January 2025

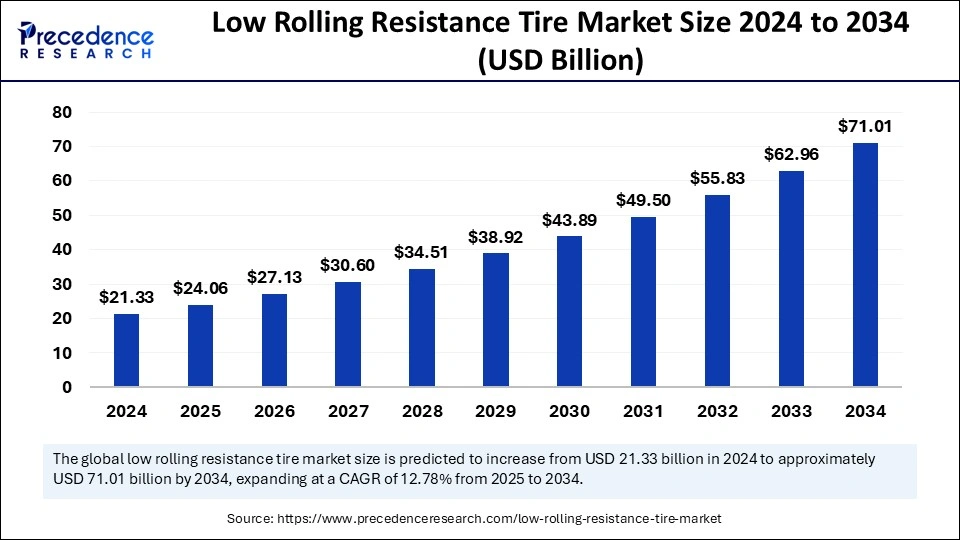

The global low rolling resistance tire market size is calculated at USD 24.06 billion in 2025 and is forecasted to reach around USD 71.01 billion by 2034, accelerating at a CAGR of 12.78% from 2025 to 2034. The North America market size surpassed USD 7.68 billion in 2024 and is expanding at a CAGR of 12.93% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global low rolling resistance tire market size accounted for USD 21.33 billion in 2024 and is predicted to increase from USD 24.06 billion in 2025 to approximately USD 71.01 billion by 2034, expanding at a CAGR of 12.78% from 2025 to 2034. The rising production of vehicles and the increasing focus on improving vehicle performance boost the growth of the low rolling resistance tire market.

Artificial intelligence (AI) has changed the landscape of various industries in the last few years. AI technology is utilized to optimize tires' designs, materials, and performance features. With AI and Machine Learning algorithms, manufacturers can optimize tire designs that suit specific characteristics like improving fuel efficiency. AI technology enables manufacturers to create more customized and personalized tire solutions. AI also enables manufacturers to identify new materials with optimal properties for low rolling resistance tires, increasing lifespan, durability, and resistance to wear and tear. In addition, integrating AI in manufacturing significantly enhances production output and tire quality.

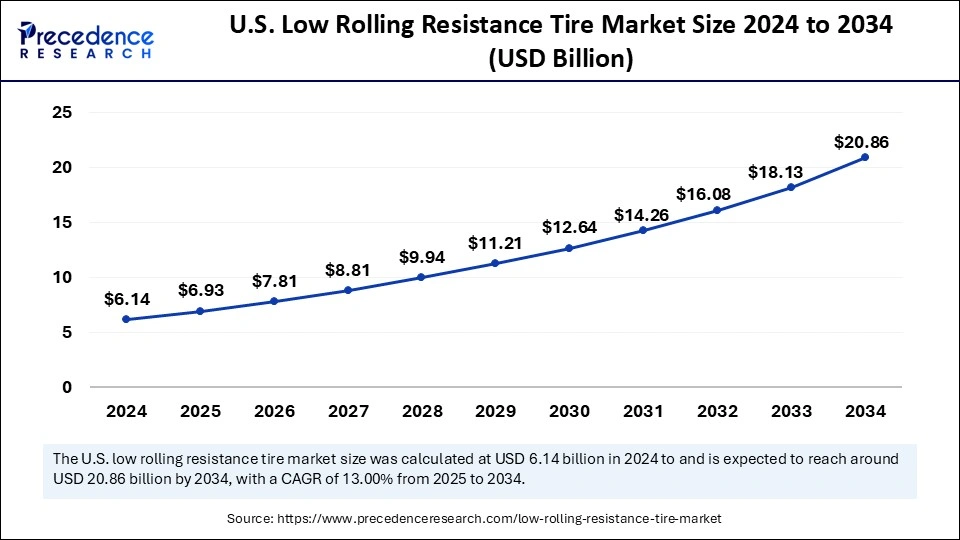

The U.S. low rolling resistance tire market size was exhibited at USD 6.14 billion in 2024 and is projected to be worth around USD 20.86 billion by 2034, growing at a CAGR of 13.00% from 2025 to 2034.

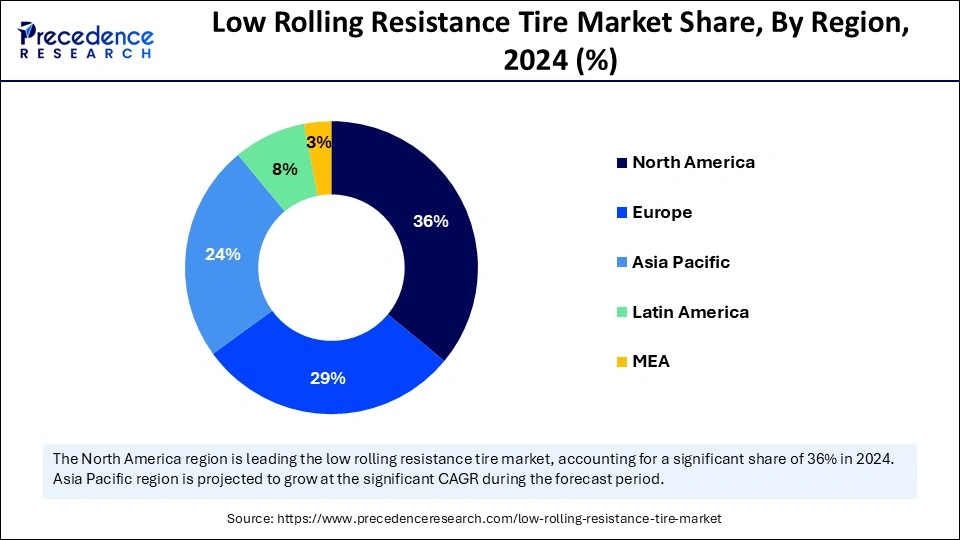

North America held the largest share of the low rolling resistance tire market in 2024. The region is home to some of the leading automakers, which boosts the growth of the market. The rising awareness of the benefits of utilizing low-rolling resistance tires and increasing focus on reducing carbon emissions support regional market growth. The demand for electric and hybrid vehicles is rising in the region, contributing to market expansion. Logistic companies and fleet operators in the region are increasingly choosing fuel-efficient vehicles to reduce carbon emissions.

The U.S. is expected to have a stronghold on the North American low rolling resistance tire market. Stringent regulations regarding environmental sustainability and fuel efficiency are encouraging automakers to use high-performance low-rolling resistance tires. These tires significantly improve fuel efficiency and the performance of vehicles. The rising adoption of electric vehicles and increasing vehicle ownership contribute to regional market growth.

Asia Pacific is seen to grow at the fastest rate in the low rolling resistance tire market during the forecast period. This is mainly due to the region’s robust automotive sector. A rise in consumer awareness about environmentally sustainable practices has propelled the demand for electric and hybrid vehicles in the region, majorly boosting the need for high-performance tires to boost vehicle performance.

Countries like China and India are major contributors to the Asia Pacific low rolling resistance tire market. China is known as the leading automobile manufacturing hub. According to the China Association of Automobile Manufacturers, car sales are predicted to reach 32.4 million units in 2025, with New Energy vehicle sales growing by 24.4%. In addition, the rapid shift toward EVs and the increasing focus on improving vehicle performance support market growth.

Europe is projected to show notable growth in the upcoming period. This region has established automotive sectors that are a key factor for regional market growth. The growing focus on reducing carbon footprints from the automotive sector further supports market expansion. The rising sales of electric and hybrid vehicles directly boosts the demand for low-rolling resistance tires. The European government has imposed stringent regulations regarding fuel efficiency, contributing to regional market growth.

Low-rolling resistance tires help reduce energy loss that happens as the tire rolls. This decrease in rolling efforts helps improve the fuel efficiency of the vehicle. The low rolling resistance tire market is witnessing rapid growth because of the rising demand for fuel efficiency. Increased awareness among consumers has led to a substantial increase in demand for vehicles that are fuel-efficient, boosting the need for low-rolling resistance tires. These tires are specifically designed to reduce the energy usage of vehicles. This directly helps in minimizing carbon emissions and reducing fuel consumption.

Governments across the world have implemented stringent regulations in order to reduce carbon emissions and promote sustainability. These efforts have led to the wider adoption of low-rolling resistance tires by automakers and consumers alike. Electric and hybrid vehicles regularly utilize these tires to improve the fuel and energy efficiency of vehicles. The rise in demand for electric and hybrid vehicles is a major factor propelling the market’s growth worldwide. The growing focus on environmentally sustainable practices and rising consumer awareness further support market growth. Advancements in tire technology and the rising focus of key players on research and development activities further contribute to market growth.

| Report Coverage | Details |

| Market Size by 2034 | USD 71.01 Billion |

| Market Size in 2025 | USD 24.06 Billion |

| Market Size in 2024 | USD 21.33 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.78% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vehicle, Width, Sales Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increasing Demand for Electric Vehicles

The rising awareness among consumers about the importance of reducing carbon emissions has significantly increased the demand for electric vehicles across the world. With consumers prioritizing vehicles that offer fuel efficiency, the adoption of electric vehicles (EVs) has rapidly increased. In 2024, 17.1 million EVs were sold worldwide, which is 25% year-over-year growth. In India alone, the sales of EVs surpassed 2 million units in 2024. As the production of EVs increases, so does the demand for low-rolling resistance tires. EVs benefit from these tires, as they enhance efficiency and range, further reducing fuel consumption. Automakers are utilizing low-rolling-resistance tires in electric vehicles to enhance the efficiency, performance, and fuel efficiency of vehicles.

High Initial Costs

Low-rolling resistance tires are costlier compared to traditional tires. This creates barriers for some consumers. The high initial cost of these tires is directly reflected in the selling price of the products. It can deter the consumers that are price sensitive and limit the market's consumer base. Despite many advantages of these tires, including long-term cost savings, the initial investment is too high, which influences the decision of consumers with a fixed budget. In addition, the limited availability of these tires hinders the growth of the market. Key players operating in the market must find solutions that are more affordable.

Technological Advancements

Advancements in technology have opened up new avenues for innovations. Advanced technologies like CAD and 3D printing enable manufacturers for more precise and efficient production of low rolling resistance tires. Moreover, advanced technologies allow researchers to identify new materials. With innovative materials like graphene, manufacturers can enhance the design and features of low-rolling resistance tires. This further enhances the performance of vehicles.

The passenger cars segment dominated the low rolling resistance tire market with the largest share in 2024. The rise in demand for fuel-efficient cars, along with heightened awareness among people about sustainability, bolstered this segment’s growth. The low-rolling resistance tires help in enhancing fuel efficiency as well as reduce energy loss in rolling. It helps in improving the fuel economy of passenger cars. With growing regulations about emissions, the automobile industry has shifted toward sustainable options, boosting the demand for high-performance, low-rolling resistance tires.

The electric vehicles segment is projected to grow at the fastest rate during the forecast period. With the growing production and adoption of EVs, the demand for high-performance, low-rolling resistance tires is rising. The rising awareness about the environmental impact of emissions is a key factor encouraging consumers to shift toward EVs. Low-rolling resistance tires are sustainable, making them a preferred choice for EVs.

The wide band segment led the low rolling resistance tire market in 2024. Wide-band low-rolling resistance tires are popular because they are capable of distributing the vehicle weight over a larger surface area. This helps in minimizing tire wear and reduce frictional heat. Such features make it an attractive choice for commercial vehicles that are generally heavy. These tires help in enhancing the fuel efficiency of vehicles, which is important for long-distance travel.

The dual width segment held a significant market share in 2024 and is anticipated to grow at a steady growth rate over the studied period. Dual-width low-rolling resistance tires are heavily used in light commercial vehicles. These tires are specifically designed to boost vehicles' stability and load-carrying capacity with enhanced fuel efficiency. These tires are also more affordable and versatile, making them a preferred choice.

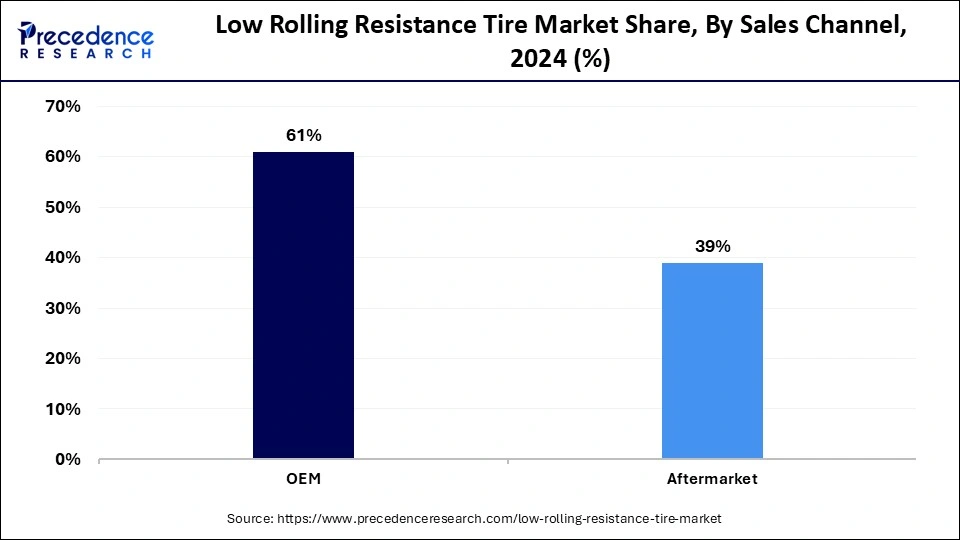

The OEMs segment dominated the low rolling resistance tire market in 2024. The rise in government regulations across the world for reducing carbon emissions encouraged the automobile industry to adopt low-rolling resistance tires. These are increasingly used in electric and hybrid vehicles to promote efficiency. OEMs help ensure that the tires are being customized to suit particular vehicles. The exponential growth of the automotive industry and the rise in demand for EVs and hybrid vehicles bolstered the segment’s growth.

The aftermarket segment is expected to expand at a rapid pace in the upcoming period. The growing awareness among the population regarding the benefits of utilizing low-rolling resistance tires is a key factor supporting segmental growth. Vehicle owners are increasingly seeking solutions to boost vehicle efficiency and performance, boosting the demand for low-rolling resistance tires.

By Vehicle

By Width

By Sales Channel

By Regional

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

December 2024

November 2024