April 2025

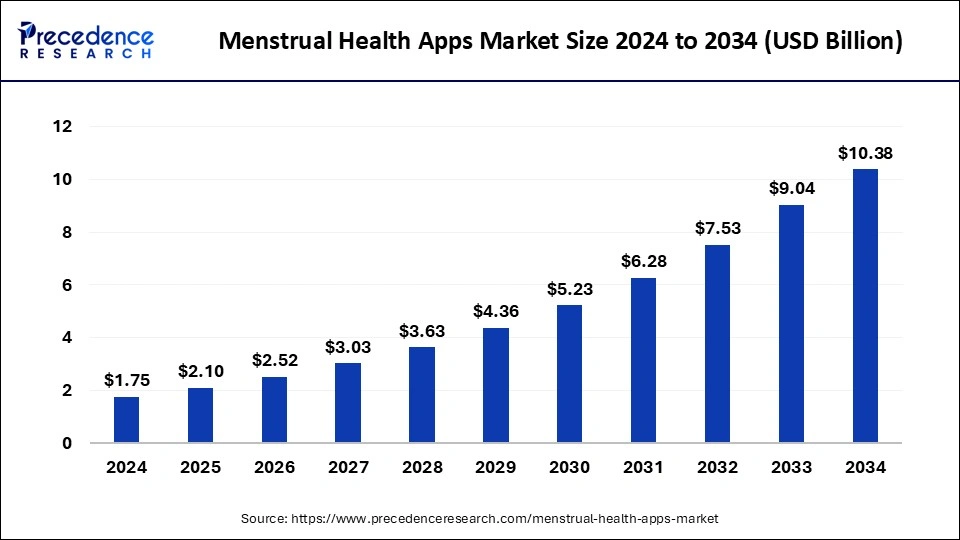

The global menstrual health apps market size is calculated at USD 2.10 billion in 2025 and is forecasted to reach around USD 10.38 billion by 2034, accelerating at a CAGR of 19.49% from 2025 to 2034. The North America menstrual health apps market size surpassed USD 720 million in 2024 and is expanding at a CAGR of 19.53% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global menstrual health apps market size was estimated at USD 1.75 billion in 2024 and is predicted to increase from USD 2.10 billion in 2025 to approximately USD 10.38 billion by 2034, expanding at a CAGR of 19.49% from 2025 to 2034. The rising health awareness among the women, especially in developing countries is expected to fuel the menstrual health apps market’s growth.

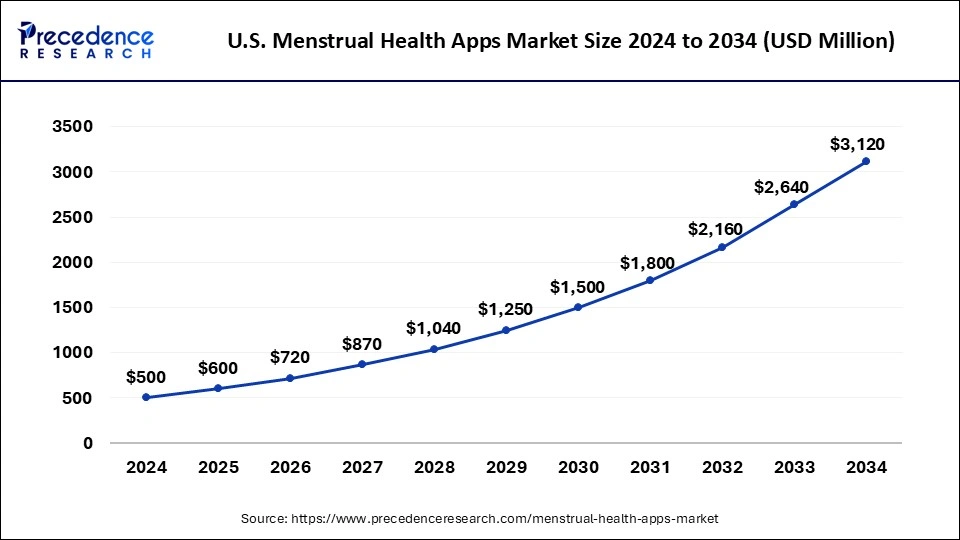

The U.S. menstrual health apps market size was exhibited at USD 500 million in 2024 and is projected to be worth around USD 3,120 million by 2034, poised to grow at a CAGR of 20.09% from 2025 to 2034.

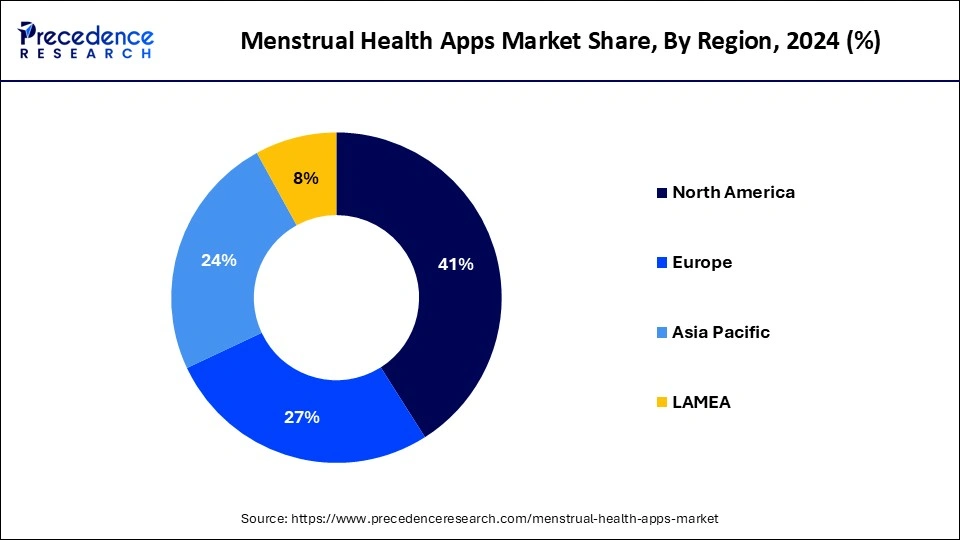

North America dominated the global menstrual health apps market with the largest share in the year 2024. Advanced internet connectivity in countries like the United States and Canada stands out the one of the major reasons behind the dominance of the region. This helps the individuals get access to various applications including menstrual health. Advanced health infrastructure and government initiatives help individuals to focus on menstrual health resulting in more focus towards health expenditure.

Additionally, the well-established IT infrastructure and access to multiple technologies help the companies improve their app functionality based on consumer preference and feedback. The increasing number of funds towards the enhancement of various technologies is expected to carry forward the growth of the menstrual health apps market in the North American region. Multiple North American players are focused on the integration of AI0based solutions in the menstrual health apps.

Asia Pacific is expected to register the fastest growth with a notable CAGR during the forecast period 2025 to 2034. The increasing number of smartphone users in countries like China, India, and Japan is considered to be the reason behind the increasing demand for digital health solutions. The number of internet users especially in developing areas has resulted in the increasing popularity of women's health solutions in the region. This need has led to increasing expenditure towards women's health and wellness which could boost the growth of the menstrual health apps market in the upcoming years.

Europe is expected to grow at a decent pace during the forecast period 2024 to 2033. The strong regulations towards data protection help the companies to ensure the safety of the sensitive data of the users. This also increases the reliability of the consumers and attracts more women individuals to use the menstrual health apps. Governments in the United Kingdom, France, and Germany support the promotion of digital health among their citizens which helps the market companies to come up with ideas related to menstrual health. This regulatory support could potentially the growth pace of menstrual health apps in Europe.

The menstrual health app also known as the period tracker app is a mobile application specially designed to assist women in tracking their menstrual cycle and their reproductive health. These applications provide a better understanding of menstrual health with the help of tools which offer a wide range of features to the users. Menstrual health apps help in tracking future cycles based on the end and start date of the previous menstrual cycle. The application also allows the user to track many additional things including the flow during the cycle, cramps, and mood swings. These apps analyze the present data and provide insights about the ovulation days and the fertility window. This provides a better understanding of women’s health which may also play a crucial role in case of any health-related issue to be discussed with the healthcare provider.

The menstrual health apps market has been accounting for significant growth over the past few years due to the increasing digitalization. The widespread use of smartphones is increasing the acceptance of digital health solutions related to women's health. The easy access and availability of the Internet in developing economies is fueling the growth of the menstrual health apps market.

Most Popular Menstrual Health Apps in World:

| Report Coverage | Details |

| Market Size by 2034 | USD 10.38 Billion |

| Market Size in 2025 | USD 2.10 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 19.49% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Platform, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising menstrual health awareness

The growing recognition of menstrual health especially in the workplace environment has been playing a key role towards the development of the menstrual health apps market. Campaigns, advertisements, and increasing educational efforts towards women’s health are playing an impactful role towards increasing the quality of life among women. Many governments are taking initiatives by implementing policies to ensure the health of women. This is beneficial as it increases the adoption of digital health solutions including menstrual health. This helps with market expansion by attracting more investment towards the development of the women's health sector.

Rising internet penetration

Technological advancements around the globe as resulted in an increasing number of mobile networks and broadband. This has availed access to internet connections in almost every corner of the world. The increasing menstrual health campaigns on social media and the increasing media coverage related to menstrual health have increased the influence of digital health solutions. This promotes the use of health tracking apps which help in monitoring the menstrual cycle, ovulation and fertility of the individual. The internet provides real-time insights with personalized notifications to manage the cycle and enhance overall health. These advanced features are expected to fuel the growth of the menstrual health apps market.

Data privacy concerns

The menstrual health apps have grown significantly in the past few years but there are still some factors which still stand as a threat to the market growth. The application takes sensitive data of the women which tracks their overall activities and the menstrual cycle details. Any misuse of the data can be a potential threat to the individual. Many poor data management practices do not contain the delete function which could risk the privacy of the data. Certain mismanagement reduces the trust level of the consumers which would potentially slow down the growth of the menstrual health apps market. Many companies are focusing on the enhancement of their security and data management systems which could tackle this error in the upcoming times.

Technological advancements in the digital health sector

Emerging technologies like Artificial intelligence (AI) play a vital role in the enhancement of menstrual health applications. AI can analyze a huge data and provide personalized recommendations to the users which might help in gaining significant attention from the customer base. These emerging technologies can also predict ovulation and fertility and the symptoms related to the menstrual cycle. Many companies are using these technologies to understand the needs of the consumers which may help them to understand the problems associated with menstrual health. The increasing demand for wearable technologies with support mobile apps could potentially boost the growth of the menstrual health apps market.

Increasing partnerships and collaborations

The increasing awareness related to menstrual health is leading towards partnerships and collaboration to boost the growth of menstrual health apps. The market has gained significant attention due to constant campaigning and efforts to improve the menstrual health of women. Many Fem tech companies are also focusing towards expanding their market reach through partnerships and collaboration which could increase their presence in the market.

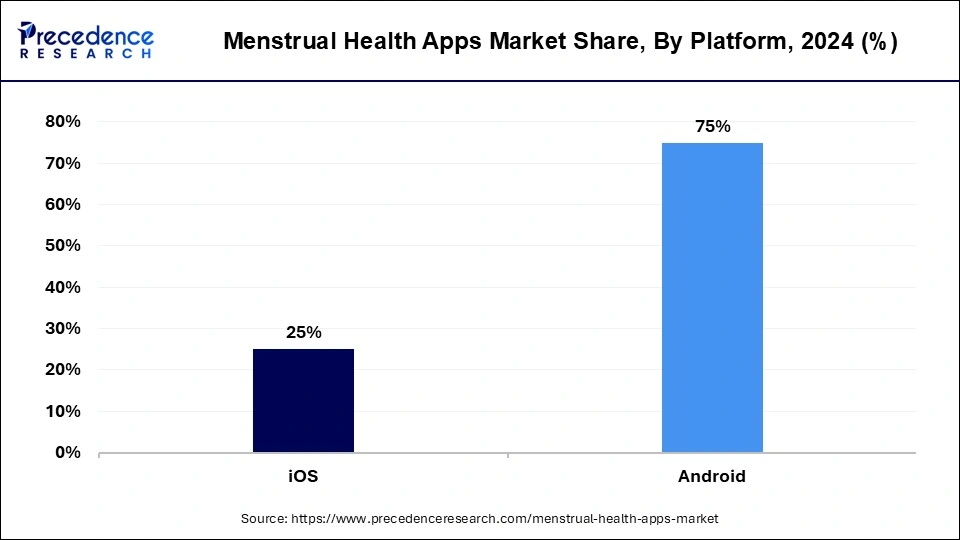

The Android segment was the dominant with the largest share of revenue in 2024. The dominance is attributed to the huge number of Android phones among individuals. Android is considered a flexible option in app development which provides a greater customization compared to others. Android phones usually are cheaper options which has been the reason behind the global reach of these phones. It has also been projected that the Android segment is expected to maintain its dominance during the forecast period due to increasing demand for these devices in multiple regions. The integration of Android with Google is expected to play a key role in the development of the menstrual health apps market.

The iOS segment is expected to register significant growth during the forecast period 2024 to 2033. This segment is gaining popularity due to its robust security ensured by Apple. The increasing threat to the protection of data is increasing the need for platforms which could ensure the safety of sensitive data. iOS also provides the fastest updates which helps to tackle all the errors present in the system or the device.

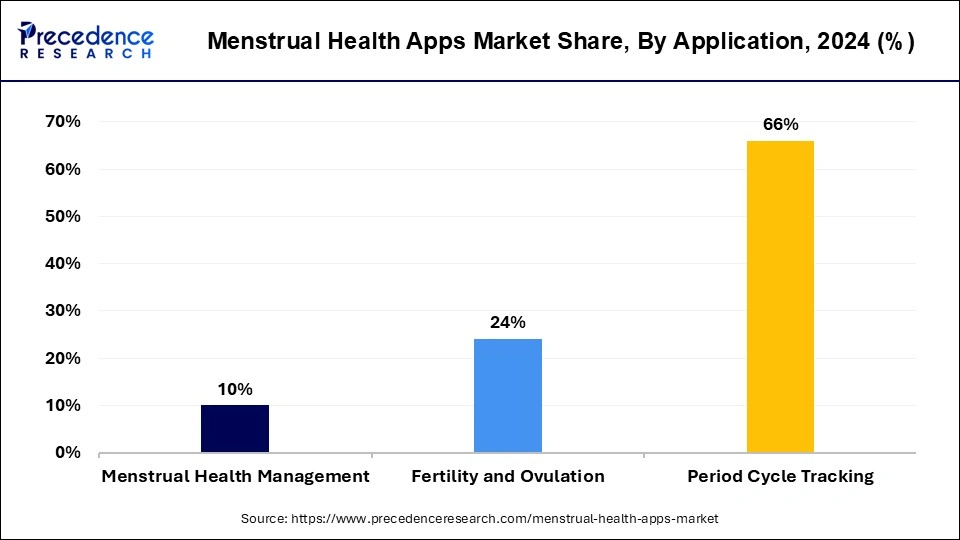

The period cycle tracking segment held the largest shares in the year 2024. These applications usually use various technologies to predict the upcoming menstrual dates with the help of the present data. They cater to wider demands of women like tracking various symptoms and helping them to manage through personalized recommendations. These applications provide a better understanding of their hormonal cycles and help them optimize their lifestyles. Many companies are focusing on building user-friendly period cycle tracking applications which could target multiple users and help them enhance their menstrual health.

The fertility and ovulation segment is expected to register the fastest growth during the forecast period. These applications track the accurate ovulation date which helps the individuals who are considering family planning. The fertility-based apps usually help individuals to track their fertility insights using tools. The ongoing technological advancements like AI and ML are improving these applications which would attract a huge user base in the upcoming years. These technological advancements are considered to play a vital role in the overall growth of the menstrual health apps market.

By Platform

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

March 2025

February 2025

April 2025