January 2025

Medical Radiation Detection Market (By Type: Gas-Filled Detectors, Scintilators, Solid-State; By Product: Personal Dosimeters, Area Process Dosimeters, Surface Contamination Monitors, Others; By End Use: Hospitals, Ambulatory Surgical Centers, Diagnostic Imaging Centers, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2023-2032

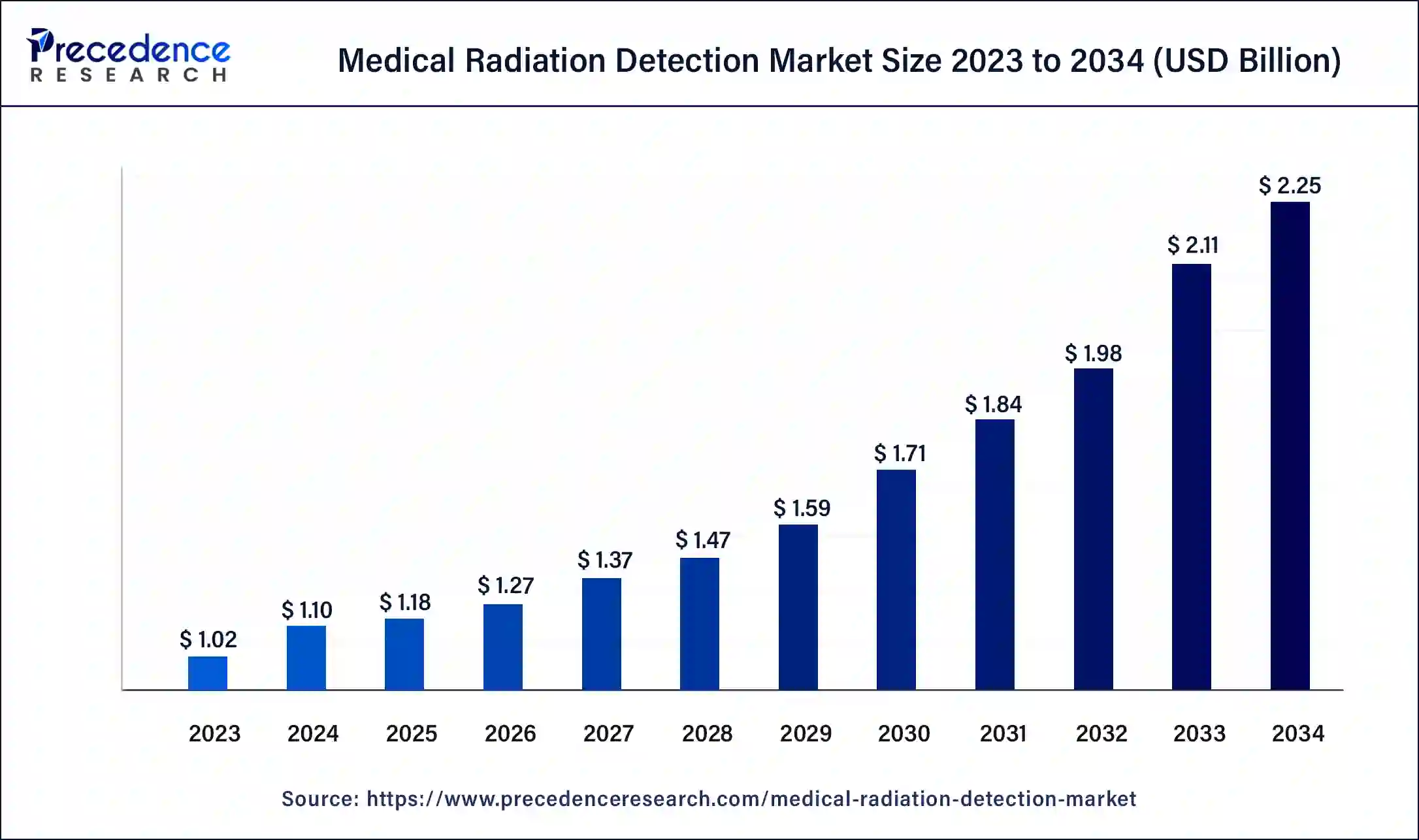

The global medical radiation detection market size was USD 1.02 billion in 2023, calculated at USD 1.10 billion in 2024, and is expected to reach around USD 2.25 billion by 2034, expanding at a CAGR of 7.4% from 2024 to 2034.

The sphere of medical radiation detection market pertains to the global arena dedicated to crafting, fabricating, and disseminating intricate contrivances and apparatuses tailored for the discernment and quantification of ionizing radiation within medical milieus. These technological innovations play an indispensable role in safeguarding the well-being of patients and healthcare practitioners during diagnostic and therapeutic procedures that involve the utilization of X-rays, gamma rays, and other radiation modalities.

The medical radiation detection market encompasses an array of products, encompassing dosimeters, Geiger-Muller counters, scintillation detectors, and imaging systems. It thrives on factors such as mounting exposure to medical radiation, adherence to regulatory directives, and the imperative for meticulous radiation surveillance within healthcare facilities.

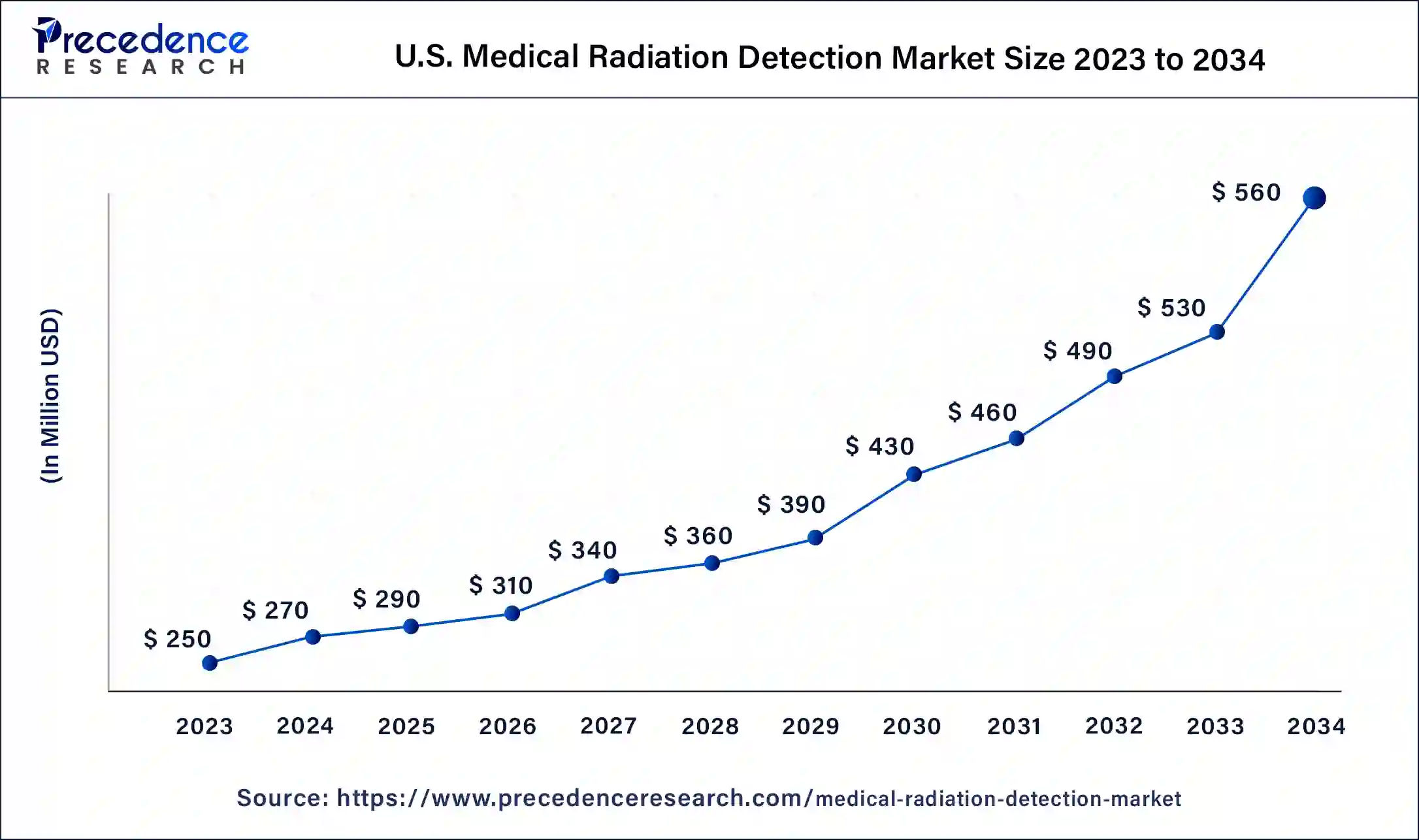

The U.S. medical radiation detection market size was valued at USD 250 million in 2023 and is estimated to reach around USD 560 million by 2034, growing at a CAGR of 7.6% from 2024 to 2034.

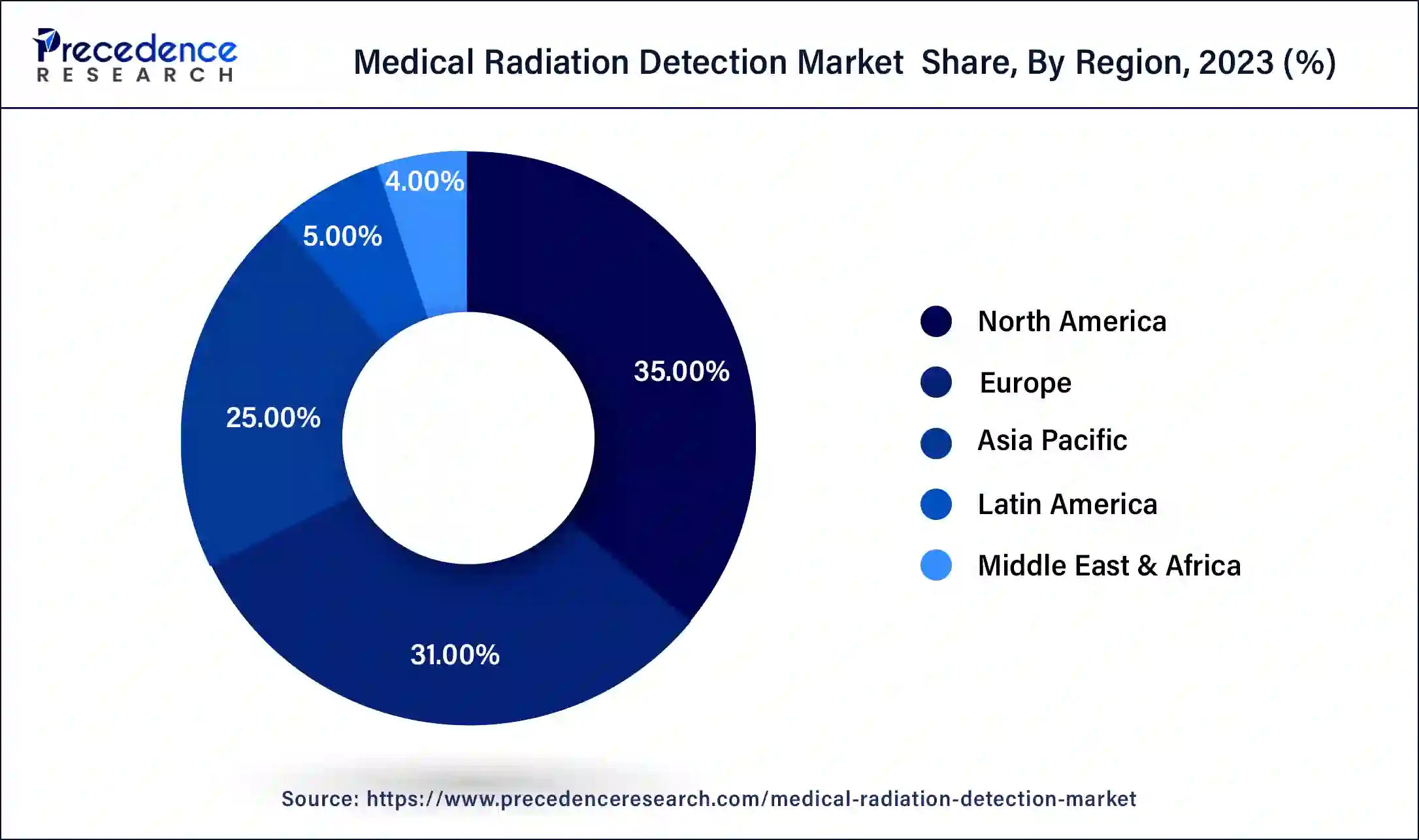

North America has held the largest revenue share 35% in 2023. North America commands a significant share due to advanced healthcare infrastructure, robust research and development activities, and stringent regulatory compliance. The region houses leading medical institutions and facilities that heavily rely on radiation technologies for diagnosis and treatment. Additionally, a growing awareness of radiation safety and a high prevalence of cancer cases drive the demand for cutting-edge radiation detection solutions. The presence of key market players and a favorable reimbursement environment further solidify North America's dominant position in the global medical radiation detection market.

Asia-Pacific is estimated to observe the fastest expansion. Asia-Pacific holds a substantial growth due to several key factors. The region's population is vast, and with increasing healthcare infrastructure and diagnostic facilities, there's a growing need for radiation detection equipment in medical settings. Additionally, rising awareness about radiation safety, a surge in cancer cases demanding radiation therapy, and government initiatives for nuclear safety contribute to the market's prominence. Furthermore, technological advancements and collaborations with global players in the Asia-Pacific region further boost its market growth in the medical radiation detection sector.

The realm of medical radiation detection market, an integral facet of the healthcare sector, revolves around the evolution and dispersion of advanced technologies tailored for the identification and quantification of ionizing radiation within medical environments. These pivotal instruments serve as sentinels, ensuring the security of patients and healthcare practitioners during procedures that entail the use of X-rays, gamma rays, and other sources of radiation. This market encompasses a wide array of products, including dosimeters, Geiger-Muller counters, scintillation detectors, and state-of-the-art imaging systems.

The medical radiation detection market is experiencing significant growth driven by several key trends and factors. One major trend is the increasing adoption of digital radiation detection technologies, which offer higher precision and real-time data monitoring. The rising demand for radiation therapy in cancer treatment is also fueling market growth, as healthcare facilities require advanced radiation detection solutions for accurate dosage delivery. Moreover, stringent regulatory standards and guidelines pertaining to radiation safety are encouraging healthcare institutions to invest in innovative detection and monitoring equipment. This trend is especially notable in developed regions.

Despite its promising prospects, the market is not without its challenges. One central hurdle is the substantial cost associated with cutting-edge radiation detection equipment, potentially impeding adoption among smaller healthcare facilities. Moreover, the perpetual necessity for calibration and maintenance of radiation detectors poses logistical and financial obstacles for healthcare providers. Striking a balance between cost-effective solutions and cutting-edge technology remains an ongoing conundrum for industry stakeholders.

The medical radiation detection market presents numerous opportunities for both established companies and newcomers. The increasing awareness of radiation safety among healthcare professionals and the general public opens doors for businesses offering training and education services related to radiation detection and protection. Furthermore, the emergence of compact and portable radiation detection devices provides opportunities for market expansion into outpatient and remote healthcare settings. Collaborations with research institutions to develop cutting-edge radiation detection technologies and solutions also offer substantial growth prospects.

In summary, the medical radiation detection market is driven by the adoption of digital technologies, the growing demand for radiation therapy, and regulatory compliance. However, it faces challenges related to cost and maintenance. The industry's future lies in embracing opportunities such as radiation safety education and the development of portable detection devices, making it a dynamic and evolving sector within the broader healthcare landscape.

| Report Coverage | Details |

| Market Size by 2032 | USD 2.25 Billion |

| Market Size in 2023 | USD 1.02 Billion |

| Market Size in 2023 | USD 1.10 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 7.4% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Product, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising incidence of cancer

The surge in cancer prevalence stands as a primary impetus behind the expansion of the medical radiation detection market. With cancer rates on an upward trajectory globally, there exists a mounting need for radiation detection technologies capable of precisely gauging and overseeing radiation dosing during treatment. This requirement arises from the necessity to tailor treatments to individual patients, striving for optimal therapeutic outcomes while mitigating the impact on healthy tissues.

Furthermore, the ongoing evolution of radiation detection equipment is ushering in more streamlined and secure treatment protocols. Advanced technologies offer real-time monitoring and feedback mechanisms, affording healthcare providers the ability to fine-tune treatment parameters when required. This not only elevates the caliber of patient care but also heightens patient comfort and nurtures confidence in the effectiveness of their treatment strategies.

In essence, the burgeoning incidence of cancer acts as a compelling force in propelling the medical radiation detection market, compelling the development of ever more intricate and precise radiation detection solutions to meet the exacting demands of contemporary oncological therapies.

Complex regulatory environment

The intricacies of the regulatory framework present a formidable obstacle to the expansion of the medical radiation detection industry. This intricate landscape is characterized by a multitude of national and international standards, guidelines, and compliance prerequisites governing the utilization of radiation in healthcare contexts. Healthcare institutions and manufacturers of radiation detection equipment are compelled to allocate significant investments in terms of both time and resources to ensure alignment with these intricate regulations. Maintaining compliance necessitates ongoing effort, which can hamper the pace of product development and market entry.

Furthermore, the dynamic nature of regulatory requirements demands continuous adaptation and adjustments to equipment and procedures, amplifying the costs and complexities associated with compliance. Such intricacies may dissuade smaller entrants from participating in the market and challenge their ability to effectively compete. The elaborate regulatory landscape can also lead to protracted product approval and market clearance processes, impinging upon the timely introduction of innovative radiation detection technologies. In sum, the complex regulatory milieu erects formidable barriers that hinder market growth and innovation within the medical radiation detection sector.

Expansion of radiation therapy

The burgeoning utilization of radiation therapy, encompassing both its application in cancer treatment and its emerging role in addressing non-cancerous conditions, is cultivating noteworthy prospects within the medical radiation detection industry. With healthcare institutions increasingly relying on radiation therapy to elevate patient outcomes, a burgeoning demand arises for cutting-edge radiation detection technologies that can ensure the precision and safety of radiation delivery. This demand extends to the development of equipment capable of real-time radiation dosage monitoring and adjustment, thereby augmenting treatment precision and diminishing potential side effects.

Opportunities unfurl in the realm of pioneering radiation detection devices tailored explicitly to the unique requisites of radiation therapy. These technologies should not only meet exacting regulatory mandates but also encompass attributes such as heightened sensitivity, seamless data integration, and intuitive user interfaces. Additionally, offering comprehensive training and support services to healthcare practitioners utilizing these advanced tools constitutes another avenue for expansion. In essence, the expanding domain of radiation therapy provides a fertile ground for market participants to innovate, fostering enhanced patient care while fortifying their presence within the sphere of medical radiation detection.

The gas-filled detectors sector has held a 43% revenue share in 2023. The gas-filled detectors segment holds a significant share due to its reliability, accuracy, and wide range of applications. Gas-filled detectors, like ionization chambers and proportional counters, are well-established and trusted technologies for measuring ionizing radiation. They offer precise dose measurements, making them essential in radiation therapy for cancer treatment. Additionally, they are often used in diagnostic radiology, nuclear medicine, and laboratory research. Their versatility and proven performance have solidified their position, making them a preferred choice for healthcare facilities, and contributing to the segment's substantial market share.

The solid-state detectors are anticipated to expand at a significant CAGR of 8.7% during the projected period. The solid-state detectors segment commands substantial growth in the medical radiation detection market due to several key advantages. Solid-state detectors offer superior accuracy and sensitivity in measuring ionizing radiation, making them crucial for precise radiation therapy and diagnostic procedures. They are more durable, require less maintenance, and have a longer lifespan compared to traditional detectors. Additionally, their compact size and ability to provide real-time data make them ideal for modern healthcare settings. As the industry increasingly emphasizes precision and efficiency in radiation detection, solid-state detectors have become the preferred choice, contributing to their major market growth.

The personal dosimeters sector had the highest market share of 39% on the basis of the product in 2023. The personal dosimeters segment commands a significant share due to its critical role in safeguarding the well-being of healthcare workers and radiation professionals. Personal dosimeters are worn by individuals exposed to ionizing radiation, providing real-time monitoring of their radiation exposure levels. With increasing awareness of radiation safety, stringent regulatory requirements, and a growing number of diagnostic and therapeutic procedures involving radiation, the demand for personal dosimeters has surged. This segment's prominence reflects the industry's commitment to ensuring the safety of personnel and compliance with radiation protection standards, thereby contributing to its substantial market share.

The surface contamination monitors is anticipated to expand at the fastest rate over the projected period. The surface contamination monitors segment holds a significant growth due to its critical role in ensuring radiation safety. These monitors are essential for detecting and quantifying radioactive materials on surfaces, equipment, and personnel, preventing contamination spread and minimizing radiation exposure. With stringent regulatory requirements and increased awareness of radiation safety, healthcare facilities and nuclear power plants rely heavily on surface contamination monitors to maintain compliance. Moreover, ongoing technological advancements have made these monitors more efficient and user-friendly, further driving their adoption and market growth within the broader field of radiation detection.

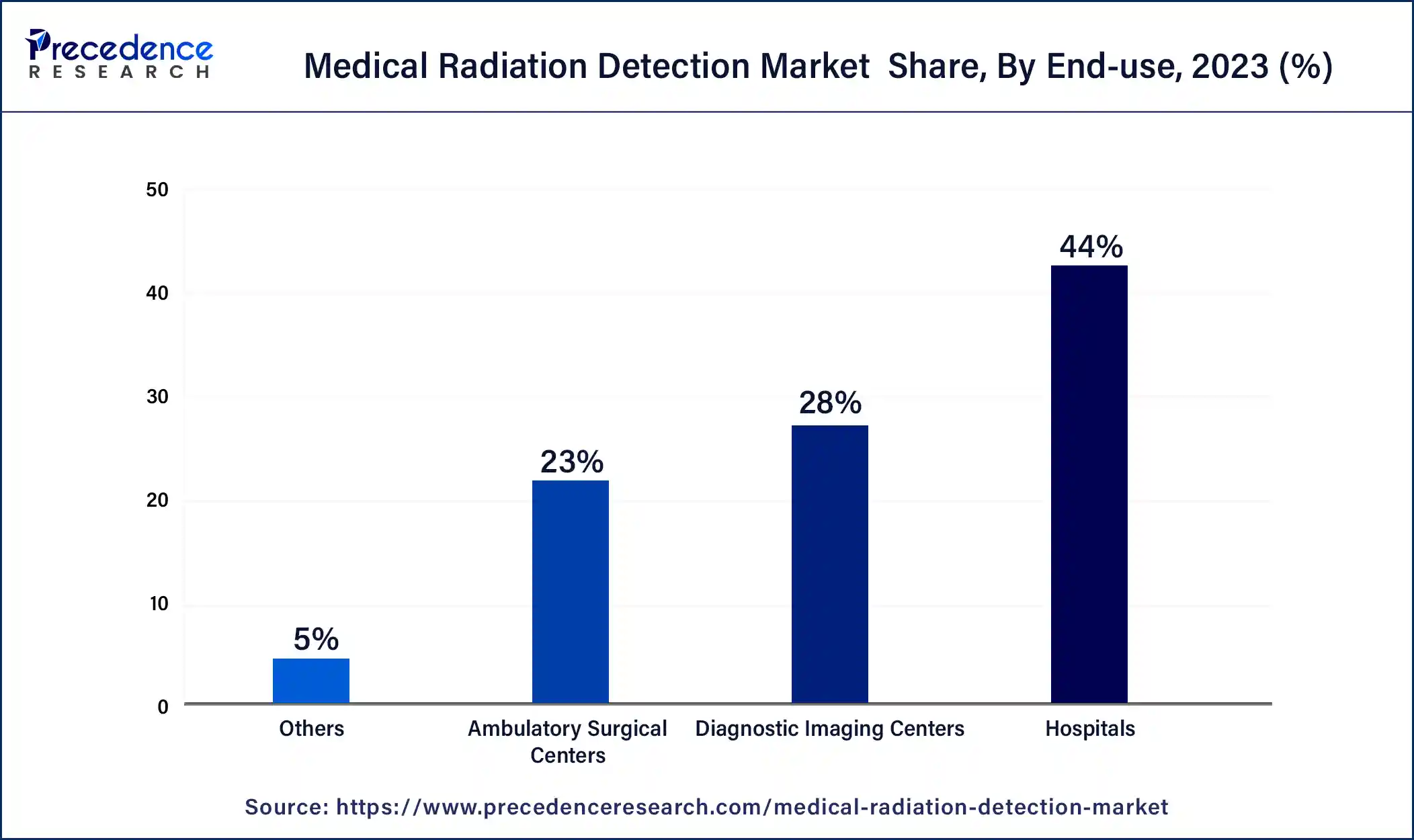

The hospitals segment held the largest revenue share of 44% in 2023. Hospitals hold a major share due to their central role in healthcare delivery. Hospitals are primary locations for diagnostic imaging, radiation therapy, and interventional procedures, all of which involve ionizing radiation. To ensure patient safety and regulatory compliance, hospitals invest significantly in radiation detection equipment. Additionally, the rising incidence of cancer and the increasing demand for radiation therapy contribute to the dominance of hospitals in the market. Their access to resources, expertise, and the need for comprehensive radiation detection solutions make hospitals a key driver of market growth and innovation.

The diagnostic imaging centers segment is anticipated to grow at a significantly faster rate, registering a CAGR of 7.9% over the predicted period. The diagnostic imaging centers segment holds a substantial growth due to several factors. These centers are vital hubs for various medical imaging procedures, including X-rays, CT scans, and MRIs, all of which involve ionizing radiation. Ensuring accurate dosage delivery and radiation safety is paramount, driving the demand for sophisticated detection technologies. Additionally, diagnostic imaging centers often handle a high volume of patients, necessitating efficient and reliable radiation detection systems. Stringent regulatory standards further emphasize the need for precise monitoring, making this segment a significant contributor to the market's growth and revenue.

By Type

By Product

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025