January 2025

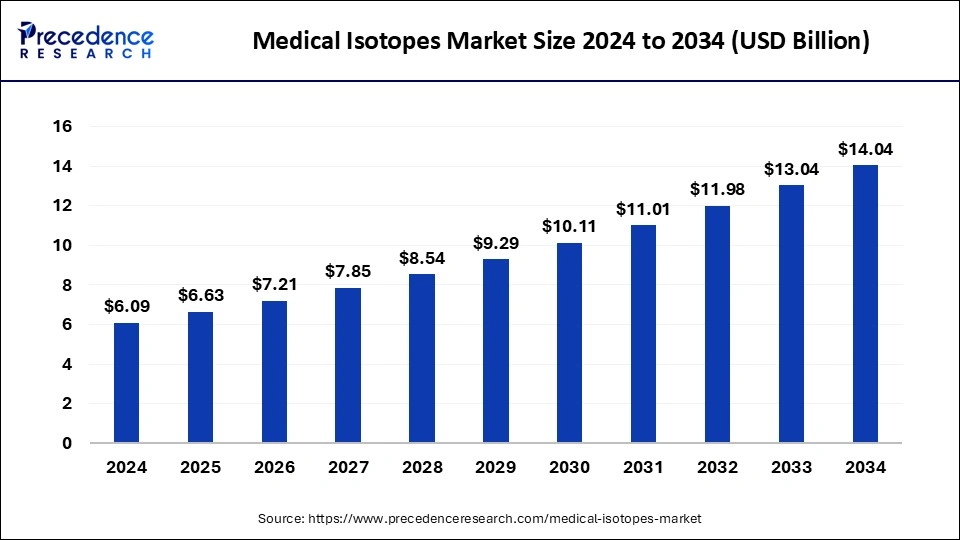

The global medical isotopes market size is calculated at USD 6.63 billion in 2025 and is forecasted to reach around USD 14.04 billion by 2034, accelerating at a CAGR of 8.71% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical isotopes market size was estimated at USD 6.09 billion in 2024 and is predicted to increase from USD 6.63 billion in 2025 to approximately USD 14.04 billion by 2034, expanding at a CAGR of 8.71% from 2025 to 2034. The medical isotopes market is driven by the growing need for PET imaging.

The market for medical isotopes includes the manufacturing, supplying, and using isotopes in imaging, treatment, and diagnosis. Chemical element variations known as isotopes have various quantities of neutrons but the same number of protons, giving them unique characteristics. Isotopes are mostly employed in medicine for diagnostic imaging techniques, including radiation treatment, positron emission tomography (PET), and single-photon emission computed tomography (SPECT).

The market for medical isotopes is significant because it plays a vital role in contemporary healthcare. Physicians may see and diagnose a wide range of illnesses and ailments with the use of medical isotopes, including cancer, heart disease, neurological disorders, and metabolic diseases. They are essential to customized medicine because they enable accurate diagnosis and patient-specific treatment plans.

Medical Isotopes Market Data and Statistics

| Report Coverage | Details |

| Market Size in 2025 | USD 6.63 Billion |

| Market Size by 2034 | USD 14.04 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.71% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increased patient awareness regarding radiation and radiation therapy

New developments in radiation technology frequently accompany and raise patient awareness. Patients are increasingly likely to adopt advanced radiation therapy procedures that rely on medical isotopes as they become more developed and widely known. When patients know the advantages and availability of radiation therapy, efforts to increase its accessibility, such as by implementing mobile units or extending the healthcare infrastructure, are more likely to be effective. The demand for medical isotopes is further exacerbated by this enhanced accessibility. This drives the growth of the medical isotopes market.

Lack of skilled professionals and the accuracy concern in imaging

Medical isotope quality and purity can differ by facility and production method. Patient safety and diagnostic accuracy may be jeopardized by inconsistent quality, which might produce erroneous imaging results. Supply chain disruptions, such as shortages and transportation issues, can impact the availability of high-grade isotopes. Due to this discrepancy, the use of less-than-ideal isotopes may exacerbate the imaging accuracy problem. Regulatory scrutiny may result from worries about image accuracy and a shortage of qualified specialists. Governments may enact more stringent regulations and inspection procedures, further complicating the market environment and raising operating expenses for suppliers of medical isotopes. This limits the growth of the medical isotopes market.

Integration of medical isotopes with advanced healthcare technologies

Modern healthcare technologies allow for the real-time observation of patient health metrics and the distant consultation of healthcare providers. These technologies include wearables, remote monitoring systems, and telemedicine platforms. Due to the incorporation of medical isotopes, these technologies allow clinicians to monitor disease progression, evaluate treatment response, and modify therapy regimens without requiring frequent hospital visits. This integration makes healthcare more accessible generally, especially for those living in distant or underdeveloped areas, and increases patient convenience and early intervention. This opens an opportunity for the growth of the medical isotopes market.

The radioisotopes segment dominated in the medical isotopes market in 2024. Reactor and cyclotron technology improvements have increased the availability and efficiency of producing a range of radioisotopes, guaranteeing a consistent supply to keep up with the increasing demand. New radiopharmaceuticals that improve the efficacy of therapeutic and diagnostic processes result from ongoing research and development activities.

Many governments encourage the use of nuclear medicine by providing financing for research and development and enacting favorable healthcare laws. This, in turn, fuels the expansion of the radioisotope market. Simplified regulatory procedures for the approval of new radiopharmaceuticals and imaging agents facilitate the rapid integration of novel radioisotopes into clinical practice.

The stable isotopes segment shows a notable growth in the medical isotopes market during the forecast period. Applications for stable isotopes in medicine and diagnosis are growing. They are essential to metabolic and biochemical research because they can be used as tracers in metabolic experiments, to assess the effectiveness of treatments, and to assist in understanding the mechanisms behind the disease. Stable isotopes are more appealing in therapeutic settings because they are safe for patients due to their non-radioactive nature. The use of stable isotopes in research and development has increased significantly.

These isotopes are used by pharmaceutical corporations and academic institutions for medication development and testing, focusing on personalized medicine. Drugs are labeled with stable isotopes, which enables researchers to monitor the body's absorption, distribution, metabolism, and excretion (ADME) activities.

The diagnostic segment dominated in the medical isotopes market in 2024. The need for diagnostic imaging tests has grown dramatically as the prevalence of chronic illnesses, including cancer, heart disease, and neurological problems, rises. Radiopharmaceuticals are medical isotopes vital to the early diagnosis, treatment, and surveillance of various illnesses. The relevance of nuclear medicine has been acknowledged by numerous governments across the globe, which have funded and supported research and development projects that have enhanced the availability and application of diagnostic isotopes.

The nuclear therapy segment is the fastest growing in the medical isotopes market during the forecast period. Nuclear therapy is becoming more widely recognized and accepted by both patients and medical professionals. Nuclear treatment is becoming more popular due to educational initiatives and easier access to information about its advantages and safety. Patients are more inclined to think of nuclear therapy as a good substitute for traditional therapies as they become more knowledgeable about their available options.

The hospitals segment dominated in the medical isotopes market in 2024. There has been a noticeable rise in hospitals and other healthcare facilities worldwide. Several nations invest significantly in their healthcare systems to improve their citizens' services. This expansion strengthens the position of hospitals in this industry by increasing both the supply and demand for medical isotopes. Hospitals are at the forefront of medical innovation; they frequently provide novel isotope-based treatments and diagnostic techniques. Their part in creating and evaluating these advancements guarantees a consistent and rising need for medical isotopes.

The diagnostic centers segment is the fastest growing in the medical isotopes market during the forecast period. The need for diagnostic imaging is mainly driven by the rise in cancer cases worldwide. Medical isotopes play a critical role in cancer surveillance and early identification, which enhances treatment results and patient survival rates. For efficient care, cardiovascular diseases, an additional major global cause of morbidity and mortality, need precise diagnostic imaging. Medical isotopes are essential for non-invasive cardiac imaging because they help detect problems in the perfusion and function of the heart.

North America had dominated in the medical isotopes market in 2024. In North America, the discovery and manufacturing of medical isotopes are facilitated by many public-private partnerships. These partnerships take advantage of each other's advantages to propel nuclear medicine forward. These collaborations frequently lead to large infrastructural expenditures, such as brand-new manufacturing facilities and research labs, strengthening the area's competitiveness in the medical isotopes market.

Asia-Pacific is observed to be the fastest growing in the medical isotopes market during the forecast period. Patients and medical professionals are becoming increasingly aware of nuclear medicine's advantages. The expansion of training programs and seminars on the use of medical isotopes for diagnosis and therapy is producing a more skilled workforce. Public awareness campaigns on nuclear medicine's potential for early diagnosis and treatment of chronic diseases are encouraging more widespread use.

Government programs and encouraging laws are significant factors in the market expansion for medical isotopes. Market expansion is facilitated by quicker regulatory approvals for medical isotopes used in diagnosis and therapy. Governments encourage innovation and application in the medical industry by sponsoring research and development projects about isotopes and nuclear medicine. Establishing production facilities for medical isotopes through partnerships between public and commercial entities guarantees a steady supply.

By Type

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025