October 2024

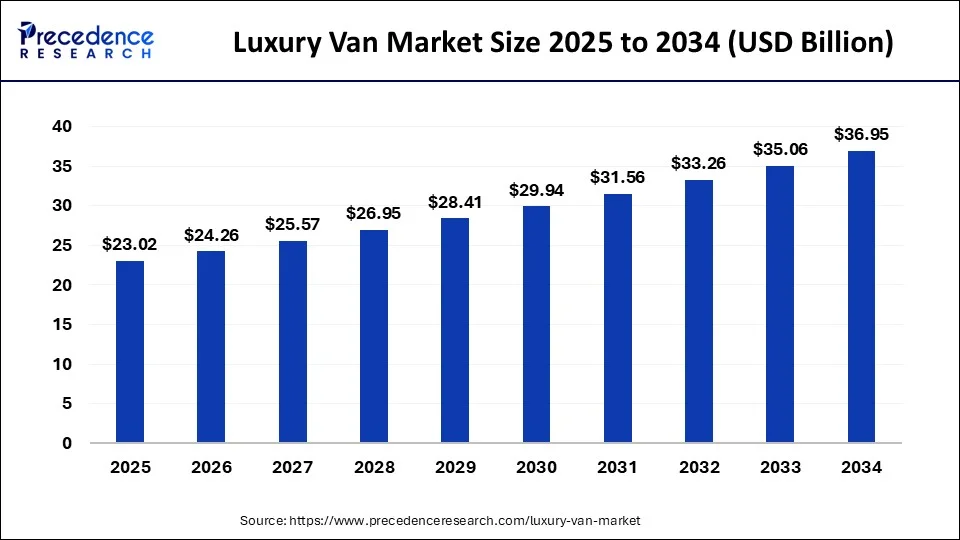

The global luxury van market size is calculated at USD 21.84 billion in 2024, grew to USD 23.02 billion in 2025 and is projected to worth around USD 36.95 billion by 2034. The market is poised to grow at a CAGR of 5.40% between 2024 and 2034.

The global luxury van market size is worth around USD 21.84 billion in 2024 and is anticipated to reach around USD 36.95 billion by 2034, growing at a CAGR of 5.40% over the forecast period 2024 to 2034. The market for luxury vans has experienced growth due to increasing disposable income, technological innovations, easy rental, and subscription models.

A luxury van is a vehicle that has the characteristics of a business-use vehicle, as well as the style and features of a high-end car. For passengers, business, or recreational uses, luxury vans are a type of vehicle designed and built for transporting people. A luxury car is a car that offers above-average to high-end levels of comfort, features, and equipment. These luxury vehicles are traditionally linked with better-performing engines, innovation, and superior standard equipment. These vans' purposes include recreational use, travel, and touring, as well as commercial vehicles.

AI Impact on the Luxury Van Market

It can improve vehicle safety through intelligent driving assistance systems, improve the safety of the driver, improve the engine, and improve the fuel consumption rate. Smart vehicle Infotainment systems are sophisticated systems that guarantee and coordinate specially tailored entertainment and information for the driver and travelers. Regional languages are understood by car voice assistants, and they are used for playing music, directing directions, or changing temperatures.

Driver and passenger facets of automobiles controlled by voice assistant personal technologies are revolutionizing the connection people have with their cars. The introduction of advanced infotainment models, such as voice recognition, navigation systems, and integration with smartphones, will enhance the driving experience significantly.

| Report Coverage | Details |

| Market Size by 2034 | USD 36.95 Billion |

| Market Size in 2024 | USD 21.84 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.40% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Seating Capacity,End-use, Propulsion Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Increase in disposable income and development

Improving global economic situations and increasing per capita income, more consumers have the purchasing power to buy premium cars. This economic uplift is helping to drive the luxury van market as more individuals seek to invest in premium automotive options. The demands for luxury cars are dependent on consumers and are moved by consumers changing preferences by having higher disposable income. In the matured market of automobiles, the increase in the global income level and enhanced quality of life have resulted in the need for luxury vans.

Increasing demand for premium transportation

Luxury vans are characterized by high-end features such as high-quality interior parts, high technology, enhanced comfort, and elegant design. These vehicles provide an improved mode of transport and cater to affluent consumers. Increase in demand driven by rising disposable incomes, urbanization, and a desire for premium driving experiences. People in the higher classes of society are looking for elegance, comfort systems, and performance targets for their cars. These vans are fitted with elegant materials and the newest features that can be found on motor vehicles, providing large space as well as comfort.

Depending on the owner’s specifications, luxury vans come with qualities like leather reclining seats, high-tech audio-video systems, Internet and cellular phone connections, and assorted mini-bars and can be converted to mobile living rooms or business places.

High initial and maintenance cost

High initial and operating costs are major barriers for most people to purchase luxury vans. A drawback of these cars is that their purchase price tends to be considerably high, which limits their ability to afford them. Also included in the cost are insurance, repair, and maintenance, as well as any other additional services required periodically, which are extensive and hamper the growth of the luxury van market. Therefore, consumers may probably prefer the rental or subscription options so they can get the experience of the luxury property without buying.

Development of Luxury Van Rental and Subscription Model

Luxury van rental, leasing, and subscription services that let people rent cars and vans. As recreational activities, such as road trips, have been adopted, more consumers are increasing to the market in search of larger, comfortable automobiles. Luxury vans come with a solution that aims to satisfy the needs of families and groups of individuals in terms of transportation. However, services offered by these rental companies, such as one-touch pickup & drop and trained drivers, are making these services even more beneficial, which are provided by the rental owners and are also driving the luxury van market, as more consumers prefer to obtain convenient and high-quality services.

The 7 to 8 segment accounted for the largest share of the luxury van market in 2023. Lightweight and compact luxury vans are in high demand in the market. Due to their small size, they are very comfortable to navigate through traffic and require less space for parking. The 7-seater van is predominantly used by the tourism and hotel industries.

The 14 to 15 segment will register the fastest growth in the luxury van market during the foreseeable period. These vans afford a seating complement of 14-15 persons, including the driver. Luxury vans are mainly used as passenger vehicles or business vehicles. On the global level, increasing income per capita, as well as elevation in living standards, is pressurizing the demand for luxury vans in the market.

The ICE segment held the largest share of the luxury van market in 2023. Internal combustion engine (ICE) vehicles are frequently adopted by luxury vehicles and have been the standard engine technology for over a century. Conventional internal combustion engines provide very powerful and responsive performance and are thus appropriate for aggressive drivers. These include a high power-to-weight ratio, readily available fuel, and relatively cheap and easy to use. IC engines include combustion engines, which are applicable in all sectors, including mobility, energy, and manufacturing industries. These include vehicles such as cars, trucks, boats, motorcycles, and airplanes, besides generators, pumps, and compressors.

The electric segment is expected to grow significantly in the luxury van market during the forecast period. A shift towards sustainability, luxurious electric vans have recently emerged on the market. Some powerful electric models manufactured by automobile manufacturers resemble regular combustion engines in luxury and performance. The consumer’s inclination towards sustainability, the innovation of improved battery technology and charging, and the growing demand for electric luxury cars are causing a growing demand for electric luxury cars. This inclination is driven by factors such as concerns about climate change, regulatory pressures for cleaner transportation, and the need for innovation. Introducing modern, sophisticated technology, superior style and design, and eco-friendly benefits.

The private segment dominated the global luxury van market in 2023. The enhancements in global wealth and the inclinations for individualized transportation solutions have significantly contributed to market expansion. A private vehicle is a personally owned vehicle used for individual transportation and has the benefits of flexibility, privacy, and convenience of the owner. The main customers are individual buyers or fleet operators who employ these vans primarily for leisure purposes, including recreational use, travel, and touring, or even as commercial supplies and distribution vehicles.

The commercial segment is expected to grow significantly in the luxury van market during the forecast period. A commercial luxury van is a vehicle that combines the capabilities of a commercial vehicle with the style and features of a car. They are usually applied for business or passenger-carrying purposes. Various industries such as tourism, transportation, entertainment, movies, and hotels are the major clients of luxury vans. The growth and development of the industrial sector can enhance the luxury van market all across the world.

North America is expected to showcase notable growth in the luxury van market in the upcoming period due to enhanced consumer preference for high-end automobiles, rising disposable income, and leisure travel. The new technologies and the increasing number of market players drive the market. The transition to more premium, the demand for modern multipurpose vehicles, and improved standards of living. The established market players such as Mercedes-Benz, Ford, and Ram ramped up competition through the presentation of new models.

Asia Pacific held the largest share of the luxury van market in 2023. The continuous development in the technology field, growing popularity of recreational activities, increasing use of leisure activities, and increased disposable income in this region are creating demand for luxury vans. The rapid development in the electronics and IT industry, adoption of advanced technology, increasing manufacturing activities, and also the growing travel and tourism industry are backing the growth of the market. The surging urban population, growth in the industrial segment, emerging infrastructures, rise in the standard of living, and the escalated disposable income of people.

Segments Covered in the Report

By Seating Capacity

By End-use

By Propulsion Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

October 2024

September 2024

November 2024