September 2024

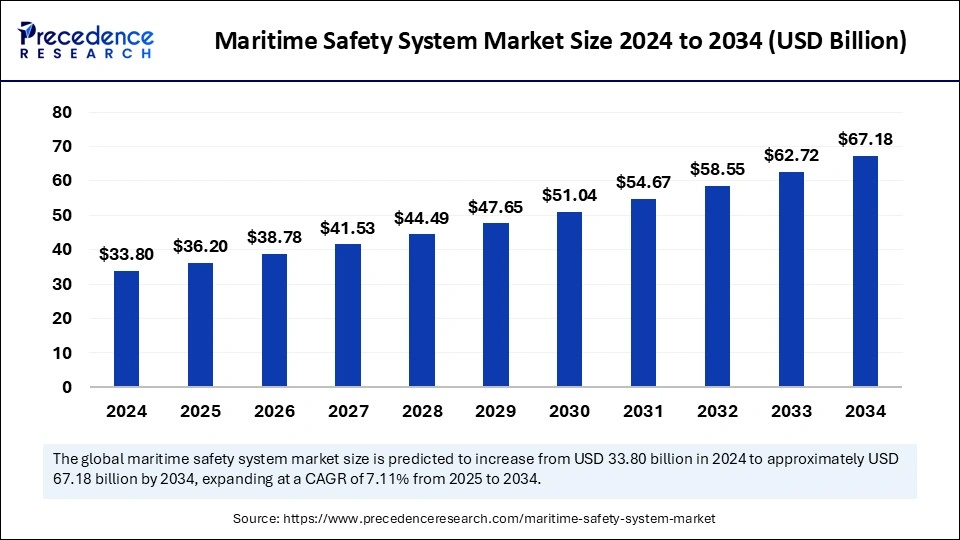

The global maritime safety system market size is calculated at USD 36.20 billion in 2025 and is forecasted to reach around USD 67.18 billion by 2034, accelerating at a CAGR of 7.11% from 2025 to 2034. The North America market size surpassed USD 14.20 billion in 2024 and is expanding at a CAGR of 7.23% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global maritime safety system market size was estimated at USD 33.80 billion in 2024 and is predicted to increase from USD 36.20 billion in 2025 to approximately USD 67.18 billion by 2034, expanding at a CAGR of 7.11% from 2025 to 2034. The growth of the maritime safety system market is expanding rapidly due to increasing maritime trade and ongoing technological advancements. Furthermore, the rising awareness about maritime safety contributes to market expansion.

The integration of artificial intelligence in maritime management has a significant impact, improving safety at sea security. Integrating AI algorithms in maritime safety systems analyzes large amounts of data from various sources to predict potential hazards. AI-driven maritime safety systems reduce human errors, which are a leading cause of maritime accidents. AI technologies are used to optimize shipping ways by analyzing data from various sources, like traffic, weather, and Global Positioning System (GPS) sensors. Moreover, AI analyzes sensor data from ship engines to identify the patterns that indicate when maintenance is needed, preventing unexpected breakdowns. AI is used to create autonomous ships that dock and navigate independently. AI significantly enhances maritime security by detecting malicious attacks and cyber threats.

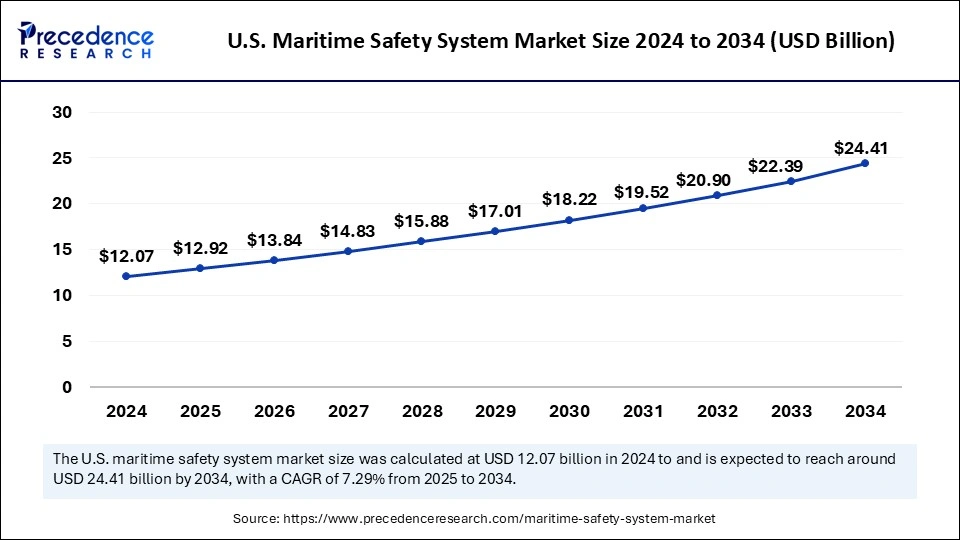

The U.S. maritime safety system market size was exhibited at USD 12.07 billion in 2024 and is projected to be worth around USD 24.41 billion by 2034, growing at a CAGR of 7.29% from 2025 to 2034.

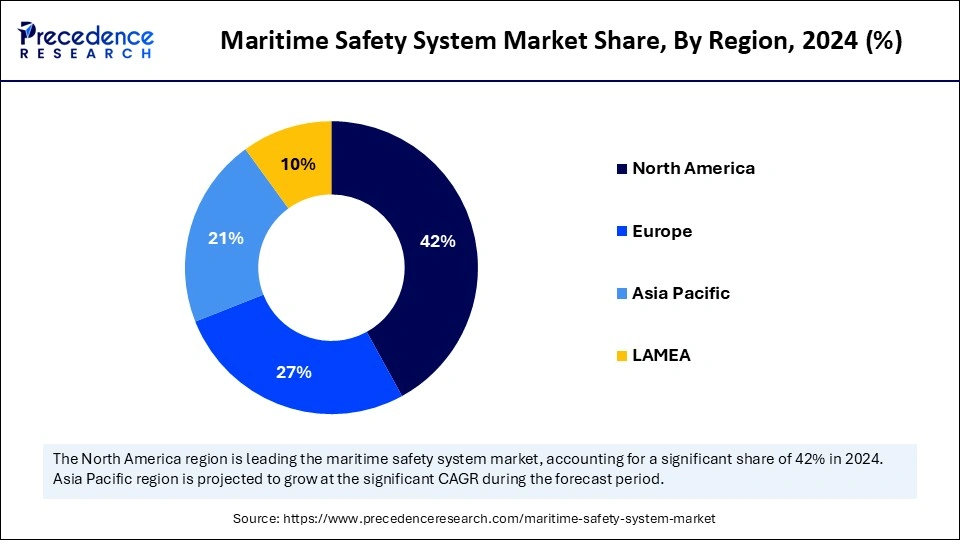

Stringent Regulations Supported North America’s Dominance

North America registered dominance in the maritime safety system market by capturing the largest share in 2024. This is mainly due to the robust regulatory frameworks that offer a strong foundation for improving the performance of the marine industry. Increased government investments in maritime security and safety further supported the region’s market dominance. In addition, the region has a robust shipping industry with major ports and improved maritime infrastructure that contributes to market growth.

The U.S. and Canada play a key role in the North American maritime safety system market. The presence of major defense and shipping agencies in the U.S., such as the Defense Intelligence Agency (DIA), the National Security Agency (NSA), the National Geospatial-Intelligence Agency (NGA), the National Reconnaissance Office (NRO), UPS (United Parcel Service), FedEx, and USPS (United States Postal Service) contribute to the growth of the market. These countries also boast state-of-the-art marine infrastructure. The increasing focus on coastal security and the rising import & export activities further support market growth. Moreover, rising government funding to modernize port influence the market.

Europe: The Fastest-Growing Region

Europe is expected to emerge as the fastest-growing region in the maritime safety system market due to the well-established shipping industry. The region has stringent maritime safety regulations. The European Maritime Safety Agency provides expertise to European countries to help enhance maritime safety and security. The U.K. is the world’s leader in manufacturing and delivering smart shipping technologies. There is a strong emphasis on sustainable shipping practices, supporting market growth. In addition, Germany is the hub of around 130 shipyards. Rising marine engineering and shipbuilding further impacts the market.

Asia Pacific Maritime Safety System Market Trends

Asia Pacific is projected to grow at a significant growth rate in the upcoming period. The rising government initiatives to enhance border and coastline safety are expected to drive market growth. The rapid expansion of the shipping industry further supports regional market growth. Moreover, increasing maritime trade activities boosts the demand for maritime safety systems to ensure the safety of cargo.

The maritime safety system market is expanding rapidly due to the growing concerns about piracy and terrorism. The maritime safety system ensures the safety and security of ships and crews. This system is mainly designed to prevent accidents underwater and protect against piracy. The rising marine trade activities further boost the growth of the market. The maritime sector plays a significant role in global trade, facilitating the movement of goods and resources worldwide. The maritime safety system ensures the safety of the supply of food, energy, and commodities. Stringent regulations regarding cargo safety and the growing need to protect marine ecosystems support market expansion. Regulatory bodies such as the International Maritime Organization (IMO), Global Maritime Distress and Safety System (GMDSS), and Safety of Life at Sea (SOLAS) have imposed several safety standards, influencing the market.

| Report Coverage | Details |

| Market Size by 2034 | USD 67.18 Billion |

| Market Size in 2025 | USD 36.20 Billion |

| Market Size in 2024 | USD 33.80 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.11% |

| Dominating Region | North America |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offering, Security Type, System, Application, End-User, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Rising Government Investments

The significant increase in investments by governments to improve port infrastructure and maritime safety to reduce maritime threats and protect the maritime ecosystem is a major factor driving the growth of the maritime safety system market. Government investments in port modernization create a favorable environment for the adoption of maritime safety systems. In addition, the rising concerns about border security are driving the growth of the maritime safety market. With the growing concerns about border security, governments of various countries are providing grants and subsidies to encourage the adoption of innovative safety solutions at ports and coastlines.

Maritime Cybersecurity Challenges

Cybersecurity is a critical challenge in the maritime safety system, with increasing threats such as phishing, spear-phishing, malware, and ransomware attacks targeting ships and port infrastructure. Advanced maritime safety systems rely heavily on interconnected networks, creating cyberattack vulnerabilities. The lack of standardized protocols and interfaces further hinders interoperability and creates challenges for implementing safety systems.

Emerging Technologies

Ongoing technological advancements create immense opportunities in the maritime safety market. The emergence of innovative technologies, such as remote monitoring and tracking solutions, is improving maritime safety and security. Such innovations are enabling the real-time monitoring of vessels, reducing the risk of accidents. In addition, the Internet of Things and AI technologies are enabling the development of more sophisticated and effective maritime safety systems.

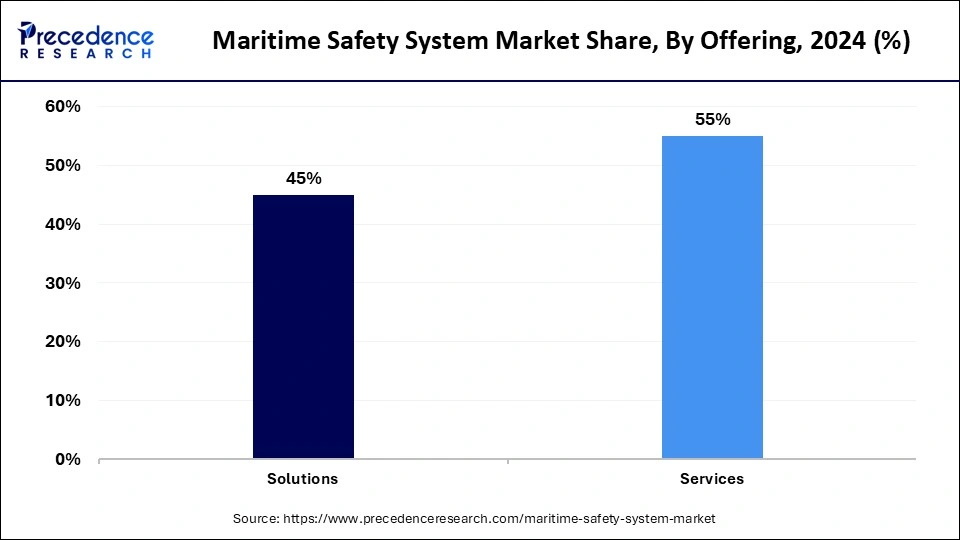

The services segment dominated the maritime safety system market with the largest share in 2024. This is mainly due to the increased demand for specialized expertise and support to upgrade safety systems. Service providers offer various services, including monitoring and management services, to streamline operations. This reduces the risk of accidents by detecting and mitigating risks at an early stage. Such services are important in ensuring seamless maritime operation.

On the other hand, the solutions segment is expected to expand at the fastest rate in the coming years. The growing focus on improving maritime safety is a major factor supporting segmental growth. Comprehensive solutions can streamline maritime operations by improving communication and reducing human errors. Advancements in technology lead to the development of sophisticated safety solutions, influencing the segment.

The port & critical infrastructure security segment led the market in 2024 as it protects against illicit operations and terrorism. This type of security provides a consistent, standardized approach to the maritime system by ensuring the safety of ships and ports. The rapid increase in ship traffic and trade activities further bolstered the segment’s growth.

The coastal security segment is projected to grow at a considerable rate over the studied period. The segment growth is attributed to the increasing concerns about protecting coastal areas from threats like piracy and smuggling. Coastal security prevents smuggling activities, streamlining global trade.

The ship security reporting system segment dominated the maritime safety system market in 2024. This system allows ships to navigate through the most vulnerable areas. This system ensures better maritime security. Ship reporting systems contribute to the safety of crews as well as passengers. The rise in suspicious activities and smuggling supported the segment’s dominance.

The automatic identification system (AIS) is projected to grow at a considerable rate during the projected timeframe as it helps identify ships, assists in search and rescue operations, and simplifies information exchange. AIS provides major benefits in managing vessel traffic. It also helps with tracking vessels. It plays a crucial role in enhancing vessel safety.

The monitoring & tracking segment dominated the market in 2024 as it is crucial for enhancing fuel efficiency and complying with environmental regulations. Tracking and monitoring ships is important to ensure immediate help in times of any threats. Monitoring & Tracking systems enhance the safety and security of vessels as well as crew members. These systems allow vessel operators to track vessel movements in real-time, ensuring the safety of cargo.

The security & safety management segment is expected to grow rapidly during the projection period. The segment growth is attributed to the rising focus on risk management and safety protocols within the maritime industry. Security and safety management systems majorly focus on vessels’ protection and their cargo from piracy and smuggling. They also help vessel operators identify and mitigate potential risks.

The marine & construction segment dominated the maritime safety system market in 2024 due to stringent safety regulations for maritime construction activities. Maritime safety systems ensure the safety of workers during maritime construction. It is used to protect the ships and passengers aboard vessels and those working and living close to water bodies from the risk of injury or fatality and any hazardous situation during marine construction.

The shipping & transportation segment is expected to expand at a notable growth rate in the coming years. Maritime safety systems provide information about hazardous weather conditions, streamlining transportation and shipping operations. The rising trade activities further contribute to segmental growth.

By Offering

By Security Type

By System

By Application

By End-user

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

August 2024

November 2024

March 2025