January 2025

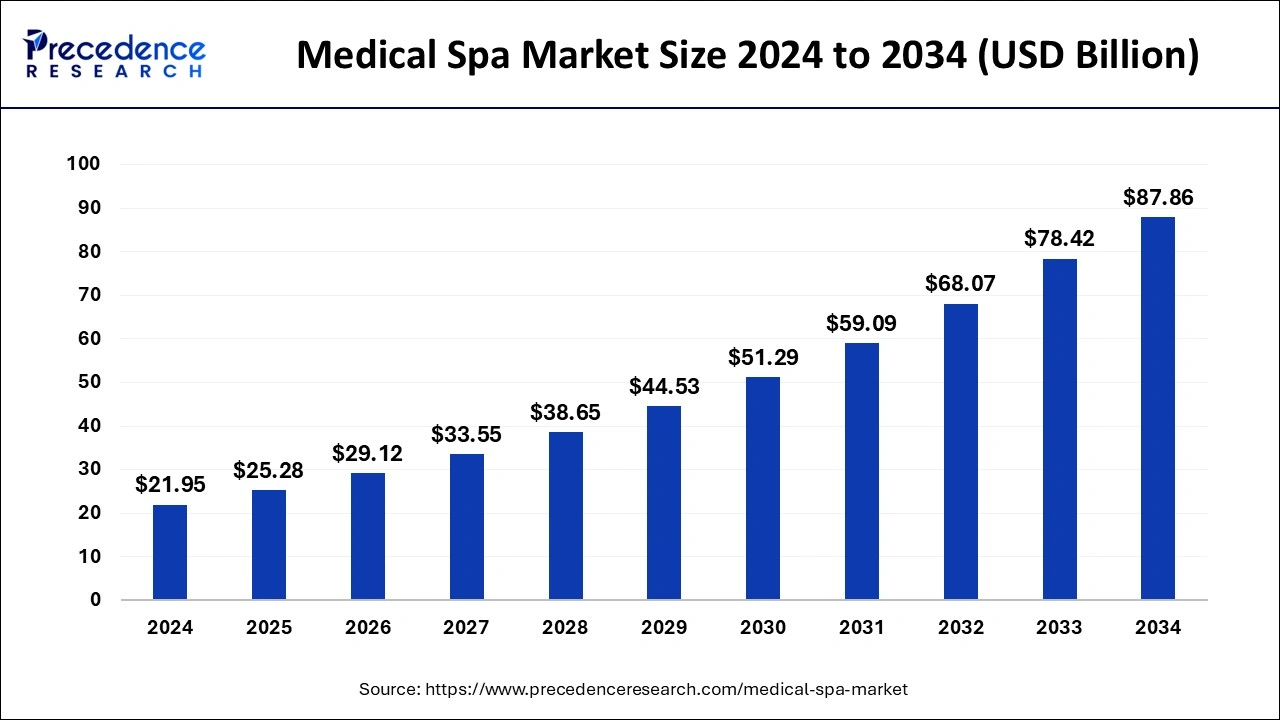

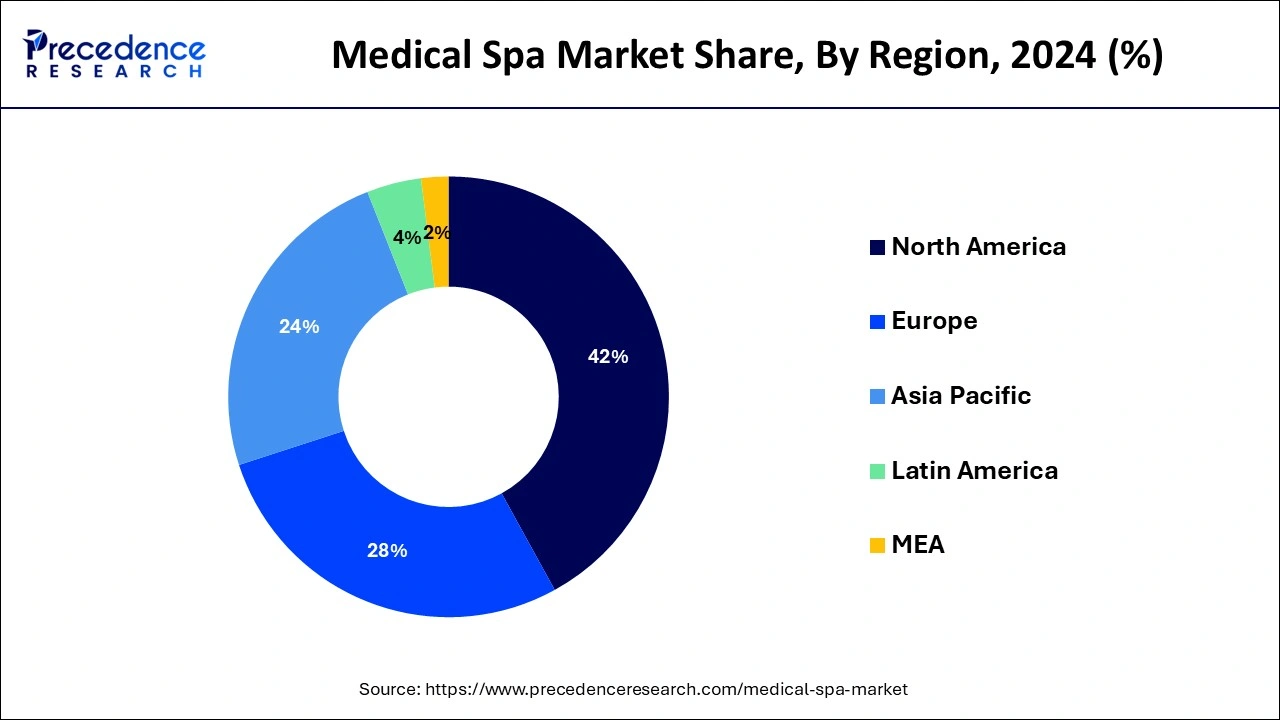

The global medical spa market size is calculated at USD 25.28 billion in 2025 and is forecasted to reach around USD 87.86 billion by 2034, accelerating at a CAGR of 14.88% from 2025 to 2034. The North America medical spa market size surpassed USD 9.22 billion in 2024 and is expanding at a CAGR of 14.89% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global medical spa market size was estimated at USD 21.95 billion in 2024 and is predicted to increase from USD 25.28 billion in 2025 to approximately USD 87.86 billion by 2034, expanding at a CAGR of 14.88% from 2025 to 2034. The medical spa market is driven by the growing interest in non-invasive and minimally invasive aesthetic procedures.

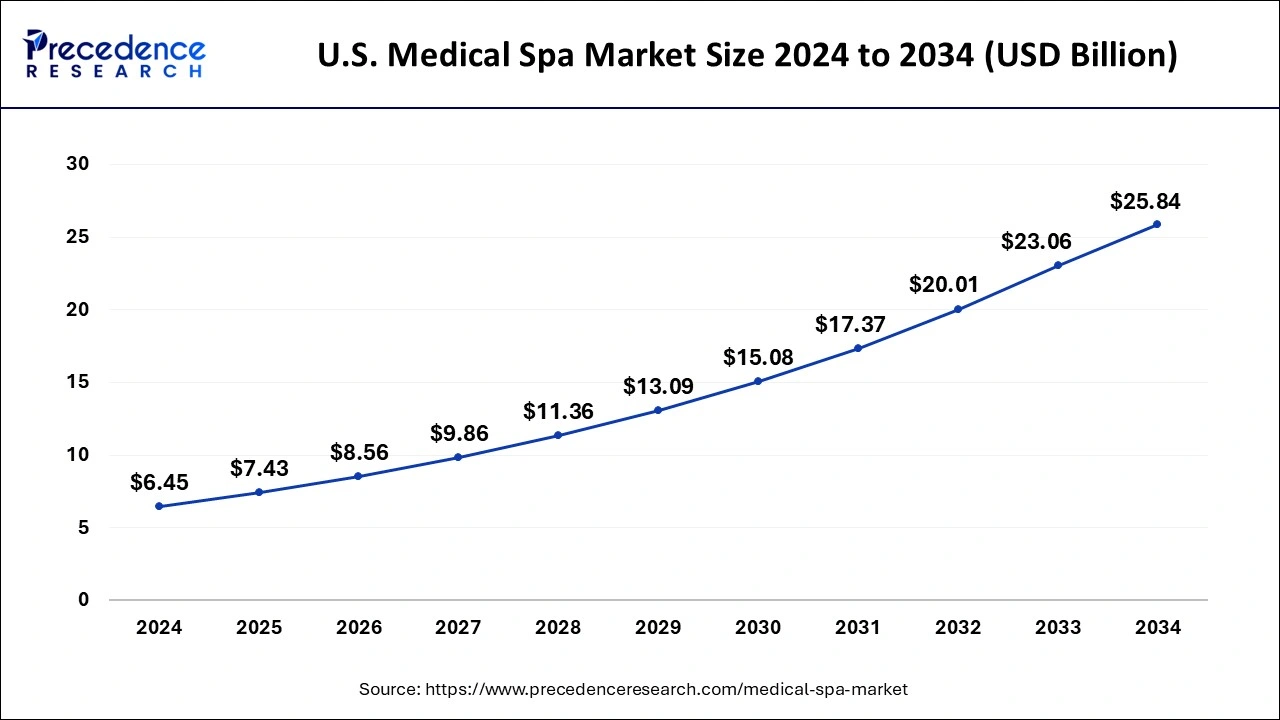

The U.S. medical spa market size was valued at USD 6.45 billion in 2024 and is anticipated to reach around USD 25.84 billion by 2034, poised to grow at a CAGR of 14.90% from 2025 to 2034.

North America held the largest share of the medical spa market in 2024. Patients looking for medical spa treatments are drawn to North America because of its well-established healthcare infrastructure, which includes cutting-edge medical facilities and technologies. More people can now afford medical spa operations because of its comparatively prosperous population and high disposable income. Leading the way in technological advancements for the medical spa sector, it provides state-of-the-art operations and treatments that draw both local and foreign customers. The growing interest in non-invasive cosmetic procedures, skincare, and well-being has increased the demand for medical spa services in North America.

Asia-Pacific is expected to witness the fastest rate of expansion in medical spa market during the forecast period. Growing earnings have led to a rise in discretionary spending on health and beauty services, including medical spa treatments, in several Asia-Pacific nations. The demand for medical spa services is driven by a desire for a young appearance and a heightened knowledge of aesthetic treatments, influenced by social media and globalization. Numerous nations in the Asia-Pacific area, including South Korea, Thailand, and India, have emerged as well-liked hubs for medical tourism, drawing in travelers looking for luxurious, however reasonably priced, medical spa services.

The medical spa market offers cosmetic procedures including fillers and Botox injections, laser hair removal and skin rejuvenation, microneedling, chemical peels, and non-invasive body sculpting. New technologies that provide less invasive and more effective medical care are developed daily. This covers the application of robotics, radiofrequency, ultrasound, and lasers. With procedures like Botox, microdermabrasion, and hair loss treatments becoming increasingly popular, more men are pursuing medical spa treatments. Social media significantly impacts customer behavior and the promotion of medical spa services.

Telehealth platforms are becoming increasingly popular since they enable monitoring patients remotely after treatment and conducting virtual consultations. In response to the increasing need for stress reduction and mental health treatments, medical spas provide massage therapy, light therapy, and meditation.

| Report Coverage | Details |

| Market Size by 2034 | USD 87.86 Billion |

| Market Size by 2025 | USD 25.28 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.88% |

| Dominated Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service, Gender, Age Group, Service Provider, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising demand for non-surgical aesthetics

As non-surgical aesthetic treatments are less invasive than standard surgical procedures, a more comprehensive range of people can access and find them appealing. The rising demand for such non-surgical aesthetics acts as a major driver for the medical spa market. Many non-surgical techniques enable people to resume daily activities sooner than surgical procedures because they require less recovery time. A greater emphasis on physical appearance has resulted from the growth of social media and beauty influencers, raising awareness and acceptability of non-surgical aesthetic operations.

Growing focus on wellness

Consumers are increasingly looking for holistic approaches to health and beauty, placing more emphasis on overall wellbeing than on treating symptoms or pleasing appearances. In line with the trend toward proactive health management, medical spas provide wellness-promoting preventative healthcare services such as lifestyle interventions, stress management, and dietary counseling. The medical spa sector is expanding due to rising demand for wellness programs and anti-aging therapies that preserve youth and quality of life.

Safety concerns and potential for adverse effects

These worries stem from invasive and non-invasive techniques, like chemical peels, lasers, and injections, which can cause difficulties or unfavorable reactions if not used properly. Furthermore, oversight increases these hazards, and some areas require more uniform laws. Due to concerns about side effects or unsatisfactory outcomes, patients may be reluctant to receive treatments or may look for other options. To alleviate these worries and promote trust in the medical spa sector, it is imperative that practitioners have the appropriate training and certification, and that risks and advantages are communicated openly and honestly.

Growing demand for non-invasive and minimally invasive procedures

In comparison with standard surgical operations, these methods offer patients lower risk, faster recovery times, and frequently more inexpensive options. Medical spas are well-positioned to cater to consumer desires as they prioritize convenience, safety, and results that seem natural. Furthermore, new developments in technology and methods keep broadening the scope of services offered by medical spas, drawing in a more extensive clientele of people looking for non-surgical aesthetic upgrades and rejuvenation. In addition to increasing revenue for medical spas, this trend encourages innovation and competition among service providers as they compete to give the newest and most efficient treatments.

Focus on wellness and preventative care

Along with standard cosmetic procedures, medical spas can offer integrative therapies, including dietary counseling, acupuncture, massage therapy, and stress management. This all-encompassing strategy targets mental and physical health, appealing to a growing market of customers concerned about their health. It can offer preventive screenings, health assessments, and lifestyle consultations to identify potential health problems early on and provide recommendations on preventative measures.

This preventive strategy fits the growing trend of people who want to prevent health problems before starting. Medical spas can improve preventative care services by incorporating new technology, such as wearables and health tracking applications. Proactive health management is made possible by these technologies, which let clients track their progress and monitor their health parameters.

The facial treatment segment dominated the medical spa market with the largest share in 2024. A tendency for minimally invasive or non-invasive cosmetic operations has grown. This group includes facial treatments, which provide non-surgical solutions for various skin issues. Numerous services are included in facial treatments, such as chemical peels, microdermabrasion, laser treatments, and facials. Due to its ability to accommodate different skin types and issues, medical spas can draw on a broader clientele.

Medical spas frequently provide individualized treatment programs based on their patrons' specific aims and skin issues. Customization improves customer satisfaction and experience, encouraging return business and enduring loyalty.

The body shaping & contouring segment is the fastest growing in the medical spa market during the forecast period. The desire for non-invasive methods to provide a more sculpted and contoured body image is rising. Options offering less downtime and efficient outcomes are becoming increasingly sought after by consumers.

The emphasis on keeping a young appearance is growing as the population matures. Body shape and contouring procedures deal with typical issues like cellulite, drooping skin, and persistent fat deposits. On social media, celebrities and influencers frequently share their experiences with body contouring procedures, raising consumer interest and awareness.

The female segment dominated the medical spa market with the largest share in 2024. Historically, women have been the primary users of health and cosmetic services, including those provided by medical spas. They frequently look for therapies for anti-aging, hair removal, skin renewal, and general health. Because of society's emphasis on female looks and cultural conventions, women are more likely to devote time and money to skincare, beauty treatments, and aesthetic procedures provided by medical spas.

The male segment witnessed lucrative growth in the medical spa market during the forecast period. Men are showing growing interest in medical spa treatments as they become more aware of their general well-being and looks. There is less stigma attached to men seeking cosmetic operations because of a change in society's attitudes regarding male grooming and self-care. Men seeking all-encompassing methods for bettering their health and well-being are drawn to medical spas that combine wellness treatments with cosmetic surgeries.

The adult segment dominated the medical spa market in 2024. In contrast to younger groups, adults usually have more spare income, which enables them to purchase pricey medical spa treatments. Medical spas are seeing an increase in demand for anti-aging and rejuvenation treatments as the population ages. Adults are increasingly likely to spend money on operations that enhance their physical attractiveness and general well-being as their understanding of health and wellness grows.

The geriatric segment shows a notable growth in the medical spa market during the forecast period. Seniors seeking wellness and beauty treatments to maintain or improve their appearance and general well-being are becoming more prevalent as the world's population ages. The number of older adults interested in non-invasive cosmetic procedures to treat age spots, wrinkles, and fine lines is rising. Thanks to technological advancements, older people who might be worried about the risks involved with traditional surgical interventions can now undergo safer and more effective procedures.

The single ownership segment dominated the medical spa market with the largest share in 2024. Stronger control over service quality is made possible by single ownership, ensuring consistency and high standards are followed. Maintaining a consistent brand identity and image across services, marketing, and customer experience is simpler when only one owner exists. Since the owner is personally accountable for the operation and reputation of the company, patients frequently like medical spas with a single ownership structure since it gives the impression that the facility is trustworthy and accountable.

The free-standing segment is the fastest growing in the medical spa market during the forecast period. Beyond typical spa services, consumers are increasingly looking for customized treatments. Free-standing medical spas are becoming increasingly popular because they provide a variety of specialist treatments, such as non-invasive body contouring, laser hair removal, and Botox injections for cosmetic purposes. Customers find free-standing medical spas handy because they are frequently found in conveniently accessible locations like shopping malls or urban districts. Recurring business is encouraged, and this accessibility improves consumer engagement.

By Service

By Gender

By Age Group

By Service Provider

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025