July 2024

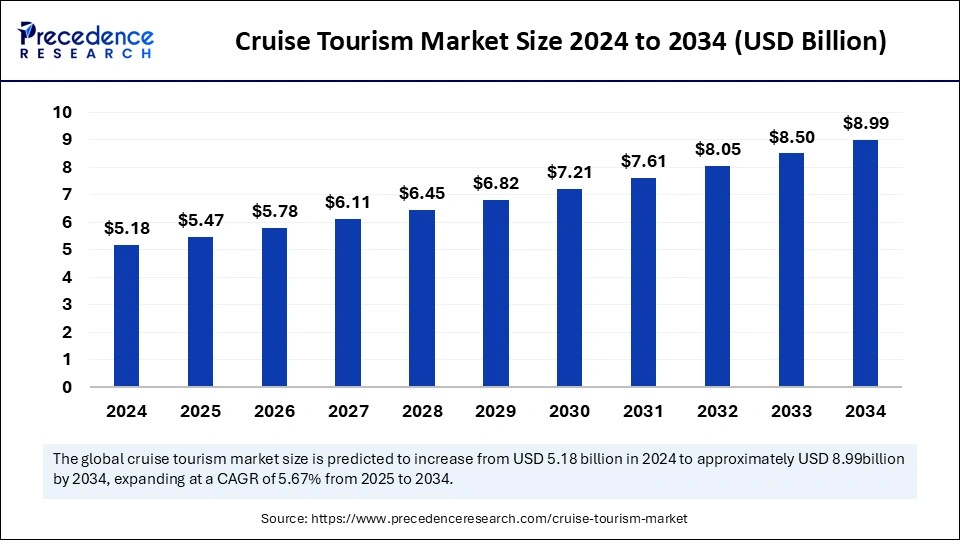

The global cruise tourism market size is calculated at USD 5.47 billion in 2025 and is forecasted to reach around USD 8.99 billion by 2034, accelerating at a CAGR of 5.67% from 2025 to 2034. The North America market size surpassed USD 1.87 billion in 2024 and is expanding at a CAGR of 5.78% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global cruise tourism market size was estimated at USD 5.18 billion in 2024 and is predicted to increase from USD 5.47 billion in 2025 to approximately USD 8.99 billion by 2034, expanding at a CAGR of 5.67% from 2025 to 2034. The growth of the cruise tourism market is driven by the increasing government initiatives to promote tourism. Governments worldwide have recognized the potential of cruise tourism to drive financial growth, job creation, and cultural preservation. Thus, they are focusing on increasing e-visa facilities for cruise passengers and investing heavily in advanced technologies to enhance travel experience.

Artificial Intelligence integration in cruise tourism revolutionizes the cruise tourism industry by creating safer, smoother, and more efficient operations. AI technologies automate several tasks like navigation and maintenance. This, in turn, enhances efficiency and reduces operational costs. These technologies also improve consumer services and recommend tailored activities, enhancing the traveling experience.

AI technologies address several challenges related to passenger safety. They identify potential threats and schedule maintenance, reducing downtime and improving the efficiency of cruise and passenger safety. By integrating AI technologies, cruise operators can find the best routes, automate navigation, and manage ports. They also aid in weather forecasting, maritime surveillance, and enhancing the experience of consumers with chatbots and personalized services. With the help of AI and the Internet of Things sensors, consumers keep track of cruise conditions and predict future failure.

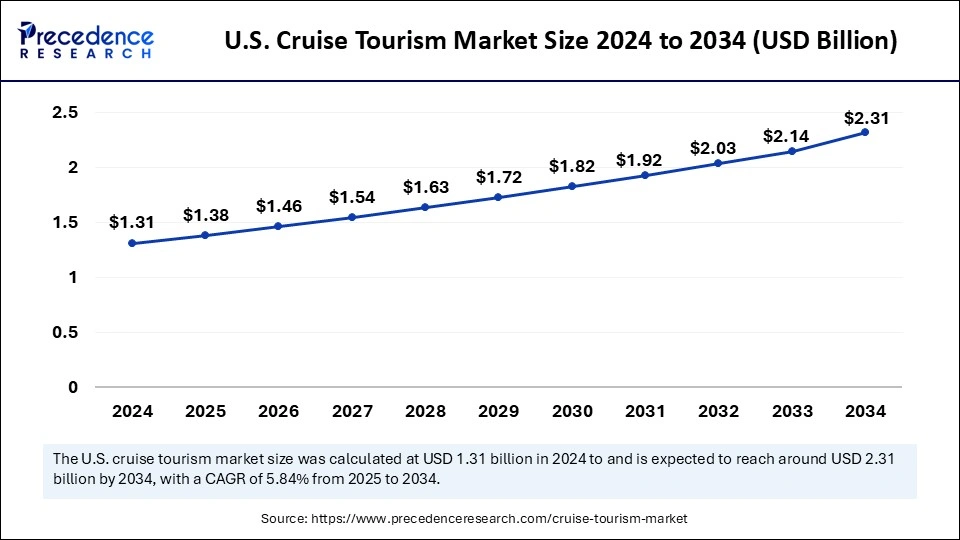

The U.S. cruise tourism market size was exhibited at USD 1.31 billion in 2024 and is projected to be worth around USD 2.31 billion by 2034, growing at a CAGR of 5.84% from 2025 to 2034.

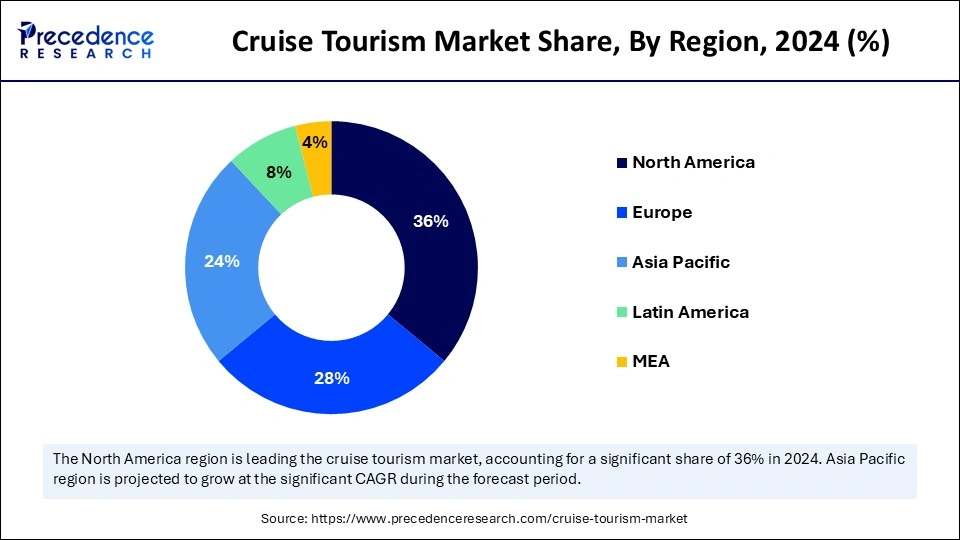

North America’s Leadership in the Market

North America registered dominance in the cruise tourism market in 2024. This is mainly due to the presence of well-established cruise lines, such as Carnival Cruise Line, Holland America Line, Royal Caribbean International, and Celebrity Cruises. High disposable income and increased government initiatives to support cruise tourism further bolstered the market growth in the region. There is a strong focus on modernizing cruise line operations, boosting the adoption of advanced and smart technologies. Such technologies reduce downtime and enhance passenger safety. The U.S. and Canada are major contributors to the regional market growth. Canada has the World’s longest coastline. In the U.S., there is a strong emphasis on digitalization in the tourism industry, leading to significant cost reduction, enhanced transparency, and improved passenger security. Cruise operators in the U.S. are spending on innovative technologies to streamline operations.

Europe: The Fastest-Growing Region

Europe is expected to be the fastest-growing region in the cruise tourism market. European countries are popular worldwide for their wide range of touristic attractions that blend ancient grandeur with modern leisure. Tourists explore ancient ruins, majestic palaces, and world-renowned museums that showcase centuries of artistic and cultural achievements of Europe. Moreover, river cruises are gaining popularity in Europe. The travel & tourism sector of the UK contributes to job creation and national development. According to the Cruise Lines International Association, the cruise industry contributes £10 billion to the UK economy per year and supports more than 88,000 jobs.

Asia Pacific Cruise Tourism Market Trends

Asia Pacific is observed to grow at a significant growth rate in the upcoming period. This is mainly due to the increasing disposable income in countries like China, Japan, and Australia. This encourages people to spend on traveling. The rapid expansion of the travel & tourism sector further supports market growth. Moreover, rising government initiatives supporting cruise tourism contribute to regional market growth.

The cruise tourism market is witnessing rapid growth due to consumers' rising interest in luxury travel. Cruise tourism has become a popular choice for vacation, providing various onboard activities. Technological advancements have improved energy efficiency, navigation, and safety, which reduces the operational costs of cruises. By using smart technologies, cruise operators can track traffic, weather, and port congestion. This helps to find suitable routes, save the fuel, and reduce the costs. Rising government funding for port expansion and the development of smart ports further contribute to market growth. In addition, the growing focus on sustainable operations supports market growth. Cruise lines are investing in sustainable technologies and practices to reduce environmental impact.

| Report Coverage | Details |

| Market Size by 2034 | USD 8.99 Billion |

| Market Size in 2025 | USD 5.47 Billion |

| Market Size in 2024 | USD 5.18 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.67% |

| Dominating Region | North America |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Duration, Passenger Age and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising Demand for Recreational Activities

With the increasing stress-related issues, people are increasingly looking for ways to relieve stress. This, in turn, boosts the demand for recreational activities, which is a major factor driving the growth of the cruise tourism market. Cruises offer a wide range of onboard and shore excursions, providing a unique experience. Cruises offer various activities like swimming, live entertainment, fitness, and sunbathing, attracting a broader audience looking for adventure as well as recreational activities. Moreover, the increasing interest of millennials and Gen Z populations in luxurious travel contributes to market expansion.

Environmental Concerns

Cruise lines are major contributors to carbon emissions. This raises concerns about environmental sustainability and air and water pollution, disrupting the marine ecosystem. Therefore, governments worldwide have imposed stringent regulations on the cruise tourism industry to reduce carbon emissions, affecting the growth of the cruise tourism market.

Technological Advancements

The cruise tourism industry is focusing on improving passenger experiences by adopting advanced technologies, like contactless technology and virtual reality. Mobile applications and wearable devices are transforming the way passengers access cabins, make purchases, and book onboard activities, ensuring seamless, safe, and efficient traveling. VR technology is further reforming cruise planning by providing immersive virtual trips of cabins, destinations, and ships, allowing tourists to make informed booking decisions while enhancing expectancy. Moreover, the increase in online cruise ticket booking is streamlining the reservation process, making cruise travel more accessible and convenient for consumers. These technological advancements enhance consumer engagement and operation efficiency and raise the overall cruise experience.

The ocean cruise segment led the cruise tourism market in 2024 and is likely to sustain its dominance over the studied period. Ocean cruising is the ultimate way to travel to various destinations in the world while indulging in luxury, unforgettable experiences, and adventure. Ocean cruising is cost-effective, convenient, and provides tourists with peace of mind. Ocean Cruise is often equipped with state-of-the-art amenities and provides travelers with spacious and stylish amenities, enhancing the traveling experience. The rise in traveler demand for luxurious experiences contributes to segmental growth.

The 7 days segment registered dominance in 2024 and is expected to grow at a steady rate in the coming years. This is mainly due to the rise in interest in short vacations. The 7 days segment provides a chance to experience many cultures in a very short timeframe. 7 days vacation offers a good balance between value and work schedule, allowing people to experience luxury travel without taking too much time.

The 40-49 years segment dominated the cruise tourism market in 2024. Passengers between the age group of 40 and 49 years are often financially stable. Thus, they can afford the cost of a cruise vacation. People of this age group often have established careers and are increasingly look for career break or a gap from professional life. Cruise tourism allows them to explore several destinations and provides a luxurious experience.

The 20-29 years segment is projected to expand at the fastest rate during the forecast period. People in this age group often look for adventure and new experiences. Cruise tourism allows them to visit many places at once without worrying about unpacking and repacking between destinations or paying for shipping between cities. Many cruises have various facilities for this age group, such as port talks, destination immersion lectures covering the culture and history of a destination, a variety of art galleries, and trivia games. Cruises are a great way to learn more about the world to meet new people and learn from them.

By Type

By Duration

By Passenger Age

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024