December 2023

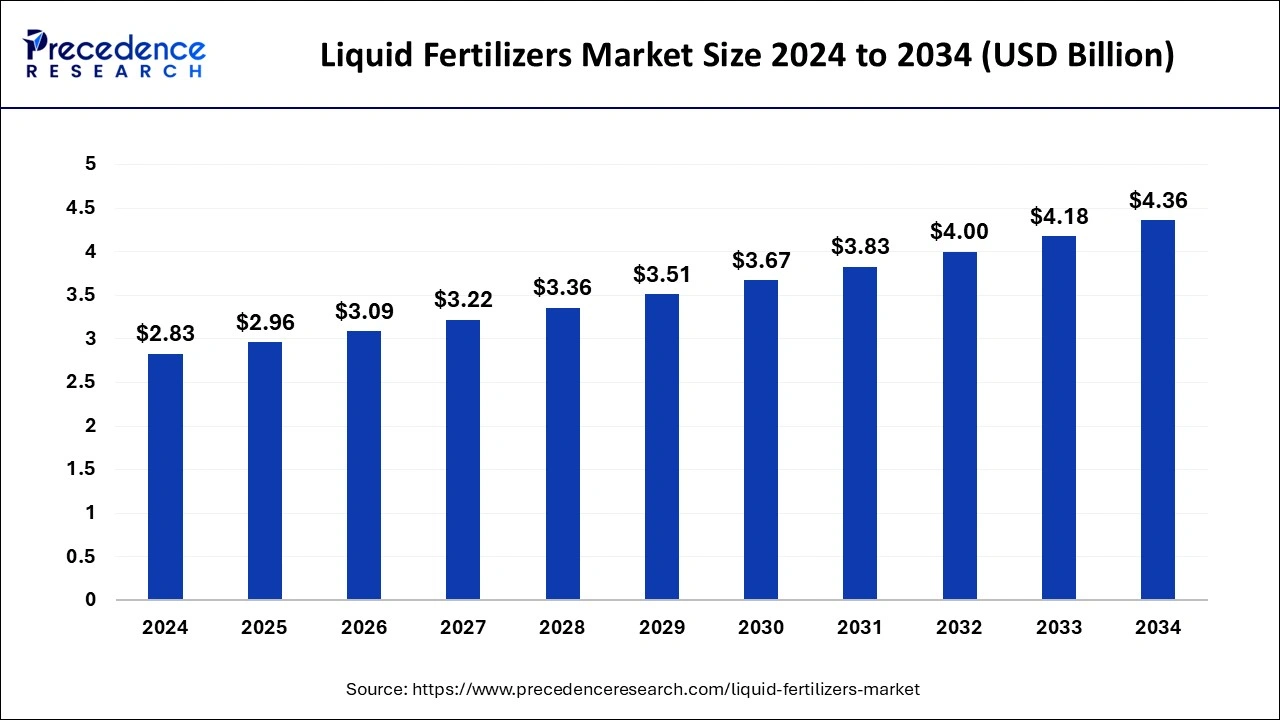

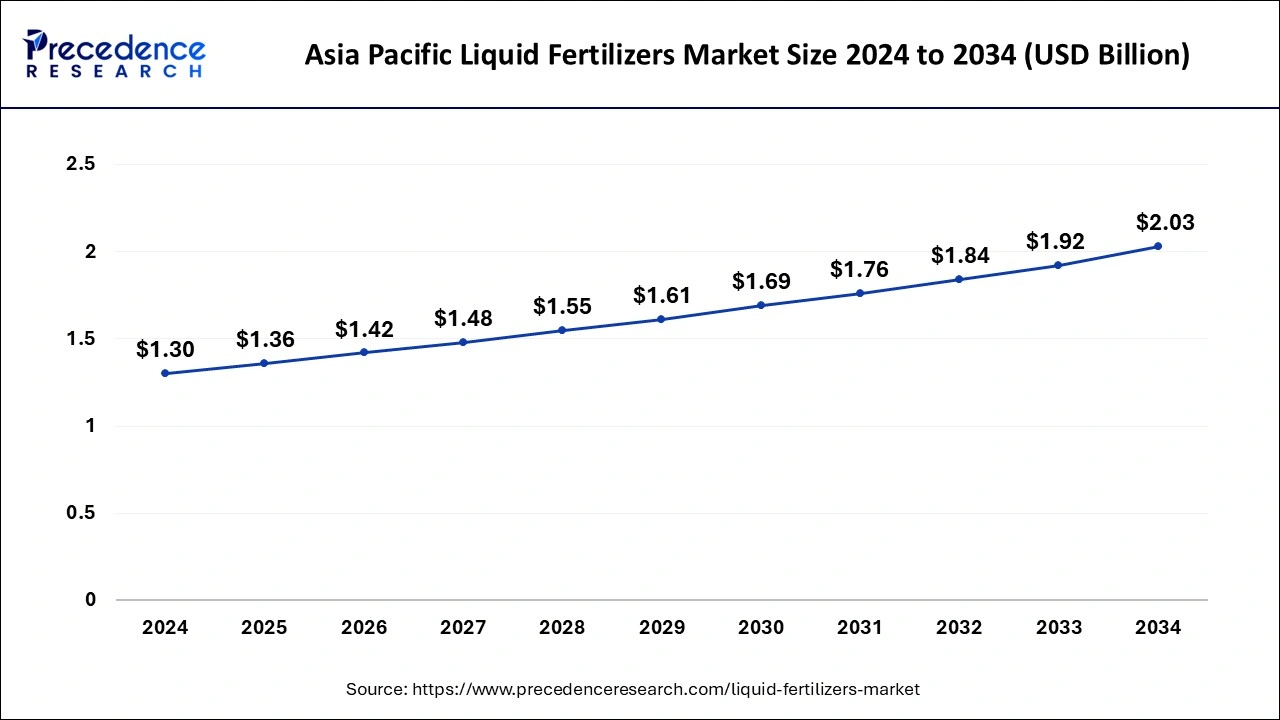

The global liquid fertilizers market size is estimated at USD 2.96 billion in 2025 and is predicted to reach around USD 4.36 billion by 2034, accelerating at a CAGR of 4.42% from 2025 to 2034. The Asia Pacific liquid fertilizers market size surpassed USD 1.36 billion in 2025 and is expanding at a CAGR of 4.55% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global liquid fertilizers market size was estimated for USD 2.83 billion in 2024 and is anticipated to reach around USD 4.36 billion by 2034, growing at a CAGR of 4.42% from 2025 to 2034. Advances in agricultural technology, newer formulations and the unique benefits of innovative fertilizers are all propelling growth in the liquid fertilizers market.

Artificial intelligence (AI) allows to predict the trend of nitrogen in soil, avoiding fertilizer overuse and related environmental damage. It can help in the optimization of crop management practices. AI in fertilizers aims to demonstrate that the prediction of optimal fertilization timings and amounts using a short-term forecast is feasible and can enhance upon current fertilization strategies in a changing climate. Generally, AI based fertilizer systems have lower upfront costs, consistent & easy application, and fast acting for quick results. These factors help the growth of the liquid fertilizers market.

The Asia Pacific liquid fertilizers market size was estimated at USD 1.30 billion in 2024 and is anticipated to be surpass around USD 2.03 billion by 2034, rising at a CAGR of 4.55% from 2025 to 2034.

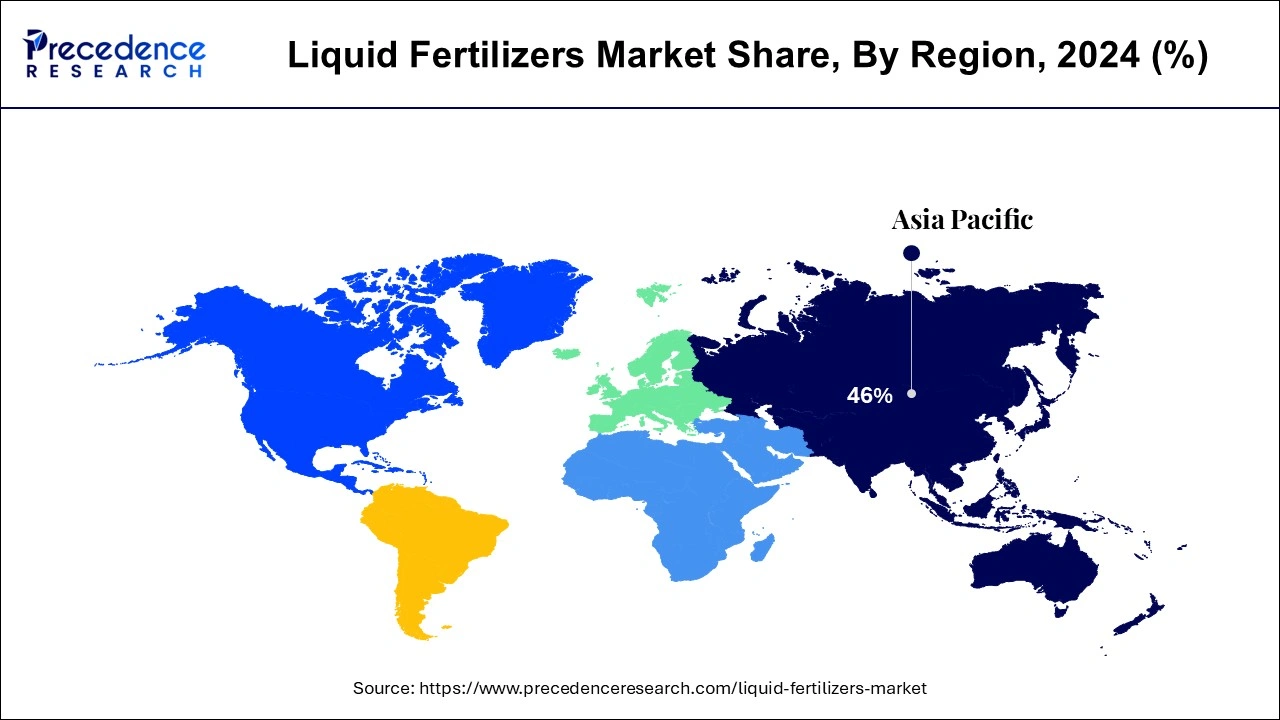

Asia Pacific dominated the global liquid fertilizers market with the largest market share of 46% in 2024. The growing expense of conventional fertilizers, as well as their negative environmental effects, has led in a tremendous increase in the usage of high-efficiency fertilizers in agriculture, such as liquid potassium fertilizers. Rising food consumption, high crop yields, and developments in automated irrigation systems are driving demand for liquid fertilizers in the Asia-Pacific area. China has the region's largest market share (46.5 percent), while Australia is expected to grow the fastest in the coming years. Due to extraordinary economic growth, population growth, and support from governments; Asia-Pacific is the largest and fastest-growing market for liquid fertilizers.

North America is expected to expand at a solid CAGR during the forecast period. The existence of a diverse variety of fertilizer producers in the area, as well as the creation of new manufacturing facilities and distribution channels, will drive market expansion throughout the projection period. Furthermore, increased knowledge regarding the use of organic fluid fertilizers, as well as rising demand for high-value goods, would promote market expansion.

Europe is the third-largest market for liquid fertilizers. The market in this region is expected to grow significantly during the forecast period due to a variety of factors such as increased access to subsidized fertilizers, hydroponic system field areas, and an increase in automation, which has resulted in the growing acceptance of technologies such as liquid fertilizer sprayers. Along with market expansion, companies in the liquid fertilizers market are focusing not just on product quality and marketing, but also on expanding their presence into emerging markets.

| Report Coverage | Details |

| Market Size by 2034 | USD 4.36 Billion |

| Market Size in 2025 | USD 2.83 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.42% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Crop Type, Compounds, Type, Ingredient, Application, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

On the other hand, presently available land for agriculture has reduced because of soil erosion, urbanization, and pollution. The only possible way to produce large quantity of food for everyone is by growing the yield per area of the available lands. This is possible only through the intelligent application of fertilizers along with other advanced farming techniques which will help the growth of the liquid fertilizers market.

During the studied period, the fruits and vegetables segment dominated the liquid fertilizers market. Fruit consumption has increased dramatically over the last two decades, and this trend is expected to continue in the next years. Report published by FAO says China is the top producer of fresh fruits and vegetables in the world, which is greater than US and Indian production and growth in 2018. Increased fruit and vegetable exports have resulted in an increase in crop plantation area, which has resulted in enlarged output levels. As a result, the market for chemical fertilizers and pesticides for fruits and vegetables is expected to grow substantially. As an outcome, the market is expected to grow.

The cereals and grains segment is expected to witness the highest growth rate during the forecast period. Liquid fertilizers for these crops, notably in Asian and North American nations. Furthermore, owing to increased demand for crops such as corn, wheat, rice, and sorghum across many sectors, crop protection chemical consumption is expected to rise in order to improve the output of these cereals. As a result of these factors, the segment is expected to develop at the fastest rate during the forecast period. Asia Pacific accounted for the highest share of the liquid fertilizer market for cereals and grains, owing to high crop output in nations such as the United States, China, India, and Japan.

Nitrogen segment dominated the global market. Macro and microelements are of great importance for plant growth. Nitrogen is heavily ingested nutrient for all the current farming practices in the world. It's utilized to make amino acids, which turn into proteins, and it's involved in nearly every metabolic reaction in a plant. Farmers generally face the problem of low availability of nitrogen in the soil. As a result, more liquid nitrogen fertilizer is needed to solve the problem. Further, multiple mixtures of nutrients are created and utilized to feed plants. As a result, global demand for liquid nitrogen fertilizers remains high.

Potash is expected to witness the highest growth rate during the forecast period. The market for potash fertilizers is expected to increase at a 4.47% CAGR from USD 21.6 billion in 2017 to USD 30.87 billion by 2032. This market's expansion may be linked to an increase in the requirement for increased productivity utilizing limited land area, as well as an increase in the application of potash fertilizers. As an increasing number of agricultural producers adopt these products, the benefits of employing these fertilizers are driving market expansion.

Calcium Ammonium Nitrate (CAN) captured high revenue share in the global liquid fertilizer market as it is the significantly and widely used nitrogen fertilizer because of its comparatively high nutrient content along with physical properties, such as high solubility that helps in quick dissolving of the fertilizer into the soil. It contains magnesium and calcium that helps in upgrading the efficiency for absorbing nitrogen by the roots along with reducing nitrogen losses that makes the fertilization more profitable; this also protects subsoil waters counter to pollution by nitrogen compounds. Henceforth, the aforementioned factors help in driving the market growth for CAN in the upcoming years as well.

Fertigation captures notable revenue share in the global liquid fertilizers market owing to its numerous benefits. It is basically a profitable agriculture technique that includes fertilizer and water application by means of irrigation. The entire process offers lucrative opportunity to increase the yield capacity of land as well as to minimize the environment pollution. Moreover, increased focus of government bodies along with rising awareness among people triggers the growth and demand for such techniques. Therefore, the above mentioned factors drive the market growth for fertigation during the upcoming period.

By Crop Type

By Type

By Compounds

By Ingredient Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2023

November 2024

January 2025

October 2024