February 2025

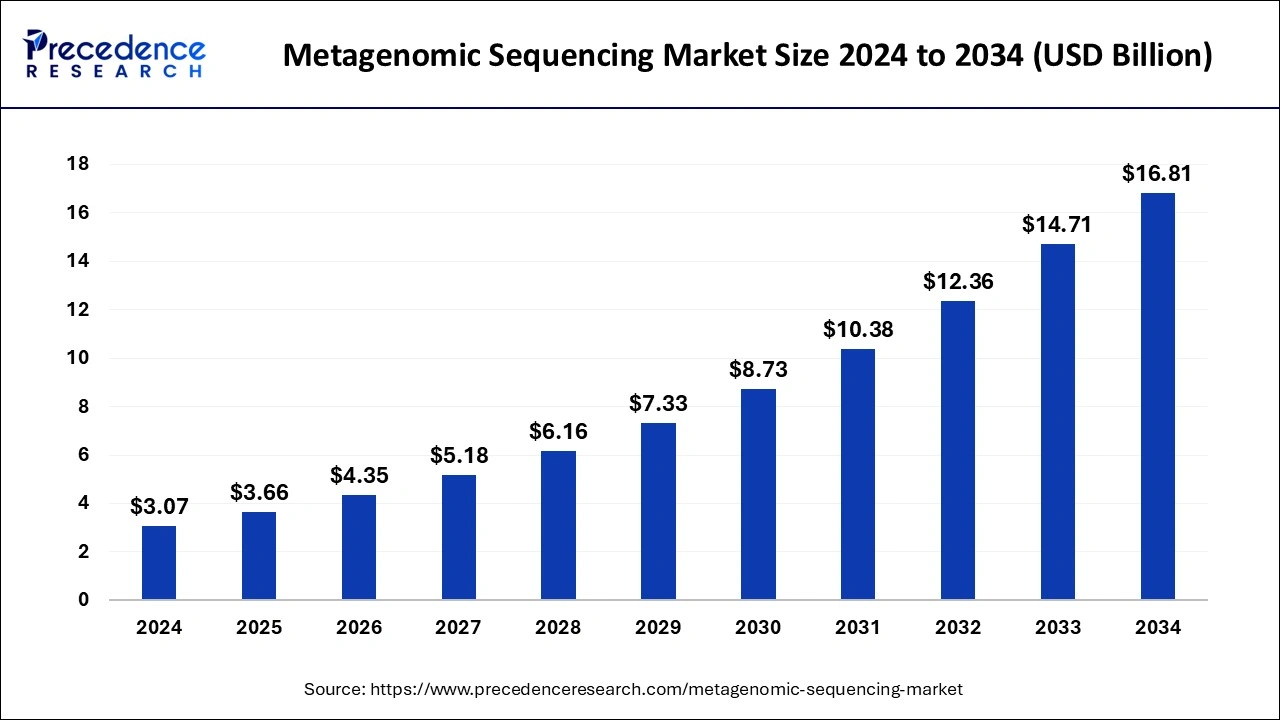

The global metagenomic sequencing market size is accounted at USD 3.66 billion in 2025 and is forecasted to hit around USD 16.81 billion by 2034, representing a CAGR of 18.53% from 2025 to 2034. The North America market size was estimated at USD 1.32 billion in 2024 and is expanding at a CAGR of 18.54% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global metagenomic sequencing market size was calculated at USD 3.07 billion in 2024 and is predicted to reach around USD 16.81 billion by 2034, expanding at a CAGR of 18.53% from 2025 to 2034. Metagenomic sequencing is a molecular biology method used to examine the genetic material found in a complicated assemblage of microbes, such as a soil sample or the microbiome of the intestine.

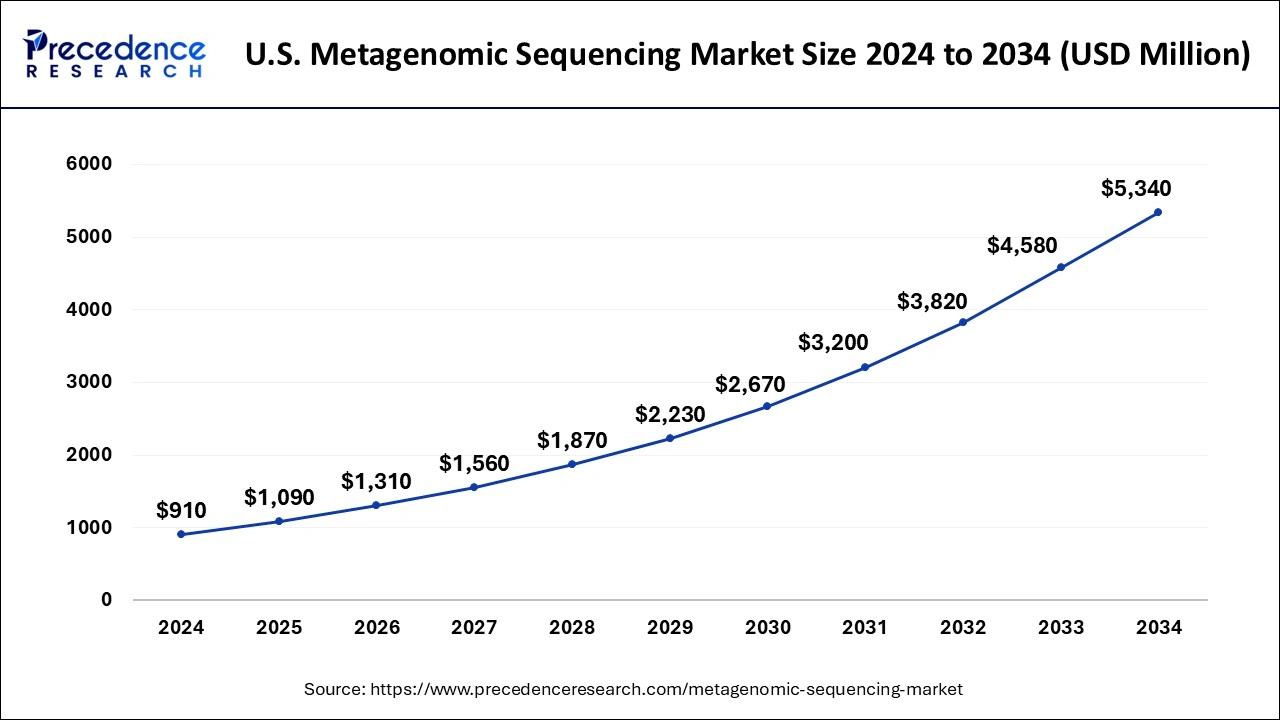

The U.S. metagenomic sequencing market size was exhibited at USD 910 million in 2024 and is projected to be worth around USD 5,340 million by 2034, growing at a CAGR of 19.36% from 2025 to 2034.

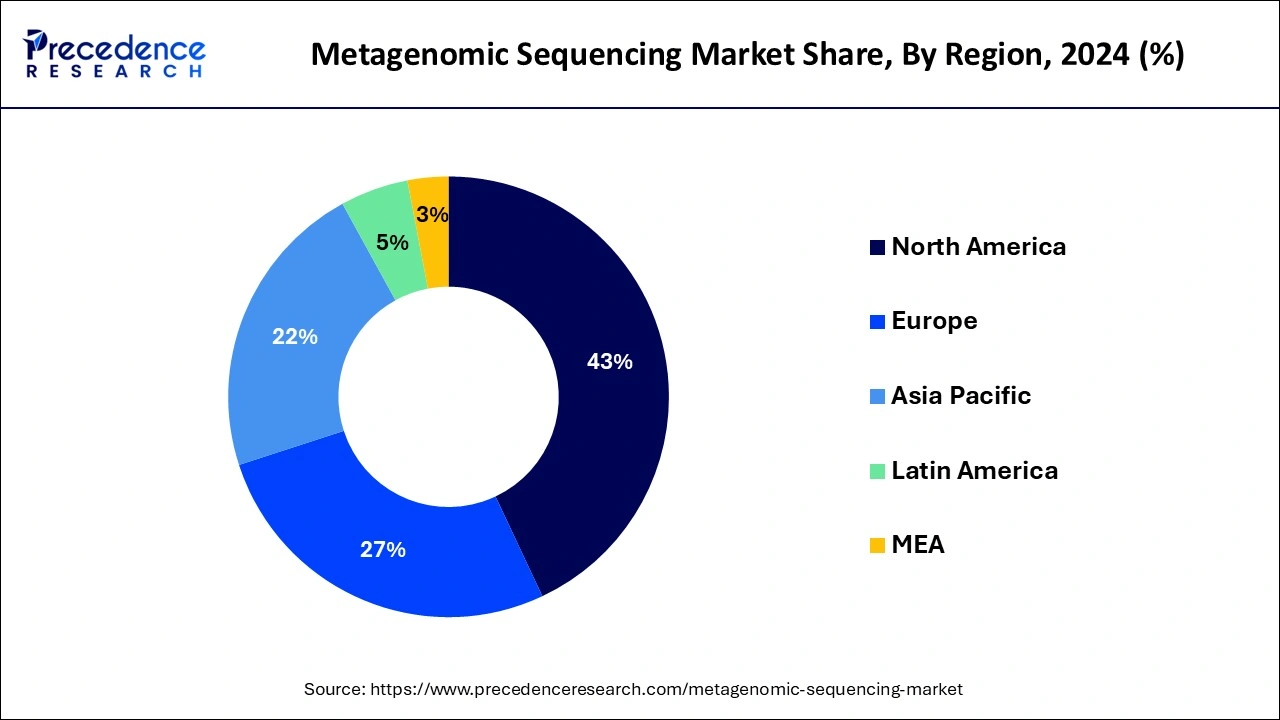

The market for worldwide metagenomics sequencing is currently dominated by North America, and this trend is anticipated to continue throughout the projection period. The North American region generated more than 42.14% of the revenue share in 2024. This is explained by the fact that more metagenomics apps in this area are implementing DNA sequencing. Additionally, this region's supremacy has been aided by the quick implementation of novel sequencing technologies there. Growth of the market is fueled by an increase in product clearance, product launches, and acquisitions by major companies operating in North America. Additionally, the presence of key market players and government support for genomics research is expected to drive the growth of the market in this region. The European region is expected to witness substantial growth in the metagenomic sequencing market due to the increasing demand for genomic research and development, and the presence of key market players.

The Asia Pacific region is expected to witness rapid growth in the metagenomic sequencing market due to the presence of a large patient population and increasing investments in healthcare infrastructure.

The ability of scientists to study microbial communities from an infinite variety of environments is expanding, and one of the main factors promoting this growth is the continuous development of faster sequencing techniques, rising demand for personalized medicine, technological advancements, and rising funding for genomic research. Advancements in sequencing technologies and data analysis tools have made metagenomic sequencing more accessible and affordable, which is expected to drive market growth.

Molecular biology study has been accelerated by the development of Next Generation DNA Sequencing (NGS) technology, leading to a wealth of new findings and ideas. Rising technical developments in DNA sequencing will therefore probably fuel market expansion over the course of the projection period. Increasing government initiatives and financing for large-scale sequencing projects, as well as rising general knowledge of genetic abnormalities, are some of the main forces propelling the global metagenomic sequencing market. Numerous hereditary diseases with distinct clinical symptoms have been discovered. A confirmed birth abnormality affects 3 to 6% of infants, at least 50% of whom have a genetic basis. Around 30% of postnatal infant mortality in wealthy countries is attributable to genetic illness; 30% of juvenile hospital hospitalizations and 10% of adult hospital admissions have a genetic cause.

The growing adoption of next-generation sequencing (NGS) technologies is also expected to drive the growth of the market. The development of novel sequencing platforms with improved accuracy, throughput, and cost-effectiveness has increased the adoption of NGS technologies for metagenomic sequencing. Additionally, the increasing demand for metagenomic sequencing in environmental monitoring and microbiome research is expected to drive the growth of the market. Over a quarter of NHGRI's FY2018 funding is allocated to projects with substantial computational genomics or data science components; these fields are essential to many of NHGRI's awards and initiatives. The NHGRI Funding Policy's general concepts and objectives are followed by funding for computational genomics and data science.

Some of the key trends in the metagenomic sequencing market are:

| Coverage | Details |

| Market Size in 2025 | USD 3.66 Billion |

| Market Size in 2024 | USD 3.07 Billion |

| Market Size by 2034 | USD 16.81 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 18.53% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Segmentation | Product and Services, Technology, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

NGS platform technology is constantly evolving

The development of effective, portable, and simple-to-use NGS systems with better turnaround rates has been made possible by the ongoing technological advancements in sequencers. A number of well-known businesses are increasingly concentrating on R&D in order to improve their marketplaces and share as a result of the launch of such goods and technologies giving competitors an instant competitive advantage.

For instance, the Sequel ll System was introduced by Pacific Biosciences of California, Inc. (US) in April 2019. When compared to the prior Sequel System, the new product lowers project costs and timelines by roughly eight times the amount of data production. PromethlON 24 and Prometh|ON 48 were introduced by Oxford Nanopore Technologies plc. (UK) in January 2019. These devices provide modular high throughput, extended read, and direct nanopore sequencing data. Thermo Fisher Scientific's lon GeneStudio S5 System and Illumina's Seq 100 are two other ground-breaking systems that guarantee high sequencing efficiency at lower prices.

Budgetary restrictions for consumers in emerging nations

Academic R&D in emerging nations is primarily reliant on outside financing. Despite ongoing attempts by governments and private organizations to provide funding for research globally, many study and academic institutions experience financial restrictions when it comes to the acquisition and use of cutting-edge and expensive equipment and technologies. NGS sequencers are still expensive even though NGS sequencing costs have decreased. The NovaSeq 5000 and 6000, lumina's most sophisticated sequencing systems, cost USD 850,000 and USD 985,000, respectively. These sequencers are approximately 70% quicker at sequencing than the majority of llumina's current platforms, and they can be made even faster with future system and program updates. Another major participant in the NGS market, Pacific Biosciences of California, offers its PacBio RS Il at USD 750,000 and its most recent sequencing platform, the Sequel system, at USD 350,000. Even though low-cost sequencing systems like the iSeq have entered the market, many end consumers in developing APAC and LATAM nations still find their price to be prohibitive. As a consequence, the adoption of related NGS products for metagenomics is being hampered by the restricted use of cutting-edge technologies, such as NGS, in university and research institutions in emerging nations.

NGS data analysis using big data

The amount of data generated during whole-genome sequencing typically ranges in the terabyte region. The management of such massive amounts of data is a significant worry for NGS-based metagenomic sequencing's end users. Due to inconsistent data formats and a dearth of industry-wide standardization for data output from various NGS systems, data storage needs can be quite complicated. However, the output of NGS runs has grown considerably as a result of the use of big data tools, Al, and process management. With improvements in sequencing technology, more data is generated during a sequencing cycle. In comparison to 16.2 megabytes at the beginning of the Human Genome Project in 2001, one human genome's sequencing results in approximately 743 terabytes (743,000 gigabytes) of data as of July 2017, according to a study from the National Human Genome Research Institute. Because the volume of produced genetic data exceeds the capabilities of human analysis, there is a chance to use cutting-edge computing techniques for evaluation and analysis. Various businesses are integrating cutting-edge algorithmic technologies into their sequencing products in line with this. For example,

The worldwide market for metagenomics sequencing is segmented into three product and service categories: reagents and consumables, tools, and services. Metagenomics sequencing services and research & data interpretation options make up the services sector. The services segment led the market in 2023 and is projected to reach a value of USD 3,945 million by 2033, growing at a CAGR of 17.90% between 2024 and 2033. Over the course of the study period, reagents and consumables are expected to expand at the fastest rate. By using reagents and consumables, one can be confident that the DNA used for metagenomics sequencing analysis is typical of all the cells in the sample and suitable for creating genomic libraries. Additionally, the pre-sequencing consumables make sure that the DNA material being submitted to sequencing is precisely handled to produce the desired nucleotide sequence. Due to the rise in genetic illnesses, diseases, and metagenomics sequencing study initiatives, there is an increase in the demand for metagenomics sequencing, which spurs the market's expansion.

The worldwide market for metagenomics sequencing is divided into four categories based on technology: metatranscriptomics, whole genome sequencing and de novo assembly, and shotgun metagenomics sequencing. Due to the benefits that shotgun sequencing offers over other sequencing techniques, the rise in the number of metagenomics sequencing-based research activities, and healthcare professionals, it is anticipated that the shotgun metagenomics sequencing segment will grow at the fastest rate during the analysis period.

The worldwide metagenomics sequencing market is expected to grow as more people choose to implement shotgun sequencing due to the better benefits provided. Shotgun metagenomic sequencing has seen a rise in use over the past few years as a result of an application that allows for the reading of all the genomes contained within a DNA molecule.

The ecological and environmental metagenomics, clinical diagnosis, drug development, biofuel, and industrial application segments make up the worldwide metagenomics sequencing market, In 2023. However, due to the advancement of tools and software used in metagenomics research, the clinical diagnostics sector is anticipated to expand at the greatest rate from the forecast period. The prevalence of viral and pathogenic diseases has increased, creating opportunities for the worldwide metagenomics sequencing industry to expand.

Additionally, the rising incidence of infectious diseases the need for rapid and accurate diagnostics, and Growing awareness and adoption of precision medicine approaches for personalized treatment foster the growth of clinical diagnostics applications. Furthermore, Growing concerns about environmental pollution and climate change, and Advances in sequencing technologies and bioinformatics tools for studying complex microbial ecosystems drive the growth of ecological and environmental metagenomic applications. Moreover, the growth of this segment is also attributed to increasing demand for new, effective as well as natural product-based drugs to treat various diseases and conditions.

By Product and Services

By Technology

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

December 2023

January 2025

October 2024