September 2024

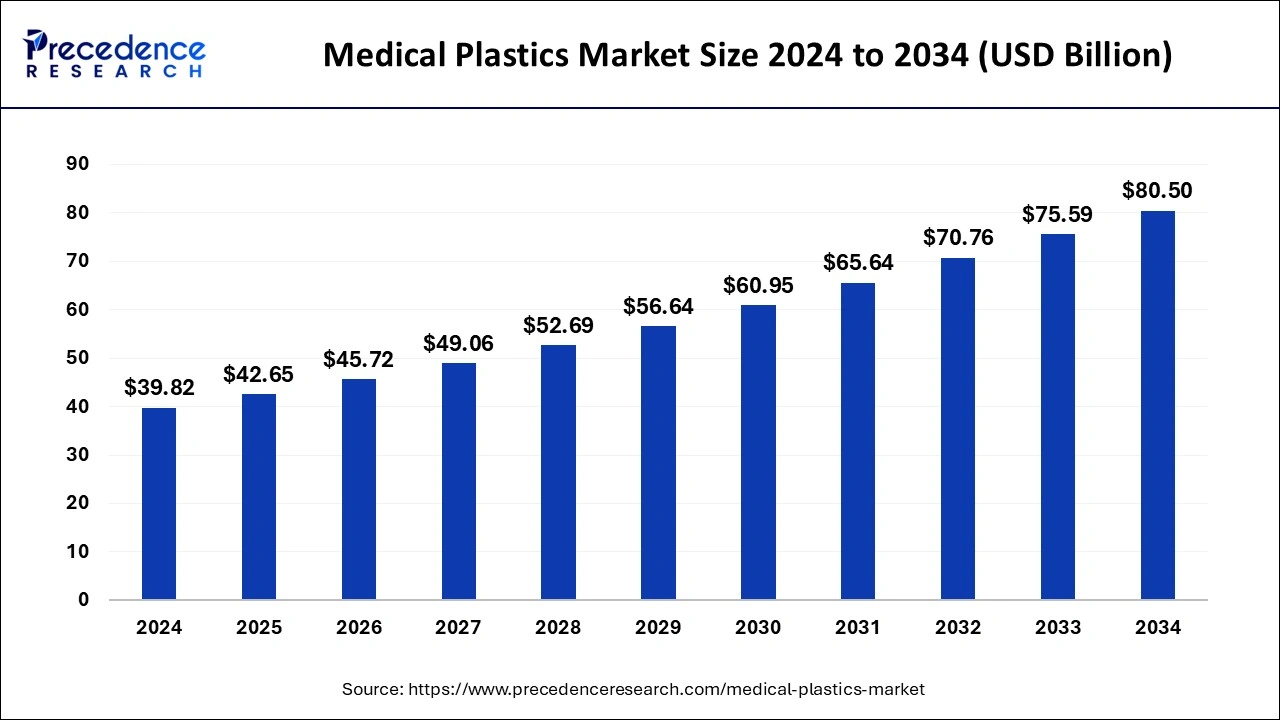

The global medical plasticsmarket size is calculated at USD 42.65 billion in 2025 and is forecasted to reach around USD 80.50 billion by 2034, accelerating at a CAGR of 7.29% from 2025 to 2034. The North America market size surpassed USD 13.54 billion in 2024 and is expanding at a CAGR of 7.30% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical plastics market size accounted for USD 39.82 billion in 2024 and is expected to exceed USD 80.50 billion by 2034, growing at a CAGR of 7.29% from 2025 to 2034. The growing demand for well-packaged and several medical equipment has boosted the medical plastics market development.

Integration of artificial intelligence has contributed profoundly to the medical plastics market by bringing advancement in manufacturing and quality of the plastics used in medicals. This supports in customization of products according to the requirement which boosts the demand in the medical plastics market. It has made designing products convenient by predicting the market performance of plastic products. Artificial intelligence enhances the method of automation, decreases errors, and increases efficiency. It checks the quality of the products which will enhance the reliability of this market and increase the scope of development.

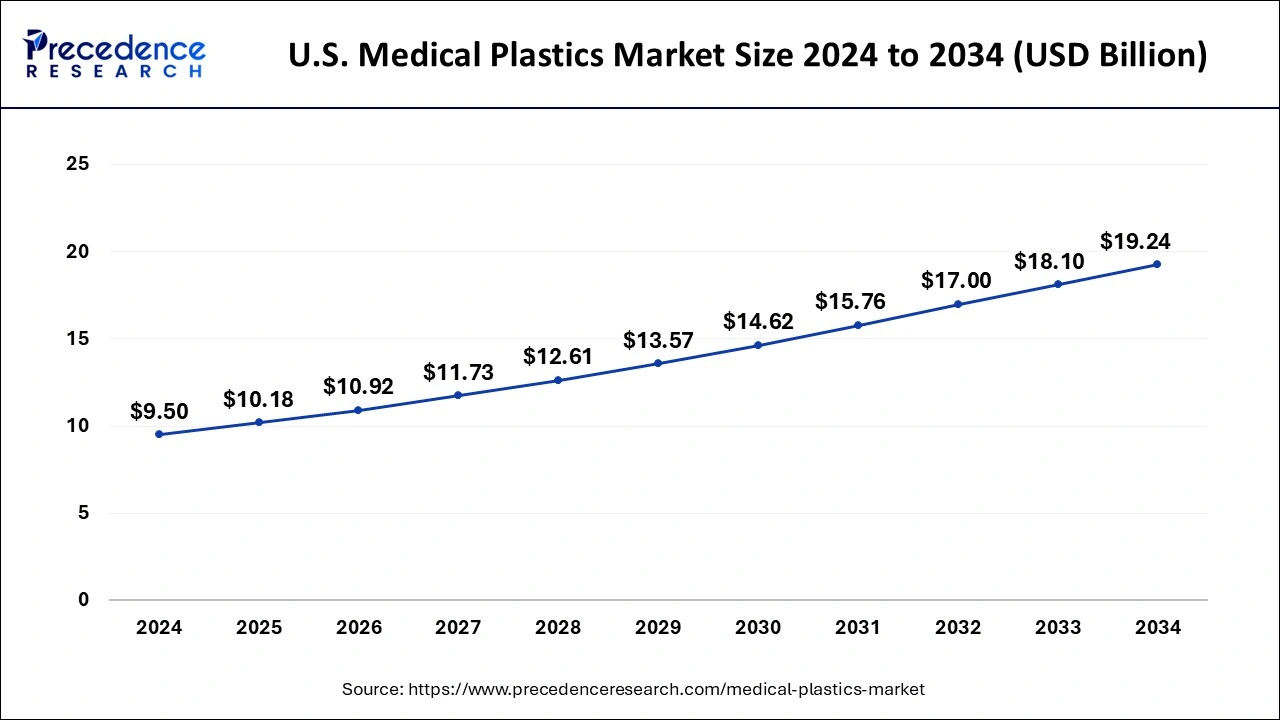

The U.S. medical plastics market size was exhibited at USD 9.50 billion in 2024 and is projected to be worth around USD 19.24 billion by 2034, growing at a CAGR of 7.31% from 2025 to 2034.

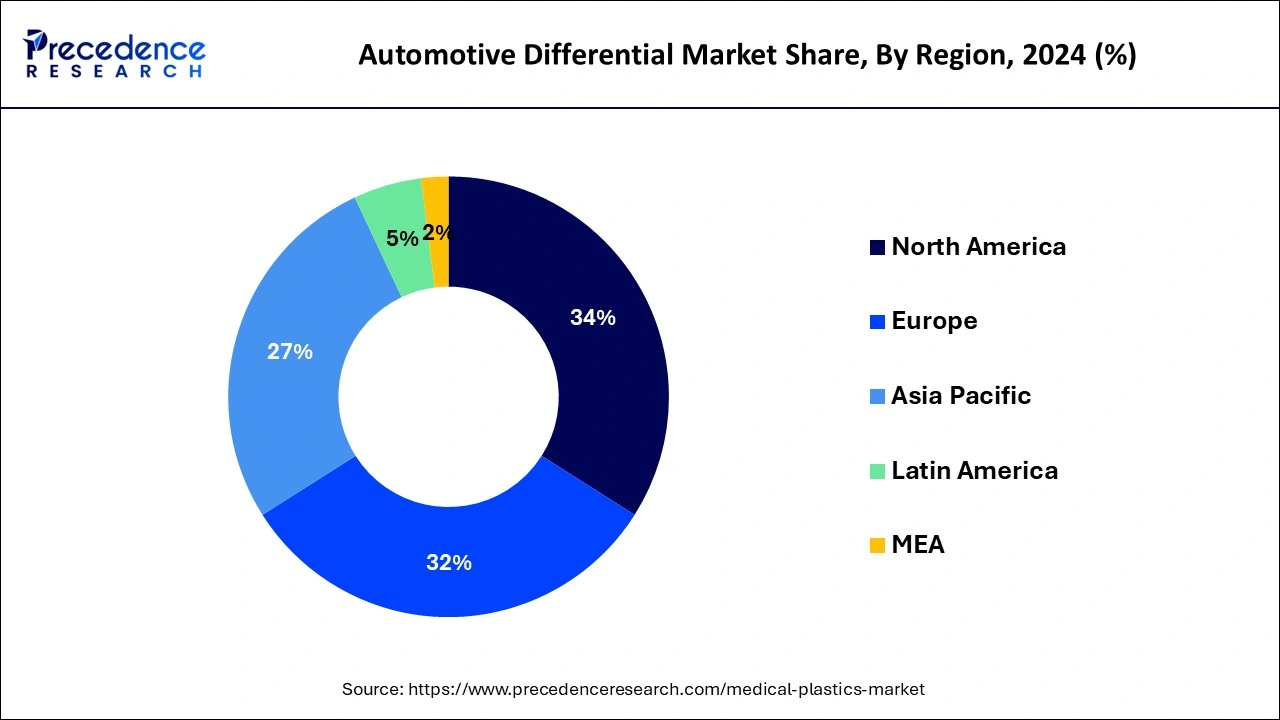

In the year 2022, North America is the dominating region in the medical plastics market and hit a revenue share of around 34%. With per capita healthcare spending increasing in the United States, the demand for medical equipment will increase significantly over the next few years. This is expected to boost demand for products in the region. In addition, the presence of key manufacturers such as Dow Inc., DuPont, Celanese Corp., and Eastman Chemical Co., in the region is expected to have a positive impact on the overall growth of the market during the forecast period.

Asia-Pacific is expected to be the largest medical plastics market during the forecast period. This is primarily due rapid growth of industrialization and urbanization in this region. In addition, the region has immense growth potential driven by the increasing demand for a better healthcare system. Asia-Pacific region covers some vast and rapidly growing economies, including China, India, Indonesia, Malaysia, Vietnam, and Thailand. Across these economies, local governments are restructuring regulations in fields including advanced materials, IT integration, and others in the healthcare industry to increase the efficiency and efficacy of medical devices and related healthcare services. Key drivers for the medical device industry in APAC are value-based care reform in legacy systems, ecosystem partnerships across the value chain, increased research and development, and digitalization medical system.

| Report Coverage | Details |

| Market Size in 2025 | USD 42.65 Billion |

| Market Size by 2034 | USD 80.50 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.29% |

| Dominating Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The engineering plastics segment is a major revenue-generating segment in the medical plastics market and is expected to dominate during the forecast period. Engineering plastics offer many advantages over standard plastics, such as good ductility, faster production times, low weight, high impact, resistance to fire, impact, and chemicals, and reduced friction. Improved standards and regulations requiring high-quality plastics used in medical applications are responsible for the large market size in this segment. In addition, the increasing use of engineering plastics in robotic aids, AI-driven processes, 3D printing of implants and prostheses, and more, is driving the use of engineering plastics.

Depending on the application, the market is divided into prosthetics, drug delivery, medical instruments & tools, medical disposables, and others. The medical components segment dominated the market and garnered a revenue share of around 40% in 2022.

The disposable medical segment is predicted to show the highest growth rate during the forecast period. The usage of medical plastics is rising owing to their versatility. Disposable medical items can be defined as single-use products used in surgical and procedural applications. The use of these medical products in general health check-ups and procedural applications is increasing. Furthermore, the use of these disposable products in accordance with the guidelines of various agencies, such as the US FDA and the European FDA, drives the demand for medical plastics globally. The rising prevalence of chronic diseases, changing lifestyles of middle-income groups, demand for better healthcare facilities, and increasing aging population are the main drivers of the market.

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

October 2024

December 2024

December 2024