January 2025

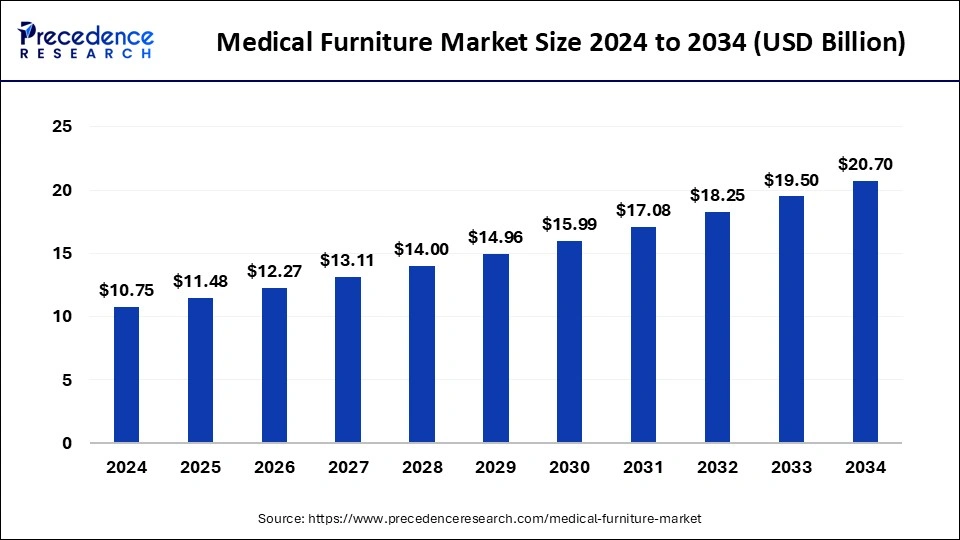

The global medical furniture market size accounted for USD 11.48 billion in 2025 and is forecasted to hit around USD 20.70 billion by 2034, representing a CAGR of 6.77% from 2025 to 2034. The North America market size was estimated at USD 3.98 billion in 2024 and is expanding at a CAGR of 6.91% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical furniture market size accounted for USD 10.75 billion in 2024 and is predicted to increase from USD 11.48 billion in 2025 to approximately USD 20.70 billion by 2034, expanding at a CAGR of 6.77% from 2025 to 2034. The rising prevalence of chronic diseases Worl widely, needs to treat with long-term care and robust infrastructure facilitated with medical equipment is propelling the markets growth on a global scale.

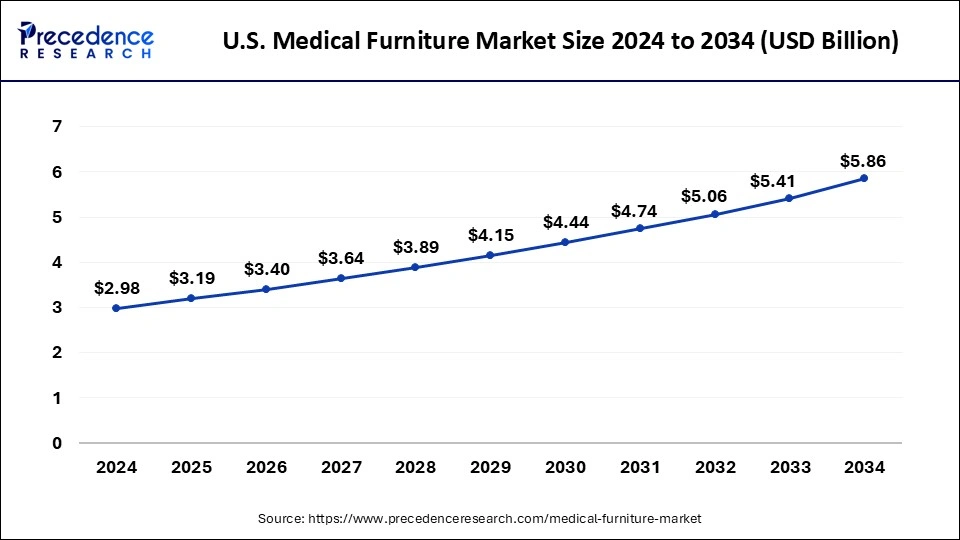

The U.S. medical furniture market size was exhibited at USD 2.98 billion in 2024 and is projected to be worth around USD 5.86 billion by 2034, growing at a CAGR of 7.00% from 2025 to 2034.

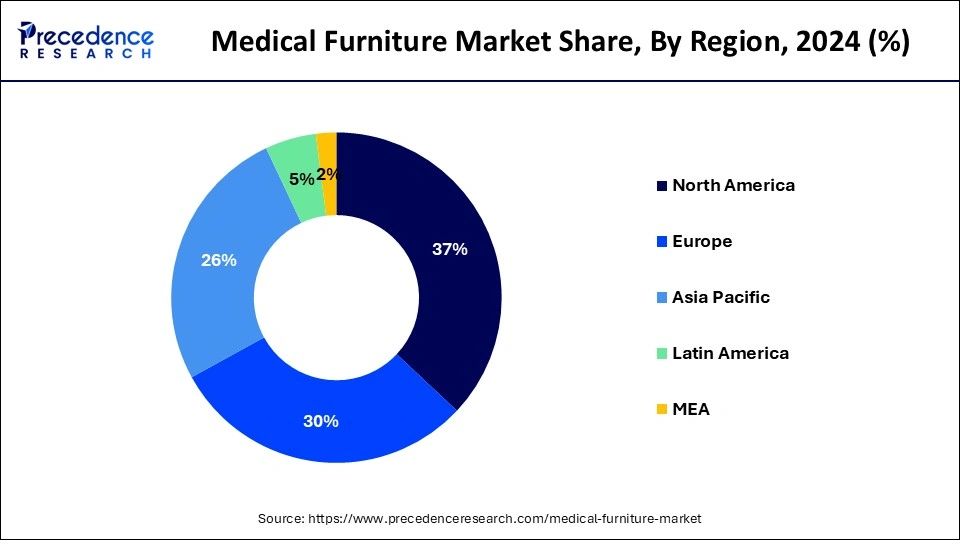

North America led the medical furniture market with the largest share of 3.98% in 2024. The market in North America is driven by the stronghold on the healthcare infrastructures and facilities accessible to the masses, particularly in developed nations like Canada and the United States of America. Favourable healthcare policies made for private and public sector employees, including their family members, have a constructive impact on the nation's healthcare sector.

Additionally, the government has increasing policies for the geriatric population to serve them better in terms of medical emergencies, which is further expected to augment the medical furniture market in the North American region. The rising number of chronic diseases in the United States is adding to the growth of North America. Also, the increasing prevalence of the geriatric population in the North American region further fuels the growth of the medical furniture market.

Age-associated illnesses require special care and, most probably, hospitalization in many cases. So, it becomes necessary for healthcare centres to invest in medical equipment, including medical furniture, to expand the area and facilities for more and more patients. Thus, increasing investment in medical furniture by several healthcare centres is fuelling the growth of the market drastically.

Asia Pacific is the fastest growing region in the medical furniture market. Owing to the presence of major key players in the region fuelling the market growth. Marketers continuously launch innovative products to assist the hospital facility with a robust infrastructure. In recent years, India has been one of the leading countries to allocate the optimum budget for developing the hospital infrastructure.

Medical furniture can be defined as a movable article that is primarily used by every healthcare centre, like hospitals, clinics, operation theatres, and nursing homes, to assist patients and visitors. Some examples of medical furniture include stretchers, medical trolleys, medical beds, tables, and chairs designed for bedbound patients. As per the data published by the World Health Organisation, in June 2021, more than 1.2 million people in the world died as a result of road accidents due to traffic crashes. Around 20 to 50 million people meet with an injury that is non-fatal but has the potential to make them permanently handicapped due to accidents. Such unfortunate incidences of road accidents are rising all over the world, causing severe damage to people's lives that needs to be acknowledged.

One of the significant initiatives for it would be hospitals built with emergency care units facilitated with necessary medical equipment and provisions to treat patients. Such a rising awareness is leading to the medical furniture market in the forward direction, propelling its growth on a global level.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.77% |

| Market Size in 2025 | USD 11.48 Billion |

| Market Size by 2034 | USD 20.70 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Product, End-use, and Sector |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising hospitalization rate

Due to the increasing of patients with chronic diseases such as cancer, cardiovascular diseases, and diabetes, it is likely to augment the demand for medical furniture to serve the patients with proper care and treatment by medical professionals. For instance, according to the report published by national diabetes statistics, around 11.4% of the United States population has been diagnosed with diabetes. In the COVID pandemic, the market has benefitted due to the upsurge in hospitalization and medical emergencies. Also, growing efforts by medical faculties to expand the medical examination processes and diagnosis further drive the global medical furniture market.

The rising prevalence of accidental emergencies is another reason to treat patients and hospitalize them as early as possible. This needs medical equipment, including stretchers, chairs, and ambulatory surgical centers for first aid treatment. All these factors are gaining momentum due to urbanization, and people seek more medical help for various reasons, including an unregulated working lifestyle. Furthermore, hospitals are developing rapidly in many urban and rural areas to provide accessibility to everyone with facilitating infrastructure, and policies are likely to increase the demand for medical furniture and, thus, drive the market on a global scale.

Rising preference for reconstructed products

Reconstructed or refurbished products are setting new trends in the market. Almost every business is adopting these products due to the convenience they provide with a low budget. Similarly, refurbished products are used in the healthcare market also owing to their higher demand and availability in the market. To meet the requirements of rising demand, many hospitals management tend to buy refurbished products, propelling manufacturers of refurbished products in the market. Such a practice of rental and reconstructed materials products can be a restraining factor to the growth of the medical furniture market.

Innovative designs of medical furniture

The medical furniture market is highly fragmented due to several domestic and international companies working in different areas of the market. Still, many marketers are creating opportunities for developing innovative medical products that ease the efforts of professionals and patients' treatment.

Many companies launch such innovative products in the market to strengthen their hold by manufacturing the required furniture for hospitals and clinics. Such efforts by marketers will create vast opportunities to grow the market further with a higher expansion rate.

The metal segment is dominate the market in 2023. Metal is a delicate, yet durable material found abundantly in the market. Also, metal can be made pliable by some processing; hence, it is safe to use and can be easily customizable as per the consumer's needs and demands so that it can be aesthetically moulded. Owing to these advantages of metal, this segment is bolstering the medical furniture market and will grow further. Materials made from metals are space-savvy and affordable in price.

Moreover, unlike wood materials, they have low maintenance and are resistant to pests. Metal-based medical chairs, beds, and tables can be easily washable by using water and soap. They do not necessarily require any specific sanitization process that makes them easy to handle and sustainable. As a result, the metal segment is growing due to the higher demand in the medical furniture market globally.

The table segment is further expected to grow at a higher pace during the foreseen period. The increasing number of critical to routine surgeries led the segment to grow faster. It is necessary to have an advanced table facility to perform surgeries that inevitably fuel the demand of the table segment. The rising prevalence of surgeries is propelling the demand for the table segment and thus increasing the growth of the market all around the world.

The beds segment held the largest share of the medical furniture market, with the largest share held in the market. To ensure the sleep quality of patients, it is essential to check up on good quality sleep, which also depends upon the quality of beds used by hospital faculty to treat patients. Therefore, a hospital bed is an essential part of the overall recovery of the patients.

A journal of surgical research published an article in November 2020 on the shortage of beds and its consequences on patients during the COVID-19 pandemic. They studied the global hospital bed, acute care bed, and ICU-Intensive care unit bed capacity. It shows that the mortality rate is likely to be affected by many resource incompatibilities, including bed shortages. Hence, to avoid such a man-made disaster, it has become necessary to develop an adequate system with medical facilities. Such a need for beds is propelling the growth of this segment, and it is expected to grow further in the forecast period owing to the reasons which are mentioned above.

The ambulatory surgical centers, held a significant share of the medical furniture market on a large scale. Professionals prefer to use ambulatory services for patients with major injuries and shorter time spans to treat them with adequate dosage. It is a great convenience for patients and physicians to perform even complex surgeries in a shorter period due to the critical condition of patients. Many surgeries performed in ambulatory centers are reimbursed, which solves the patients' concern about the minimum income level and makes it affordable. Such benefits are again facilitating this segment of the market.

Moreover, the rising prevalence of chronic conditions often leads to life-threatening situations that need to be resolved at the very moment and cared for critically after treatment. Here, ambulatory surgical centers play a crucial role in treating patients at regular intervals, which will further impel the segment of ambulatory surgical centers in the medical furniture market.

The private segment held the largest market share in 2023 owing to the rapid privatization of hospitals and other healthcare centers. The rising number of hospitals due to the new entries of many professionals in the critical care unit within specialty hospitals is fuelling the construction of the healthcare sector.

In semi-urban and metropolitan areas, initiatives taken by professionals to start their own practices with the clinic they own are fuelling the growth of the market. also, the government has partnered with the private sector to provide the best possible treatment to the patients, further increasing this segment's growth. Many welfare schemes are launched by both private and public sectors to improve healthcare areas, thereby raising investments to expand healthcare facilities.

By Material

By Product

By End-use

By Sector

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

January 2025

January 2025