October 2024

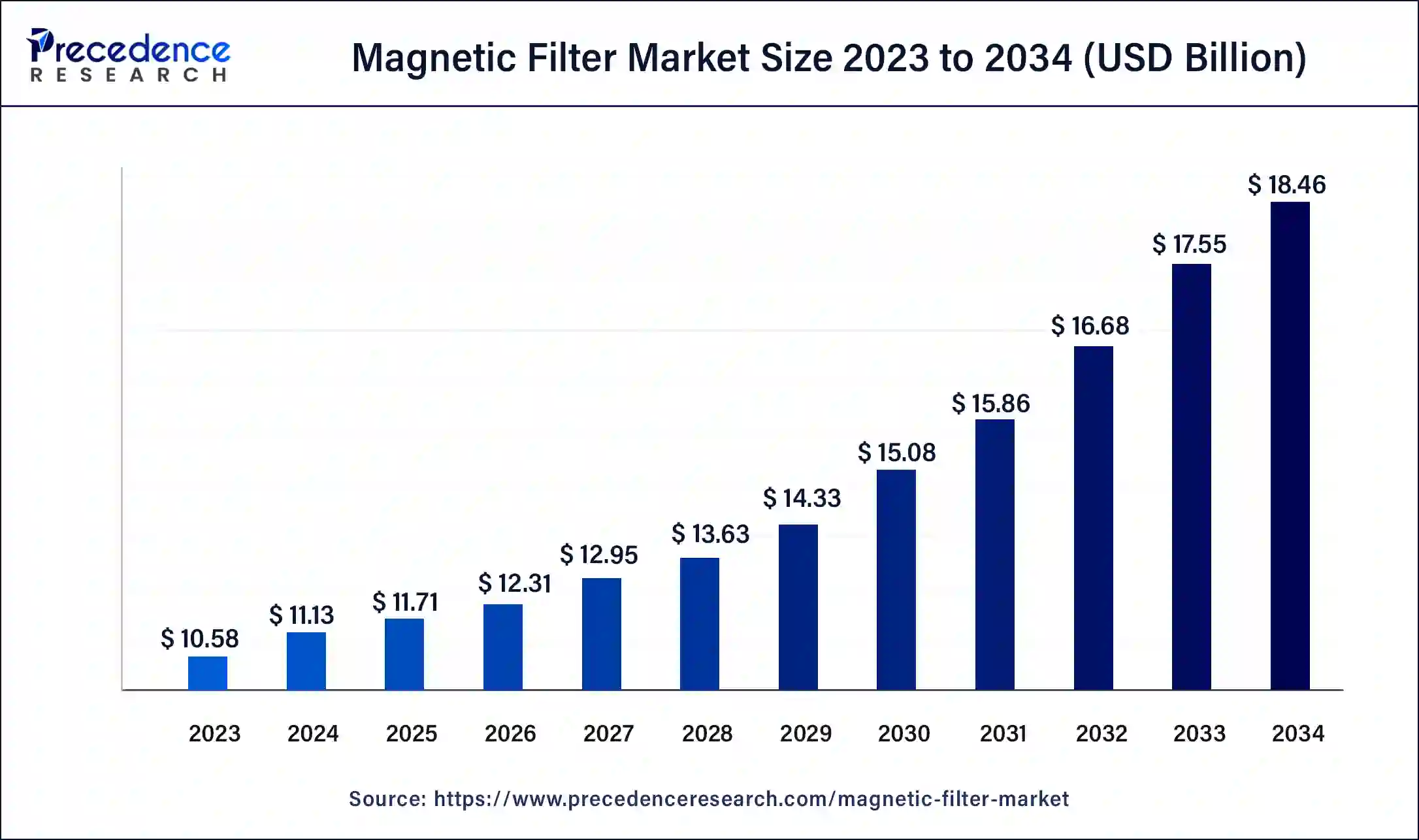

The global magnetic filter market size was USD 10.58 billion in 2023, calculated at USD 11.13 billion in 2024 and is expected to be worth around USD 18.46 billion by 2034. The market is slated to expand at CAGR of 5.19% between 2024 and 2034.

The global magnetic filter market size is expected to be worth USD 11.13 billion in 2024 and is anticipated to reach around USD 18.46 billion by 2034, growing at a solid CAGR of 5.19% over the forecast period 2024 to 2034. Stringent regulatory rules for safety and quality in the spectrum of industries globally due to rising concern over environmental changes are the propelling the magnetic filter market.

Magnetic filtration is a system that involves a device that separates ferrous or Fe particle/iron articles by attracting them so as to produce clean fluids or semi-fluids, which then encounter either machines or tools or a wash system. The global magnetic filter market is experiencing a substantial growth rate driven by rising industrial automation and increasing demand for efficient filtration solutions in manufacturing processes.

Magnetic filters are essential in removing ferrous contaminants from fluids, enhancing the performance and longevity of machines. Major key players in diverse industries like chemical, food, beverages, and automotive are main consumers and, thus, significant contributors to the magnetic filter market globally.

Technological advancements like development of high gradient magnetic filters are again propelling markets expansion. Regions like Asia pacific and north America holds substantial market shares due to their well-established industries. On the other hand, restraining factors like high initial costs and competition from alternatives filtration methods, hinders the market growth.

| Industry | Magnetic Filter’s Application |

| Food & beverages industry | To ensure food purity by removing ferrous particles within processing streams. |

| Pharmaceutical industry | To maintain the integrity of drug formulation by preventing contamination. |

| Automotive industry | To protect crucial components like engines from the damage caused by iron contaminants or rusting. |

| Water treatment plant | To ensure the safety and quality of drinking water by removing ferrous contaminants that are hazardous to human health. |

| Report Coverage | Details |

| Market Size by 2034 | USD 18.46 Billion |

| Market Size in 2023 | USD 10.58 Billion |

| Market Size in 2024 | USD 11.13 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.19% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers

Eco-friendly method for liquid purification in industries

One of the driving factors for propelling the magnetic filter market is its eco-friendly nature while eliminating the ferrous particles from fluids that may be seen as contamination. These ferrous particles collected into the magnetic mesh can be recycled further and converted into a single product/material. Due to this, none of the ferrous waste goes into landfills, which is the major cause of environmental detriment.

Moreover, these filters can be reused again after finishing the task to collect ferrous particles in the liquid, which flows towards the magnetic filter, since these filters are washable and can be cleaned easily. Due to such convenience, these magnetic filters can be widely used in various industrial sectors, thus fuelling the growth of the magnetic filter market globally.

Productivity doesn't get affected by employing a magnetic filter

The major advantage that a magnetic filter provides is that productivity does not get restrained while using it. Magnetic filters are designed in such a way that they are able to remove even the smallest particle of one micron in size since even this size of particles can affect the purity and performance of the fluid and may cause bacterial buildup and damage the tools for which the liquid is used. Even if the magnetic filters cross the limits to capture contaminants, they will not outburst or hinder the productivity of the tools where they are employed. Such convenience causes the magnetic filter market to propel in the forward direction with maximum growth potential.

High maintenance and less effectiveness for non-Fe particles.

The major drawback a magnetic filter market may have is the complex procedure to maintain the magnetic filter for proper working to get optimum output while using it. Some of the systems for filtration may require cleaning and recharging of magnets within a specific interval of time to keep them going properly, which adds up the cost to the enterprise and causes barriers to market growth, particularly for SMEs where budget is the concern.

Again, another drawback is that the magnetic filtration system is designed to capture only iron particles or ferrous particles stuck within the liquid to decontaminate the liquid with such articles, but only ferrous particles would not be considered a contaminant in the context of purity. Other small particles would also cause harm/damage to the tool where the liquid is required to operate. These non-ferrous particles cannot be cleaned or derived by the magnetic filter. They require other methods to get rid of these other materials, which adds u the cost of purification. This is seen as a major drawback to the growth of the magnetic filter market.

Expansion of industry 4.0

The significant opportunity that holds the potential to expand the market is the rising trend for Industry 4.0, which is a revolutionary aspect in the future to build technically advanced infrastructure. Therefore, the integration of magnetic filter systems with advanced technologies like predictive maintenance and remote monitoring will present lucrative opportunities to proliferate the magnetic filter market exponentially. Additionally, the increasing rate of industrialization with technically advanced manufacturing processes is at its peak, further fuelling the market growth on a larger scale.

Offering customized solutions

Another opportunity that the magnetic filter market holds is customization, which offers magnetic filters for specific industries with their requirements to help reduce the cost of filtration. Also, strategic partnerships between major players and acquisitions create significant opportunities that aid in market expansion globally.

The above 60 μm segment dominated the global magnetic filter market in 2023. Magnetic filters with 60 micrometers or above are the most used type of filter as they effectively capture fine ferrous particles without causing significant pressure drops in fluid systems. This filtration level is optimal for protecting sensitive machinery components and maintaining high-quality standards in various industrial processes, including automotive, manufacturing, and chemical processing.

The 60 mm size strikes a balance between capturing contaminants and maintaining efficient fluid flow, reducing wear and tear on equipment, and preventing costly breakdowns. Its widespread use is driven by the need for precise filtration methods to enhance operational efficiency, minimize maintenance costs, and extend the machinery's lifespan. Therefore, this level of filtration is essential for industries where maintaining clean fluids is crucial for product quality and reliable operations.

The oil & gas segment accounted for the largest share of the market in 2023. The oil and gas segment holds a larger market share due to the critical need to maintain clean fluids in this industry. Contaminant-free fluids are essential for ensuring the efficiency and longevity of expensive equipment such as drilling rigs, pumps, and pipelines. Magnetic filters are particularly effective in removing ferrous particles from lubricating oils, hydraulic fluids, and other operational fluids used in oil and gas operations.

During drilling and extraction processes, ferrous contaminants can cause significant wear and tear on equipment, leading to costly downtime and repairs. Magnetic filters help mitigate these risks by capturing even fine metal particles, thus protecting machinery and enhancing operational reliability. Additionally, in refining processes, clean fluids are crucial for maintaining product quality and meeting stringent regulatory standards. The high operational costs and potential environmental impact of equipment failure in the oil and gas sector further drive the adoption of advanced filtration solutions like magnetic filters. The industry's focus on efficiency, reliability, and regulatory compliance makes magnetic filters an indispensable component, thereby contributing to its larger market share.

The chemical segment is anticipated to witness significant growth in the market over the studied period. The chemical segment shows the fastest growth rate in the market due to the industry's stringent requirements for high-purity processes and product quality. Chemical manufacturing involves complex processes where even minor contaminants can lead to significant product defects, inefficiencies, and safety hazards. Magnetic filters are highly effective in removing ferrous particles from fluids, which is essential for maintaining the purity and integrity of chemical products. In the production of pharmaceuticals, any contamination can compromise the efficacy and safety of the final product. Magnetic filters help ensure that the fluids used in these processes remain contaminant-free.

Additionally, in petrochemical plants, clean fluids are crucial for the optimal functioning of catalysts and other critical equipment, preventing costly breakdowns and maintaining operational efficiency. The increasing emphasis on sustainable and environmentally friendly practices in the chemical industry also drives the demand for magnetic filters, as they help reduce waste and improve process efficiency. The industry's continuous push for technological advancements and regulatory compliance further accelerates the adoption of advanced filtration solutions, contributing to the rapid growth of the magnetic filter market in this segment.

Asia Pacific accounted for the largest share of the magnetic filter market in 2023. This region holds the highest market share in the market due to rapid industrialization, infrastructure development, and increasing adoption of advanced manufacturing practices across the region. Recent developments highlight this trend, such as a significant increase in industrial output in countries like China and India. A surge in demand for industrial filtration solutions across Asia-Pacific is driven by expansions in automotive production, chemical manufacturing, and infrastructure projects.

China, as a major manufacturing hub, has been instrumental in driving the market forward. The country's emphasis on upgrading industrial facilities to meet higher efficiency and environmental standards has led to a substantial increase in the adoption of magnetic filters. India, on the other hand, has seen growth in sectors like automotive and pharmaceuticals, where clean fluids are critical for production processes.

Moreover, Southeast Asian countries such as Vietnam, Thailand, and Indonesia are also contributing to the region's market share growth. These nations are witnessing investments in industrial sectors and infrastructure, further boosting the demand for magnetic filters to ensure reliable and efficient operations.

Additionally, regulatory measures aimed at improving environmental sustainability are encouraging industries across Asia-Pacific to invest in advanced filtration technologies. This includes initiatives to reduce air and water pollution, which necessitate cleaner industrial processes supported by effective filtration solutions like magnetic filters. Overall, Asia-Pacific's dominance in the magnetic filter market is driven by robust industrial growth, infrastructure developments, and regulatory pressures toward cleaner production practices.

North America is witnessing growth at a notable rate in the global magnetic filter market due to several key factors driving demand and adoption across various industries. The data highlight significant developments in the region, indicating a surge in investments in manufacturing automation and industrial efficiency improvements. One of the primary drivers is the region's strong focus on technological advancements and innovation. Data has reported an increase in the deployment of advanced magnetic filtration systems across sectors like automotive, aerospace, and electronics manufacturing. These industries rely heavily on precision and reliability, where magnetic filters play a crucial role in maintaining equipment performance and product quality.

Additionally, stringent environmental regulations in North America push industries to adopt cleaner production practices, including effective filtration technologies like magnetic filters. These regulations aim to reduce environmental impact and ensure compliance with emissions standards, further driving market growth.

North America's robust industrial base and high levels of automation in manufacturing processes contribute to the increased adoption of magnetic filters. Companies are investing in technologies that can improve operational efficiency, reduce maintenance costs, and enhance overall productivity, driving the demand for advanced filtration solutions. In summary, North America's notable growth in the magnetic filter market is fuelled by technological innovation, regulatory pressures, and a strong industrial foundation focused on efficiency and sustainability.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024