January 2025

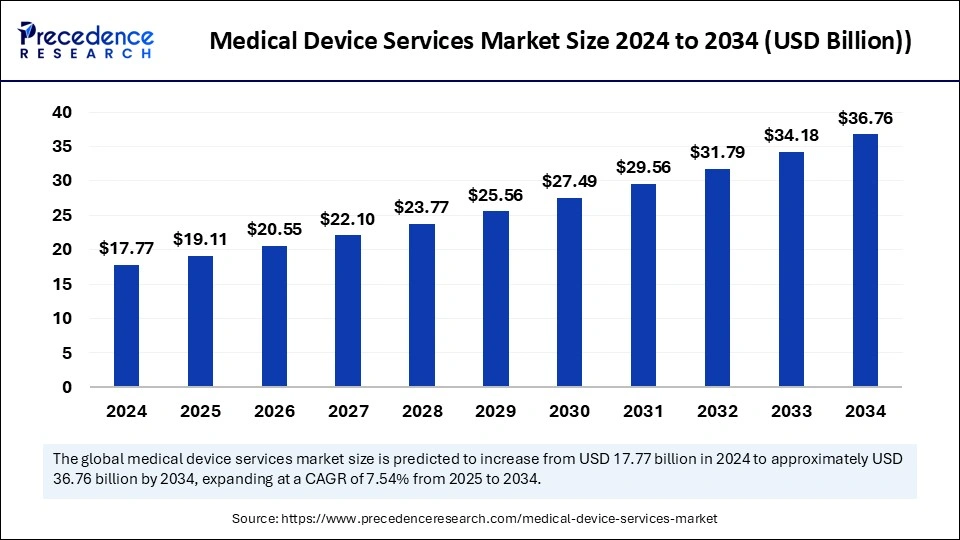

The global medical device services market size is evaluated at USD 19.11 billion in 2025 and is forecasted to hit around USD 36.76 billion by 2034, growing at a CAGR of 7.54% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical device services market size was calculated at USD 17.77 billion in 2024 and is predicted to increase from USD 19.11 billion in 2025 to approximately USD 36.76 billion by 2034, expanding at a CAGR of 7.54% from 2025 to 2034. The market shows rapid growth due to technological progress and a customer need for advanced healthcare solutions of high quality.

The medical device services market utilizes Artificial Intelligence technologies to boost medical device functionalities while improving accuracy levels. The use of AI-powered imaging systems enables medical personnel to achieve better diagnosis results while speeding up the analysis of X-rays, Computed Tomography Scan

scans, and magnetic resonance imaging, thus enabling disease detection at an earlier stage. The AI developments will embed the technology into medical devices to boost operational performance and lower diagnostic mistakes while improving accuracy, thus expanding the market.

The medical device services market evidenced rapid growth owing to technological developments, including telehealth, and the increasing significance of wearable health devices and patient-centered care. The growth number of patients with chronic illness including cancer, diabetes, and cardiovascular diseases. As healthcare progress demands better, sophisticated medical devices, the medical sector faces an expanding necessity for more innovative equipment. The rise in patient numbers creates substantial demand for diagnostic and surgical procedures, stimulating market requirements for medical devices and supporting services.

| Report Coverage | Details |

| Market Size by 2034 | USD 36.76 Billion |

| Market Size in 2025 | USD 19.11 Billion |

| Market Size in 2024 | USD 17.77 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.54% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Device Type, End User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Growing prevalence of chronic disorders

Market demand for medical device services grows rapidly because chronic disorders such as cancer, diabetes, cardiovascular diseases, and respiratory illnesses keep increasing. Medical technology requirements intensify as the worldwide presence of chronic diseases keeps rising. Medical patients who have chronic illnesses require ongoing evaluation, continuous therapeutic procedures, and rehabilitation solutions, which increases the need for device-based medical technologies that address these needs.

The medical device services market includes wearables plus diagnostic technologies and solutions for distance medical observation. Medical device innovation continues to expand worldwide due to the growth of patients as it develops solutions that enhance healthcare results. The medical device industry advances because healthcare systems focus on sustained care for long-term disease management while medical tools develop for better disease monitoring and improved patient outcomes and healthcare professional practice.

Shortage of the skilled workforce

The medical device services market faces a crucial business restraint from an inadequate skilled labor force. Advanced medical device development, manufacturing, and maintenance process demands specialized personnel who hold expertise in biomedical engineering, regulatory compliance, and data analytics. Operating professionals need continuous training and upskilling programs as technology advances since this creates additional pressure on the workforce. The lack of qualified personnel slows down the proper implementation of advanced medical devices, which leads to poor patient healthcare outcomes for medical institutions.

Expansion of telehealth and remote monitoring

Medical device connectivity has experienced strong growth because healthcare institutions focus on patient-centered care resulting from digital health technology advancements. Patients use telehealth services to consult healthcare providers remotely as this service gains increasing popularity in rural and underdeveloped areas. The health market demands new devices for remote patient care through wearable tools and diagnostic systems that send real-time information to healthcare providers.The medical device services market will grow by building advanced solutions for digital health system device management, patient surveillance, and regulatory requirements compliance.

The manufacturing services segment will have the largest medical device services market share in 2024. Manufacturers of advanced medical devices use external services to fulfill their regulatory needs as well as maintain top-quality outcomes in their production processes. The patient population growth and ongoing medical device technological development require manufacturers to deliver safer effective devices.

The expansion of this segment occurs because manufacturers require precise, high-quality components. The production of advanced medical devices has become more efficient with the simultaneous adoption of additive manufacturing and robotic manufacturing processes. The medical healthcare industry requires rapid deployment methods for new products because it needs faster access to innovation.

The product design and development segment is anticipated to show considerable growth over the forecast period. Medical device product design and development services maintain critical significance in creating medical devices that demonstrate effectiveness and meet all regulatory standards.

Regulatory compliance stands as a vital element for developers because it allows them to achieve the specified health authority requirements throughout the entire development period. Companies focus more research and development investments on creating medical devices that fulfill patient requirements by combining safety measures and market compliance standards.

The surgical devices segment captured the biggest medical device services market share in 2024. The medical facility uses specialized surgical tools as well as instruments and devices that surgeons utilize for diagnosis, prevention, treatment, and cure of medical conditions. The market expansion due to technological innovations and population aging will boost the necessity for extensive support solutions that maintain these devices.

The patient monitoring devices segment is expected to grow the fastest during the forecast period. The market continues to grow because chronic diseases increase while diagnosis devices become essential for measuring disease development and patient treatment management. Remote monitoring and wearable technologies maintain a central position in this market trend because telehealthcare and homecare continue to expand their requirements.

Patient monitoring devices achieve greater performance through technical developments and big data analytics. The segment demonstrates fast growth as an effect of population aging, advancements in connected health technologies, and expanding health awareness among patients.

The medical device manufacturers segment donated the leading medical device services market share in 2024. Manufacturers send essential functions such as product testing, manufacturing, and regulatory compliance maintenance to external partners to prioritize their main role of product innovation. The companies can better manage resources and minimize operational expenses while meeting complex international standards.

The investment in research and development drives manufacturers to introduce innovative products to the market while service outsourcing helps them optimize operation management. Medical device manufacturers can achieve growth in their segment while developing innovative devices since they depend on specialized service providers.

The healthcare facilities segment is anticipated to show considerable growth over the forecast period. High-quality care delivery depends on imaging equipment, surgical instruments, patient monitoring devices, and diagnostic tools that help achieve optimum patient results. The expanding healthcare expenses across public and private sectors activate demand for advanced medical devices that boost clinical efficiency and enhance healthcare service speeds.

Healthcare facilities must acquire reliable and high-performance medical devices because outpatient and inpatient visits for treatment and surgery continue to increase in number. The rising healthcare expenditures in emerging markets lead to increased hospital development, which constantly expands the demand for medical device services.

North America held the dominating share of the medical device services market in 2024. The region benefits from positive reimbursement benefits, developed healthcare facilities, and quick acceptance of advanced medical equipment, thus establishing itself as a center for medical equipment development and service operations. Chronic disease increases with patient numbers have helped the region gain more control of this industry segment.

Medical device manufacturers based in the United States are migrating various business operations, such as regulatory reporting and clinical trial application work, as well as product design and maintenance, to specialized service providers. The high R&D expenditure and raw material management efficiency have raised the implementation of outsourcing practices, which lowers expenses.

Asia Pacific is anticipated to witness the fastest growth during the forecasted years due to the rising demand for innovative medical products by healthcare organizations. The rising incidence of cardiovascular diseases, diabetes, and infectious diseases is fueling the need for medical devices. This market growth is further supported by rising healthcare expenditures and government initiatives aimed at enhancing healthcare accessibility. The local market embraces premium medical devices very quickly, although research and development activities develop homegrown innovations to reduce import reliance.

The European medical device services market is experiencing sustained growth. The market expansion is supported by factors such as aging demographics with increasing illness prevalence and state initiatives for healthcare facility modernization. The market advances because of rising healthcare budgets, the adoption of advanced diagnostic equipment, and the transition of healthcare delivery from institutional to home settings. The market demand increases due to portable medical devices that both global companies and domestic producers introduce into the market.

By Service Type

By Device Type

By End-User

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025