What is the Managed Detection and Response (MDR) Market Size?

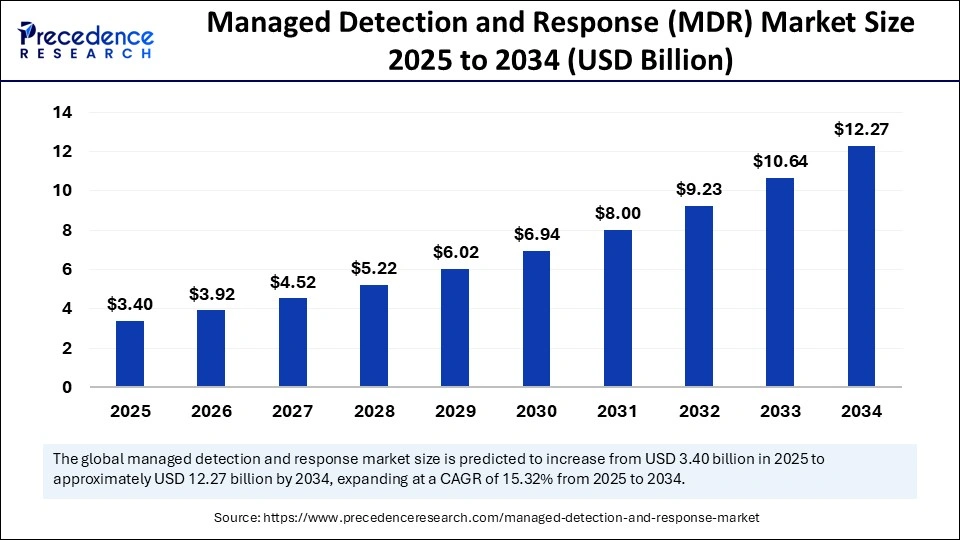

The global managed detection and response (MDR) market size is calculated at USD 3.40 billion in 2025 and is predicted to increase from USD 3.92 billion in 2026 to approximately USD 13.90 billion by 2035, expanding at a CAGR of 15.12% from 2026 to 2035. The managed detection and response (MDR) market is growing due to the digital economy facing increasing compliance burdens because of overlying cybersecurity laws from different government bodies to address this growing need for managed detection and response solutions to protect individuals, organizations, and national interests by set morals for digital security.

Managed Detection and Response (MDR) Market Key Takeaways

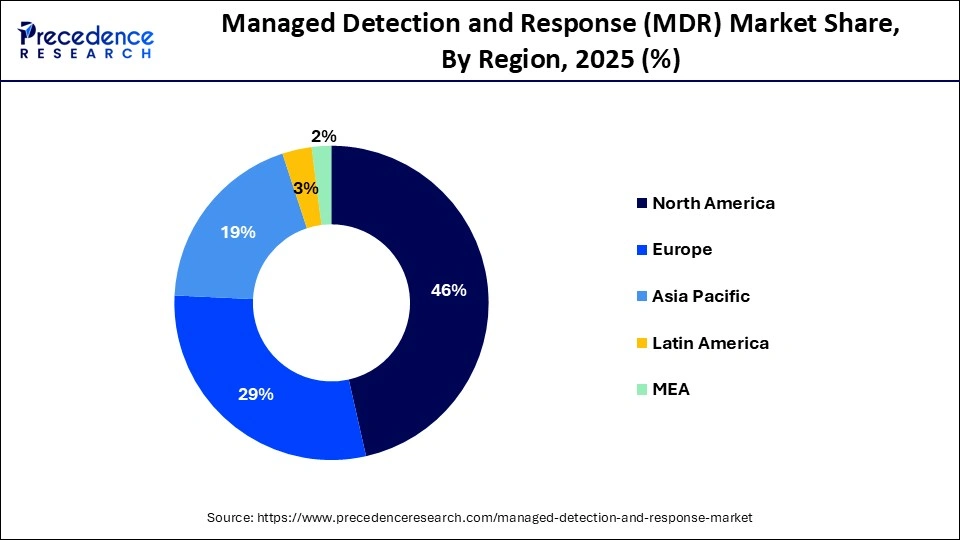

- North America dominated the global market with a largest market share of 46% in 2025.

- Asia Pacific is expected to witness the fastest growth in the coming years.

- By security type, the cloud detection and response segment led the market in 2025.

- By security type, the managed endpoint detection and response (MEDR) segment is expected to expand at the fastest growth during the forecast period.

- By deployment, the cloud-based segment contribute the biggest market share in 2025.

- By deployment, the on-premises segment is likely to grow rapidly during the projection period.

- By enterprise size, the SMEs segment held the largest share in 2025.

- By enterprise size, the large enterprises segment is expected to expand at the highest CAGR between 2026 and 2035.

- By vertical, the BFSI segment led the market with the largest share in 2025.

- By vertical, the IT & telecom segment is likely to witness the fastest growth in the upcoming period.

Impact of AI on the Managed Detection and Response (MDR) Market

Artificial Intelligence (AI) significantly impacts the managed detection and response (MDR) market. AI offers several advantages, including accelerating the identification and containment of cyberattacks. AI detects false positives, safeguarding security teams to emphasize genuine threats. AI-based insights enhance the accuracy of threat identification, lowering the challenges of oversight. The capability of AI to analyze massive datasets, predict emerging threats, and respond in real-time ensures that businesses remain resilient in the face of evolving risks. AI not only increases threat recognition but also enhances cybersecurity approaches. AI can analyze threat data from multiple sources and identify potential threats, enabling MDR providers to prepare for new attack vectors proactively.

Market Overview

The managed detection and response (MDR) market is growing rapidly due to the frequency and sophistication of cyberattacks. MDR services identify a broad range of threats, including suspicious activities in the network, access attempts, insider threats, unauthorized phishing attacks, and malware. Comprehensive MDR safety solutions encompass threat identification and an active response to lower the potential challenges. This proactive approach distinguishes MDR from conventional security solutions. With the increasing concerns of cyber threats, companies are focusing on actively addressing and remediating them.

MDR cybersecurity solutions are offered by EDR vendors and specialized managed security service providers (MSSPs). The rising demand for advanced approaches to security operations and threat management that are both proactive and reactive, like threat hunting, is boosting the market's growth. MDR solutions support organizations in managing threats and grappling with vulnerabilities.

Managed Detection and Response (MDR) Market Growth Factors

- The rising adoption of cloud computing is a key factor boosting the growth of the market.

- The shortage of skilled cybersecurity professionals is expected to boost the adoption of MDR solutions.

- The rising need for proactive solutions supports market growth. MDR services provide organizations with the ability to manage security operation centers (SOC) remotely.These services allow organizations to rapidly detect, investigate, analyze, and actively respond by threat mitigation and containment.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 13.90 Billion |

| Market Size in 2025 | USD 3.40 Billion |

| Market Size in 2026 | USD 3.92 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 15.12% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Security Type, Deployment, Enterprise Size, Vertical, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Sophistication of Cyber Threats

The rising sophistication of cyber threats is a key factor driving the growth of the managed detection and response (MDR) market. With the increasing digitalization worldwide, challenges associated with addressing cyberattacks are rising. Cybercriminals are leveraging progressive technologies containing machine learning, bots, automation, and AI to intensify their attacks' complexity, speed, and scale, predominantly through ransomware, social engineering, and AI-based cybercrime. As a result, organizations face several challenges in adopting adaptive and proactive cybersecurity measures. This drives the demand for MDR solutions among businesses seeking continuous monitoring, quick incident response, and real-time threat identification to combat the evolving cyber threat landscape. MDR is progressively integrated into XDR (Extended Detection and Response) to provide an integrated and comprehensive technique of threat identification, adaptation, and response to novel threats.

Restraint

Advanced Threat Evasion Techniques Pose Challenges

Despite the increasing demand for progressive cybersecurity solutions, the managed detection and response (MDR) market faces challenges because of the rising sophistication of cyberattacks targeting enterprises and SMBs. Threat actors are employing innovative tactics like fileless malware, polymorphic threats, and multi-stage attacks involving lateral movement methods that often evade detection, even by modern security monitoring devices such as SIEM and XDR. These advanced evasion techniques reduce the effectiveness of current MDR solutions, which limits the adoption of MDR solutions. Moreover, integrating MDR solutions into existing security systems can be challenging, restraining the growth of the market.

Opportunity

Evolving Threat Landscape

The increasing complexity of the cybersecurity landscape, driven by advanced tactics, techniques, and procedures (TTPs) used by cybercriminals, is creating significant opportunities in the managed detection and response (MDR) market. As traditional security measures prove inadequate against advanced and persistent threats, organizations are turning to MDR solutions for real-time threat identification, in-depth analysis, and quick incident response.

MDR providers offer a strategic combination of cutting-edge security technologies, cybersecurity analysis, and specialized monitoring devices that proactively safeguard network environments, critical infrastructure, and endpoints. This increasing demand for adaptive and proactive cybersecurity frameworks positions MDR services as a critical growth factor in the developing digital security ecosystem.

Security Type Insights

The cloud detection and response segment dominated the managed detection and response (MDR) market with the largest share in 2025. This is mainly due to the increased demand for robust security solutions. Cloud detection and response (CDR) enables organizations to prevent cyber threats in their cloud environments. CDR is a safety method for cloud environments that focuses on service incorporations, quick incident response, and threat identifications. It ensures comprehensive security that is tailored to cloud computing.

The managed endpoint detection and response (MEDR) segment is expected to expand at the fastest growth during the forecast period. This is mainly due to its capability to recognize and lower threats more efficiently than outdated safety solutions. MEDR solutions enable organizations to meet regulatory compliance by offering essential documentation and security controls.

Deployment Insights

The cloud-based segment held the largest share of the managed detection and response (MDR) market in 2025. This is primarily due to the heightened adoption of cloud-based models among banks, enterprises, and businesses. Cloud-based models, including hybrid, public, and private cloud, offer enhanced flexibility and scalability, making them suitable for large enterprises. These models are constructed based on various aspects. Cloud deployment is the method of deploying an application by one or more hosting models, like infrastructure as a service (IaaS), platform as a service (PaaS), and/or software as a service (SaaS).

The on-premises segment is likely to grow rapidly during the projection period. On-premises deployment provides several benefits, from improved safety to cost predictability. On-premises solutions provide businesses with full control over systems and data. These solutions offer customizable choices that cater to precise operational and regulatory requirements.

Enterprise Size Insights

The SMEs segment led the managed detection and response (MDR) market with the largest share in 2025. This is mainly due to the rapid shift of SMEs toward cloud computing, making them susceptible to cyber threats. MDR solutions provide SMEs with improved visibility, quick incident response capabilities, and proactive threat identification, ultimately lowering the risk of cyberattacks and data breaches. MDR solutions offer continuous monitoring of whole IT environments, including cloud systems, endpoints, and networks.

The large enterprises segment is expected to expand at the highest CAGR during the forecast period. MDR solutions enable large enterprises respond quickly to cyberattacks and offers access to modern safety tools. Through the utilization of MDR, several large enterprises can lower the risk of data breaches and enhance their long-term safety. It emerged as an ideal solution for defensive organizations against sophisticated challenges. Moreover, large enterprises often deal with vast data, making them vulnerable to cyber threats. This, in turn, boosts the demand for MDR solutions.

Vertical Insights

The BFSI segment led the managed detection and response (MDR) market in 2025. As BFSI organizations handle vast sensitive data, they often require robust security solutions. MDR solutions enable them to quickly identify threats and minimize the impact of threats. They continuously monitor network anomalies, quickly responding to cyber threats.

The IT & telecom segment is likely to witness the fastest growth in the upcoming period. IT and telecom businesses heavily depend on robust security solutions as they handle a large amount of data, making them susceptible to cyberattacks. The rapid expansion of the IT infrastructure and shift toward cloud computing are likely to boost the growth of the segment.

Regional Insights

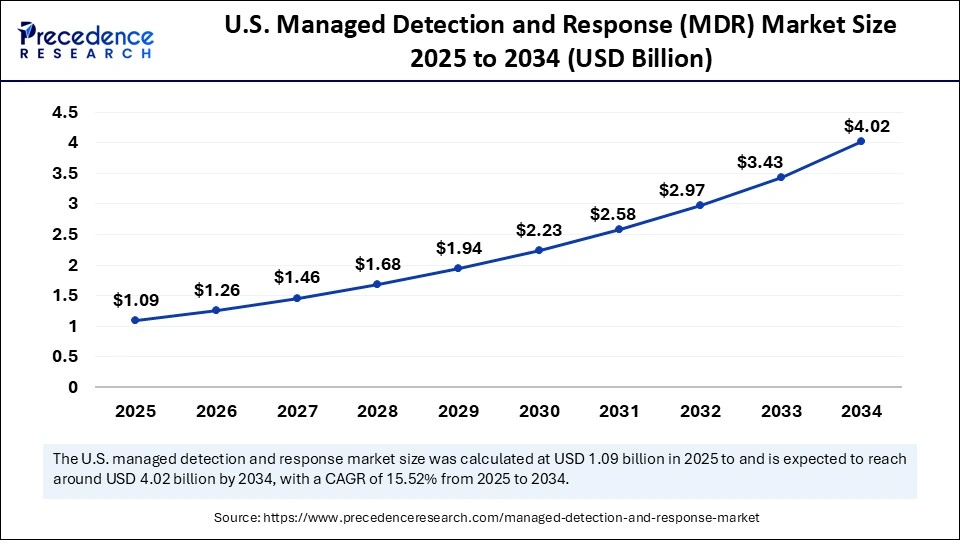

U.S. Managed Detection and Response (MDR) Market Size and Growth 2026 to 2035

The U.S. managed detection and response (MDR) market size is exhibited at USD 1.09 billion in 2025 and is projected to be worth around USD 4.52 billion by 2035, growing at a CAGR of 15.28% from 2026 to 2035.

North America held the largest share of the managed detection and response (MDR) market in 2025. This is mainly due to its advanced digital infrastructure, increased adoption of novel technologies, and high government spending on connectivity initiatives and smart city projects. With the high adoption of cloud computing, the demand for MDR solutions has increased in the last few years. The region also faces a high volume of cyberattacks, boosting the demand for MDR solutions.

U.S. Managed Detection and Response (MDR) Market Trends

The U.S. is a major contributor to the market in North America. The increasing spending on robust cybersecurity solutions is a key factor boosting the growth of the market. The U.S. spends approximately USD 25 billion on cybersecurity solutions to defend federal systems against cyber threats like ransomware and hacking. The heightened awareness about cybersecurity risks, along with the high cybersecurity budgets of federal governments, banking, and manufacturing, further supports market growth. The country also boasts a robust IT infrastructure, boosting the need for managed detection and response solutions.

Asia Pacific is anticipated to witness the fastest growth during the forecast period. The managed detection and response (MDR) market in Asia Pacific can be attributed to the increasing popularity of automation and digital payments. Robust government frameworks regarding cyber security further support regional market growth. Governments around the region are progressively identifying cybersecurity status and imposing stringent regulations and laws to protect critical infrastructure. The rising integration of cutting-edge technologies in telecommunication and BFSI is further contributing to market growth in the region. With the rapid digital transformation in various industries, the frequency of cyberattacks is rising, boosting the need for MDR services.

- In 2024, India faced more than 369 million cyberattack events, with tier-2 cities such as Ahmedabad, Jaipur, and Surat observing a sharp growth in attacks because of weaker cybersecurity. As these regions grow in tech hubs, cloud-based threats surged, accounting for 62% of attacks. Rapid growth in digitalization has boosted cyberattacks, making it complex to strengthen its defense measures.

China Market Trends

China's market is driven by rising cyber threats, evolving regulatory landscapes, and the growing demand for advanced security solutions among enterprises around the globe. Organizations are seeking comprehensive, proactive cybersecurity strategies to detect, analyze, and even respond to threats swiftly.

Europe is projected to grow significantly during the forecast period. The growth of the market in Europe can be attributed to the rising awareness among businesses about cybersecurity risks. The increasing adoption of digital technologies and the growing penetration of the internet further support market growth. In addition, stringent regulations regarding data security and privacy are boosting the demand for robust security solutions like MDR, contributing to regional market growth.

Europe Trends of the Managed Detection and Response (MDR) Industry

Europe's market shows a significant growth rate during the forecast period. It is driven by escalating cyber threats such as espionage, ransomware, and digital transformation, with major expansion in BFSI, Manufacturing, and mainly Germany's industrial base.

France Managed Detection and Response (MDR) Market Trends

France's market is driven by rising sophistication and frequency of threats like ransomware, phishing, and even APTs, necessitating advanced defenses. French government initiatives like Cybersecurity Strategy 2023, along with GDPR mandates, compel robust security adoption, especially for critical sectors.

Latin America Trends for the Managed Detection and Response (MDR) Industry

Latin America's market shows notable growth during the forecast period. It is driven by a significant cybersecurity talent gap, rising sophisticated cyber threats, and increased cloud adoption, mainly among SMEs facing budget or staff constraints. Limited in-house security expertise and budget constraints are driving demand for MDR solutions, which offer cost-effective access to continuous monitoring, threat intelligence, and rapid remediation capabilities without the need to build full internal security operations.

Argentina Managed Detection and Response (MDR) Market Trends

Argentina's market is driven by increased cybersecurity knowledge among businesses and consumers alike. Regulatory compliance is becoming a vital factor influencing security service adoption across numerous sectors. Organizations are adopting MDR services to bridge internal skill gaps and build security resilience without the high costs of establishing full in-house security operations centers.

MEA Trends for Managed Detection and Response (MDR) Industry

MEA's market shows a rapid growth rate during the forecast period. It is driven by escalating cyber threats such as ransomware, phishing, a severe cybersecurity talent gap, and even increased cloud or IoT adoption, with major trends leaning towards XDR or MXDR for unified visibility and industry-specific solutions.

UAE Managed Detection and Response (MDR) Market Trends

UAE's market is driven by aggressive digital transformation, rising cyber threats such as ransomware, APTs, and even strong government support. Adoption is being accelerated by digital transformation initiatives, cloud migrations, and expanding IoT and remote work environments that have widened the threat surface for enterprises across sectors like finance, government, healthcare, and energy.

Recent Developments in the Market

- In March 2025, Pondurance, the leading provider of MDR cybersecurity services specifically engineered to eliminate breach risks for midmarket organizations, announced a major new version of its cybersecurity platform. Pondurance Platform 2.0 provides the foundation for Pondurance's unique risk-based MDR service, specifically designed to eliminate breach risks.

- In March 2025, eSentire Introduced Next-Level Cybersecurity Offering, Prioritizing Threat Prevention with Integrated Continuous Threat Exposure Management and Managed Detection and Response Services.

- In January 2025, CyberMaxx announced the Acquisition of Cybersafe Solutions and onShore Security to Scale Modern Managed Detection and Response (MDR) Services.

- In June 2024, Darktrace, a global leader in cybersecurity AI, announced the launch of its new service offering, Darktrace Managed Detection & Response (MDR). The service combines its best-in-class detection and response capabilities spanning across the enterprise with the expertise of its global analyst team.

- In July 2024, Optiv, the cyber advisory and solutions leader, launched its managed detection and response service, Optiv MDR, on the Google Security Operations (SecOps) platform, enabling organizations to rapidly detect and respond to emerging threats with industry-leading managed threat detection and response capabilities.

Managed Detection and Response (MDR) Market Companies

- Accenture

- Arctic Wolf Networks Inc.

- CrowdStrike

- Deepwatch

- FORESCOUT

- Fortra, LLC

- LMNTRIX

- Rapid7

- Red Canary

- Secureworks

Segments Covered in the Report

By Security Type

- Managed Endpoint Detection And Response (MEDR)

- Managed Network Detection And Response (MNDR)

- Cloud Detection And Response

- Others

By Deployment

- Cloud-based

- On-premises

By Enterprise Size

- SMEs

- Large Enterprises

By Vertical

- BFSI

- Retail

- IT & Telecom

- Healthcare

- Manufacturing

- Government & Defense

- Others

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting