March 2025

Printed Circuit Board Market (By Product: Rigid PCBs, Standard multilayer, HDI/build-up/microtia, Flexible circuits, IC substrate, Others; By Substrate: Rigid, Flexible, Rigid-flex; By Laminate Materials: FR-4, FR-4 high Tg, FR-4 halogen free, Standard & Others, Flexible (PI,PET), Paper, Composites, Others; By Raw Material; By Application) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2033

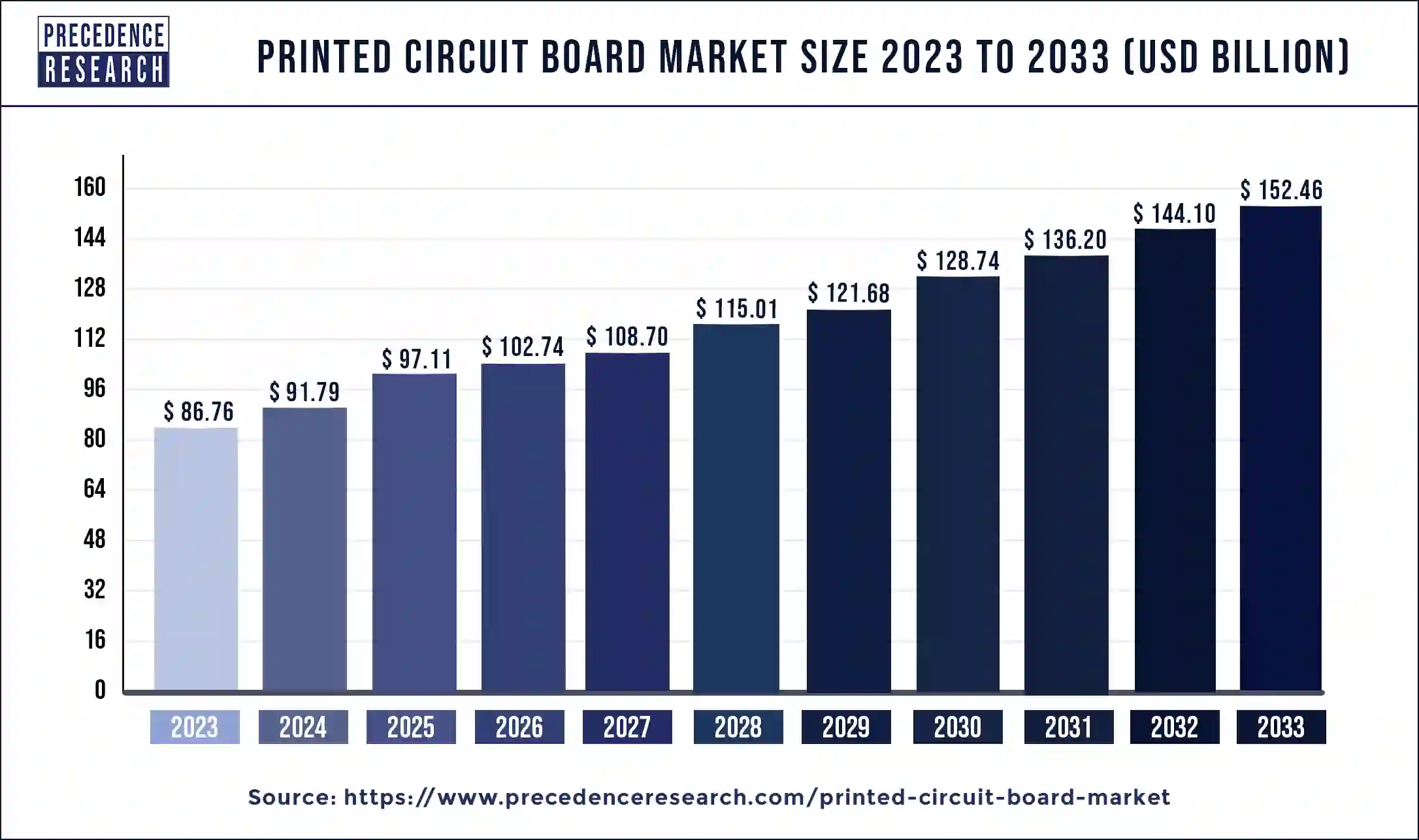

The global printed circuit board market size was USD 86.76 billion in 2023, accounted for USD 91.79 billion in 2024, and is expected to reach around USD 152.46 billion by 2033, expanding at a CAGR of 5.8% from 2024 to 2033. The PCB market is driven by increasing demand for electronic devices, technological advancements, increasing integration of electronic components in automotive industry, continuous expansion of telecommunication infrastructure globally, and stability and efficiency of the supply chain.

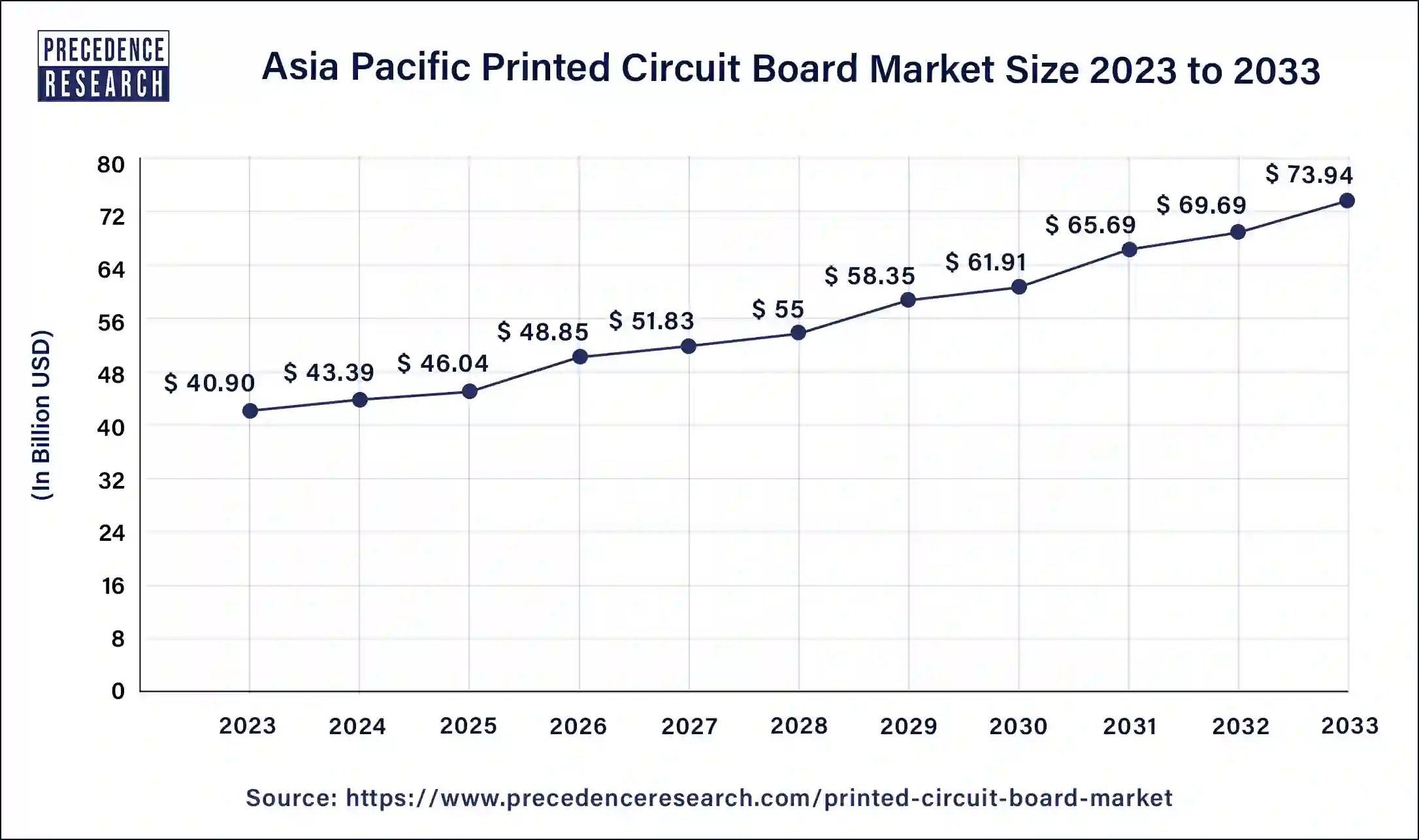

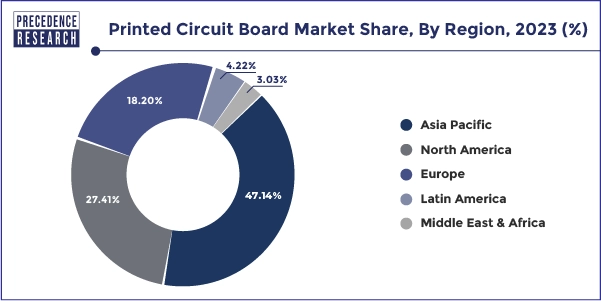

The Asia Pacific printed circuit board market size was estimated at USD 40.90 billion in 2023 and is predicted to be worth around USD 73.94 billion by 2033, at a CAGR of 6.1% from 2024 to 2033.

In the year 2023, Asia-Pacific is the dominating region in the printed circuit board market owing to the rising application of PCBs (printed circuit board) in the electronics devices and also due to existence of many semiconductor producers in APAC region. Moreover, the proliferation of PCBs (printed circuit board) market in this region is also due to growing acceptance of smart electronic gadgets in countries like China, India, Japan and others. Moreover, the rising internet penetration in developing countries like India is expected to offer immense growth opportunities for the printed circuit board market. APAC printed circuit boards are driving the growth of the market by increasing deployment in the 5G network in countries such as South Korea, China, and Japan.

The North American market is expected to be one of the fastest-growing regions in the printed circuit board market during the forecast period. This is attributable to the rising demand for electronic devices from the aerospace & defense sector. U.S. President has applied restrictions on manufacturers in the U.S. to source from domestic suppliers, hence, providing job opportunities in the country.

Market Overview

The printed circuit board (PCB) market is a vital component of the global electronics industry, serving as the foundation for electronic devices and systems. The foundational building block of most modern electronic devices is printed circuit boards or PCBs. Printed circuit boards are made up of printed pathways that link the board's various components, including integrated circuits, resistors, electrolytic capacitors, PLCs, transistors, and resistors, which also offer mechanical support. A printed wiring board or printed wiring cards are also known as PCB. Most frequently, materials like composite epoxy, fiberglass, or other composite materials are used to make them. The PCB is operated in numerous automobile applications, including battery control systems, engine timing systems, digital displays, audio systems, power relays, antilock brake systems, and many more.

Nowadays, the usage of printed circuit boards in the automotive sector has transformed how people drive. Printed circuit boards are becoming more necessary as additional accessories are requested by drivers and car owners. A printed circuit board for a car or truck needs to be extremely durable and dependable. Smart devices and rising customer demand for consumer electronics are the main drivers of industry expansion. Additionally, variables including rising consumer expenditure, rapid expansion in loT gadgets, increased electronic waste-related demand for eco-friendly PCBs, and expanding demand from emerging nations are the main driving factors for the growth of the PCBs market.

| Report Coverage | Details |

| Market Size in 2023 | USD 86.76 Billion |

| Market Size in 2024 | USD 91.79 Billion |

| Market Size by 2033 | USD 152.46 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 5.8% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | Product, Substrate, Laminate Materials, Raw Material, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The main important factor that is propelling the growth of the printed circuit board market is the growing demand for electronic gadgets such as smartphones laptops, smart televisions, and others all across the globe. These electronic devices are increasingly becoming a necessity for consumers all across the globe in this modern era. These electronic gadgets use printed circuit boards as automated machinery and cell tower.

Additionally, the rising global population coupled with the rising penetration of electronic devices across the world majorly in developing economies has led to a proliferation in the requirement for printed circuit boards in the industries like consumer electronics, automobiles, IT & telecom, and others. Moreover, aerospace & military, and other government institutions are also using electronic devices for various purposes which in turn is likely to bolster the demand for the growth of the market in terms of value sales. Furthermore, the rising application of advanced electronic devices in military & defense sectors all across the globe is anticipated to offer immense opportunities to propel the printed circuit board market growth during the forecast years.

Furthermore, advancements in technology in industrial automation, medical devices, and the growing adoption of modern electronic gadgets among consumers are some of the factors that are contributing to the increasing demand for printed circuit boards from various industries. The rising requirement for printed circuit boards in vehicles that allows drivers to link their smartphones with the vehicle in order to check the battery status, start climate control systems, unlock doors, and others, are some additional key factors propelling the growth of the market. Additionally, the market is witnessing positive growth in the printed circuit board market due to the increased potential for small, high-performance printed circuit boards, smart wearable, many portable electronics, medical devices, and light-weighted.

The rising demand for additive manufacturing in the electronics sector carries accurate components therefore, it aids drive the growth of the PCB market. Moreover, additive manufacturers have been taking initiative in designing printed circuit boards beyond the prototyping stages. Therefore, it aids in improving the performance as well as the functionality of the devices. Henceforth, the rising development in additive manufacturing as well as 3D printing, is accelerating the growth of the printed circuit boards market.

By product, the market is segmented into rigid PCBs, standard multilayer, HDI/build-up/microvia, flexible circuits, IC substrate, and others. The HDI /build-up/microvia segment is expected to be the fastest-growing segment during the forecast period. High density interconnect (HDI) PCBs has an excellent circuit density over traditional circuit boards and thus it is considered to be the most promising technology in the industry. High density interconnects (HDI) technology also enables manufacturers to deploy one or more elements on both sides of the raw printed circuit board by offering multiple alternatives. Therefore, the abovementioned facts have driven the growth of the overall market in terms of value sales.

The complex size of the rigid PCB is adopted in heavy-duty applications and complex circuit applications which included high voltage variation and high frequency. Moreover, a printed circuit board ensures its enhancement in industrial automation applications like automation machinery, robots, and pressure controllers which drive the growth of the market. The increasing industry progression or development in rigid printed circuit boards is due to the increasing trends of automated machinery and industrial robots in manufacturing plants.

Depending on the application, the consumer electronic segment holds the largest market share in the global market in the year 2023. PCBs (Printed circuit boards) are widely used in the electronic gadgets including calculators, smartphones, large circuit boards, smartwatches, and others. Growing advancement helps propels the printed circuit boards market but variability in raw material restraints market growth during the forecast period. In addition to this, these electronic gadgets are in high demand among the consumers especially the among millennials that plays a vital role in propelling the overall growth of the printed circuit board market in terms of value sales.

FR-4 high Tg segment holds the largest share of the printed circuit board market. A particular kind of flame-retardant material called FR-4 is frequently used to produce printed circuit boards (PCBs). "high Tg" refers to the "glass transition temperature," a crucial factor in assessing the material's thermal stability. High Tg FR-4 PCBs better tolerate higher temperatures than regular FR-4 materials. The glass transition temperature is the temperature at which a substance changes from a stiff, glassy condition to a softer, rubbery state. A greater Tg is preferable in PCBs since it denotes improved thermal stability and high-temperature performance.

High Tg materials can tolerate higher working temperatures without causing appreciable dimensional changes or electrical property degradation. This is important for automotive, industrial, or high-power electrical devices where the PCB may be subjected to high temperatures. High Tg FR-4 materials guarantee that the PCB can operate at its best under a range of temperature settings, which adds to the overall reliability of electronic equipment. This is particularly crucial for situations where frequent temperature changes occur.

Glass fabric segment holds the largest share of the printed circuit board market. One of the frequently utilized substrate materials in PCB production is glass fabric. It is renowned for having superior mechanical strength, dimensional stability, and electrical insulating qualities. Usually, glass cloth is impregnated with epoxy resin to form a laminate, which serves as the PCB's foundation material. Glass cloth is an excellent option for applications where electrical insulation is essential because of its high dielectric strength and low dissipation factor. Glass fabric gives the PCB good mechanical strength and stiffness. This is necessary to preserve the circuit board's structural integrity, particularly when the board might be subjected to mechanical stress.

Glass fabric ensures the dimensional stability of the PCB under various operating conditions, as it expands and contracts less than other materials with temperature changes. Its good thermal insulation properties are crucial for PCBs operating at high temperatures, helping to prevent deformation or failure in high-temperature situations. The flame-retardant nature of many glass fabric laminates used in PCBs adds an extra layer of safety to electronic devices. Glass fabric is often the material of choice for many applications due to its affordability compared to some alternatives.

Recent Developments

In August 2023, With characteristics that allow industrial-grade applications, IDEC Corporation announced launching its new printed circuit board (PCB) relays, the RC Series. The relays offer high-capacity power switching, are available in several low-profile variants, and function dependably in harsh conditions. According to the manufacturer, the RJxV Series PCB mount relays are upgraded and replaced by the RC Series.

In October 2023, Krypton Solutions, a Texas-based company, plans to invest USD 100 million (about Rs 832 crore) to establish a Printed Circuit Board production unit in Karnataka. Meanwhile, Texas Instruments, a semiconductor manufacturing giant, has reaffirmed its commitment to expanding research and development in the state. This was discovered during a meeting in the US between the company representatives and an official delegation headed by M B Patil, the Minister of Large and Medium-Sized Industries for Karnataka.

In January 2021, Orbotech, one of the key manufacturers of the printed circuit board has declared an R2R (roll to roll) manufacturing solution for the flexible PCBs that will elevate the mass production as well as the designing of modern electronic devices such as modern automobiles, advance medical gadgets, 5G smartphones, and others.

In 19 Oct 2021, Luminovo acquired PCB software provider Electronic Fellows to create next-generation software tools. This is a Wiesbaden-founded startup of Electronic Partners rising the growth of existing processes as well as creating new opportunities of interconnectedness for the electronics industry.

In March 2020, Zhen Ding Technology Holding Ltd was acquired by Boardtek Electronics Corporation by Share-swap. Boardtek Electronics Corporation would become the exclusively kept secondary of Zhen Ding. Boardtek Electronics Corporation is involved in research and, development sales of the multilayer printed circuit boards, a production that mainly focuses on high-frequency microwave, high-performance computing as well as higher efficiency of thermal dissipation.

In Feb 2020, TTM Technologies Inc. declared Advanced Technology Center in Chippewa Falls. The Advanced Technology Center in Chippewa Fall Wisconsin strengthened the 40,000 sq. ft. facility which is situated at 850 Technology Way. Advanced Technology Center offers the most advanced printed circuit board manufacturing solutions with the capability to manufacture substrate-like printed circuit boards offered in North America.

Segments Covered In The Report

By Product

By Substrate

By Laminate Materials

By Raw Material

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

January 2025

December 2024

April 2023