January 2025

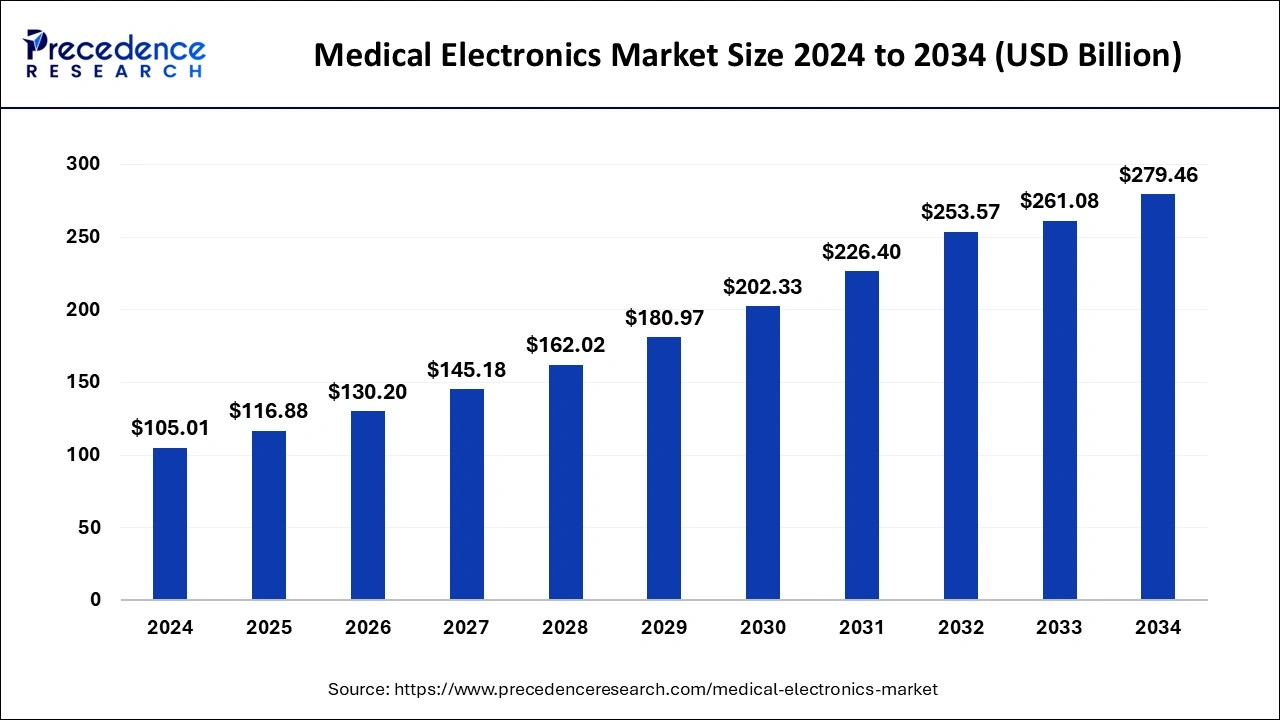

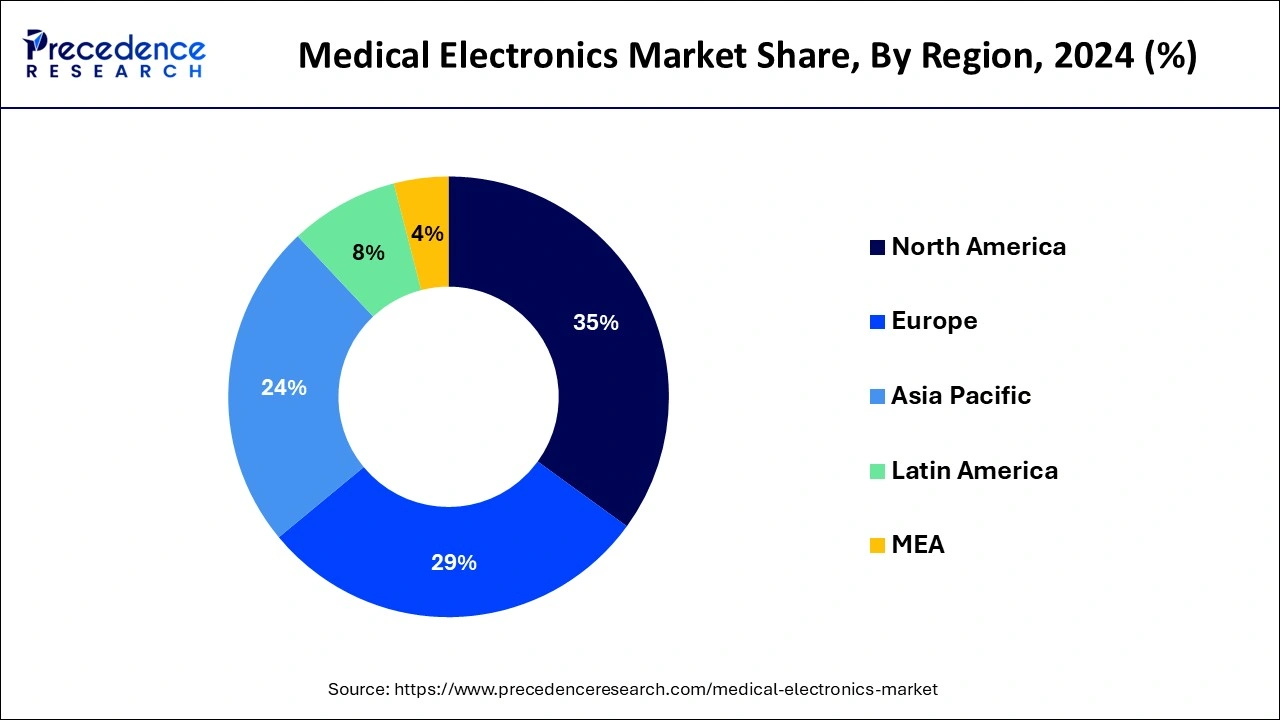

The global medical electronics market size is calculated at USD 116.88 billion in 2025 and is forecasted to reach around USD 279.46 billion by 2034, accelerating at a CAGR of 10.28% from 2025 to 2034. The North America medical electronics market size surpassed USD 36.75 billion in 2024 and is expanding at a CAGR of 10.34% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical electronics market size was accounted for USD 105.01 billion in 2024 and is anticipated to reach around USD 279.46 billion by 2034, growing at a CAGR of 10.28% from 2025 to 2034.

Integrating AI into medical devices has reorganized healthcare by improving precision and efficiency. Advancements in algorithms and machine learning permit the monitoring of medical information, such as images, with unmatched accuracy. This, paired with automation, raises efficiency and removes the possibility of error.

AI is used in hospitals and other healthcare facilities to offer an efficient patient experience while making room to treat more patients daily. Some AI platforms target automating and prioritizing patient safety. These platforms can aid hospitals in better managing operational costs by tracking wait times and declining inpatient and emergency department length of stay.

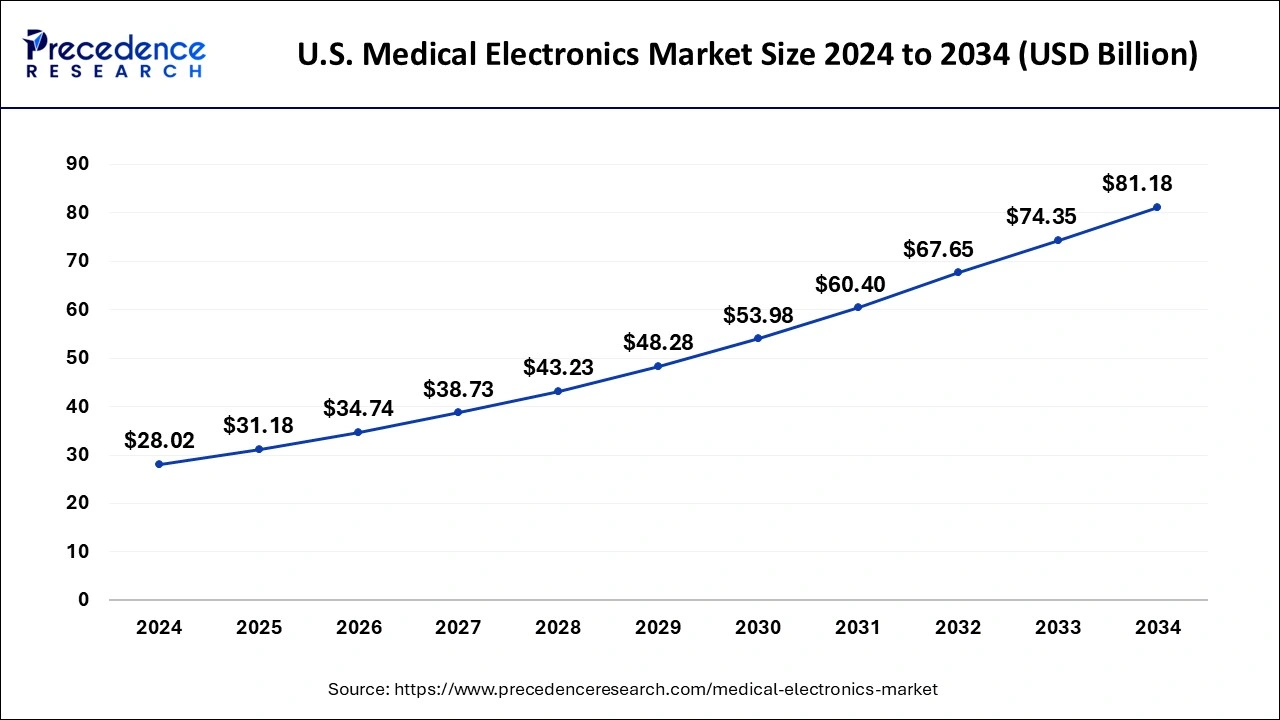

The U.S. medical electronics market size was evaluated at USD 28.02 billion in 2024 and is predicted to be worth around USD 81.18 billion by 2034, rising at a CAGR of 11.22% from 2025 to 2034.

North America accounted for around 45% of the market share in 2022. The high disposable income, higher adoption of the electronic devices in healthcare industry, high healthcare expenditure, and improved access to healthcare facilities are the major factors that augmented the growth of the North America medical electronics market. The rising government and corporate investments in the development of the smart hospitals and efficient healthcare services is fueling the demand for the various medical electronics in the region.

United States

On the other hand, Asia Pacific is estimated to be the most opportunistic segment during the forecast period. The rapidly growing geriatric population is expected to boost the demand for the advanced medical electronics in the forthcoming years. According to the World Health Organization, 80% of the geriatric population in the globe will be living in the low and middle-income countries by 2050. The countries like South Korea, China, and India are attracting FDIs of the healthcare industry players and the rising government investments in the development of the smart and technologically advanced healthcare infrastructure is fueling the growth of the medical electronics market in Asia Pacific region.

India

The global medical electronics market is primarily driven by the rising prevalence of various chronic diseases and growing geriatric population across the globe. The chronic diseases such as diabetes, cancer, cardiovascular diseases, and COPD are the major factors responsible for the increasing adoption of the medical electronics. According to the United Nations, the global geriatric population was estimated at around 382 million (aged 60 years and above) in 2017 and this number is projected to reach at 2.1 billion by 2050. The geriatric people are more prone to the various chronic diseases and hence boosts the demand for various diagnostics and therapeutics medical electronic devices such as CT scanner, ultrasound, patient monitoring systems, medical implantable devices, pacemakers, and respiratory care devices. Furthermore, the rising number of ICU admissions is fueling the growth of the global medical electronics market. According to the Society of Critical Care Medicine, almost 40 to 50% of the ICU admissions require ventilators, which fosters the growth of the medical electronics. The availability of wider range of diagnostic and therapeutic devices coupled with the rising government and corporate investments to equip the hospitals with digital and electronic equipment across the globe is a significant growth driver of the market.

The surging uses of the diagnostic devices such as ultrasound equipment, CT scanners, and X-Rays in the diagnosis of various diseases and bones related issues has significantly driven the market growth in the past. Moreover, the rising investments in the research has led to the integration of the latest technologies like artificial intelligence (AI) with the various medical electronics. The technological advancements helps the healthcare units to offer enhanced patient care services and increases the patients conveniences and results in improved customer experiences in any healthcare setting. The rising demand for the early detection and treatment of the disease among the population and rising popularity of the minimal-invasive surgeries is propelling the demand for the various medical electronics across the globe that fosters the growth of the medical electronics market.

| Report Coverage | Details |

| Market Size in 2025 | USD 116.88 Billion |

| Market Size by 2034 | USD 279.46 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 10.28% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The therapeutics segment dominated the global medical electronics market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. This is attributed to the extensive demand for the therapeutic devices such as medical implantable devices, pacemakers, surgical robots, and respiratory care devices. The surging prevalence of the cardiovascular diseases, neurological disorders, and chronic respiratory diseases is expected to further fuel the growth of the therapeutics segment during the forecast period. According to the World Health Organization, cardiovascular diseases are among the top causes of deaths that accounts for around 32% of the global deaths.

On the other hand, the diagnostics segment is estimated to be the most opportunistic segment during the forecast period. The rising awareness amongst the population regarding the benefits of the early detection of the diseases is augmenting the growth of this segment. The rising penetration of the diagnostic centers and hospitals coupled with the rising prevalence of various diseases is expected to drive the demand for the diagnostic medical electronics such as ultrasound equipment, X-Rays, and MRI scanners.

The hospitals segment contributed the highest market share of 45% in 2024. The rising number of hospital admissions owing to various factors like growing incidences of CVDs, neurological disorders, growing incidences of road traffic accidents, and rising geriatric population. The increasing investments in the development of multi-specialty hospitals and equipping them with advanced medical equipment is a major factor that has significantly boosted the growth of the hospitals in the medical electronics market.

On the other hand, the homecare is expected to be the fastest-growing segment during the forecast period. The rising disposable income, rising healthcare expenditure, and increasing awareness regarding the hospital acquired infections is resulting in an increased adoption of the homecare healthcare services. The rising demand for receiving healthcare services at the comfort of the home is significantly augmenting the demand for the homecare medical electronics across the globe.

By Product

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025