September 2024

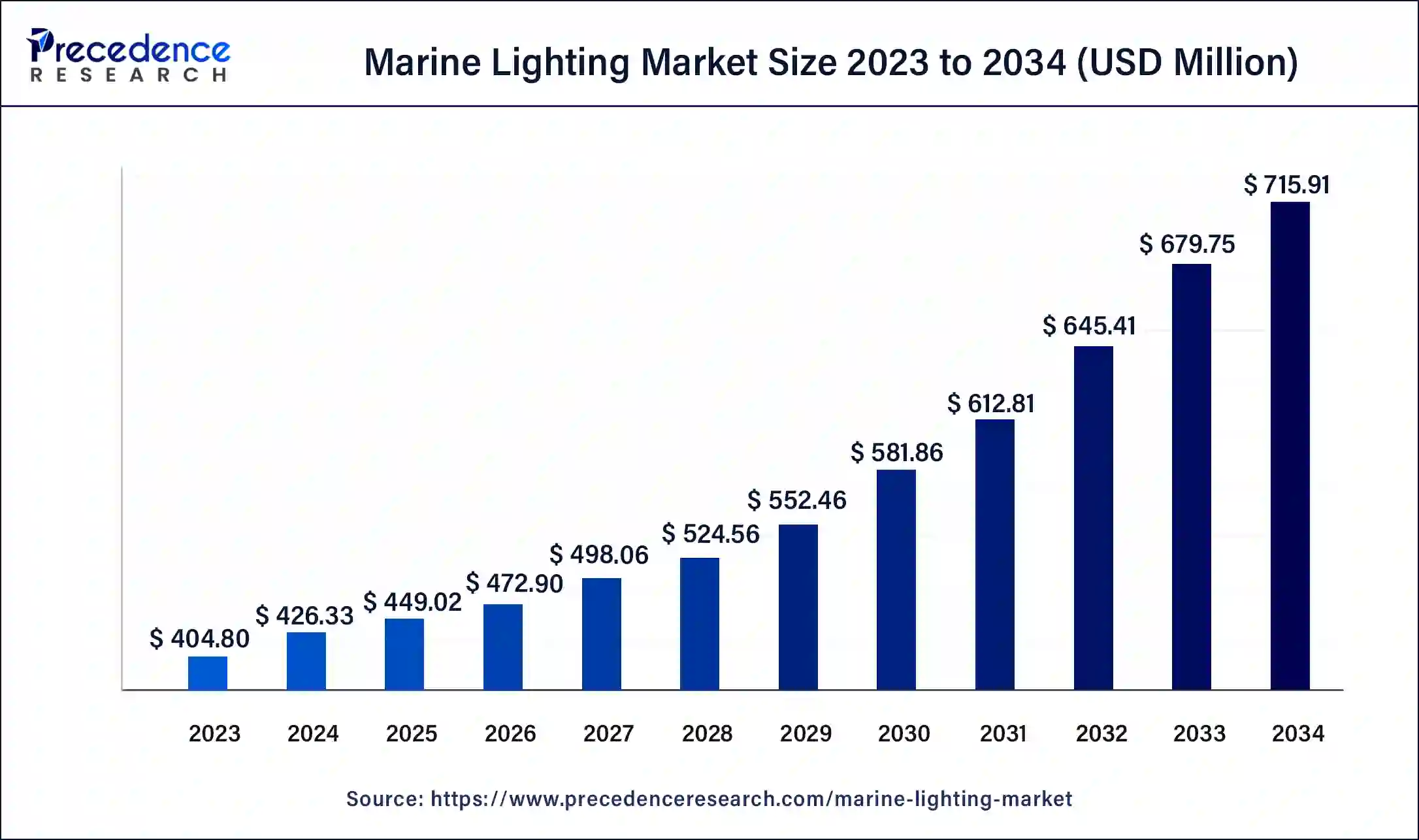

The global marine lighting market size surpassed USD 404.80 million in 2023 and is estimated to increase from USD 426.33 million in 2024 to approximately USD 715.91 million by 2034. It is projected to grow at a CAGR of 5.32% from 2024 to 2034.

The global marine lighting market size is projected to be worth around USD 715.91 million by 2034 from USD 426.33 million in 2024, at a CAGR of 5.32% from 2024 to 2034. The increase in shipping activities like maritime trade, enhanced military naval activities, and shipping accidents drives the marine lighting market.

Marine Lighting Market: Illumination of the Waves

The marine lighting market includes design, manufacture, and distribution of marine lights for ships and boats. The marine lights should be in accordance with the ship norms and international conventions. Marine lights are used for ship navigation and signal transmission. The marine lights should possess the following properties: high stability to withstand high temperatures, high salt and high-frequency vibration, and long service life.

Additionally, the lights should resist vibration and can create lighting effects based on environmental requirements. Furthermore, they should be safe, i.e., do not break easily, emit toxic substances, maintain moisture resistance, and not have noise or radiation. Different marine vessels that require marine lighting include workboats and response vessels, navy and coast guard, commercial marine, cruise and ferry, yachts, warships, rescue and safety boats, fishing boats, etc.

Market Breakthroughs

In July 2024, Hanwha Ocean announced that it has Approval in Principle (AIP), a certification process that evaluates the feasibility and reliability of new technologies in the maritime industry, from the Korean Register (KR) for its innovative ‘Smart Lighting Control System’ applied to ships.

The system was developed in order to enhance energy efficiency and reduce carbon emissions in the shipbuilding industry. The AIP certificate indicates the reliability of Hanwha Ocean’s Smart Lighting Control System for the marine industry. The innovative system reduced carbon dioxide emissions by 45% and fuel and power consumption by 44%. Additionally, the lifespan of the lighting system was found to be increased by 48% due to optimized illumination.

How can AI help the Marine Lighting Market?

Artificial Intelligence (AI), being an emerging field in every industry, demonstrates its potential in the marine lighting market. AI in the lighting industry can be used in the design, installation, commissioning, and configuration of lighting systems. AI can help optimize the lighting by observing the environment to enhance user experience.

AI can be executed on a server to make centralized decisions or at the source component, such as a sensor, for decentralized, real-time decision-making. The sensor can be used to automatically control the lighting system. Also, it can enable controlling lights using a mobile application. Additionally, the lighting devices attached to sensors collect specific data on cloud servers for analysis.

| Report Coverage | Details |

| Market Size by 2034 | USD 715.91 Million |

| Market Size in 2023 | USD 404.80 Million |

| Market Size in 2024 | USD 426.33 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.32% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Technology, Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rise in maritime trade

The increasing maritime trade increases the demand for marine lighting in ships and other vessels. Countries like China and the U.S. are the countries with the highest maritime shipping worldwide. Intercontinental trade, bulk raw material transportation, and the import/export of affordable food and manufactured commodities are feasible only through shipping. Thus driving the marine lighting market.

Light pollution

Several studies highlight the consequences of artificial lights in coastal areas leading to light pollution. These artificial lights significantly affect whales, fish, corals, and plankton, putting their life at risk. Marine animals depend on the natural moonlight and starlight to regulate their physiological and behavioral processes. This can hamper the growth of the marine lighting market.

In the marine lighting market, artificial lights can easily wash out the glow of moonlight and starlight, disrupting their hormonal cycles, inter-species behavior, and reproduction. Artificial lights mitigate the migration of zooplankton from the bottom of the sea to the surface. Other organisms that are affected are sea turtles, as they may not come ashore, and females lay their eggs in dark spots only. In addition, hatchlings are attracted to artificial lights instead of moonlight and die due to starvation and dehydration.

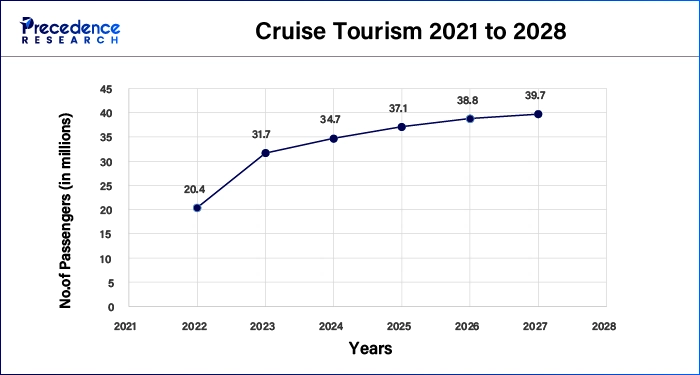

Rising cruise tourism

Compared to other travel and tourism, cruise tourism has been found resilient, especially after the COVID-19 pandemic. The COVID-19 post-pandemic era reported an increase in cruise vacations and also accelerated new-to-cruise customer acquisition. This further facilitates the installation of marine lighting on the cruise for enhanced passenger experience and efficient ship navigation, creating new opportunities for key players in the marine lighting market.

The LED segment dominated the marine lighting market in 2023. LED lights offer several advantages over traditional lights. At sea, power is often a scarce resource. Highly efficient and durable LED lighting reduces the energy usage by 50%. They are resistant to extreme temperatures like hot sun and cold water. They also offer the least heat output and maximum illumination compared to other lights. It enhances a vessel without sacrificing functionality or compromising safety. Additionally, recent developments in LED lighting, like customizable lighting controls and multi-color options, enhance user experience. All these aspects promote the use of LED lighting on marine vessels.

The functional light segment dominated the marine lighting market in 2023. Marine lighting has numerous applications, including functional applications. Marine lights are used as a navigation system for the identification of ship types and navigation status. Marine lighting is also essential for smooth and productive operations in marine installations like ports, shipyards, and offshore platforms. Dockyards, container terminals, and cargo handling areas with good lighting facilitate rapid turnaround times and maximize vessel schedules through effective loading and unloading processes. In addition, marine lighting plays a major role in emergency situations by giving signals for help, guiding rescue efforts, and ensuring the safe evacuation of vessels.

The decorative light segment is estimated to grow at fastest rate in the marine lighting market during the forecast period. The decorative lights increase the aesthetic look and elegance of marine vessels. The decorative lights enhance the passenger experience with multi-color LED lighting.

The compartment & utility lights segment dominated the marine lighting market in 2023. The compartment and utility lights are majorly used by cargo ships, container ships, bulk cargo, and oil tankers. They are generally smaller in size and offer numerous functional applications. The major compartments of the ship that require the use of lighting include the cabin, engine room, galley, head, wardroom, combat information center, etc.

The navigation lights segment is anticipated to grow at the fastest rate in the marine lighting market during the forecast period. Navigation lights are used to prevent collisions when boating in low-visibility conditions such as fog or darkness. Some of them are color-coded, i.e., red or green, to aid traffic control. The International Maritime Organization has mandated the use of navigation lights in marine vessels. Navigation lights are generally of six types, including sidelights, bi-color lights, tri-color lights, stern lights, all-around lights, and masthead lights. The utilization of different navigation lights depends on the purpose of lighting and the type and size of marine vessels.

Asia Pacific dominated the marine lighting market in 2023. China boasts the world’s second-largest fleet of commercial shipping vehicles. It has been reported that 95% of global shipbuilding happens in China, South Korea, and Japan. 99.6% of trade in Japan occurs through sea as it relies on other countries for food and is surrounded by water on all sides. Additionally, increasing cruise tourism and fisheries augments the marine lighting market.

North America is expected to grow at the fastest rate in the marine lighting market during the forecast period. The rising maritime trade, fishing, cruise tourism, military activities, and the presence of key players drive the market growth. Maritime trade is widely utilized in the U.S. It is reported that, for most U.S. industries, more than 50% of their international trade in goods travels through maritime supply chains. Panama is the most popular flag state, i.e., merchant vessels are registered and licensed under the laws of Panama. Also, the U.S. government’s emphasis on the use of navigation lights in all types of marine vessels boosts the market growth.

Segments Covered in the Report

By Technology

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

March 2025

April 2025

August 2024