April 2025

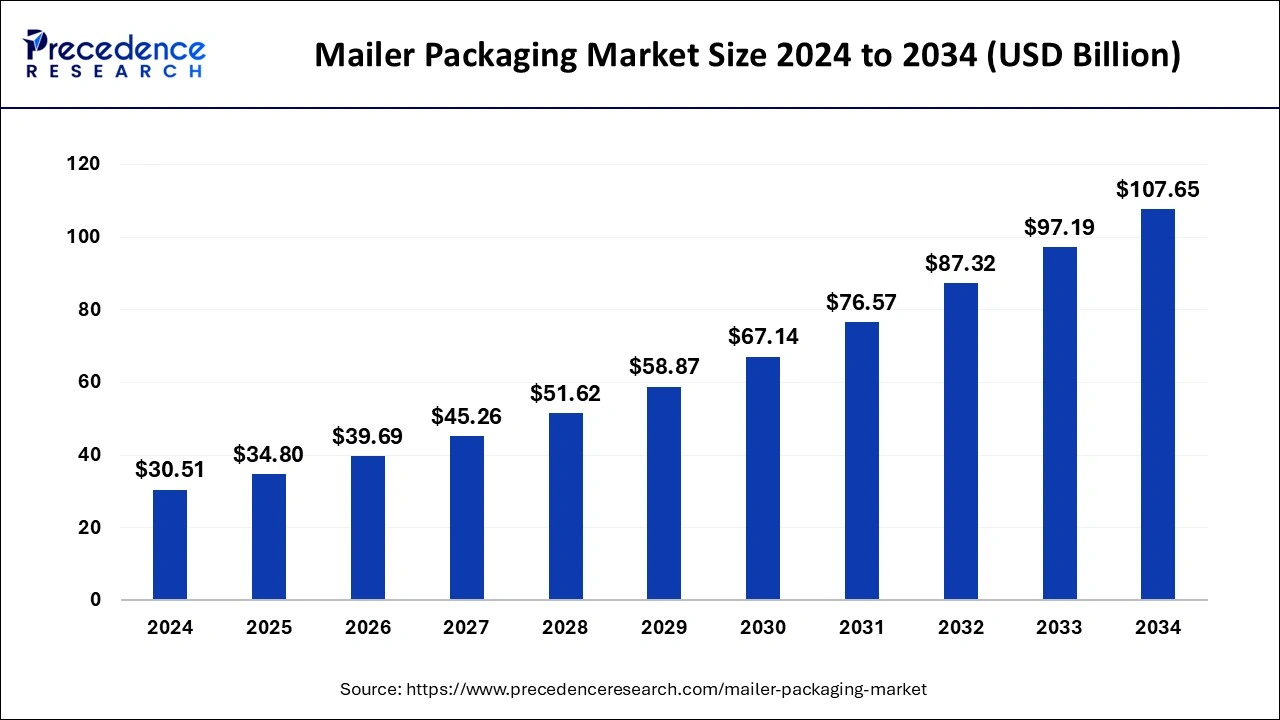

The global mailer packaging market size is estimated at USD 34.80 billion in 2025 and is predicted to reach around USD 107.65 billion by 2034, accelerating at a CAGR of 13.44% from 2025 to 2034. The Asia Pacific mailer packaging market size surpassed USD 14.62 billion in 2025 and is expanding at a CAGR of 13.58% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global mailer packaging market size was exhibited at USD 30.51 billion in 2024 and is expected to hit around USD 107.65 billion by 2034, growing at a CAGR of 13.44% from 2025 to 2034.

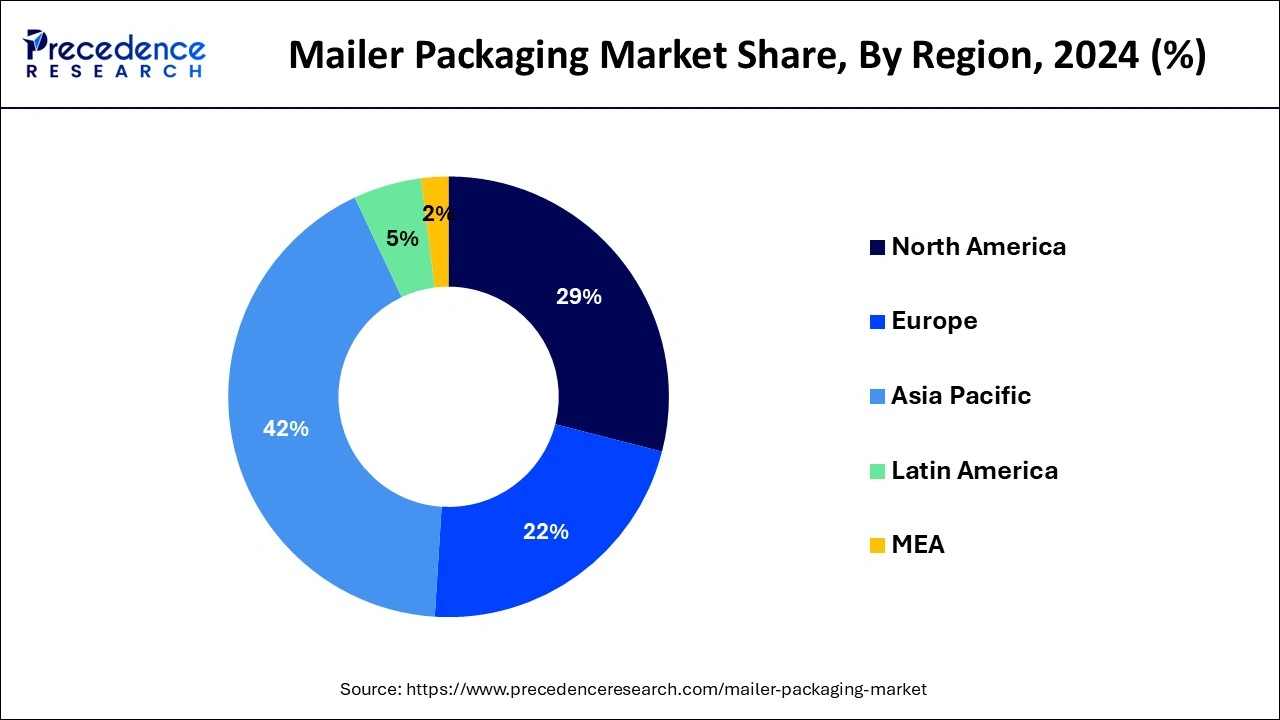

The Asia Pacific mailer packaging market size was estimated at USD 12.81 billion in 2024 and is projected to surpass around USD 45.75 billion by 2034 at a CAGR of 13.58% from 2025 to 2034.

Asia Pacific dominates the global mailer packaging market and generated more than 42% of the revenue share in 2024. India and China are considered significant contributors to the growth of the market. The development of the mailer packaging market in the Asia Pacific is attributed to the developing industrial sector and the rising involvement of people in online shopping for goods. China holds the largest market revenue share owing to the presence of major key players in the nation and the wide availability of raw materials.

North America is considered the fastest-growing region and is projected to show significant growth during the forecast period. Established e-commerce and logistics industries are seen as the primary driver for North America's mailer packaging market growth.

The mailer packaging market in Europe is experiencing significant growth due to the increased utilization of paper mailers by e-commerce companies. An increasing number of consumers in the online shopping sector, especially in fashion, media, and electronics, is likely to maintain the growth of the European mailer packaging market.

The paper and cardboard packaging material segment is growing in Latin America. However, the plastic packaging segment still dominates the market. However, the mailer packaging market is restrained by the high cost of paper packaging material. Gulf countries in the Middle East have adopted the concept of eco-friendly mailer packaging, which has boosted the growth of the paper packaging material segment in recent years.

Increased spending on cosmetic products in the region has shown significant change for the market as the cosmetics industry is considered one of the major contributors to the mailer packaging market. The mailer packaging market in the Middle East is anticipated to grow at a promising CAGR owing to the presence of diverse vital players. The market in Africa shows moderate growth and is projected to grow during the forecast period due to packaging product innovation and rising awareness for eco-friendly alternatives to mailer packaging.

Mailer packaging is generally used to ship or transport parcels protectively. Mailer packaging is used in multiple industries, such as e-commerce, logistics, manufacturing, and warehousing during the shipping process. Mailer packaging reduces environmental impacts as most are recyclable, sustainable, and eco-friendly. This packaging is available in different shapes and sizes to allow flexible and convenient shipping of the goods.

Key players in the global mailer packaging market are involved in research & development (R&D) activities, business expansion through partnerships, collaboration, merging with other competitors, and adopting various technologies to make the manufacturing process efficient. Flat mailers, poly mailers, bubble mailers, padded mailers, chipboard mailers, and kraft mailers are a few known types of mailer packaging. Poly mailers are tear-resistant, considered the cheapest option in the mailer packaging market, and are generally used in shipping clothes. In contrast, kraft mailers are used as an alternative to boxes.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 13.44% |

| Market Size in 2025 | USD 34.80 Billion |

| Market Size by 2034 | USD 107.65 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Material, By Product Type, By Insulation and By End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The global mailer packaging market is anticipated to grow during the forecast period with increasing demand from e-commerce companies for protective packaging of clothing, jewelry, appliances, books, food & beverages, and many other products. The rapid growth of the global mailer packaging market is attributed to the boosted sale of paper mailers due to increasing environmental complications caused by using plastic in packaging.

The growing number of deliveries from the food & beverage industry is seen as a significant driver for the growth of the mailer packaging market. Rising consumer preferences for flexible packaging are considered to drive the market's growth during the forecast period. Along with this, increasing demand from the cosmetic and pharmaceutical industries for sustainable packaging highlights the potential for the development of the mailer packaging market.

Furthermore, the technological advancement in machinery used for mailer packaging will propel the growth of the mailer packaging market. Machines often used for mailer packaging are wrapping machines, seal machines, laser cutters, and various dispensers. Along with this, increased sales of electronic products have surged the growth of the cushioned segment in the mailer packaging market. Despite the massive demand for different kinds of mailers, a few factors adversely impact the development of the mailer packaging market. The high cost of raw materials required in the production process is seen as a major restraining factor for the growth of the global mailer packaging market.

Based on material, the global mailer packaging market is segmented into paper and plastic. The paper material segment dominates the global mailer packaging market and is predicted to continue the same during 2025-2034. Due to increased concerns about the environmental crisis, many countries have banned the use of plastic. Mainly, single-use plastic that is used in mailer packaging is considered a hazardous substance for the environment across the globe. The restrictions on plastic use have accelerated the paper segment's growth.

The paper material is used in the packaging process of clothing, lightweight products, stationery, and medicines. The advancement in the paper material segment is attributed to printed paper material that offers a premium look to the parcel and helps advertise the company. Many e-commerce companies have started using paper mailers for packaging, contributing to the sustainable growth of the paper mailer segment in the global mailer packaging market. However, the plastic material for packaging is considered in the packaging process of products that can be affected by the external environment. Plastic packaging protects the parcel from extreme environmental conditions like rain, dust, and moisture.

Based on product type, the global mailer packaging market is segmented into cushioned and non-cushioned. The cushioned packaging segment is projected to experience the fastest growth during the forecast period of 2025-2034. The cushioned products for packaging are designed to provide extra protection to the material inside. Bubble wraps are considered cushioned mailer products. These mailers protect the item from any external harm, such as sharp edges, liquid, or other materials that can damage the parcel during shipping.

The cushioned segment will maintain growth in upcoming years owing to its durability and water resistance function. Cushioned mailers are used in packaging for electronics, jewelry, books, utensils, and other products that need an extra layer of protection. Non-cushioned mailers are generally made of plastic as they are liquid-resistant. Non-cushioned mailers are cheaper as compared to cushioned ones.

The global mailer packaging market is segmented on insulation into insulated and non-insulated. Insulated mailers are considered the fastest-growing segment. Insulated mailers are lightweight and durable and protect the package from external environmental conditions. They are manufactured with metal layers to provide thermal protection to the parcel for a limited period by maintaining the internal temperature during the shipment process.

Growing demand from the food & beverage and personal care industries is expected to fuel the growth of the insulated mailer segment in the global mailer packaging market. The development of the insulated mailer segment is attributed to their benefits, such as food safety and space efficacy, and these mailers are reusable.

Based on end-use, the global mailer packaging market is segmented into e-commerce, manufacturing & warehousing, and shipping & logistics. Among all, the e-commerce segment leads the market owing to the growing number of online consumers. Increased spending on e-commerce websites has boosted the segment's growth in recent years.

E-commerce companies are focused on providing safe and efficient handling of parcels during transport, which has enabled the demand for packaging products in the market. On the other hand, the shipping and logistics segment is expected to experience a significant increase during the forecast period of 2025-2034.

By Material

By Product Type

By Insulation

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

April 2025

January 2025

March 2025