beers. Light beer brands offer a wide variety of flavors. The young generation enjoys light beer, and hence, they help in growing the light beer market in the Asia Pacific.

By Production

By Package

By Distribution Channel

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025