M-commerce Payment Market Size and Forecast 2025 to 2034

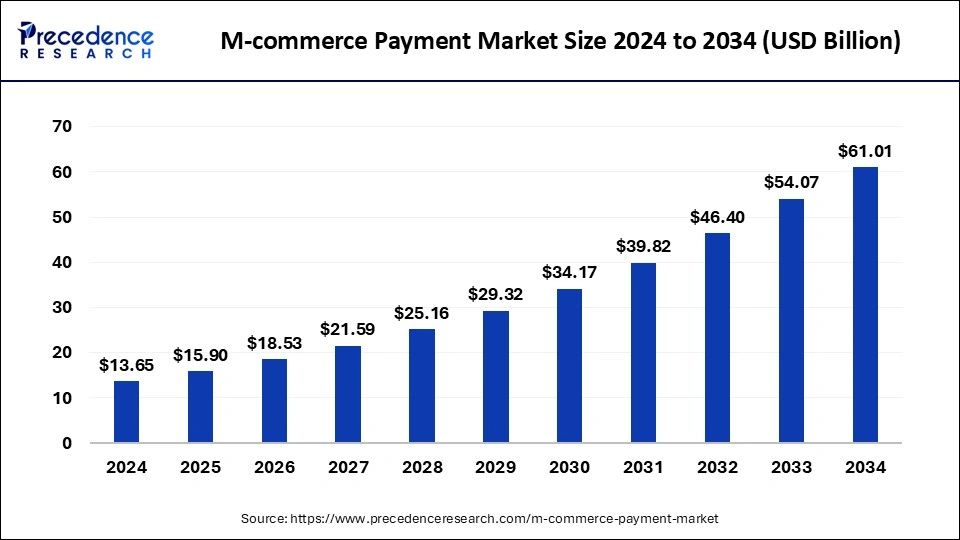

The global M-commerce payment market was calculated at USD 13.65 billion in 2024 and is predicted to increase from USD 15.90 billion in 2025 to approximately USD 61.01 billion by 2034, expanding at a CAGR of 16.15% from 2025 to 2034. Growth in developments & initiatives toward digitalized payments is anticipated to provide a potential growth opportunity for the market.

M-commerce Payment Market Key Takeaways

- The global M-commerce payment market was valued at USD 13.65 billion in 2024.

- It is projected to reach USD 61.01 billion by 2034.

- The M-commerce payment market is expected to grow at a CAGR of 16.15% from 2025 to 2034.

- Asia pacific region dominated the M-commerce payment market in 2024.

- North America is observed to witness the fastest rate of growth during the forecast period.

- By payment method, the mobile web payments segment dominated the market in 2024.

- By payment method, the near-field communication segments show the fastest growth over the forecast period.

- By transaction type, the M-retailing segment dominated the market in 2024, by holding the largest market share.

- By application, the business segment held a significant share of the market in 2024.

Market Overview

Mobile commerce (m-commerce) refers to electronic sales and transactions conducted through mobile devices such as smartphones. This involves the buying and selling of goods and services, allowing consumers to make payments conveniently from anywhere at any time. The rise in mobile dominance and reliance has led to the development of m-commerce payment applications, significantly enhancing the consumer shopping experience. With advancements in mobile technology, the number of mobile device users has surged, which results in a substantial increase in m-commerce transactions.

One prominent instance of M-commerce payment's significant share is its widespread use in app stores such as Google Play and Apple App Store. Consumers frequently use carrier billing to purchase apps, games, in-app content, and subscriptions. For example, Google Play has partnered with numerous carriers worldwide to offer M-billing as a payment option, contributing to its popularity.

M-commerce Payment Market Growth Factors

- Rise in penetration of smartphones and the internet is expected to drive the growth of the M-commerce payment market.

- Rising online shopping trend for various products can fuel market growth soon.

- The market is experiencing a surge in partnerships between fintech firms and traditional financial institutions which can contribute to the market expansion further.

- The integration of artificial intelligence and machine learning in payment systems can boost M-commerce payment market's growth in the near future.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 61.01 Billion |

| Market Size in 2025 | USD 15.90 Billion |

| Market Size in 2024 | USD 13.65 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 16.15% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Payment Method, Transaction Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Improved mobile payment solutions

The increasing inclination of customers towards mobile purchasing has led to a critical need for safe, effective, and intuitive payment methods. The industry is expanding as a result of advancements and developments in mobile payment systems. The pillars of contemporary mobile commerce are increasingly being formed by contactless payment systems, digital payment platforms, and mobile wallets. Additionally, these technologies give consumers safe and practical options to make purchases using their smartphones. People's confidence and trust in these payment options promote increased usage of mobile commerce.

- In June 2024, Flipkart Group launched payments app, Super.money, in fintech push.as it broadens its fintech ambitions more than a year and half after separating from PhonePe.

Restraint

Rise in data breaches and security concerns in mobile payments

Customers can profit greatly from innovative payment technologies in terms of convenience, but industry expansion is hampered by the increase in security concerns and data breaches. Because they worry that their financial information could be accessed by unaffiliated mobile service providers, consumers are hesitant to send or receive money using their phones. These elements restrict market expansion and significantly increase the dangers associated with making mobile payments. Thereby, data breaches and other associated risks act as a restraint for the M-commerce payment market.

Opportunity

Integration of advanced technologies

The integration of advanced technologies such as blockchain and biometrics aims to enhance the security and efficiency of mobile transactions. Moreover, the growth of subscription-based models and in-app purchases creates opportunities for manufacturers to develop customized payment solutions that support recurring billing and provide seamless user experiences. Furthermore, forming strategic partnerships with e-commerce platforms and mobile app developers can unlock new distribution channels and reach additional customer segments.

- In January 2024, Mastercard announced the expansion of its global Biometric Checkout Program in Latin America (LAC). With partners Ingenico, Fulcrum Biometrics, Fujitsu Frontech, and Scanntech, Mastercard has launched an innovative in-store biometric payment experience at Tienda Inglesa's Red Expres in Uruguay. This is the first Biometric Checkout Program pilot that allows shoppers to pay with their palm and the second pilot in the LAC region.

Payment Method Insights

The mobile web payments segment dominated the M-commerce payment market in 2024. This is because Mobile payments utilize the wireless application protocol (WAP) on smartphones to connect to the internet and facilitate payments for goods and services through online methods such as mobile wallets. The ease of use and convenience of WAP payments are expected to drive their popularity in the coming years as more people turn to online shopping.

The near-field communication segment shows the fastest growth over the forecast period. With NFC technology, a mobile device can be brought close to a payment terminal or tapped to initiate contactless transactions. Peer-to-peer payments, public transit, and mobile payments in physical retail establishments all frequently employ this technique. Many people and businesses choose NFC because of its speed, ease, and security, which helps the industry expand.

- In februvary 2023, Cred introduced near-field communication (NFC)-based payments through ‘Tap to Pay'. Tap to Pay' enables Cred members with NFC-enabled Android smartphones and eligible cards to directly pay merchants through tapping on their point-of-sale devices without the need of the physical card or any wallets.

Transaction Type Insights

The M-retailing segment dominated the M-commerce payment market in 2024, by holding largest market share. To provide a tailored experience, retail businesses generally use proximity mobile payments through their preferred mobile wallet or app. Retailer point-of-sale (POS) counters also prominently show logos for mobile payments. The industry is growing as a result of e-commerce industries becoming more digitally advanced and mobile e-commerce stores becoming accessible.

The M-billing segment is observed to grow at the fastest rate during the forecast period. M-billing simplifies the payment process for consumers by eliminating the need to enter credit card details or create additional accounts. Users can make purchases with a few taps on their mobile devices, enhancing the user experience and reducing transaction friction. M-billing is accessible to a broader audience, including those who do not have bank accounts or credit cards. This inclusivity is particularly important in regions with lower banking penetration but high mobile phone usage.

Application Insights

The business segment held a significant share of the M-commerce payment market in 2024. Businesses increasingly adopt mobile payment solutions to enhance customer experience by providing convenient, quick, and seamless payment options. This adoption drives significant transactions through mobile commerce (M-commerce) platforms. Mobile payments streamline the checkout process, reducing cart abandonment rates and boosting sales. Businesses recognize this benefit and invest in M-commerce technologies to retain customers and encourage repeat purchases.

Regional Insights

Asia Pacific dominated the M-commerce payment market in 2024, the region is observed to grow at the fastest rate mobile payments are experiencing substantial growth in the Asia-Pacific region, driven by the rise of mobile commerce. Countries such as Australia and Singapore are moving towards becoming cashless markets, which can further boost mobile payment adoption. In India, the increase in mobile payments is due to the growing youth population engaged in online media. Service providers like Paytm, Mobi Kwik, and Google Wallet are expanding into emerging Asia-Pacific markets, by offering special discounts to capitalize on the region's potential.

Governments in countries like India (with the Digital India initiative) and China have actively promoted digital payments. Policies and incentives to reduce cash transactions have propelled the adoption of m-commerce payments. Asia has a large, young, and tech-savvy population that is more open to adopting new technologies, including mobile payments.

- In April 2024, Card payments major Visa has paused it single-click checkout service for online transactions in India, amid a push by the Reserve Bank of India (RBI) to tighten security standards for digital payments. This feature did not need CVV (card verification value) or OTP (one-time password) to be punched in while making a transaction.

North America is observed to grow at the fastest pace in the M-commerce payment market during the forecast period. In North America, the M-commerce payment market is robust due to the trend towards integrated omnichannel shopping experiences. Moreover, growing awareness of mobile payment and its role in facilitating secure and convenient transactions. significantly drives market growth in this region. Retailers are integrating their online and offline operations, providing click-and-collect services, and upgrading in-store technology to meet changing customer preferences. significantly drives market growth in this region.

Europe is observed to grow at a notable rate in the M-commerce payment market. Europe has one of the highest smartphone penetration rates globally. The widespread use of smartphones facilitates mobile commerce (m-commerce) and mobile payments, making it easier for consumers to engage in m-commerce activities. European countries have well-developed mobile network infrastructures, ensuring fast and reliable internet connectivity. This infrastructure supports seamless m-commerce transactions, encouraging more consumers to use mobile payment solutions.

M-commerce Payment Market Companies

- Amazon.com Inc

- Apple Inc.

- ASOS.com Limited

- eBay Inc.

- Ericsson Inc.

- Gemalto (Thales Group)

- Google LLC

- International Business Machines (IBM) Corporation

- Mastercard Inc.

- mopay Inc.

- Netflix Inc.

- PayPal Holdings Inc.

- SAP ERP

- Visa Inc.

Recent Developments

- In March 2023: Amazon.com Inc announced the launch of 3-Way Match on the Amazon Business mobile app to assist business customers in improving and enhancing their smart business-buying strategies and automating reporting.

- In September 2023: Ericsson Inc. announced its partnership with Deutsche Telekom (DT) to launch a commercial partnership and offer communication and network APIs to developers and enterprises.

- In March 2022- Mastercard, DBS Bank, and Pine Labs have partnered to launch ‘Mastercard Installments with Pine Labs' - a new program that allows DBS/POSB credit cardholders to pay via interest-free installments at merchants with the ‘Pay Later identifier.

Segments Covered in the Report

By Payment Method

- Mobile Web Payments

- Near-field Communication

- SMS/Direct Carrier Billing

- Others

By Transaction Type

- M-retailing

- M-ticketing

- M-billing

- Others

By Application

- Personal

- 18 to 30 Year

- 31 to 54 Year

- 55 to 73 Year

- Business

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa