October 2024

Light Sensor Market (By Function, Ambient Light Sensing, Proximity Detection, RGB Color Sensing, Gesture Recognition, IR Detection; By Output: Analog, Digital; By Application: Automotive, Consumer Electronics, Industrial) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

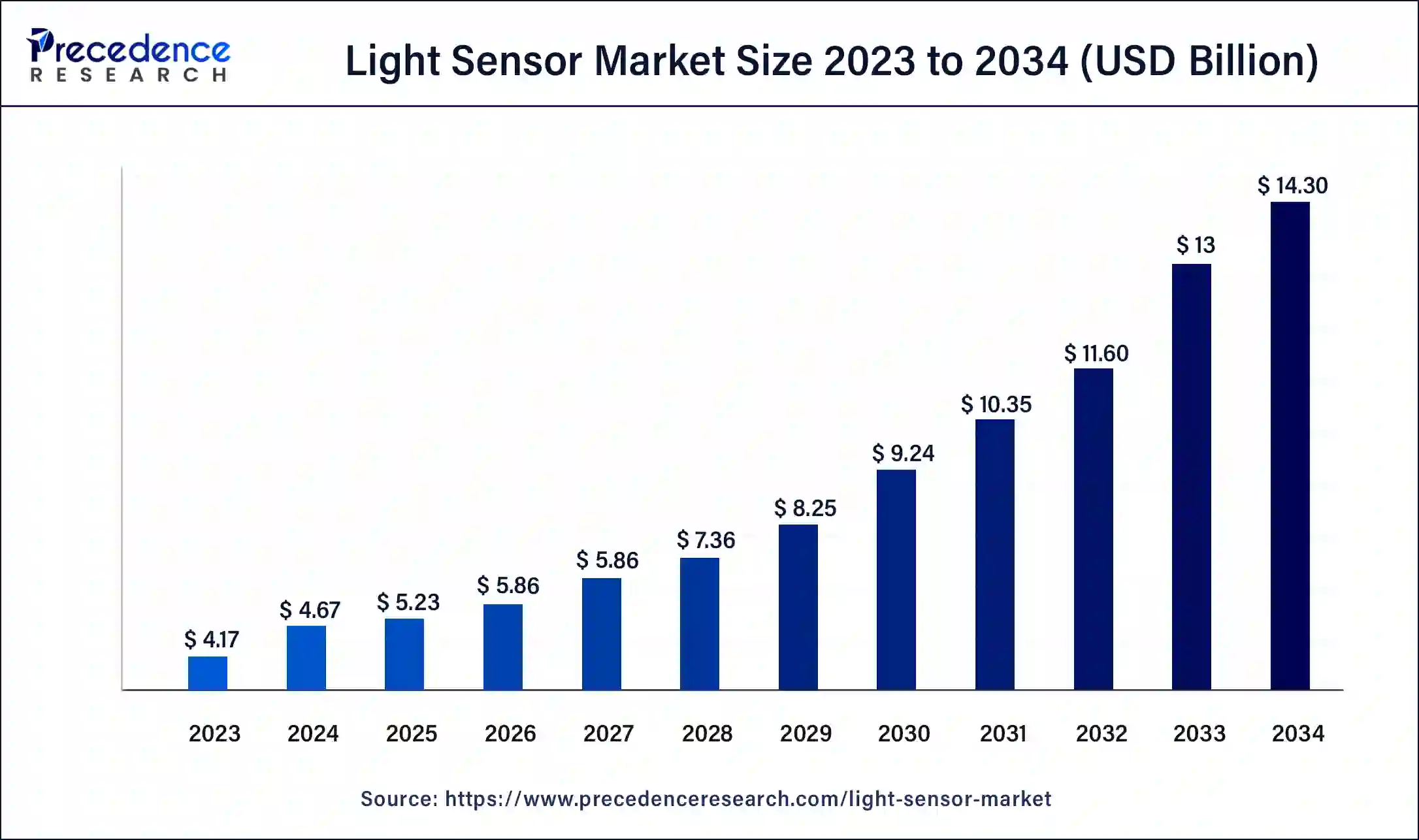

The global light sensor market size was USD 4.17 billion in 2023, calculated at USD 4.67 billion in 2024 and is expected to reach around USD 14.30 billion by 2034, expanding at a CAGR of 11.84% from 2024 to 2034. Major factors driving the demand for light sensors are the rise in the use of consumer electronics, the miniaturization of sensors, and the growing demand for implementing renewable energy.

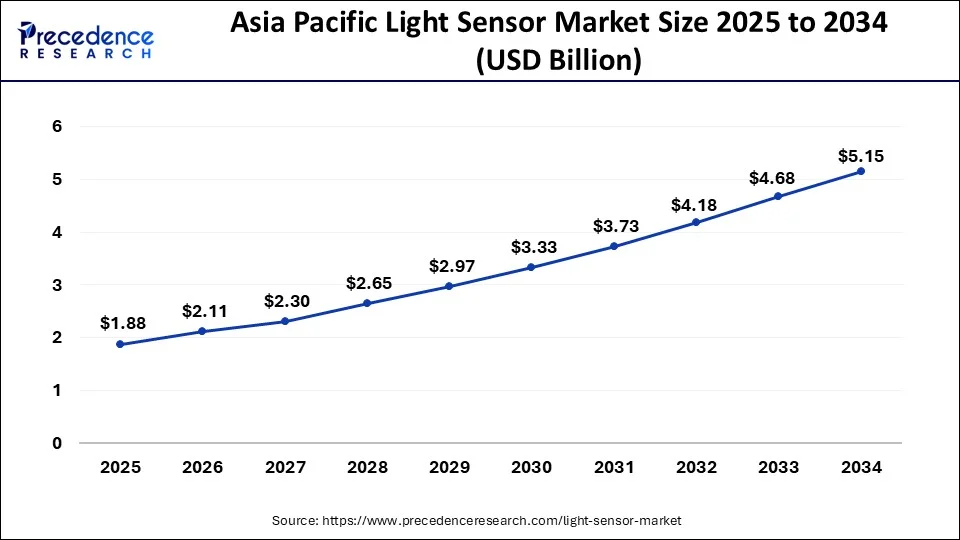

The Asia Pacific light sensor market size surpassed USD 1.50 billion in 2023 and is predicted to be worth around USD 5.15 billion by 2034 at a CAGR of 12% from 2024 to 2034.

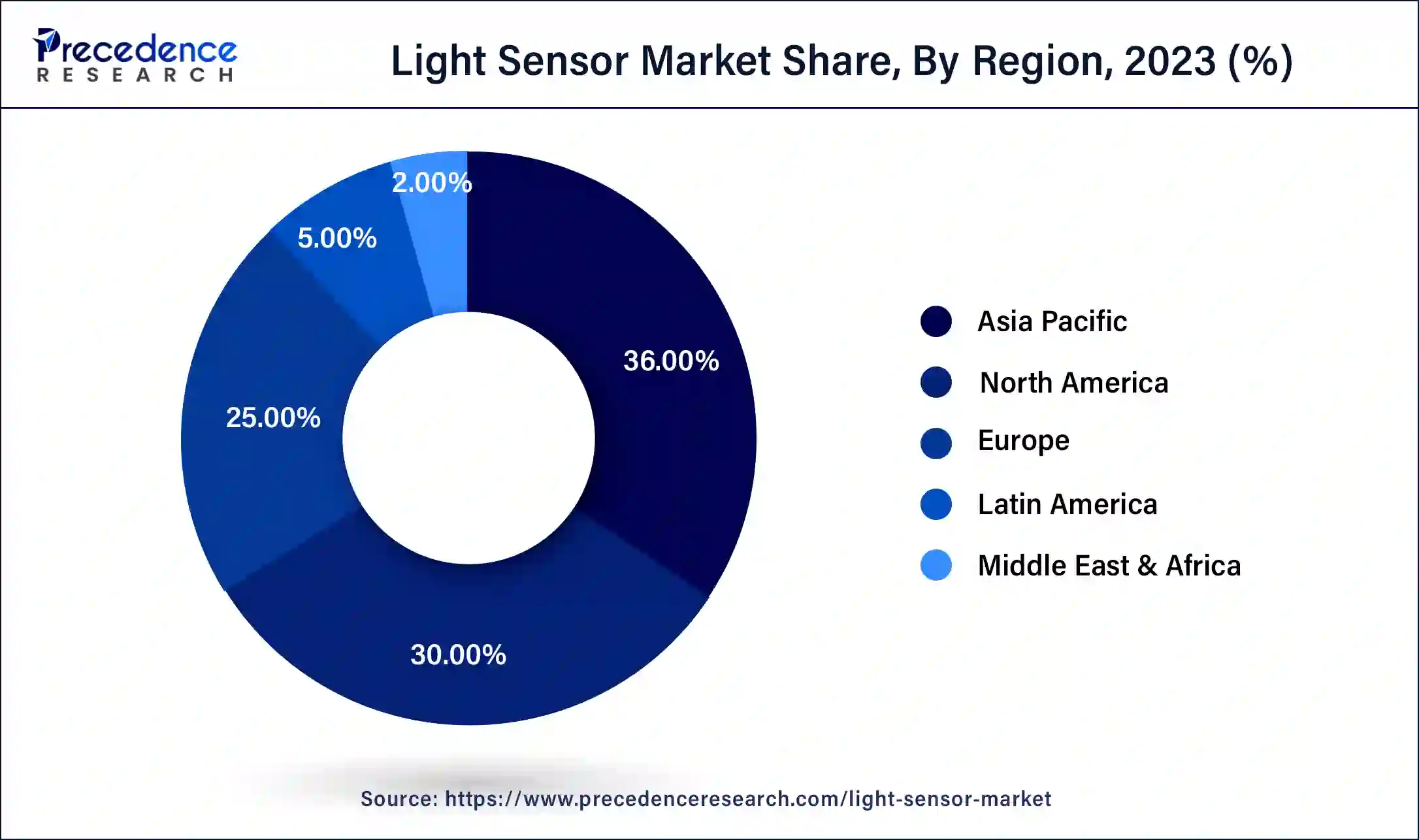

Asia Pacific dominated the light sensor market share of 36% in 2023, mainly due to its large population and rising demand for smartphones and consumer electronics. Also, the increasing availability of handheld devices with built-in light sensors is set to boost market growth. Governments in developing countries like India and China have imposed strict safety regulations, prompting automobile makers to include more sensors in mid-range vehicles. These developments are anticipated to fuel the demand for light sensors in the Asia Pacific in the coming years.

North America is expected to experience significant growth in the coming years because it has been quick to adopt light detection solutions. Many companies, like Analog Devices, Inc., Broadcom, Inc., and Maxim Integrated Products, Inc., are actively involved in innovating and developing sensors in this region. Although the United States leads globally in sensor design and research, most manufacturing occurs in the Asia Pacific region. This pattern is likely to persist in the future. Some uncertainties in global politics, particularly regarding trade policies, have prompted the U.S. industry to devise new strategies to remain competitive.

Light sensors detect radiant energy across a range of frequencies, from infrared to ultraviolet light, and convert it into electrical signals. They have diverse applications, such as helping farmers hydrate crops by connecting them to sprinkler systems and optimizing watering schedules with weather-monitoring equipment. Light sensors are also used in freight shipping to track cargo by detecting changes in light exposure when containers are opened.

The light sensor market has found applications in smartphones, computers, TV remotes, automobiles, and streetlamps to adjust brightness and activate lights automatically. Furthermore, these sensors can measure virus concentration in the air using localized surface plasmon resonance (LSPR) technology. With ongoing technological advancements, product developments, increasing industrial automation, and collaborations in the industry, the market is expected to continue growing.

| Report Coverage | Details |

| Global Market Size by 2034 | USD 5.15 Billion |

| Global Market Size in 2023 | USD 1.50 Billion |

| Global Market Size in 2024 | USD 1.68 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 11.84% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Function, Output, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Innovation in AI and ML

Light sensors have become a trend in smart city applications and emerging tech innovations, which are supported by artificial intelligence and machine learning technologies. The market is growing due to prospects across different industry verticals due to growth in automation. Moreover, the surge in the telecommunication industry and advancement in IoT devices have led to market growth. The other innovative technologies, like nanoscale photonics, are experiencing high demand from market players for their utilization in smart city infrastructure. Fueling the growth of the light sensor market.

Bezel-less designs

Smartphone manufacturers like Apple and Samsung are increasingly creating phones with bezel-less designs. This means the screens cover most of the front of the phone, giving more display space while keeping the phone compact and easy to hold. However, traditional features like the ambient light sensor, which adjusts screen brightness based on surrounding light, are being phased out in many smartphones with bezel-less designs. As a result, the demand for light sensors is decreasing due to the rising popularity of edge-to-edge screens.

Advancements in automotive technology

The light sensor market is being driven by several factors, including their use in consumer electronics like smartphones and tablets. Advancements in automotive tech, smart homes, and outdoor lighting are also boosting demand. The rise of smart cities and IoT technology is further fueling this growth. Proximity light sensors play a key role in detecting motion or nearby objects by sensing changes in infrared light. They're often used in vehicle devices to alert drivers about obstacles and in outdoor lights for security purposes. Moreover, Smartphone makers are actively integrating new technologies to enhance product quality and user experience.

Rise in smart city infrastructure

The rise of smart cities is a big trend in the light sensor market. In these cities, lights will use sensors to be energy efficient. For example, they'll automatically adjust brightness based on natural light, saving electricity. As more smart cities are built, the demand for light sensors will go up. Furthermore, there's also a growing demand for light sensors in consumer electronics. This is because of things like smaller sensors, more gadgets, and the push for renewable energy. Plus, improvements in cars, smart homes, and outdoor lighting are also boosting the market. New tech, like better manufacturing and faster circuits, are making sensors more reliable and efficient, improving the quality of products that use them.

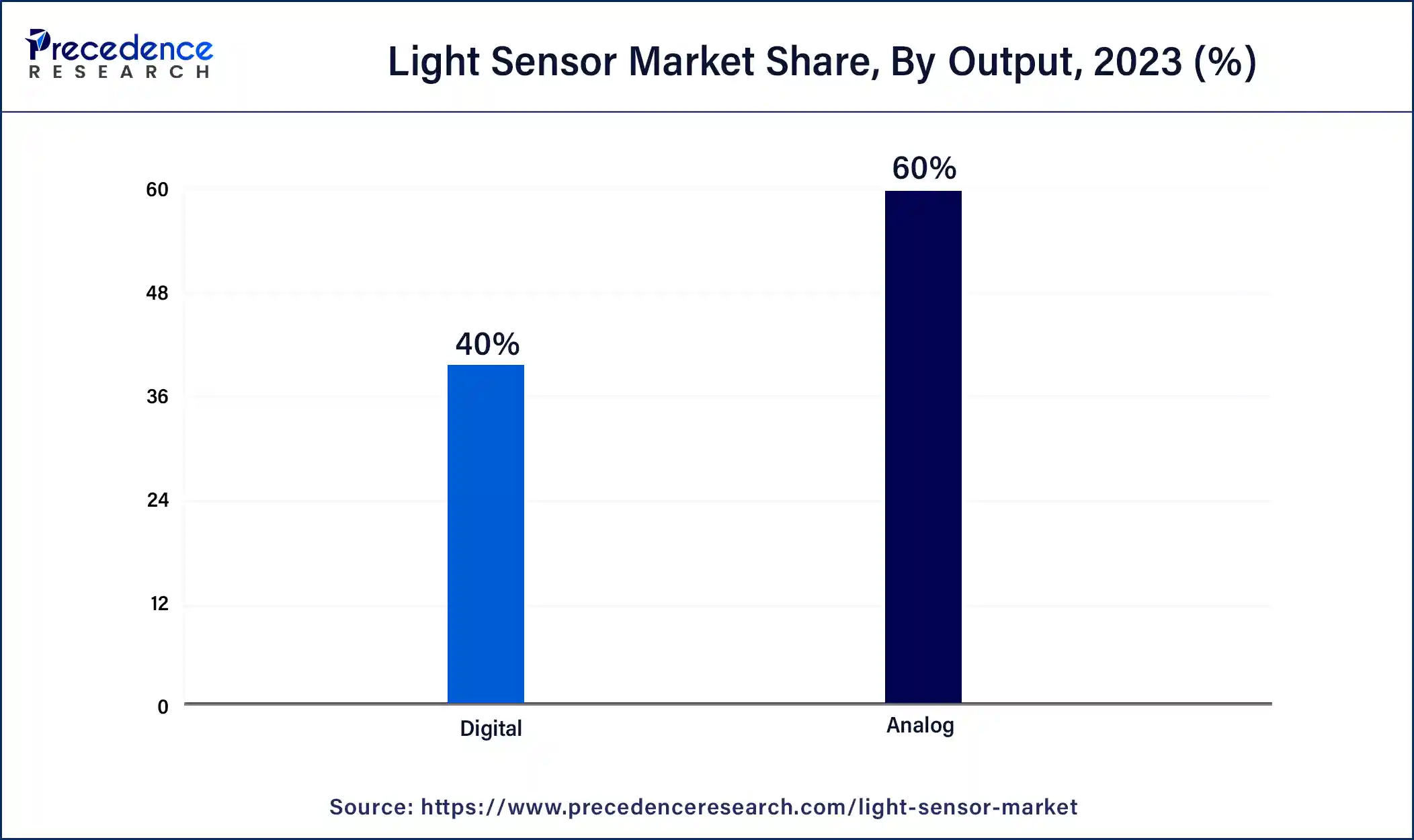

The digital segment dominated the light sensor market in 2023. In applications such as lighting control, air conditioning, temperature control systems, and ventilation, these parameters must be adjusted based on the intensity of ambient light. With the rise in the use of screen-based devices such as cell phones, laptops, and television sets, these segments are likely to experience substantial market growth during the forecast period.

The analog segment is expected to grow at a significant rate during the projected period. Analog light sensors are generally used in sectors such as healthcare, industrial automation, consumer electronics, etc. The versatility of analog light sensors is important for achieving appropriate measurement of light in diverse environments.

The ambient light sensing segment was the top revenue generator in the light sensor market in 2023. Light sensors have become crucial in meeting design requirements for consumer electronics. Technology is increasingly used in smart electronics, adjusting LCD and LED screen brightness based on ambient light levels. This not only saves energy but also provides users with optimal screen brightness for their environment.

In the light sensor market, the proximity detection segment is projected to experience the fastest growth. This growth is fueled by its extensive use in automotive and industrial manufacturing. Proximity detectors detect changes in infrared light to sense motion or nearby objects. They're frequently utilized in vehicles to warn drivers about nearby objects and in outdoor lights for security and detecting movement.

The consumer electronics segment dominated the light sensor market in 2023. This is attributed to the rise in demand and use of different electronic products among consumers. Light-sensing devices are experiencing a rise in demand from laptops, LCD/LED televisions, and smartphones. The sensors also automatically maintain the screen's brightness by responding to the light present in the environment.

The healthcare segment is anticipated to witness the fastest growth during the forecast period in the light sensor market. Light sensors are also used in the medical field to detect pathogens, diagnose blood, and monitor patient oxygen levels. These advancements will contribute to the market expansion in the coming years.

Segments Covered in the Report

By Function

By Output

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

March 2025

February 2025

August 2024