August 2024

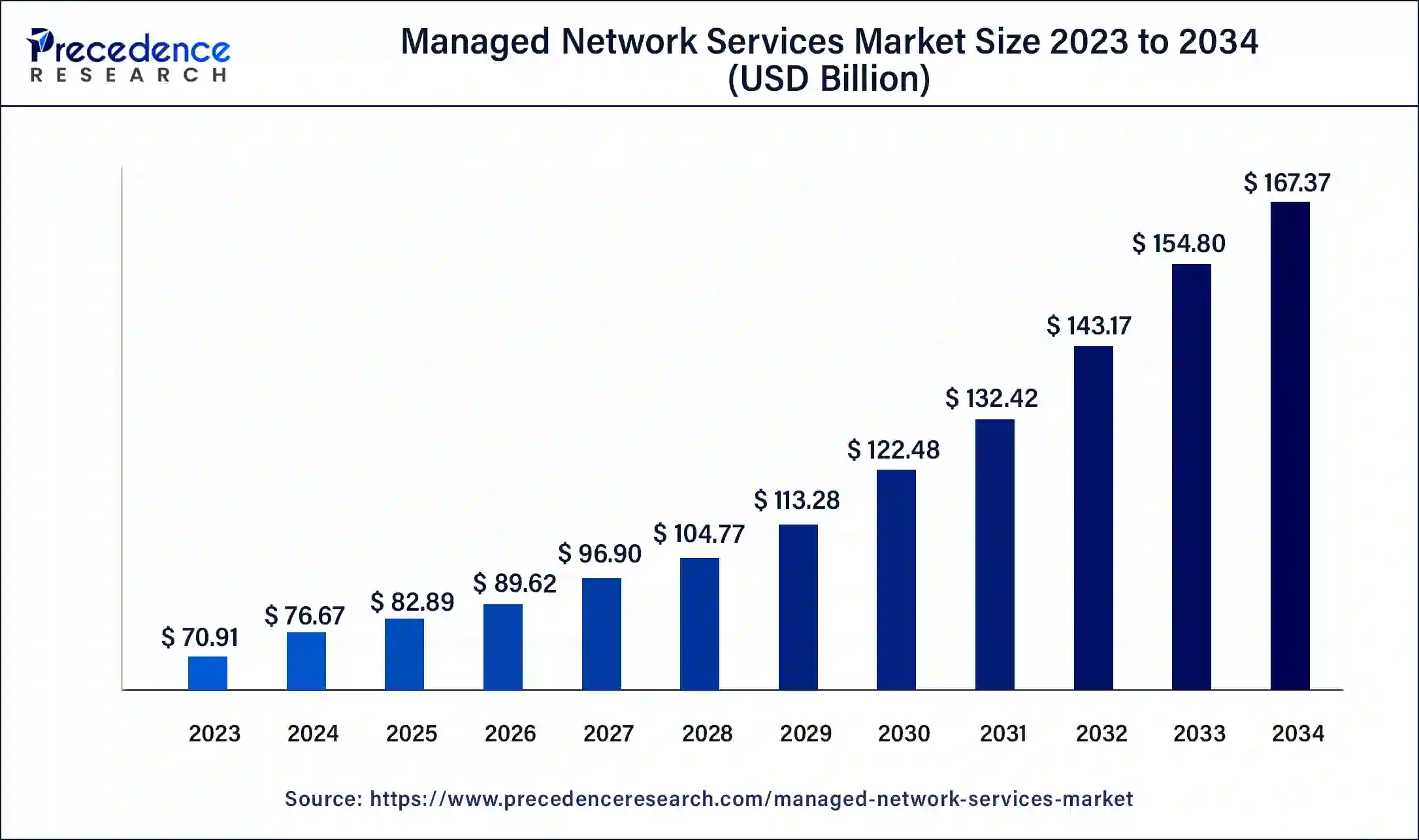

The global managed network services market size surpassed USD 70.91 billion in 2023 and is estimated to increase from USD 76.67 billion in 2024 to approximately USD 167.37 billion by 2034. It is projected to grow at a CAGR of 8.12% from 2024 to 2034.

The global managed network services market size is projected to be worth around USD 167.37 billion by 2034 from USD 76.67 billion in 2024, at a CAGR of 8.12% from 2024 to 2034. The increasing need to cut capital and operating expenses is expected to drive the growth of the managed network services market.

In a world of digitally interconnected, managed network services are integral to ensuring smooth, reliable, and efficient business operations. The managed network services market enables business organizations to outsource web applications, functions, and services that are remotely administered, operated, monitored, and maintained by a managed service provider (MSP).

Managed network services include a wide range of offerings, from managing local area networks (LAN) and wide area networks (WAN) to the latest software-defined WAN (SD-WAN) connections and network security solutions. The adoption of the managed network services market has increased substantially as it offers businesses a strategic advantage in a competitive and digitally driven landscape.

How is Artificial Intelligence (AI) Improving the Managed Network Services Market?

Artificial intelligence has transformed the managed network services market. As these services involve outsourcing network management tasks to specialized providers and with the help of AI integration, managed network services can become more efficient. Managed network services can offer quick incident response, real-time monitoring, and continuous optimization, which ensures that networks run securely and seamlessly.

The AI-managed network services market involves leveraging AI to efficiently manage several IT functions within an organization. These services include various tasks such as predictive maintenance, system monitoring, data management, security enhancement, and others. Therefore, the use of AI-managed AI services can optimize and streamline IT operations, enhancing operational efficiency and cost-effectiveness and overall improving IT performance.

| Report Coverage | Details |

| Market Size by 2034 | USD 167.37 Billion |

| Market Size in 2023 | USD 70.91 Billion |

| Market Size in 2024 | USD 76.67 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 8.12% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Vehicle Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Cost-effectiveness

The rising need to reduce capital and operating expenditure is expected to boost the expansion of the managed network services market during the forecast period. Organizations hire skilled experts to handle their networks rather than employing internal IT workers, which often results in large infrastructure expenditures. This outsourcing approach is gaining immense popularity as an affordable option for various sizes of businesses.

The managed network services market helps business to trim down their expenses as they are not required to make expensive technology investments. A cloud-based allows remote employees to access their applications, files, and data from anywhere. Companies only pay for the services they avail; providers provide scalable services that can be modified according to the needs of the company.

Lack of data privacy and growing security concern

The lack of data privacy and growing security concerns are anticipated to hamper the growth of the managed network services market. Companies often face several security concerns and data privacy issues that discourage them from adopting these services. In addition, the lack of IT infrastructure and technical expertise in lower and middle-income countries is likely to result in a slow adoption rate and limit the expansion of the market during the forecast period.

Rising demand from small-scale enterprises

The increasing demand from small-scale enterprises is projected to offer lucrative opportunities to the managed network services market during the forecast period. Managed network services assist small-scale enterprises to concentrate on their core strengths and offer them opportunities to grow and accomplish their defined goals.

The IT spending among SMEs has steadily increased, witnessing that these businesses are under constant pressure to grow by installing advanced and extended IT services. The need for managed service providers (MSPs) is expected to increase as SMEs are widely adopting automated services, cloud computing, and other innovative digital technologies. Thus, SMEs can increase their efficiency and productivity through this strategic outsourcing, which boosts overall performance.

The managed WAN segment accounted for the dominating share of the managed network services market in 2023. Managed wide area network (WAN) is a crucial component for IT and business operations. Companies are adopting these services to improve security, enhance performance, and streamline network management. Companies are heavily investing in WAN infrastructure as WAN networks support remote workforces. Companies are increasingly relying on WAN networks to connect their branch sites and ensure uninterrupted connectivity to remote locations. The rise in remote work, coupled with increasing demand for bandwidth-intensive applications, has significantly increased the demand for WAN services. Therefore, the adoption of managed WAN services has increased to improve the network for reliable and secure information delivery with speed and ease.

The managed LAN segment is expected to witness significant growth in the managed network services market during the forecast period. Managed LAN services to support operations, maintain network reliability, and control costs. The segment’s growth is majorly driven by the increasing implementation of LAN in businesses for effective and centralized network management. Managed LAN Services is a service provided by a third-party service provider to manage a company’s local area network (LAN). Managed LAN service providers offer several benefits, such as security, network monitoring, improved network performance, cost savings, reliability, and 24-hour availability. This type of service allows companies to improve business productivity and save expenses by reducing the cost of maintaining network infrastructure. It also provides an effective way to access the network remotely.

The cloud segment held a dominant presence in the managed network services market in 2023. The growth of the segment is majorly driven by the rising need to manage complex network infrastructure and ensure seamless network communications security. Many enterprises lack the in-house capabilities to manage highly complex networks, which increases the importance of specialized MNS. Cloud-based tools assist in streamlining workflows, eliminating the burden of software updates, automating routine tasks, and more.

Cloud providers emphasize data security and employ robust cybersecurity measures to protect sensitive information. Cloud computing plays an integral role in remote work and offers several benefits, such as improved security, centralized data management, enhanced flexibility, cost optimization, and others. Such factors drive the growth of the segment.

The on-premise segment is expected to register considerable growth in the global managed network services market over the forecast period. Several enterprises prefer on-premises deployment to maintain physical ownership of their network assets. On-premises deployment allows complete control over network infrastructure and data, which makes it particularly suitable for industries with stringent compliance and security requirements.

The large enterprises segment registered its dominance over the managed network services market in 2023 owing to the presence of extensive network infrastructures and the large volume of data they handle. Large enterprises opt for these services to ensure smooth and uninterrupted business operations. Large enterprises generally have considerably high IT budgets, and they are more inclined to outsource network management to specialized service providers. In addition, the increasing cases of security threats have compelled the business to leverage expertise for cybersecurity measures.

The small & medium enterprises segment is projected to expand rapidly in the managed network services market in the coming years. The cost-effectiveness of outsourcing network management attracts small & medium enterprises (SMEs) to adopt these services. Small & medium enterprises often have limited resources and expertise to manage their network infrastructure. Managed network services allow SMEs to focus on core competencies while leveraging expert network management capabilities at an affordable cost. Therefore, SMEs can increase their productivity and efficiency through outsourcing, fueling the segment's growth in the coming years.

The BFSI segment accounted for the highest share of the managed network services market in 2023 and is anticipated to grow at a robust CAGR over the forecast period. In today’s digital-paced world, financial institutions cannot afford to compromise with their security. The banking, financial services, and insurance (BFSI) sector deals with data generation and processing, which includes various critical information, including account numbers, passwords, details of credit/debit cards, and many other important details that need the utmost security.

Managed security services assist them in maintaining efficient operations and protecting the privacy of their client's data. Therefore, managed network services play a crucial role in ensuring data privacy, safeguarding against cyber threats, and facilitating uninterrupted network connectivity for all important financial transactions.

The healthcare segment is expected to grow at the fastest rate in the managed network services market during the forecast period of 2024 to 2034. In the healthcare industry, managed network services are important for smooth connectivity between different healthcare facilities, secure data transmission, and others. Managed network services empower healthcare providers to efficiently manage HIPAA-compliant networks and securely deploy and maintain mobile health applications. This outsourcing approach enables healthcare institutions to navigate complex IT challenges while focusing on their core competencies of delivering better quality patient care. Moreover, there is a rising adoption of digital health solutions and telemedicine around the world.

North America held the largest share of the managed network services market in 2023. It is a hub for world-leading MNS market players such as IBM, Lumen, Cisco, Verizon, CommScope, AT&T, and Masergy. The region's growth is attributed to the presence of a robust technological infrastructure, increasing investments in digital transformation, a rising need for cost-effective solutions through outsourcing, a supportive Government framework, and a rising number of technology start-ups. The United States is the major contributor to the market owing to the increasing number of major IT companies coupled with the widespread adoption of managed network services among businesses.

Additionally, the North American market has witnessed the rising adoption of advanced technologies in the BFSI, manufacturing, retail, and pharmaceutical industries, resulting in the growing demand for managed network services in the region. Furthermore, the rapid development of cloud computing has led to an increasing need for reliable and secure network solutions, which in turn is expected to boost the growth of the managed network services market in the coming years. Thus, cybercrime remains one of the primary risks that companies in the United States face. Cyberattacks, if successful, might have serious consequences, the main one being financial damage.

Asia Pacific is anticipated to grow at the fastest rate in the managed network services market during the forecast period. The robust growth of the region is attributed to the rising advancements in technology infrastructure, particularly in emerging economies such as China, Japan, and India. The region has a large and expanding base of small and medium-sized enterprises (SMEs) that adopt managed network services due to their cost effectiveness and streamlining of their operations.

The growing emphasis on digital transformation has increased the need for high-speed and seamless connectivity coupled with complying with regulatory standards, which is anticipated to fuel the growth of the managed network services market in the region. In addition, other factors such as increasing 5G internet penetration, rapid economic growth, increasing need for effective security solutions, and the growing adoption of cloud-based solutions are expected to spur the demand for managed network services in Asia Pacific.

Segments Covered in the Report

By Type

By Deployment Mode

By Enterprise Size

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

August 2024

February 2025

November 2024