March 2025

MEA Printed Circuit Board Market (By Type: Double-Sided, Single-Sided, Multi-Layer, High-Density Interconnect; By Substrate: Rigid, Flexible, Rigid-Flex; By End-User: IT & Telecommunication, Consumer Electronics, Industrial Electronics, Automotive, Aerospace and Defense, Others) - Industry Analysis, Size, Share, Growth, Trends, and Forecast 2023-2032

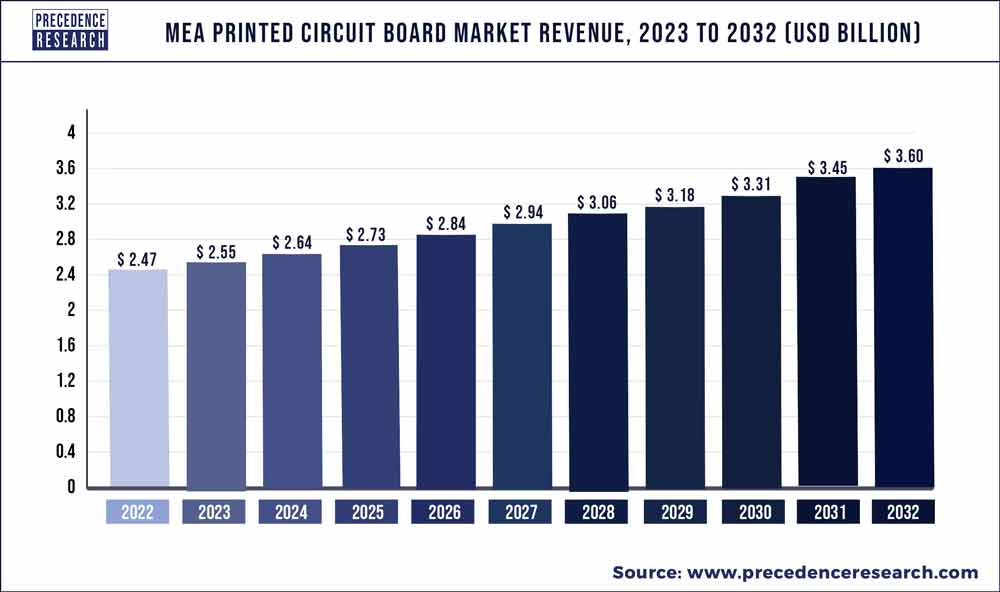

The MEA printed circuit board market size was valued at USD 2.47 billion in 2022 and is expected to surpass around USD 3.60 billion by 2032, poised to grow at a CAGR of 3.9% during the forecast period from 2023 to 2032.

The printed circuit board (PCB) market in the Middle East and Africa (MEA) region has been steadily growing in recent years. Printed circuit boards are essential components used in electronic devices to connect and support electronic components, providing electrical connectivity and mechanical support. The printed circuit board market is anticipated to grow due to the increasing expansion of the Internet of Things (IoT) as well as rising demand for healthcare and surgical robots. Additionally, the increasing need for electric vehicles is also propelling market growth.

Furthermore, there is a growing focus on renewable energy and smart grid infrastructure in the MEA region, which is also driving the demand for PCBs. Solar power, wind power, and other renewable energy sources are being increasingly adopted in the region to diversify energy sources and reduce dependency on fossil fuels. PCBs are critical in the production of electronic components used in renewable energy systems, such as solar inverters, wind power converters, and smart grid infrastructure, which are driving the demand for PCBs in MEA.

| Report Coverage | Details |

| Market Size in 2023 | USD 2.55 Billion |

| Market Size by 2032 | USD 3.60 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 3.9% |

| Base Year | 2022 |

| Forecast Period | 2023 To 2032 |

| Segments Covered | By Type, By Substrate, and By End-User |

Drivers:

Consumer electronics

Rising government initiatives

Many governments in the MEA region have been implementing various initiatives to support the growth of the PCB market. These initiatives include policies, regulations, and incentives aimed at attracting investments, promoting local manufacturing, and fostering innovation in the electronics industry. One of the key government initiatives in the MEA region is the establishment of industrial parks and free zones with favorable policies for electronics manufacturing. These industrial parks and free zones provide infrastructure, tax incentives, and other advantages to attract companies involved in PCB manufacturing and related electronic manufacturing activities.

For instance, countries such as the United Arab Emirates (UAE) and Saudi Arabia have established free zones with specialized facilities for electronics manufacturing, including PCB manufacturing, to attract foreign investment and promote local production. Another government initiative in the MEA region is the development of research and innovation centers focused on electronics manufacturing, including PCB technology.

These centers aim to promote research and development in PCB manufacturing processes, materials, and technologies, and provide support for local companies to develop new products and technologies. For example, research institutes, universities, and innovation hubs in countries like Israel and South Africa have been actively involved in PCB research and development, supported by government funding and initiatives.

Restraints:

Rising environmental concerns

Limited domestic PCB manufacturing capacity

Opportunity:

The increasing adoption of advanced technologies, such as 5G, the Internet of Things (IoT), and smart devices are anticipated to provide an opportunity for the PCB market. These technologies require sophisticated and high-performance PCBs to enable reliable and high-speed data communication, which presents a significant chance for PCB manufacturers in the region. Additionally, the automotive industry in the MEA region is also driving the demand for PCBs. Modern vehicles are becoming more electronic and connected, requiring advanced PCBs for various applications such as infotainment systems, advanced driver-assistance systems (ADAS), and electric vehicle components. The growing automotive production and sales in the MEA region are expected to boost the demand for PCBs in the automotive sector.

Impact of COVID-19:

The COVID-19 pandemic had mixed effects on worldwide industries. The supply chain was disrupted due to restrictions on migration and international trade. Additionally, the decrease in demand for flexible PCBs due to the cancellation of numerous cargos impacted the PCB market.

Furthermore, the widespread use of IoT technologies as well as HDI techniques has increased the emphasis on producing PCB components that support the stay-at-home initiative. The need for medical electronics like fog generators, ventilators, respiratory support systems, and monitors.

The Russia-Ukraine war hampered the worldwide recovery from the COVID-19 pandemic. The conflict between these two countries has resulted in economic sanctions against a number of countries, a rise in prices for commodities, and supply chain interruptions, generating inflation in goods and services and hurting numerous markets throughout the world.

On the basis of type, the double-sided printed circuit boards are anticipated to grow at the highest CAGR from 2023 to 2032. The growth of the segment is due to the wide utilization of double-sided PCBs in electronics and other applications. The double-sided PCBs consist of conducting layers that comprise dielectric layers on each side. These double-sided PCBs are mainly utilized by manufacturers for circuit boards that require a high degree of complexity. They serve as cost-effective alternatives. Vendors for double-sided PCBs are Ibiden, ATS, Nippon Mektron, Shinko Electric, Unimicron, and Sumitomo Electric.

Furthermore, the multi-layer PCB segment is anticipated to grow at the fastest CAGR from 2023 to 2032. The expansion is due to technological advancement in electronic design automation and electromagnetic shielding. The multi-layered PCBs are mainly utilized in the automotive sector such as audio systems and vehicle infotainment. They consist of three layers that include a double layer of PCBs with a conductive material in the middle. Multilayer PCBs are mainly used in medical and electronic equipment like GPS, computers, X-ray machines, handheld devices, heart monitors, etc.

The rigid PCB sector is anticipated to grow at the highest CAGR from 2023 to 2032. The demand for rigid PCB is due to its property to withstand high stress and temperature. They have high endurance against harsh chemicals, corrosive lubricants, and UV radiation. This led to their application in a wide range of products such as MRI systems, consumer electronics, EMG machines, and others. The demand is also growing due to the rising number of electronic industries using circuit boards that are of high quality, cost-effective and durable.

Rigid-flex circuits are expected to grow at a remarkable pace from 2023 to 2032. Rigid-flex circuits are the hybrid structure of flexible and rigid PCBs. The most common material used in rigid-flex circuits is polyimide. Polyimide is used for the flexible circuit portion and FR4 is used for the rigid portion.

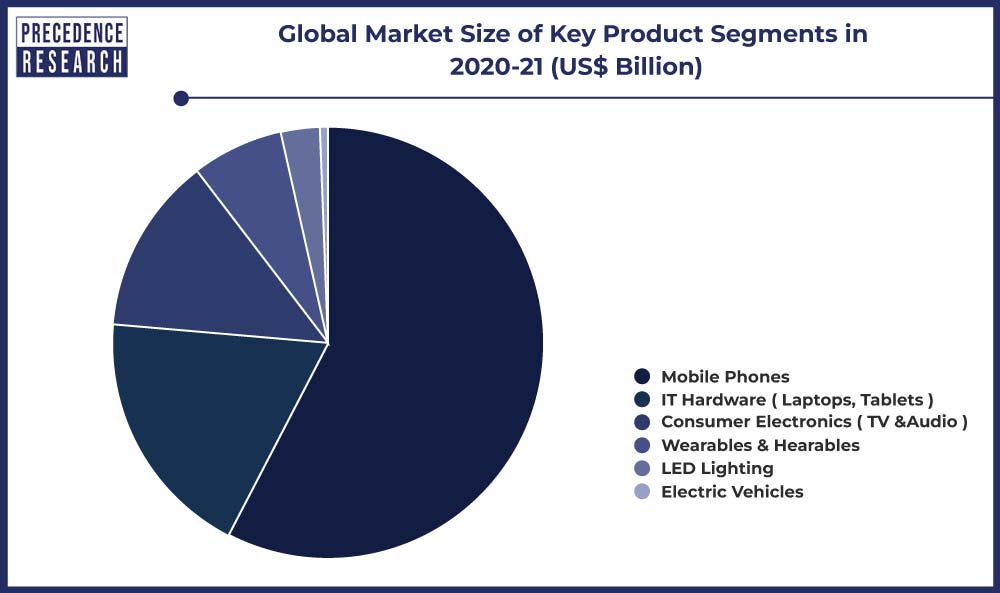

The consumer electronic sector is expected to grow at the highest CAGR from 2023 to 2032. Consumer electronics include smartphones, tablets, and wearable devices. The growth of the sector is due to the rapidly increasing living standards of the people in MEA as well as rising disposable income. The expansion is also due to the growing demand for wearables and smart devices. The changing consumer preferences for advanced electronic devices are driving the demand for consumer electronics in the region, which in turn is initiating a demand for PCBs.

The automotive sector is anticipated to grow at the fastest CAGR from 2023 to 2032. The automotive industry in MEA is witnessing significant growth as the automotive sector increasingly adopts electronic systems for safety, infotainment, and connectivity. The MEA region has seen a surge in automobile production, with many global automotive manufacturers setting up production facilities in the region to cater to the growing demand. This has resulted in an increased demand for PCBs for use in various automotive electronic applications.

Segments Covered in the Report:

By Type

By Substrate

By End-User

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

June 2024

December 2024