January 2025

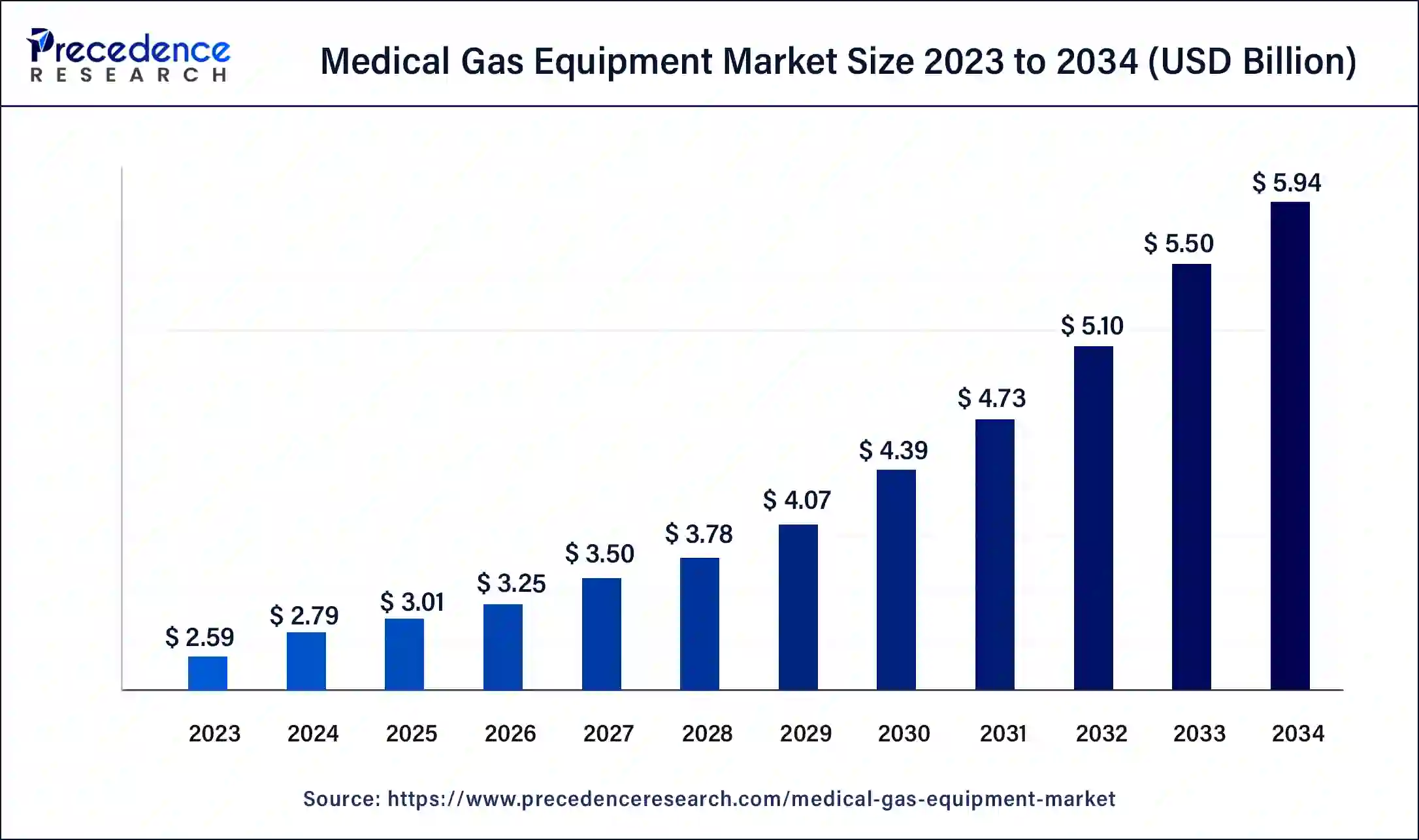

The global medical gas equipment market size surpassed USD 2.59 billion in 2023 and is estimated to increase from USD 2.79 billion in 2024 to approximately USD 5.94 billion by 2034. It is projected to grow at a CAGR of 7.83% from 2024 to 2034.

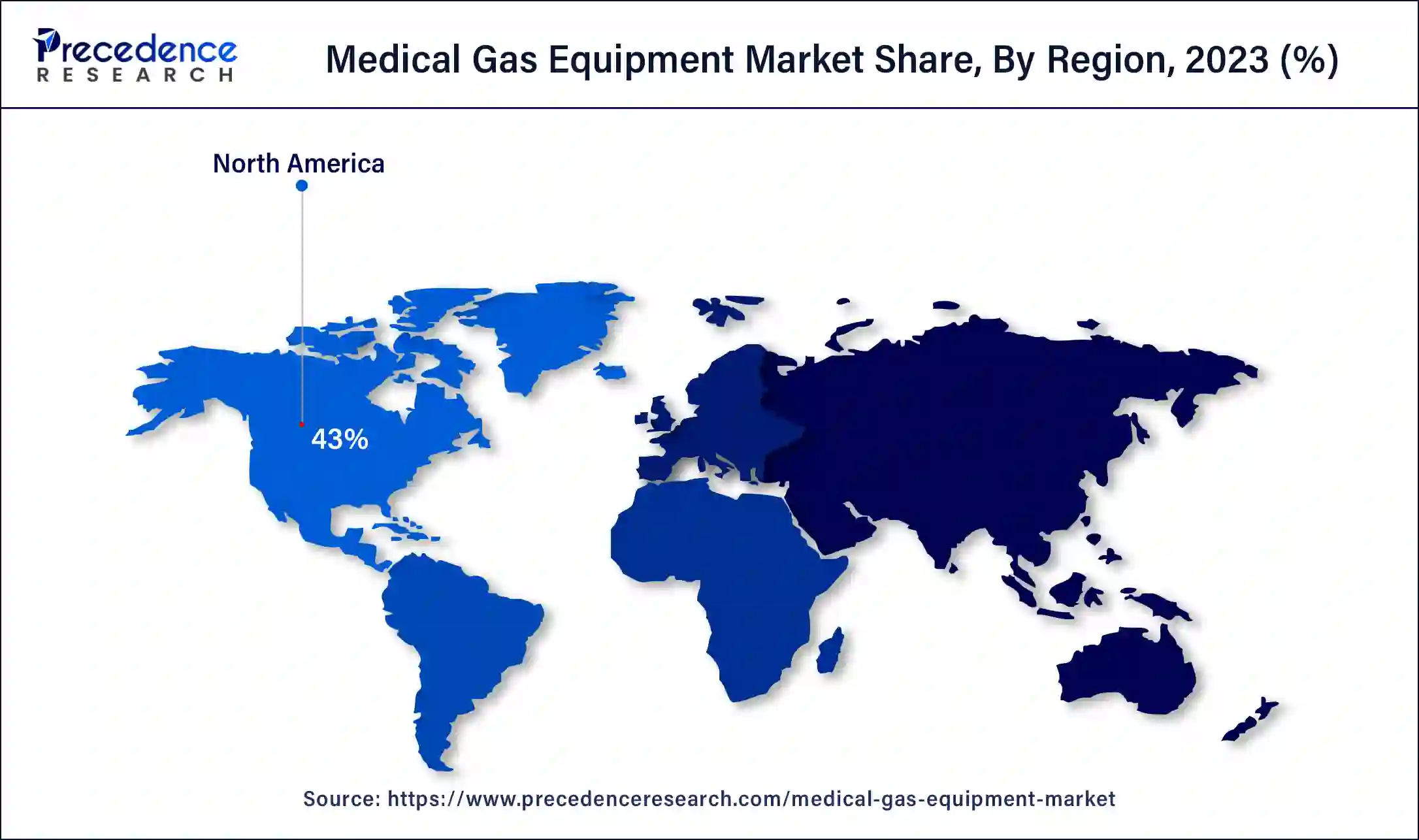

The global medical gas equipment market size is anticipated to reach around USD 5.94 billion by 2034 from USD 2.79 billion in 2024, at a CAGR of 7.83% from 2024 to 2034. The North America medical gas equipment market size reached USD 1.11 billion in 2023. The benefits of medical gas equipment include environmental considerations, compliance with standards, patient comfort, space utilization, cost-effectiveness, convenience and efficiency, safety, etc., contributing to the growth of the market.

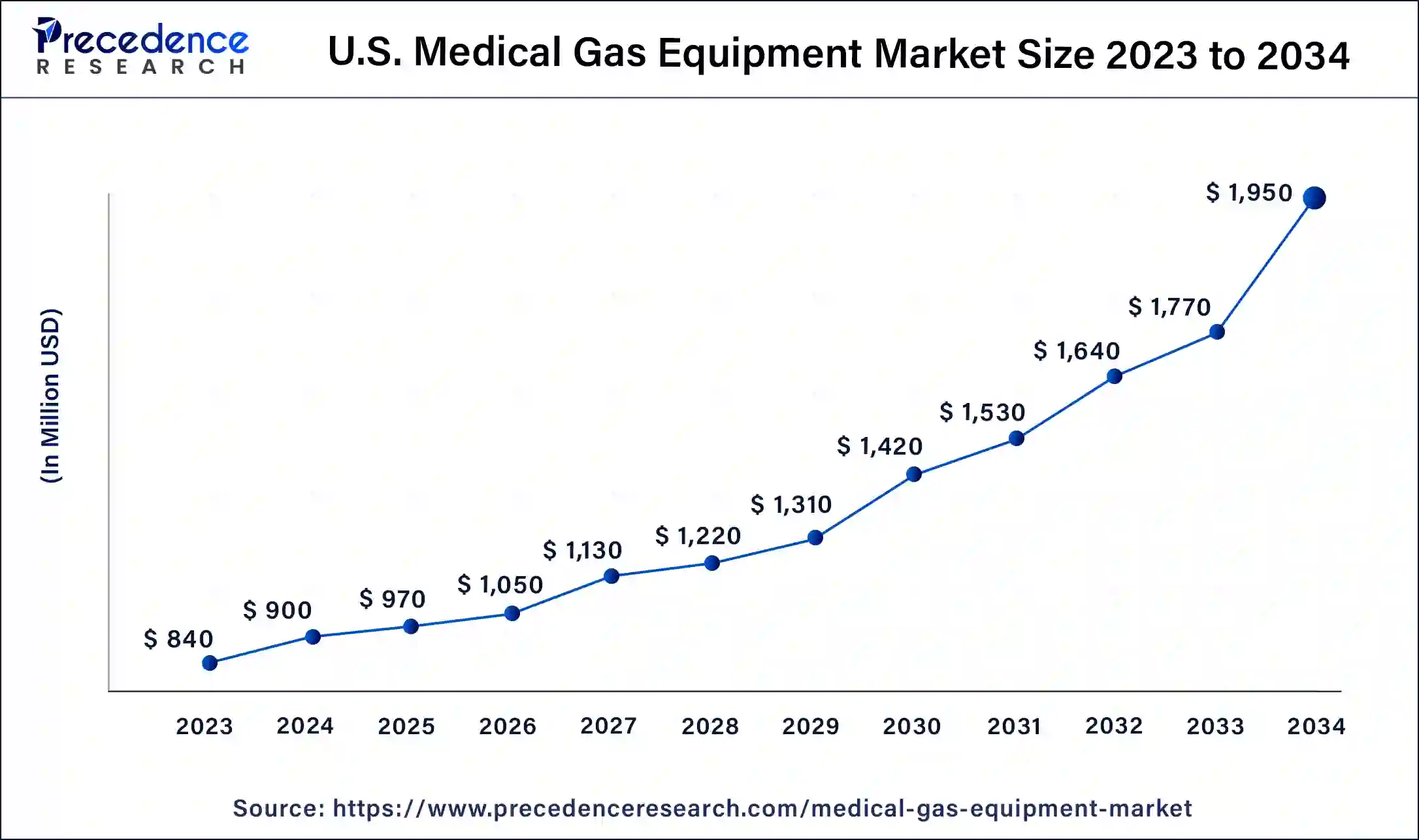

The U.S. medical gas equipment market size was exhibited at USD 840 million in 2023 and is projected to be worth around USD 1.95 million by 2034, poised to grow at a CAGR of 7.95% from 2024 to 2034.

North America dominated the medical gas equipment market in 2023. The adoption of rules like the U.S. FDA (Food & Drug Administration) Safety and Innovation Act, highly minimally invasive procedures, highly developed healthcare systems, etc., contribute to the growth of the market in the North American region. The need for respiratory support devices like ventilators and oxygen concentrators in the North American region increased due to several health conditions, which also demand medical gas equipment for patient care.

Asia Pacific is estimated to have a significant growth rate during the forecast period of 2024-2034. The increasing demand for home healthcare is due to the increasing senior population, higher demand for cost-effective and comfortable care options, and higher demand for home-based and portable medical gas equipment. For effective healthcare systems, many government policies are suitable for the Asia Pacific region's industrial expansion, which contributes to the growth of the medical gas equipment market.

The medical gas equipment market refers to buyers and sellers of medical gas equipment to deliver gases to patients and medical staff in the healthcare sector. To provide the best care, hospitals must have a safe and reliable supply of nitric oxide, nitrous oxide, oxygen, and other gases used in patient care. These gases are used for many medical purposes, like surgical procedures, anesthesia, and respiratory therapy. The benefits of medical gas equipment include environmental considerations, compliance with standards, patient comfort, space utilization, convenience and efficiency, safety, etc., which help the market’s growth.

How does AI improve Medical Gas Equipment?

The use of artificial intelligence (AI) plays an important role in medical gas equipment, which helps to improve both safety and efficiency. AI can help to predict when medical gas equipment requires maintenance or may fail. AI allows remote monitoring systems for medical gas equipment. This helps healthcare providers track the performance and status of equipment in real time. AI algorithms can optimize the use of medical gases by ensuring the real amount of gas delivered and reducing waste at the right time. This also includes the benefits of improved diagnostics, safety improvement, etc., which help to the growth of the medical gas equipment market.

| Report Coverage | Details |

| Market Size by 2034 | USD 5.94 Billion |

| Market Size in 2023 | USD 2.59 Billion |

| Market Size in 2024 | USD 2.79 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 7.83% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising senior population

Medical gas equipment plays an important role in the healthcare sector, especially for senior adults, which helps to the growth of the medical gas equipment market. Medical gas equipment includes the administration of certain gases for therapeutic reasons, primarily in the respiratory system. It is like a boost given to the lungs. Oxygen gas is commonly used in medical gas equipment. It is administered to enhance tissue oxygenation in patients who suffer from low oxygen levels. At the time of emergency care, surgeries, or for those who are with chronic lung disorders like COPD or asthma, oxygen is the lifeline.

The critical and strict regulatory process

The critical and strict regulatory processes in medical gas equipment can hamper the medical gas equipment market. The avoidable problems of medical equipment include procedures being slowed due to low suction, alarms from unknown causes, uncooperative gas fittings at the time of an adopter, which can need a little push, and anything that causes a second try must be checked. Leaking of inlets and outlets due to pressurized gases.

Analyses opportunities

The analysis opportunities for changes in market regulations, improving revenue pockets, new product launches, product approvals, advanced technologies, regional expansions, etc., can be an opportunity for the medical gas equipment market growth. The increasing prevalence of infectious diseases and demand for medical gas equipment due to increased preference for point-of-care diagnostics help the market’s growth.

The vacuum systems/pumps segment dominated the medical gas equipment market in 2023. The vacuum systems/pumps have a high range of medical applications. The medical vacuum systems are crucial for providing vacuum pressure for aspiration and to ensure both surgery rooms and patient rooms are efficient and safe. The vacuum system is essential for sterilizing medical equipment and the use of X-ray tubes in high vacuum conditions. Vacuum systems/pumps are mechanical devices that create a negative pressure in the piping system. These systems can automatically alternate. For storage, a reservoir tank is used to allow cycling off and on instead of continuous operation. Every pump capacity maintains 75% of the calculated demand at the peak time.

The manifold segment held the second-largest share of the medical gas equipment market. The various types of manifolds can used to supply gases and air for respiratory therapy and life support applications. These manifolds can make a large impact on the gas supply efficiency for these life-saving cases. Medical gas manifolds are simpler and cost-effective to install versus alternate flow control systems. These are also less susceptible to leaking than other options. It requires less space than other delivery systems. The functions of medical gas manifolds include safety, monitoring, regulation, distribution, etc., and the applications of medical gas manifolds include aquaculture, industrial processes, laboratory and research facilities, healthcare facilities, etc.

The regulators and medical gas outlets segment is expected to grow at a significant rate during the forecast period. A medical gas regulator maintains a constant pressure to ensure an accurate flow rate and reduces a medical gas cylinder's pressure to pressure delivery, which contributes to the growth of the medical gas equipment market. Every type of regulator is designed with a name/symbol for a certain gas and for specific inlets and ranges of delivery pressure. The medical gas regulators provide a convenient and safe way of connecting high-pressure gas cylinders to ventilators, flowmeters, and other equipment required to run. Outlets are connected to gas supply systems, which allow delivery of vacuum and medical air, anesthetic gas, and oxygen for patient care. This plays an important role in providing necessary support, facilitating surgical procedures, and allowing critical care interventions.

The hospital segment dominated the medical gas equipment market in 2023. Medical gas equipment is used to deliver gases to medical staff and patients to provide the best care; hospitals must have a safe and reliable supply of nitric oxide, oxygen, nitrous oxide, and other gases used for patient care. The benefits of hospitals also include comprehensive medical plans, prescription drug coverage, personal independence payment, etc.

The home healthcare segment is anticipated to be the fastest-growing during the forecast period. Medical gas equipment plays an important role in healthcare, not only in hospitals but also in home healthcare, which helps to the growth of the medical gas equipment market. In-home healthcare, medical gas equipment is used for patients who need supplemental oxygen and can receive it at home, like in a hospital. It is like a tiny oxygen bar in the living room.

Segments Covered in the Report

By Product

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025