September 2024

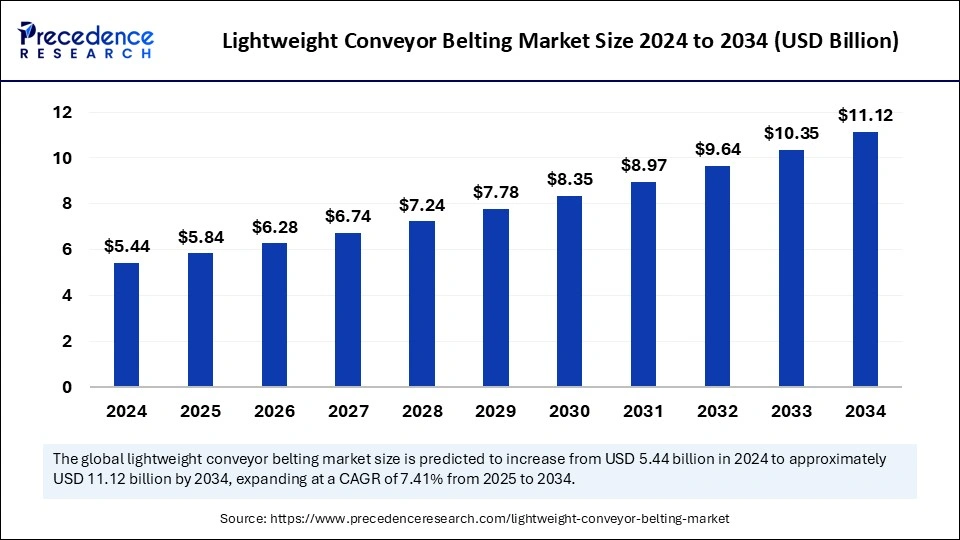

The global lightweight conveyor belting market size is calculated at USD 5.84 billion in 2025 and is forecasted to reach around USD 11.12 billion by 2034, accelerating at a CAGR of 7.41% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global lightweight conveyor belting market size was estimated at USD 5.44 billion in 2024 and is predicted to increase from USD 5.84 billion in 2025 to approximately USD 11.12 billion by 2034, expanding at a CAGR of 7.41% from 2025 to 2034. The growth of the lightweight conveyor belting market is expanding rapidly due to the increasing industrialization, along with the growing need for efficient material handling solutions. Furthermore, the growing focus on energy efficiency, speed, and sustainability propels the demand for lightweight conveyor belts.

The use of Artificial Intelligence in conveyor systems is an ideal approach to improve the reliability of a system. AI technologies are superior to monitoring conveyor belts and conveyor systems. AI algorithms analyze sensor data from conveyor systems to predict potential failures and maintenance. They automatically transport loads. AI-driven conveyor systems minimize human errors and reduce labor costs. AI-driven speed control solutions are promising for improving energy efficiency in conveyor systems.

The market for lightweight conveyor belting is growing at a significant rate due to the rising demand for conveyor systems from various industries, such as food processing and packaging, e-commerce, warehousing, automotive, electronics, and smart manufacturing. Advances in materials science led to a highly durable belt made of polyurethane and thermoplastic elastomer. Light conveyor belts are more energy efficient, making them suitable for industries that want to reduce operational costs and achieve sustainability goals. These belts streamline transport operations. In addition, the rising focus on industrial automation is further boosting the growth of the lightweight conveyor belting market.

| Report Coverage | Details |

| Market Size by 2034 | USD 11.12 Billion |

| Market Size in 2025 | USD 5.84 Billion |

| Market Size in 2024 | USD 5.44 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.41% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Product, Thickness, Application and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Use of Energy-efficient Systems

The increasing adoption of energy-efficient systems is a major factor driving the growth of the lightweight conveyor belting market. As many industries prioritize cost reduction and sustainability without compromising performance, the adoption of energy-efficient conveyor systems increases. This, in turn, boosts the need for lightweight conveyor belts. The integration of variable speed drives (VSDs) enables conveyor systems to regulate the speed based on load requirements, reducing unnecessary energy consumption.

Additionally, increasing throughput by the use of high-efficiency motors, innovative sensor technology, and automated controls ensure optimal performance and reduce energy waste. As industries look to enhance operational efficiency and comply with environmental regulations, the demand for lightweight, energy-efficient conveyor belting solutions continues to increase.

Lower Load Capacity

Lightweight conveyor belts have lower load capacity, affecting the efficiency of conveyor systems. The flexibility of lightweight conveyor belts, particularly those made from rubber or synthetic fabrics, are less and require frequent maintenance due to their lower wear resistance. These conveyor belts may not function constantly or at variable speeds, which affects operational productivity across a variety of sectors. Moreover, lightweight conveyor belts are less durable than heavy-duty belts, hampering the market's growth.

Growing Demand for Food-grade Conveyor Belts

The increasing focus on safe, efficient, and inexpensive food production is expected to boost the demand for specialized food-grade conveyor systems, which creates immense opportunities in the lightweight conveyor belting market. Advances in food processing technologies have led to the adoption of modular conveyors made from food-grade materials featuring cleated surfaces to prevent product slippage and ensure compliance with stringent hygiene standards. Furthermore, the rise of modular conveyor systems, with identical components such as belts, pulleys, and tensioners, enables food processors to customize, reconfigure, and streamline maintenance while minimizing operational costs. As the food sector continues to evolve, the need for adaptable, lightweight, and easily flexible conveyor solutions presents a significant opportunity in the market.

The polyvinyl chloride segment led the market with the largest share in 2024. This is mainly due to the increased demand for PVC conveyor belts in the food processing, logistics, and packaging sectors. These belts are preferred for their excellent resistance to chemicals, oils, and water, making them ideal for applications with exposure to chemicals. Since PVC is a lightweight, durable, and cost-effective material, it is suitable for lightweight conveyor belts.

The polyurethane (PU) segment is expected to grow at the fastest rate in the coming years. As PU conveyor belts meet food safety standards, they are widely used in the food & beverage industry. Conveyor belts made from PU can be sterilized or sanitized easily. PU is ideal for conveyor systems that require high speeds, tight curves, or complex configurations because of its lightweight and flexibility.

The flat belts segment led the lightweight conveyor belting market in 2024 due to their versatility. These belts are suitable for high-speed drive applications due to their lightweight and smooth surface with a superior grip, which further reduces the chances of product damage. Flat belts feature a flat cross-sectional shape and a trapezoidal profile, which increases the efficiency of a conveyor system.

The modular belts segment is projected to grow at a rapid pace during the forecast period. Modular belts are widely preferred because of their low maintenance, increased efficiency, long lifetimes, and excellent reliability, making them suitable for various applications. These belts are easy to clean and consume less energy.

The medium duty (2mm - 4mm) segment registered dominance in the lightweight conveyor belting market in 2024. This is mainly due to the increased adoption of medium-duty conveyor belts in industries requiring moderate load-bearing capacity. These belts are primarily preferred for their good balance between strength and flexibility. They are suitable for transporting products with medium to heavy weight. These belts increase the productivity of manufacturing businesses by efficiently transporting heavy goods.

The light duty (less than 2mm) segment is anticipated to witness the fastest growth over the studied period. The cost-effectiveness of light-duty conveyor belts is a key factor supporting segmental growth. Since these belts require less material during production, they are considered more economical. Light-duty conveyor belts are in high demand in industries like food & beverages and packaging.

The logistics segment accounted for the dominant market share in 2024. This is mainly due to the increased demand for efficient conveyor systems from logistics companies. These companies often deal with large volumes of goods. Thus, they require efficient conveyor systems for the smooth transportation of products. Lightweight conveyor belts enable faster conveyor speed, reducing handling times.

The fruits & vegetables segment is projected to be the fastest-growing segment during the upcoming period as conveyor belts speed up transportation, ensuring that fresh fruits and vegetables reach consumers in fresh condition. They reduce manual handling and decrease contamination risk, enhancing food safety.

North America’s Market Dominance

North America registered dominance in the lightweight conveyor belting market by holding the largest share in 2024. This is mainly due to its robust industrial base and high emphasis on automation, digitization, and efficient manufacturing processes. There is a high adoption of AI-driven conveyor systems in warehouses to drive automation. Several industries in the region have shifted their focus on worker safety, which boosted the adoption of conveyor systems to carry goods.

The U.S. is a major contributor to the North American lightweight conveyor belting market. The country boasts a strong manufacturing sector that relies heavily on material handling solutions, including conveyor systems. There is a rapid expansion of the e-commerce and food processing businesses. The increasing trend of online shopping is further boosting the need for efficient conveyor systems to manage large order volumes, ensure on-time deliveries, and satisfy customer needs, contributing to the growth of the market in the region.

Rapid Industrialization to Boost the Market in Asia Pacific

Asia Pacific is expected to witness the fastest growth during the projection period due to rising industrialization. As industries expand, manufacturing activities increase, and so does the need for conveyor systems to transport goods and streamline operations. Governments across the region are also making efforts to promote industrial automation, which supports market growth. Countries like India and China are expected to lead the Asia Pacific lightweight conveyor belting market over the studied period. This is mainly due to the rapid expansion of the e-commerce and food & beverages industries. There is a high emphasis on warehouse management, boosting the demand for lightweight conveyor belting.

By Material

By Product

By Thickness

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024