August 2024

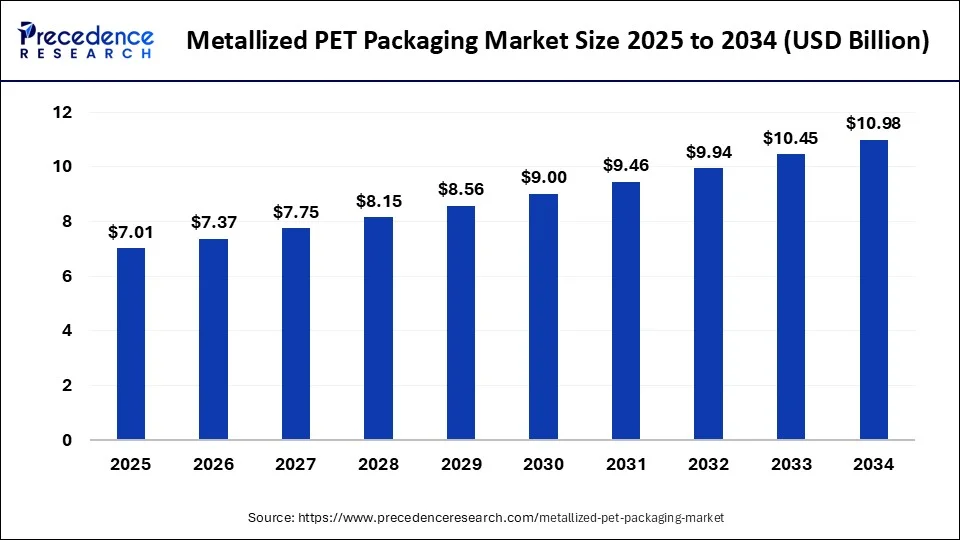

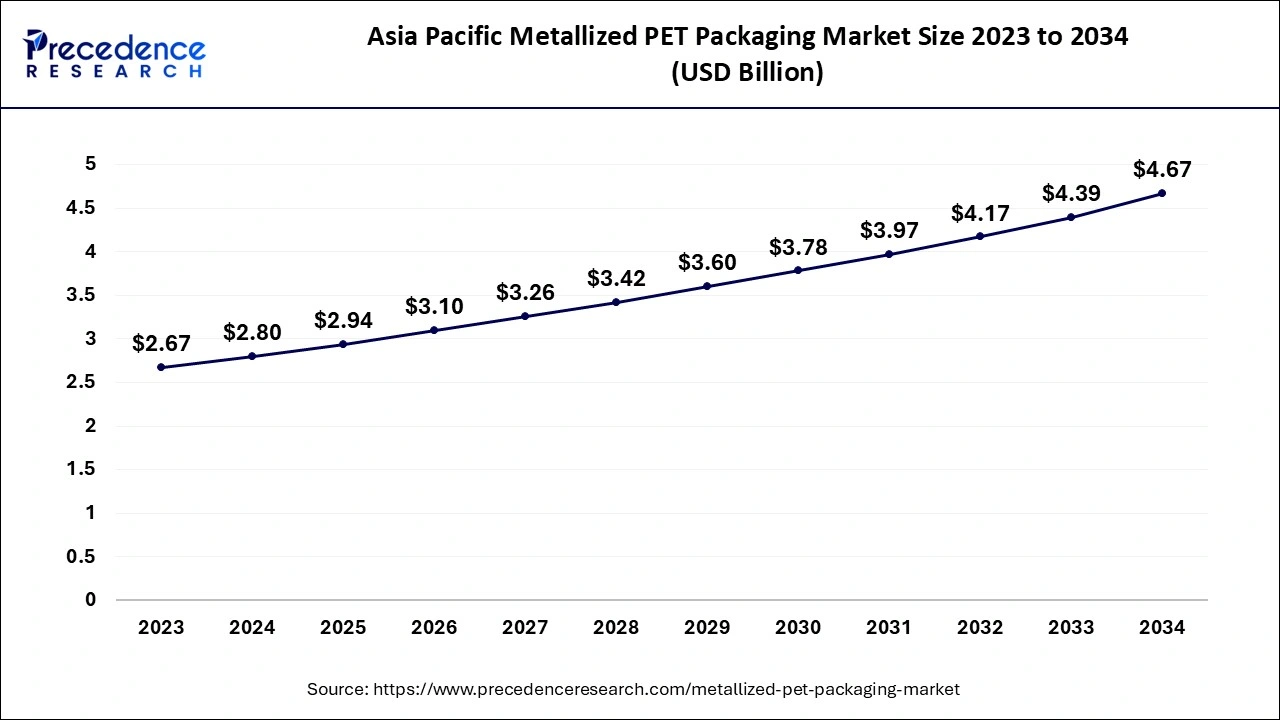

The global metallized pet packaging market size is calculated at USD 6.67 billion in 2024, grew to USD 7.01 billion in 2025 and is predicted to hit around USD 10.98 billion by 2034, expanding at a CAGR of 5.11% between 2024 and 2034. The Asia Pacific metallized pet packaging market size accounted for USD 2.80 billion in 2024 and is representing a notable CAGR of 5.22% during the forecast period.

The global metallized pet packaging market size is accounted for USD 6.67 billion in 2024 and is projected to reach around USD 10.98 billion by 2034, growing at a CAGR of 5.11% from 2024 to 2034. The rising demand for efficient and sustainable packaging solutions in various industries is driving the growth of the market.

The Asia Pacific metallized pet packaging market size is evaluated at USD 2.80 billion in 2024 and is projected to be worth around USD 4.67 billion by 2034, growing at a CAGR of 5.22% from 2024 to 2034.

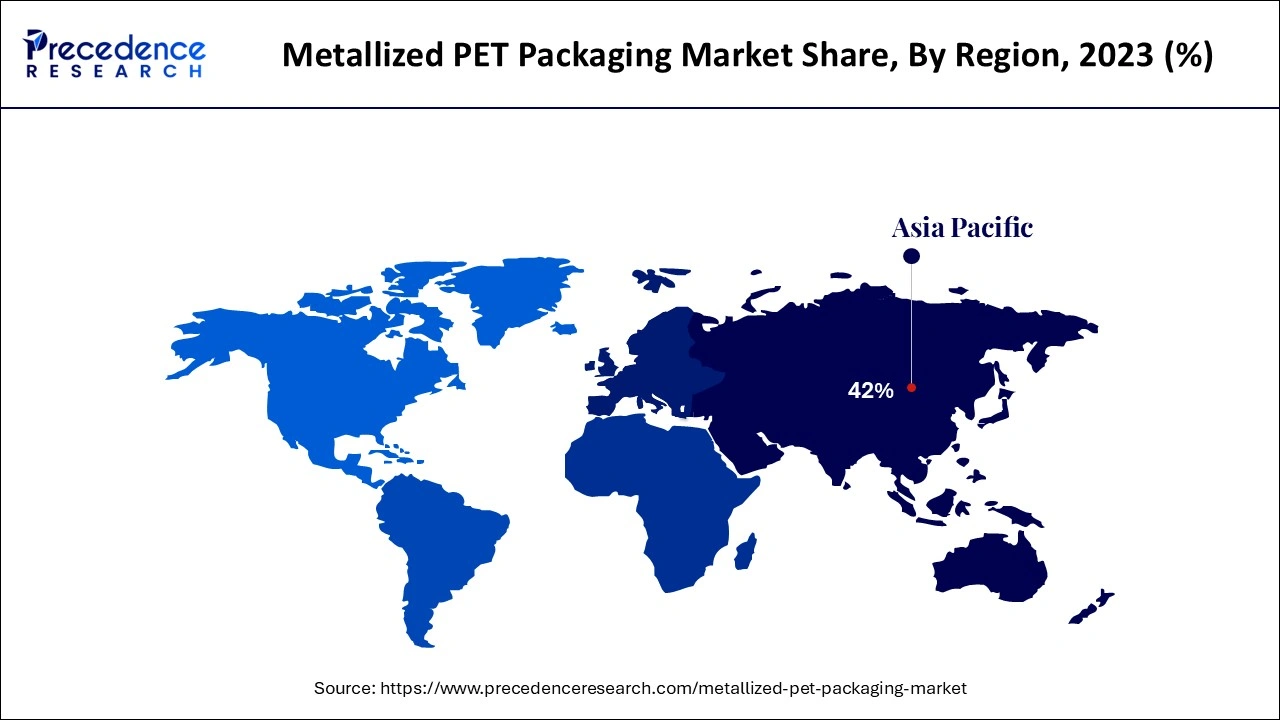

Asia Pacific dominated the metallized PET packaging market in 2023. This is mainly due to the rapid industrialization in countries like India, China, Taiwan, and South Korea. With the growing industrialization in these countries, the demand for sustainable packaging solutions has increased. However, metallized PET films are environmentally friendly and recyclable, making them ideal for sustainable packaging solutions. In addition, the rising disposable income of consumers is encouraging them to spend on consumer goods, especially on ready-to-eat and packaged foods, and the rapid expansion of the food and beverage industry is boosting the demand for flexible packaging materials, thus boosting the market in the region.

Europe is anticipated to grow at a significant rate in the market during the forecast period. The regional market growth is primarily attributed to the rising demand for sustainable packaging solutions due to the rising awareness about environmental sustainability and the growing concerns about plastic waste. Stringent environmental protection acts in the region are also encouraging various industries to reduce plastic use. In addition, the region is one of the largest consumers of packed food, which further accelerates the growth of the metallized pet packaging market in the region.

Metalized PET packaging refers to packaging that involves depositing a coating of aluminum particles into a PET substrate and then covered with a thin plastic film to create a metallic effect. This packaging exhibits excellent barrier property, maintaining product freshness and integrity. Metallized PET packaging is used in various industries, including food & beverages, automobile, and electronics, where product integrity and visual presentation are crucial.

Impact of AI on the Metallized PET Packaging Market

Artificial intelligence is revolutionizing the packaging industry by enhancing operational efficiency, designing and labeling, personalizing the customer experience, sustainability and traceability, and customer support. AI aims to streamline and optimize the packaging process by reducing manual tasks, reducing costs, increasing efficiency, and ensuring impeccable quality standards. AI is used in different processes in the packaging industry. It helps optimize the supply chain, manage inventory, control quality, and perform predictive maintenance. It also reduces wastage and detects errors.

| Report Coverage | Details |

| Market Size by 2034 | USD 10.98 Billion |

| Market Size in 2024 | USD 6.67 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 5.11% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising consumption of packaged food

With the growing population across the globe, the demand for packaged food is increasing. Fasts-paced life in developed countries, busy lifestyles, and less availability of time encourage people, especially youngsters, to use packaged or canned food and beverages. Moreover, the rapid expansion of the food industry is boosting the demand for flexible and quality packaging solutions. However, metallized PET packaging is ideal for food and beverage packaging due to its attributes, such as temperature control, preventing heat and moisture, and tear resistance. Additionally, the rising investments in advanced packaging materials contribute to the market growth.

High costs and lower density

Metals such as aluminum, copper, or silver are used in metallization. However, the high cost of these materials ultimately impacts the entire cost of metallized PET packaging. In addition, the lower density of metallized PET packaging is a key factor limiting its use, thus restraining the growth of the metallized pet packaging market.

Increasing demand for sustainable packaging

With the rising concerns about the disposal of plastic packaging waste, there is a high demand for sustainable packaging solutions with enhanced properties. Metallized PET packaging can be recycled, aligning well with the sustainability goal. Moreover, the rising government initiatives to reduce plastic waste and carbon footprints and promote sustainable packaging solutions create immense opportunities in the market. Thus, several market players are focusing on developing biodegradable packaging solutions to gain a competitive edge.

The aluminum metalized PET films segment led the metallized PET packaging market in 2023. This is primarily due to the rising demand for aluminum metalized PET films for packaging purposes in various end-use industries, such as food and beverages, electronics, and pharmaceuticals. These films offer excellent barrier properties, enhancing product protection against oxygen, moisture, and light. This further enhances shelf life and maintains product freshness.

Aluminum metalized PET films are ideal for the packaging and wrapping of various products due to their tear-resistant and lightweight properties. In the pharmaceutical industry, aluminum metalized PET film is used to protect medicines from external temperature and transportation damage. In contrast, in the food industry, it is used to prevent food spoilage from external temperatures.

The silver metalized PET films segment is expected to expand at the fastest growth rate over the studied period. The segment growth is attributed to the increasing demand for silver metalized PET packaging in a wide range of industries. Silver metalized PET films exhibit excellent heat and corrosion resistance properties, making them ideal for wrapping various products, including consumer electronics.

The packaging industry segment dominated the metallized PET packaging market in 2023. The demand for metalized PET films is rising in the packaging industry due to their beneficial properties, like excellent UV and thermal radiation protection, optical effects, tear resistance, lightweight nature, flexibility, and corrosion resistance. These properties make them suitable for packaging various products. Moreover, the increasing preference for lightweight and recyclable packaging further contributed to segmental growth.

The printing industry segment is projected to expand rapidly in the market throughout the forecast period. Metalized pet films have universal printability. Thus, they provide high-quality results in different printing processes like flexography, letterpress, UV, and offset. The metalized pet films are compatible with water, UV, and solvent, making them suitable for various printing. Printing colorful graphics and product information on metalized PET films with great clarity and brightness is possible.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

March 2024

July 2024

July 2024