January 2025

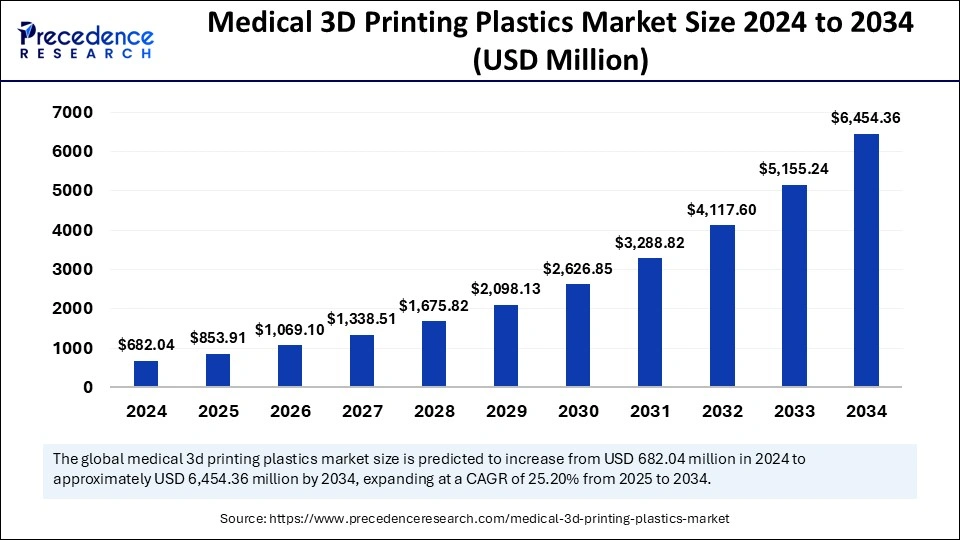

The global medical 3D printing plastics market size is calculated at USD 853.91 Million in 2025 and is forecasted to reach around USD 6,454.36 Million by 2034, accelerating at a CAGR of 25.20% from 2025 to 2034. The North America market size surpassed USD 306.92 Million in 2024 and is expanding at a CAGR of 25.33% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical 3D printing plastics market size accounted for USD 682.04 Million in 2024 and is predicted to increase from USD 853.91 million in 2025 to approximately USD 6,454.36 million by 2034, expanding at a CAGR of 25.20% from 2025 to 2034. The market growth is attributed to the increasing demand for personalized healthcare solutions and the advancements in 3D printing technologies that enable the production of custom medical devices and implants.

Artificial Intelligence algorithms interpret individual patient data to produce highly specialized implants and prosthetics. Machine learning algorithms forecast how materials perform, which allows practitioners to pick stable and biocompatible polymers suitable for medical use. AI-powered automated quality control systems identify defects in printed structures so that medical facilities reduce product errors and reduce waste. AI uses computational simulations to enhance research output by evaluating material characteristics and printing controls to speed up the development process.

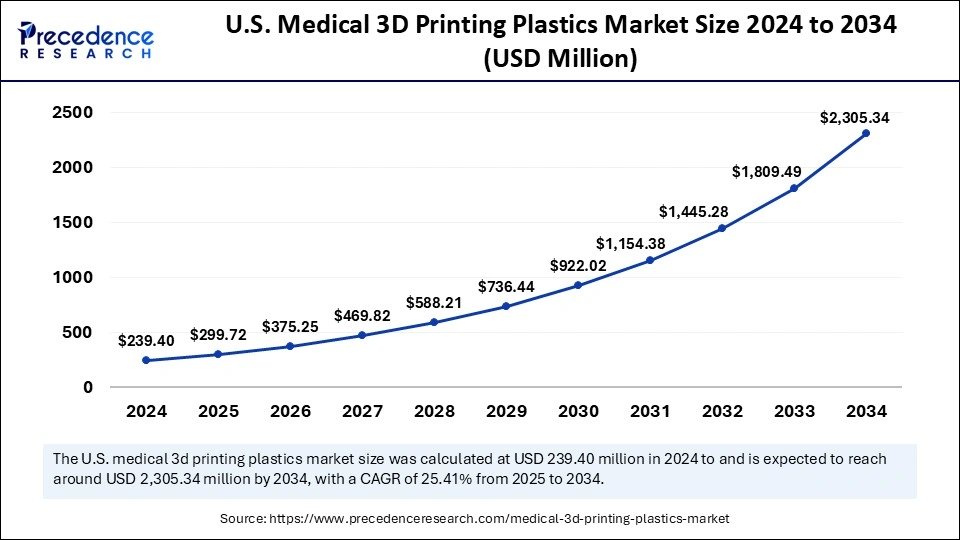

The U.S. medical 3D printing plastics market size was exhibited at USD 239.40 million in 2024 and is projected to be worth around USD 2,305.34 million by 2034, growing at a CAGR of 25.41% from 2025 to 2034.

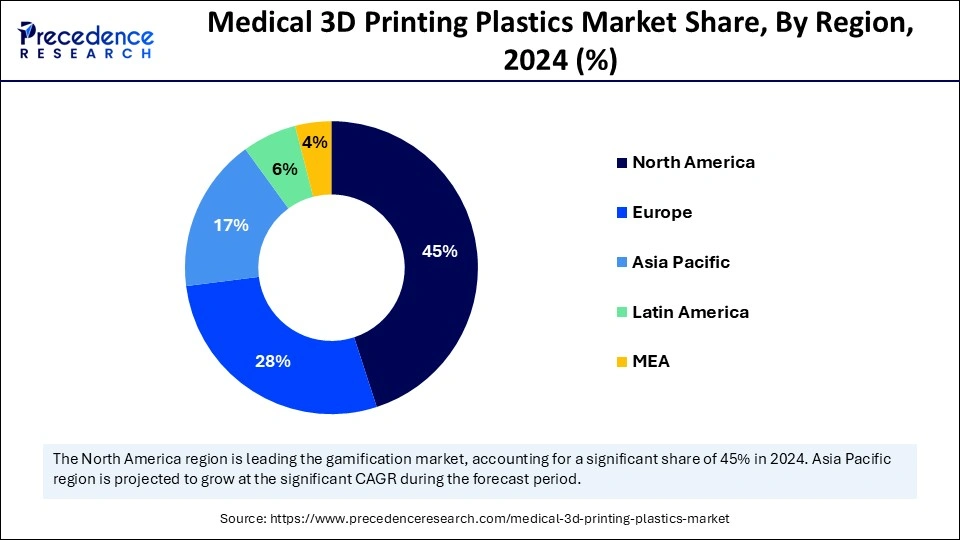

North America led the medical 3D printing plastics market by capturing the largest share in 2024. The regional market growth is driven by its well-established healthcare systems, supported by the U.S. Food and Drug Administration (FDA) guidelines and extensive research investments. There is a high demand for customized medical devices, with the expanding application of 3D printing methods in implant and prosthetic creation. Medical 3D printing technology receives substantial government funding in the U.S. and Canada, as these nations are at the forefront of medical innovations, leading to the development of cutting-edge medical devices.

Asia Pacific is expected to witness the fastest growth during the forecast period. The medical 3D printing plastics market expansion in the region stems from rising government investments in improving healthcare infrastructure and the increasing adoption of additive manufacturing, especially in countries like India and China. There is a high demand for personalized medical solutions among patients to fulfill their needs. The Made in China 2025 plan launched by the Chinese government in 2024 has made 3D printing technology one of its essential sectors for future development. Furthermore, the expanding patient populations and the increasing adoption of medical devices support regional market growth.

Europe is considered to be a significantly growing area. The medical 3D printing plastics market in Europe continues to expand because of stringent quality standards and safety regulations supporting medical device production. The German government often dedicates substantial funds to R&D activities as they advance 3D printing methods. Germany dedicates major healthcare funding toward 3D printing technology advancement to enhance the precision and quality standards of medical equipment. A strong emphasis on sustainable practices further boosts the demand for biodegradable materials for 3D printing. Moreover, the rising funding and approvals for 3D-printed medical devices contribute to market growth.

The medical 3D printing plastics market is expanding due to the rising patient requirements for customized healthcare services. This technology generates custom medical devices and implants, which improves surgical outcomes with shorter recovery times. 3D printing technologies use Fused Deposition Modelling (FDM) and Selective Laser Sintering (SLS) systems to precisely control medical components' material properties and geometric shapes suitable for implant and prosthetic and surgical guide applications. PEEK and PLA polymer materials are extensively used in medical applications due to their superior properties and compatibility, extending product lifespan.

The growing aging population further supports market expansion. WHO highlighted in 2024 that healthcare solutions requiring customization had become essential for areas with the largest older population, particularly in Europe and Asia Pacific, as these regions actively adopted innovative 3D printing developments.

| Report Coverage | Details |

| Market Size by 2034 | USD 6,454.36 Million |

| Market Size in 2025 | USD 853.91 Million |

| Market Size in 2024 | USD 682.04 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 25.20% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Form, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing Demand for Patient-Specific Implants

Increasing demand for patient-specific implants is expected to drive the growth of the medical 3D printing plastics market in the coming years. Medical professionals prefer patient-specific implants due to their improved anatomical match between implant and patient, which leads to enhanced healing results and shorter recovery times. Advanced polymers serve as the foundation for making biocompatible, lightweight, and durable implant products. The VSP PEEK Cranial Implant obtained its FDA 510(k) clearance from 3D Systems in April 2024 to become the first 3D-printed patient-specific PEEK implant intended for cranioplasty procedures.

There is an increasing acceptance of 3D-printed implants. In 2024, more than 60 successful cranioplasty surgeries were completed using 3D-printed PEEK implants across global institutions, which included University Hospital Basel in Switzerland and Salzburg University Hospital in Austria. Furthermore, hospitals and research institutions continue to adopt 3D printing technologies for challenging surgical situations, thus fueling market growth.

High Material Costs

High material costs are anticipated to limit the widespread adoption of medical 3D printing plastics, hindering the growth of the market. Advanced polymers, PEEK, and PCL require complicated manufacturing methods, which drive their manufacturing costs beyond typical medical-grade plastic products. Current limitations in manufacturing scale reduce the availability of materials, creating issues in supply chains. The approval process has become expensive for manufacturers, requiring thorough biocompatibility and sterilization tests according to regulatory standards. Furthermore, limited accessibility to customized 3D-printed implants and prosthetics restrains the market, especially in developing regions.

Rising Investments in Point-of-Care 3D Printing Facilities

Rising investments in point-of-care 3D printing facilities are likely to create immense opportunities for key players competing in the medical 3D printing plastics market. Economic investments in medical 3D printing facilities at critical care points create major expansion pathways within the plastic segment of medical 3D printing. Medical institutions and specialty clinics develop their own 3D printing labs, which produce personalized medical devices that reduce their dependence on centralized manufacturing and shorten critical procedure preparation times.

The implementation of decentralized 3D printing gets support from regulatory agencies by promoting quality assurance systems for hospital-made products. Furthermore, advancements in portable automated 3D printers are expected to propel market growth during the projection period.

The photopolymers segment dominated the medical 3D printing plastics market with the largest share in 2024. This is mainly due to their ability to improve medical devices’ design, making them suitable for dental and orthopedic uses. Photopolymers change their state from liquid to solid through ultraviolet light illumination and enable the fabrication of essential complex structures used in customized implants and surgical instruments. Furthermore, surgical guides based on photopolymer materials have gained prominence in the market, with minimally invasive approaches becoming prevalent in medical procedures.

The PEEK segment is expected to grow at the fastest rate during the forecast period. Polyether ether ketone (PEEK) has the ability to resist thermal and chemical degradation. PEEK material also exhibits a high strength-to-weight ratio and biocompatibility properties, making it suitable for use in spinal cages, orthopedic joints, and dental prosthetics that must be durable. Moreover, ongoing research and development activities to reduce production expenses while expanding PEEK applications position this material at the center of the medical 3D printing plastics industry.

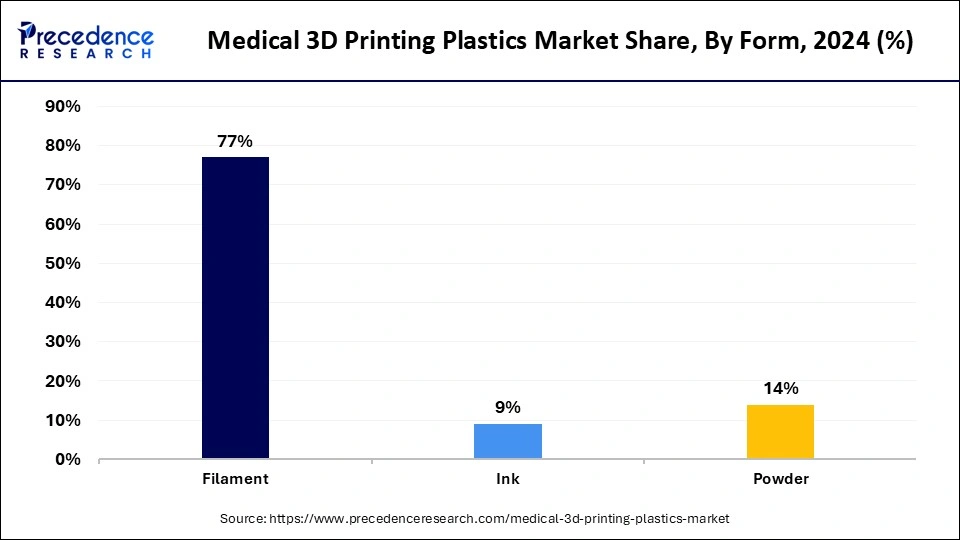

The filament segment held the largest share of the medical 3D printing plastics market in 2024. The segment growth is driven by the heightened need for medical devices and customized implants. The versatility of filaments makes them suitable for manufacturing customized medical devices such as implants and prosthetics. Advances in material formulation techniques have improved the performance characteristics and tissue-friendly qualities of filaments, further expanding their scope of applications. Furthermore, the fused deposition modeling (FDM) technology adoption in medical applications continues to maintain the filament segment’s position in the market.

The powder segment is anticipated to grow at the highest CAGR during the studied years. The advancement in precise, selective laser sintering (SLS) based powder technologies supports segmental growth, as they enable exact control over the material density and material properties, which are crucial in medical applications. The rising focus on personalized medicine and modern manufacturing drives the demand for powders, as they enable precise medical device and implant production. Furthermore, the FDA explains that medical device 3D printing uses powder bed fusion as its primary method since it supports manufacturing medical products with plastic and metal components.

By Type

By Form

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025