January 2025

Dental Prosthetics Market (By Type: Fixed Dental Prosthetics, Removable Dental Prosthetic; By Material Type: Ceramics, Cement, Composites; By End-user: Dental Hospital & Clinics, Dental Laboratories, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

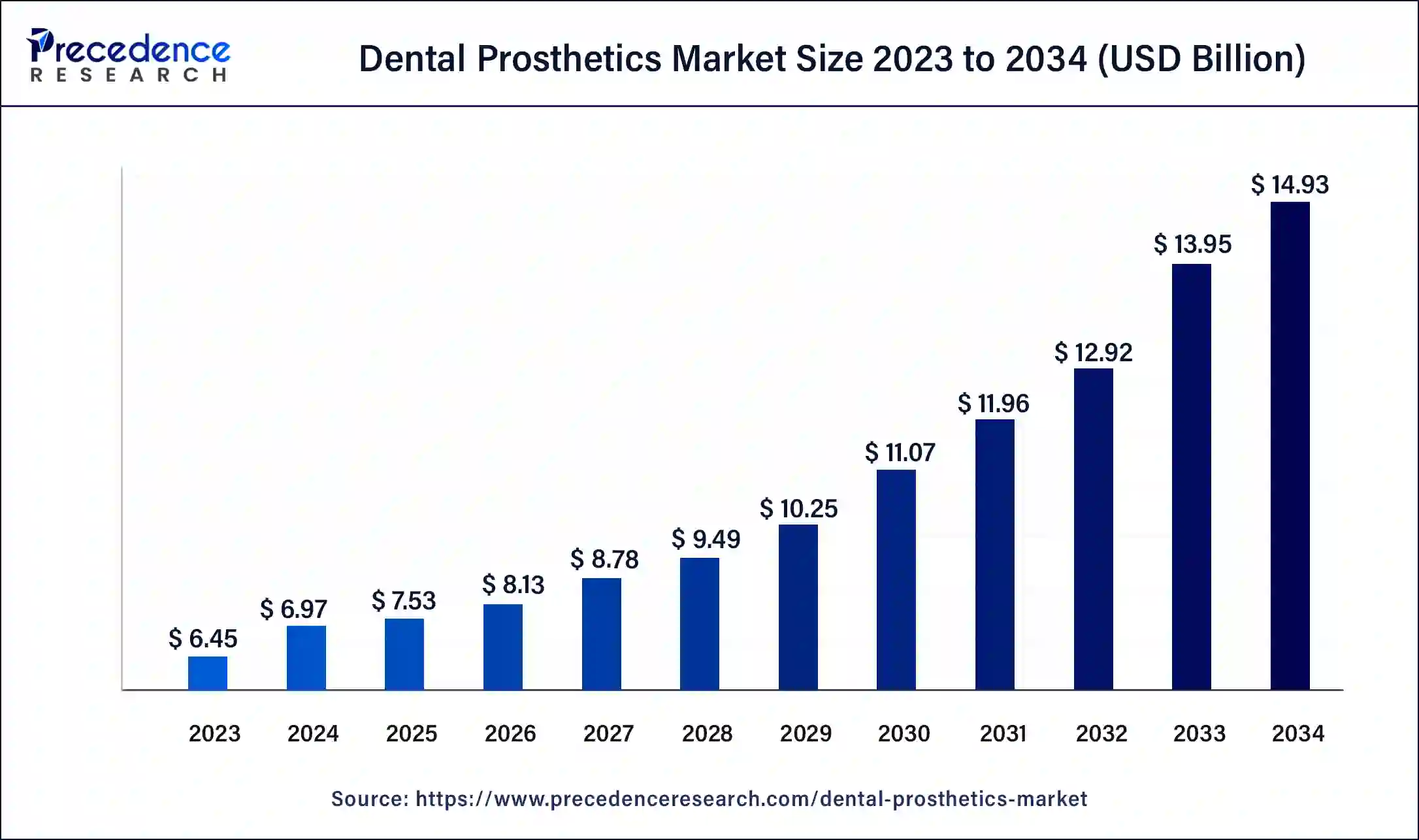

The global dental prosthetics market size was USD 6.45 billion in 2023, calculated at USD 6.97 billion in 2024 and is expected to reach around USD 14.93 billion by 2034, expanding at a CAGR of 7.9% from 2024 to 2034. The dental prosthetics market size reached USD 2.19 billion in 2023. An increasing number of people are seeking dental procedures, including prosthetics, to enhance their general well-being as a result of growing knowledge of oral health and the value of dental care.

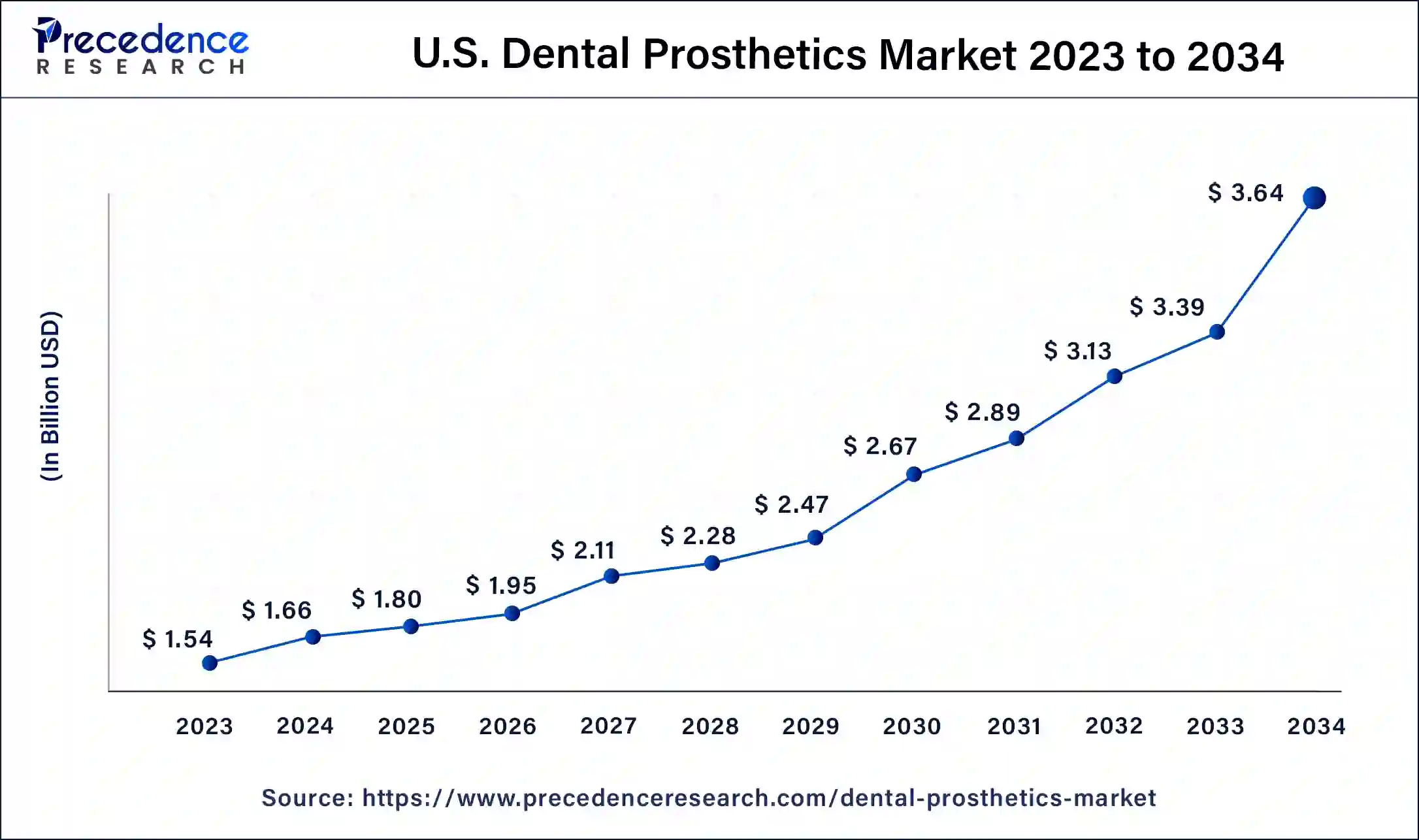

The U.S. dental prosthetics market size reached USD 1.54 billion in 2023 and is expected to be worth around USD 3.64 billion by 2033 at a CAGR of 8.14% from 2024 to 2034.

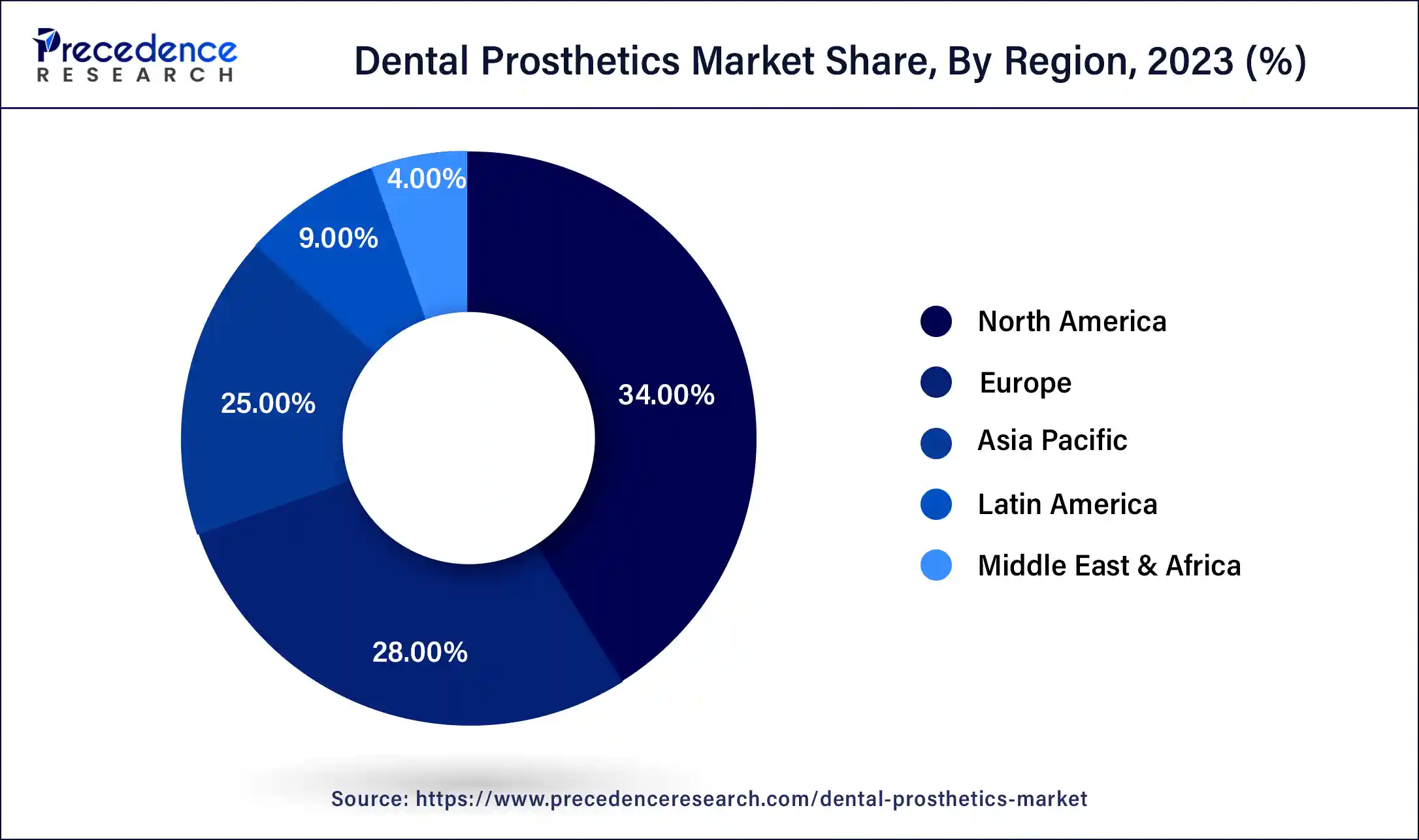

North America held the largest share of the global dental prosthetics market in 2023 and is expected to continue doing so during the forecast period. Numerous cutting-edge dental technology companies that are constantly developing new materials, manufacturing processes, and digital dentistry solutions are based in Europe. More accurate, long-lasting, and aesthetically beautiful dental prostheses are the result of these developments. Dental problems such as tooth decay, gum disease, and tooth loss are still common, particularly in the elderly population. This creates a demand for dentures, bridges, and implants, among other dental prosthetic treatments.

North America's dental prosthetics market is governed by stringent laws that guarantee the goods' effectiveness and safety. It is imperative that manufacturers and suppliers operating in this industry adhere to CE marking regulations as well as other criteria.

Asia Pacific is also expected to grow rapidly during the forecast period. This development is attributed to a number of factors, including a growing elderly population, rising disposable income, greater awareness of oral health, and advancements in dental technology. Key nations that have contributed significantly to the expansion of the dental prosthetics market in the Asia Pacific area are China, Japan, India and South Korea.

As oral problems are becoming more common in these nations and because aesthetic dental operations are becoming more and more important, there is a growing demand for dental prostheses. Furthermore, the dental prosthetics market has undergone a revolution thanks to developments in dental materials and technology, including digital imaging, 3D printing, and CAD/CAM (computer-aided design/computer-aided manufacturing) systems.

As the world's population ages, dental conditions such as tooth decay, gum disease, and tooth loss are more common, which raises the need for dental prostheses. Dental prostheses are now more comfortable, aesthetically pleasing, and long-lasting because of technological developments in dental materials and production techniques. Dental restorations are now more precisely and effectively designed and fabricated because of innovations like CAD/CAM technology. The demand for cosmetic dental operations, such as dental prostheses, has increased due to growing awareness of oral health and the significance of dental aesthetics. Spending money on procedures to improve their smiles and overall oral look is becoming increasingly common.

Globally, there has been an increase in dental problems due to changes in lifestyle, including tobacco use and bad eating habits. In order to restore oral function and aesthetics, there has been an increased demand for dental prostheses. Growing disposable income levels and economic development in emerging economies have made dental procedures, particularly prosthetic restorations, more accessible to a wider range of people. In developed nations, strict regulations and standards guarantee the quality and safety of dental prostheses, but they can also make it difficult for new manufacturers to enter the market particularly smaller ones. The COVID-19 pandemic first caused lockdowns and limits on elective surgeries, which resulted in a backlog in dental prosthesis treatments. However, the dental prosthetics market steadily rebounded as dental clinics reopened with safety procedures in place.

| Report Coverage | Details |

| Global Market Size by 2034 | USD 14.93 Billion |

| Global Market Size in 2023 | USD 6.45 Billion |

| Global Market Size in 2024 | USD 6.97 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.9% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Type, By Material Type, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Demand for aesthetic dentistry

Individuals are becoming more aware of how they look and how much a lovely smile may improve one's entire appearance. They are, therefore, looking for cosmetic dentistry procedures to make their smiles look better. Dental prostheses are becoming more and more necessary as the population ages in order to replace lost or broken teeth. However, unlike in the past, when the elderly population's main priority was practicality, modern prosthetics must also seem natural and attractive. In the dental prosthetics market, the development of more realistic prostheses that closely mimic real teeth are the result of advancements in dental materials. When compared to traditional choices, materials like porcelain and zirconia give superior aesthetic results and are incredibly durable.

Dental anxiety and fear

Dental dread and anxiety have a big role in the dental prosthetics market. A lot of people get scared or anxious when they go to the dentist, especially when it comes to dental prostheses like crowns, bridges, or dentures. Anxiety can have several causes, such as a general apprehension about dental operations, a dread of pain, or unpleasant memories from the past. Furthermore, digital dentistry's technology breakthroughs have made prosthetic production processes more accurate and productive. Computer-aided design and manufacturing (CAD/CAM) techniques facilitate the production of highly precise and personalized dental prostheses with minimal discomfort to the patient.

Increasing dental awareness

In the dental prosthetics market, educational programs are launched to inform dentists on the most recent developments in dental prostheses, including novel materials, technology, and methods. Workshops, seminars, and online courses could be a part of this. Working along with dentistry schools to include dental prosthesis courses in their curricula. This guarantees that aspiring dentists have a thorough understanding of the options accessible to their patients. Providing dental technicians and dentists with professional development opportunities to advance their knowledge in the field of dental prostheses. Programs for certification and practical training may fall under this category. Organizing conferences and continuing education programs centered on developments in dental prostheses. These gatherings can provide forums for information exchange, networking, and presenting the most recent advancements in the industry.

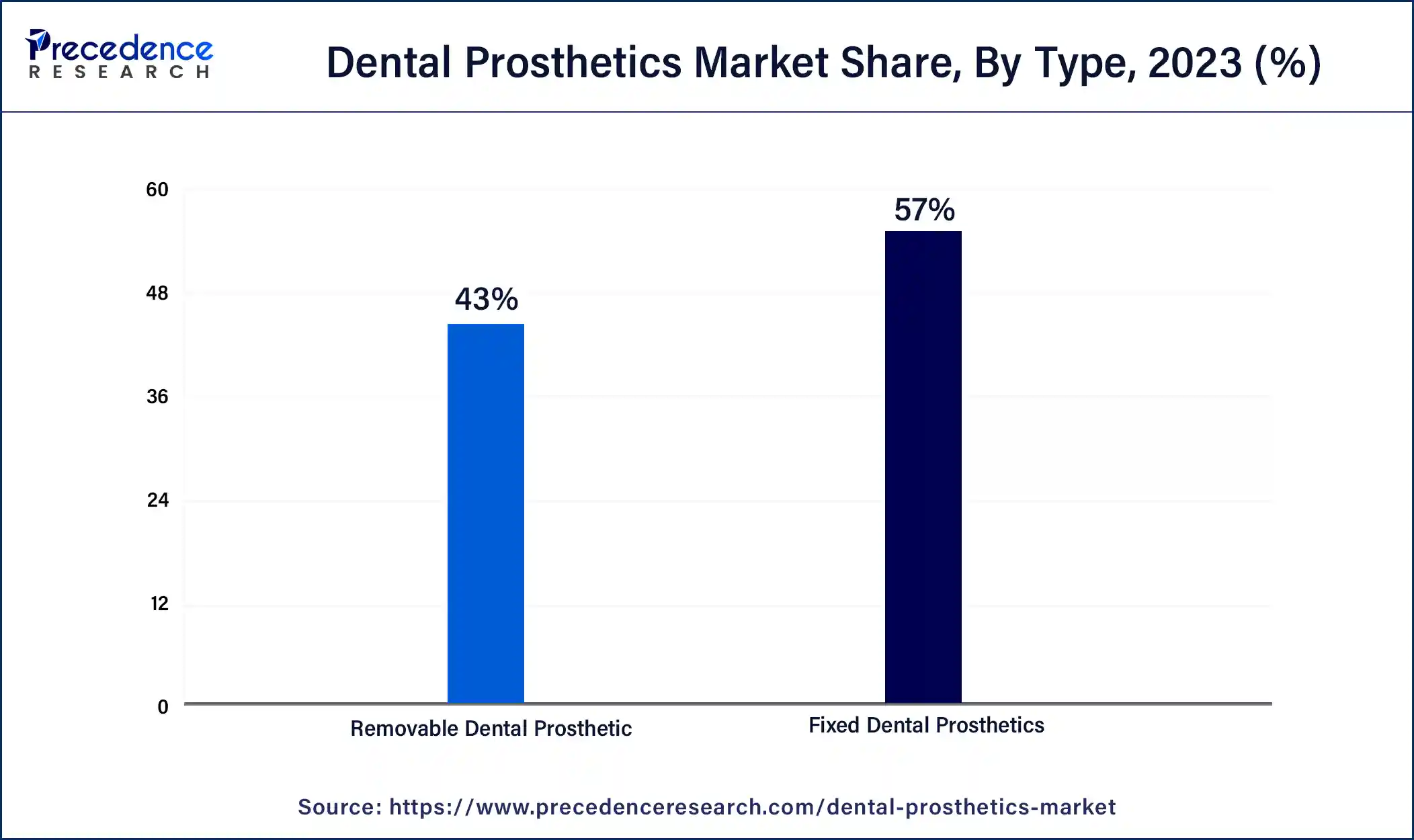

The fixed dental prosthetic segment held the largest share of the dental prosthetic market in 2023. Under the segment, the crowns sub-segment held the largest share of the dental prosthetics market and is expected to hold this position during the forecast period. These crowns blend the organic look of porcelain with the durability of metal. They are strong and resilient to chewing and biting pressures. However, occasionally, the metal behind the porcelain can be seen as a black line close to the gum line, which can be very unappealing.

These crowns are completely composed of ceramic material, which imitates the translucency of natural teeth, making them aesthetically pleasing. They are a well-liked option for restorations of front teeth. All ceramic crowns can be used by people who are allergic to metals and are biocompatible. One kind of ceramic material that is renowned for its sturdiness and strength is zirconia. Zirconia crowns are a good option for front and back tooth restoration because of their strength and outstanding looks.

The removable dental prosthetic segment is observed to grow at a significant rate during the forecast period. The denture sub-segment is expected to obtain a significant share under this segment. When all of the teeth in the upper or lower jaw, or both, are absent, these are utilized. They are usually detachable and replace all the teeth. Dental implants that have been surgically inserted into the mandible hold these dentures in place. Compared to conventional removable dentures, they provide more stability and stop bone loss. These are inserted right away following the extraction of the natural teeth. Throughout the healing process, they assist the patient in continuing to speak and look normally. However, when the gums shrink and heal, modifications can be required. Similar to dentures supported by implants, overdentures can also be supported by the natural teeth that are still present. Compared to conventional detachable dentures, they offer more stability and support.

The ceramics segment held a significant share of the market. Ceramics as a material, is widely used for prosthetic dentistry owing to their clinical properties and high strength. In addition, biocompatibility and good combination of chemical stability often acts as a notable factor for the application of ceramics. The rising rate of dental restoration, especially in younger people, is observed to promote the expansion of the segment. Moreover, the rising demand for aesthetically pleasing dental prosthetic products is expected to support the segment’s growth.

The dental hospital & clinics segment held the largest share of the dental prosthetics market in 2023 and is expected to maintain its dominance during the forecast period. Mayo Clinic, which is renowned for providing comprehensive healthcare, probably provides cutting-edge dental prosthesis procedures in addition to its other medical disciplines. Dental prosthesis services are offered by affiliated hospitals or clinics at several colleges that house dental schools. ClearChoice is a prominent player in the dental prosthetics market because of its expertise in full mouth restoration and dental implants.

Prosthetic dentistry is one of the many dental services provided by the extensive nationwide network of Aspen Dental clinics. This business primarily serves a portion of the market looking for reasonably priced prosthetic treatments by offering dentures and dental implants. Prosthetic dentistry services are provided by countless private dental clinics and practices across the globe, ranging from solo practices to larger group practices.

In the dental prosthetics market, the dental laboratories segment is expected to show significant growth during the forecast period. Dental laboratories that specialize in producing prosthetic devices such as crowns, bridges, dentures, and implants make up the dental prosthetics market. For individuals in need of restorative or cosmetic dental procedures, these labs are an essential source of dental solutions. This business is well-known for its cutting-edge dental technology and provides a wide variety of prosthetic tooth options. Offers a wide range of dental prosthetic options, including crowns, bridges, and implants, and specializes in implantology. Offering a wide range of dental prosthesis products and services, this dental laboratory is among the biggest in the world.

Segment Covered in the Report

By Type

By Material Type

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

October 2023

October 2023