March 2025

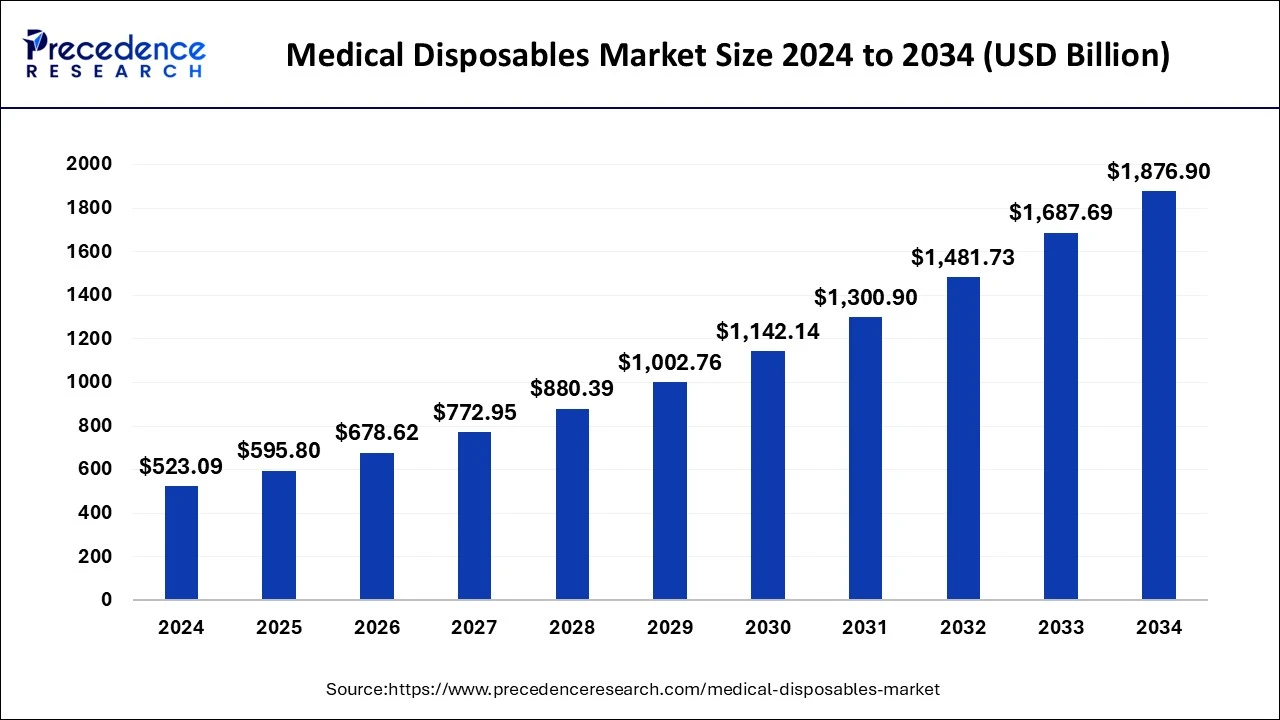

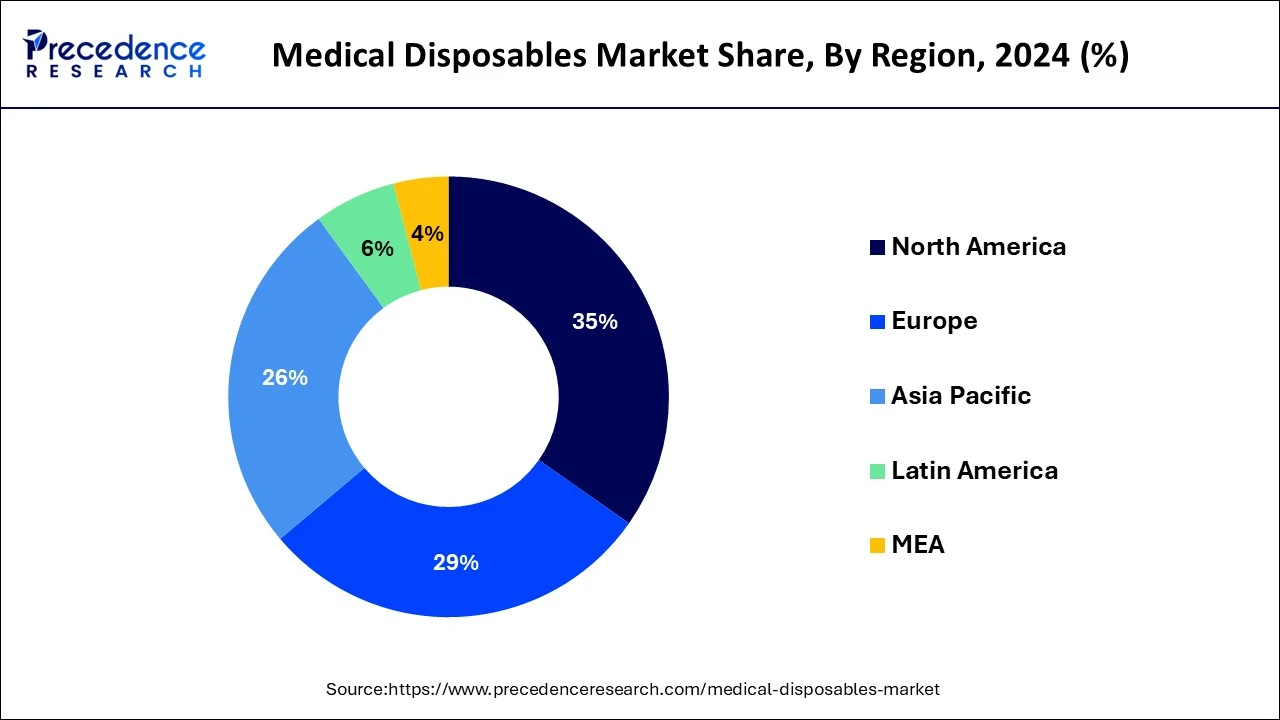

The global medical disposables market size is calculated at USD 595.80 billion in 2025 and is forecasted to reach around USD 1,876.90 billion by 2034, accelerating at a CAGR of 13.90% from 2025 to 2034. The North America market size surpassed USD 183.08 billion in 2024 and is expanding at a CAGR of 13.95% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical disposables market size accounted for USD 523.09 billion in 2024 and is expected to exceed around USD 1,876.90 billion by 2034, growing at a CAGR of 13.90% from 2025 to 2034.

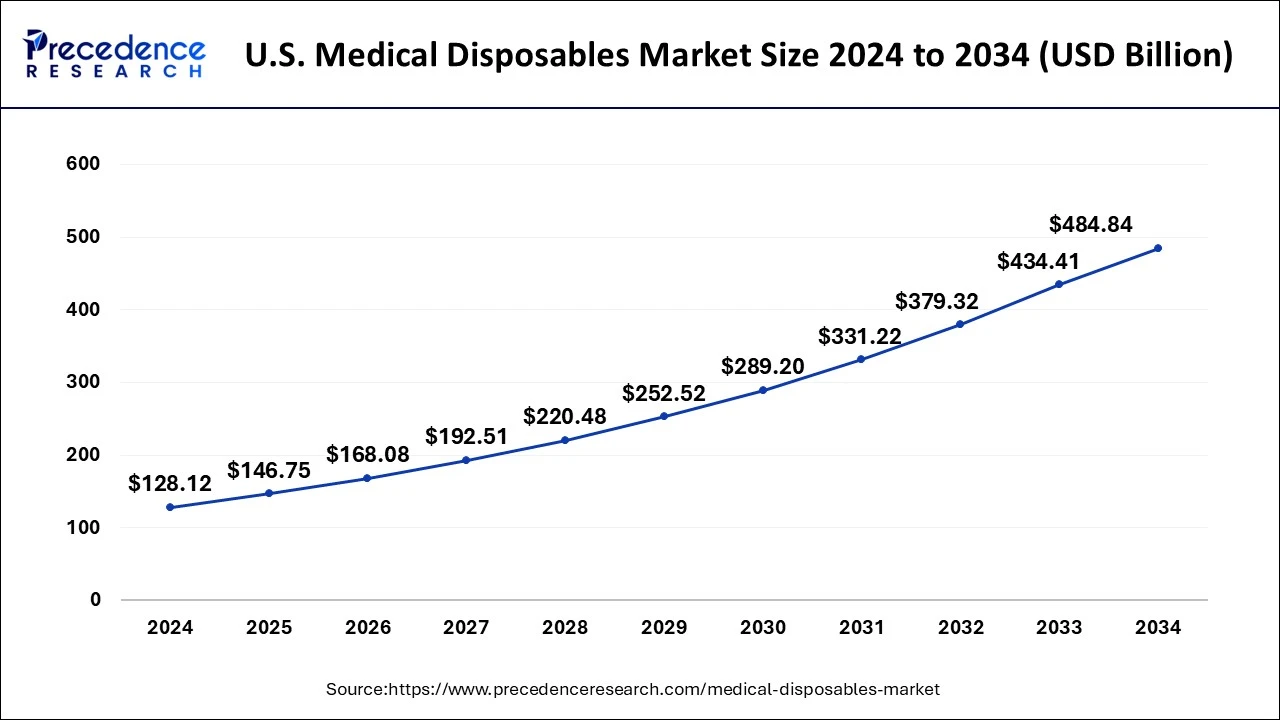

The U.S. medical disposables market size was exhibited at USD 128.12 billion in 2024 and is projected to be worth around USD 484.84 billion by 2034, growing at a CAGR of 14.23% from 2025 to 2034.

In 2024, North America accounted for the largest market share due to the presence of a large number of market players and a growing number of surgeries in hospitals. On 20th April 2020, the report published by WHO, over 3,39,09 COVID-19 active patients are reported and in Canada, around 1,509 cases are detected. Thus, the growing number of COVID-19 patients rapidly in this region is expected to boost regional market growth.

In the foreseeable years, Asia Pacific is anticipated to expand fastest. The use of disposables among all healthcare workers in the Asia Pacific area has increased due to the growing demand for disposable medical products to safeguard patients and healthcare staff from transmitting diseases and the rising frequency of nosocomial infections in hospitals.

Using medical gloves in hospital settings to reduce the prevalence of hospital-acquired infections is one of the key elements driving sales revenue in the area. These infections include catheter-associated infections, central line-associated bloodstream infections (CLABSI), and surgical site infections (SSI).

Furthermore, in China, hospital supplies, including plastic syringes, bandages, and surgical gloves, make up the majority of disposables, the least complex goods in the medical device business. Due to the relatively straightforward nature of their construction and the relatively low risk of patient injury, these items are subject to fewer regulatory restrictions than the others.

However, a lack of proper cleanliness and awareness is to blame for India's rise in infectious diseases. For instance, non-communicable conditions are to blame for 44% of lost disability-adjusted life years and 53% of all fatalities in India. More than a sixth of the world's population lives in India, experiencing significant socio-economic development and a move toward chronic non-communicable diseases.

Growing incidence of Hospital Acquired Infections (HAIs), an increasing number of chronic patients rising number of surgical procedures, and adverse impact of COVID-19 are major factors responsible for medical disposables market growth. According to WHO, geriatric population was around 84 million in 2014 and is expected to reach 2 billion by 2050 across the globe. Therefore, the growing geriatric population across the globe is estimated to fuel market growth during the forecast period. Moreover, the recent outbreak of virus SARS-CoV-2 has increased the demand for emergency supplies, hospital equipment, and medical disposable products.

| Report Coverage | Details |

| Market Size in 2025 | USD 595.80 Billion |

| Market Size by 2034 | USD 1,876.90 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 13.90% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User, and By Raw Material |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Immediate outbreak response

Although there was a speedy response to the shortfalls across several key industries during the first half of 2020, it was not enough to meet the needs at the start of the pandemic. Four main contributing factors for shortage of PPE in 2020:

However, as the pandemic continues, medical disposable constraints remain high, and for certain COVID-19 related medical disposables, supply constraints are not expected to wane until 2022.

Impact mitigation

People with treatable health concerns suffered disproportionately more during previous outbreaks because the healthcare system was strained too tight to function properly. The COVID-19 pandemic is no exception, and it could have had considerably more severe consequences.

Drivers

Cost-effectiveness of the products:

Single-use goods are generally more cost-effective in the long run, even though most practitioners may believe they are an expensive option. This is because reusable equipment is costly, and its price only increases when needed to purchase more accessories. Additionally, the products need routine upkeep and cleaning and incur an additional charge for routine sterilization. Single-use goods, in contrast, are significantly less expensive. They require the most negligible maintenance and do not need elaborate sterilizing procedures, and the repair doesn't come at any extra expense. Instead, they can deliver goods of a similar calibre to those reusable ones. Therefore, the market for medical disposables is driven by the low cost of the products.

Restraint

The surge in waste generation due to disposable products:

The sustainable healthcare industry must have effective biomedical waste management. Efficiency in treating the massive amount of generated biomedical waste became a chore for the entire world and a struggle in controlling the exuberant amount of trash with the burst of the COVID-19 pandemic when hospitals and care center was swamped with patients. According to evidence, improper waste management and flaws in the entire process—from segregation to collection to disposal—have created a significant threat to the environment and human life. This factor may hinder the market for medical disposables in the upcoming future.

Opportunity

Increasing Technological Advancements in the Devices by Startups:

Numerous entrepreneurs are working on a wide range of solutions to find viable single-use medical products on a global scale. For instance, a minimally invasive surgical tool is being developed by Irish firm Neurent Medical to cure inflammatory illnesses of the nasal. ENT doctors can treat patients in a clinical setting owing to the single-use portable device that utilizes radio frequencies. The equipment's microelectrode array can administer tailored energy to reduce irritation by inserting it into the nasal.

Thus, more companies with novel products will create attractive opportunities in the worldwide market due to the rising demand and supply of disposable medical products, which will expand at a favourable rate over the next few years.

On the basis of products, the medical disposable market is fragmented into drug delivery products, wound management products, dialysis disposables, diagnostic & laboratory disposables, disposable gloves, respiratory supplies, incontinence products, disposable masks, non-woven disposables, disposable eye gear, sterilization supplies, and others. The fastest-growing market for medical disposables is expected to be disposable nonwovens. Both the patient and the healthcare provider are highly concerned about infection prevention. To lessen the risk of cross-infection, disposable nonwovens used in surgical situations have a protective barrier from particles, microorganisms, and fluid. The use of disposable gloves and masks during surgeries indicates a considerable decrease in the postoperative infection rate. The disposable product also lowers the possibility of infections, increasing biodegradable nonwoven product demand.

Nonwoven materials can also be produced of natural fibers like linen, wood pulp, and cotton and polymers like polyester, polypropylene, polyethene, polytetrafluoroethylene, and nylon for usage in the medical industry. New biopolymers like polylactide (PLA) and others are also utilized to create biodegradable products. Therefore, the advantages of disposable nonwovens mentioned above are propelling market expansion on a global scale.

The hand sanitizer segment is anticipated to grow with the fastest CAGR during the forecast period. Hand sanitizers are generally produced with alcohol-free and alcohol-based in order to protect from harmful pathogens. The hand sanitizer segment is further subdivided into gel, foam, liquid, and others. Due to the rapid spread of COVID-19 across the globe, the demand for hand sanitizers is surging tremendously, thereby expected to drive the market for hand sanitizers.

Based on raw material, the market is classified into nonwoven material, rubber, plastic resins, paper and paperboard, glass, metals, and others. In 2024, plastic resins accounted for the largest market share, as it is widely used for manufacturing medical devices like containers, disposable syringes, and other medical items. In the predicted year, plastic resins held the most significant market share. Medical tools made of steel, ceramic, or glass are progressively being replaced by equipment made of medical plastics, which is continuing to revolutionize the health sector. This is because they are light, affordable, and suitable for various manufacturing techniques.

Additionally, plastics used in medical equipment are biocompatible with humans' circulatory systems, and their convenience in disposal has been demonstrated to be a revolution in the healthcare sector. Due to their critical necessity, it has been discovered that numerous manufacturers and distributors of high-quality medical plastics benefit from consistent demand from the many health industries around the world.

On the other hand, the nonwoven material segment is projected to have the fastest growth from 2024 to 2033. This material is widely used in clinics and hospitals, as it helps to protect from surgical site infections and borne infections. The nonwoven material is used for manufacturing sanitary napkins, masks, drapes, and surgical gowns. Thus, several applications of nonwoven material are anticipated to drive segment growth.

By end-use, the market is segmented into outpatient/primary care facilities, hospitals, home healthcare, and others. In 2024, hospital segment dominated the global market and accounted for the largest market share in terms of revenue. Disposable medical supplies are also essential to protect patients and caretakers from infections and contaminants. For instance, 6.5% of all hospitalized patients in the European Union and 3.2% of all hospitalized patients in the United States are affected by HAI, and the prevalence is likely to grow globally. However, considerable effort is put into infection control techniques and developing hospital monitoring systems through infection prevention and control programs. As a result, hospitals use disposable materials frequently to prevent infection.

Home healthcare segment is projected to have significant growth over the forecast period. In home healthcare, medical disposable comprise syringes,lancets, gloves, disposable sheets, and needles. Factors such as growing geriatric population and government regulations for reducing hospital readmissions are expected to boost the segment growth extensively in the near future.

By Product

By Raw Material

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

August 2024

January 2025

January 2025