November 2024

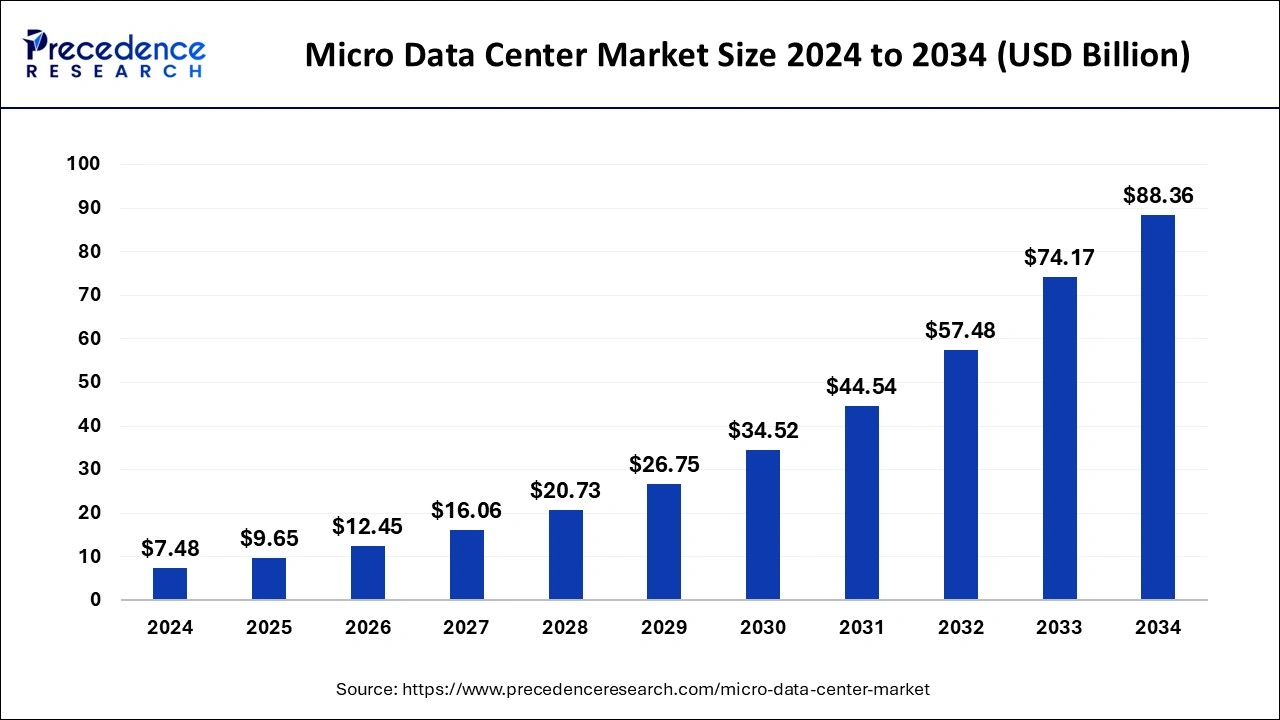

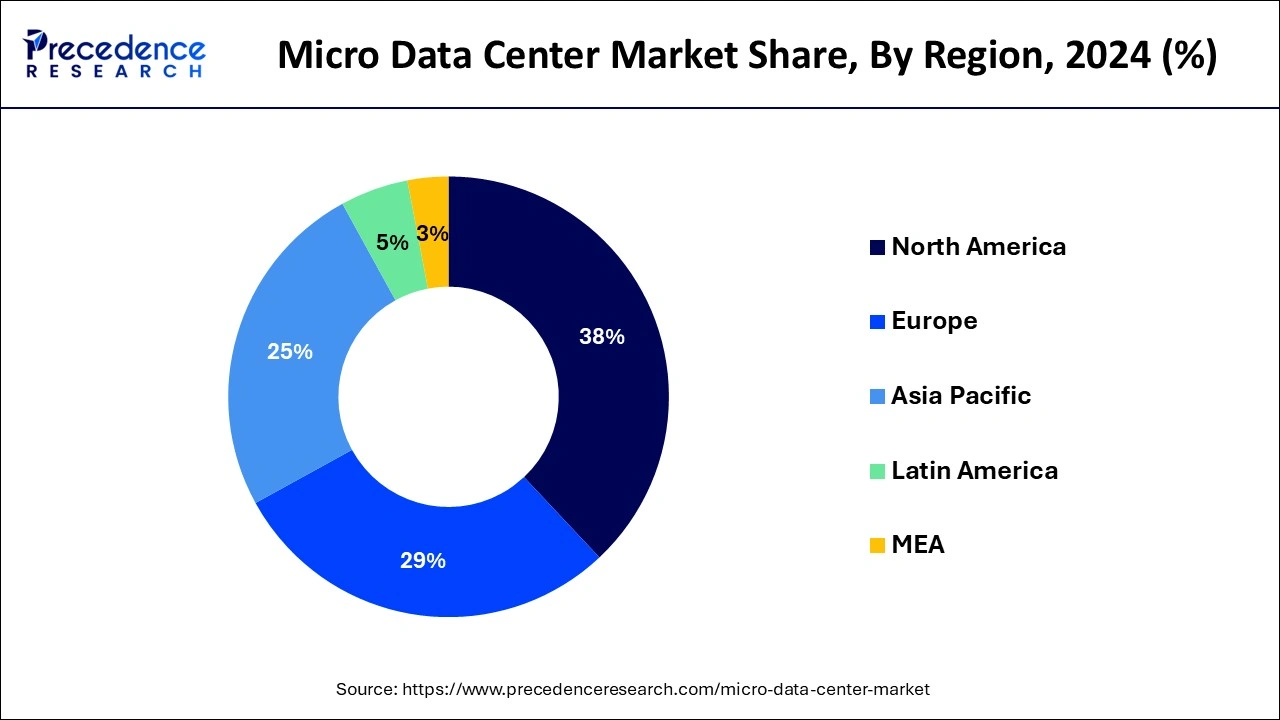

The global micro data center market size is calculated at USD 9.65 billion in 2025 and is forecasted to reach around USD 88.36 billion by 2034, accelerating at a CAGR of 28.01% from 2025 to 2034. The North America micro data center market size surpassed USD 2.84 billion in 2024 and is expanding at a CAGR of 28.19% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global micro data center market size was estimated at USD 7.48 billion in 2024 and is predicted to increase from USD 9.65 billion in 2025 to approximately USD 88.36 billion by 2034, expanding at a CAGR of 28.01% from 2025 to 2034.

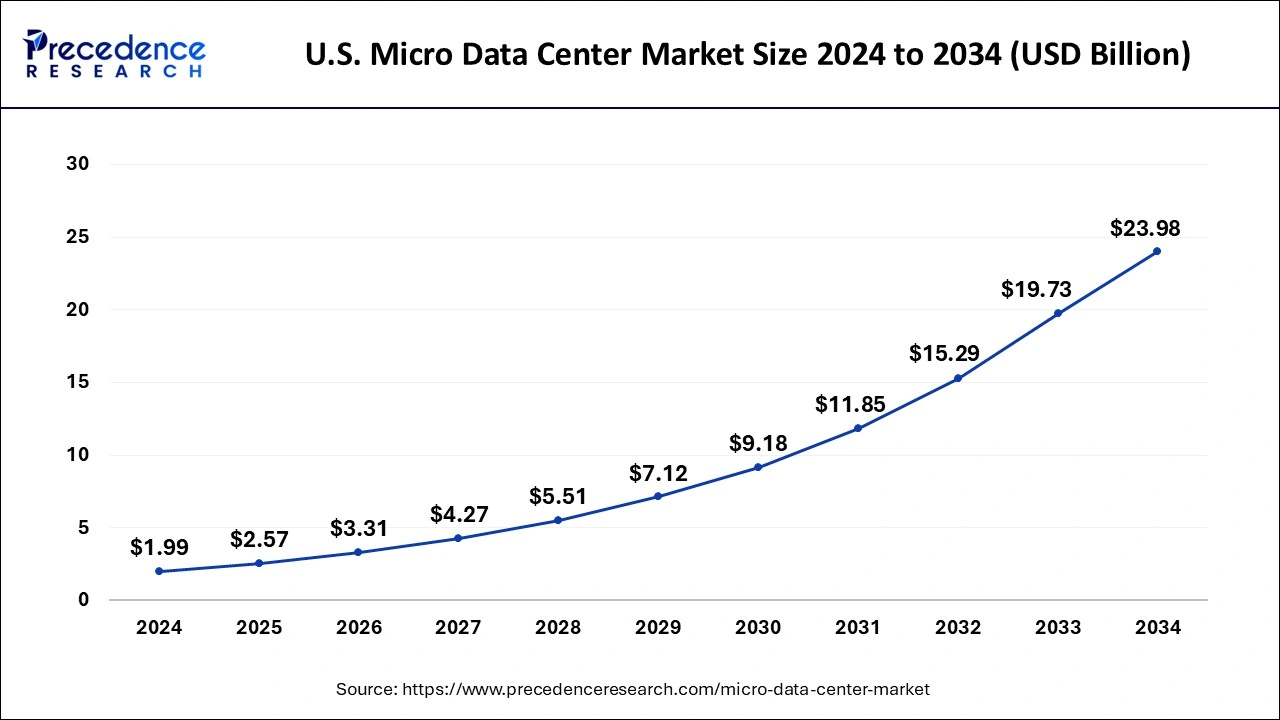

The U.S. micro data center market size reached USD 1.99 billion in 2024 and is projected to reach USD 23.98 billion by 2034, growing at a CAGR of 28.26% from 2025 to 2034.

North America held the largest share of 38% in 2024. The demand for micro data centers in North America is fueled by the growing adoption of edge computing. These data centers bring processing capabilities closer to end-users, reducing latency and enhancing the performance of applications and services.

Moreover, the deployment of 5G networks in North America has led to increased demand for micro data centers to support the distributed and low-latency requirements of 5G infrastructure, especially in densely populated urban areas. For instance, according to the recent data published by 5G Americas, by the end of 2027, there will be 601 million 5G connections in North America, or around 100 million connections annually, at a 36% population penetration rate. There are presently 267 5G and 703 LTE commercial networks in use. Thus, the aforementioned stats are expected to propel the micro data center market during the forecast period.

The micro data center market offers a standalone unit that has management and monitoring software, a UPS, power, and cooling systems, and a rack to accommodate all necessary IT components. Organizations may accelerate deployment speed, limit capital outlay, and reduce footprint and energy use by utilizing micro data centers.

Businesses are being encouraged to deploy micro data solutions at edge sites because of the several benefits that micro facilities provide, including increased networking and connection, cost-effectiveness, mobility, and power economy. Furthermore, these containerized (modular) or micro data center facilities may be quickly deployed, enabling businesses to expand their business operations during periods of high computing demand.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 28.01% |

| Market Size in 2025 | USD 9.65 Billion |

| Market Size by 2034 | USD 88.36 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Component, By Enterprise Size, By Rack Unit, By Application, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising adoption of micro data centers by organizations

Businesses rely on modular solutions that are conveniently situated at the network's edge to lower latency and enhance network connectivity for data processing and transmission. Organizations are being encouraged to deploy micro data center solutions at edge sites because of the several advantages that micro facilities provide, including increased networking and connection, cost-effectiveness, mobility, and power economy. Additionally, the quick installation of micro data center facilities enables businesses to expand their operations during periods of strong computing demand, which boosts the market for micro data centers.

Integration and cost constraints

Integrating Micro Data Centers with existing IT infrastructure and legacy systems can be complex. Compatibility issues and the need for seamless integration may pose challenges for organizations transitioning to or incorporating micro data centers into their overall IT strategy. Additionally, micro data centers can be cost-effective for certain applications, but the initial upfront costs might still be a challenge for some organizations, particularly smaller businesses with limited budgets. The perceived cost savings may also depend on factors like energy efficiency and operational expenses. Thus, this is expected to be a major restraining factor for the micro data center market during the forecast period.

Sustainability benefits of micro data centers

Significant sustainability advantages can also be obtained from micro data centers. Relocating computer resources to the data source reduces the energy required to send the data over a network. Significant energy savings and a decrease in carbon emissions from the energy required to cool and power data centers can come from this. Furthermore, micro data centers frequently have extremely efficient designs with cutting-edge power management and cooling systems that use less energy. For instance, the micro data centers from Zella DC are built with energy efficiency in mind. They decrease energy usage and lower the carbon footprint of data processing by utilizing cutting-edge cooling and power management technology. The micro data centers from Zella DC are among the most energy-efficient data centers on the market right now, with a Power Usage Effectiveness (PUE) as low as 1.2. Lowering energy use and greenhouse gas emissions helps solve environmental challenges in addition to lowering operational expenses for businesses. Thus, this is expected to offer a lucrative opportunity for the micro data center market over the forecast period.

Based on the component, the solution segment held the largest share of the micro data center market in 2024. Micro data centers are designed with a modular approach, allowing organizations to scale their IT infrastructure by adding or removing modular units as needed. This modularity enhances flexibility, enabling businesses to tailor their micro data center setup to their specific requirements. In addition, they often come equipped with integrated cooling systems optimized for the smaller scale of operations.

Efficient cooling solutions are crucial for maintaining the temperature within the micro facility and ensuring optimal performance of IT equipment.

On the other hand, the service segment is expected to grow at the highest CAGR during the forecast period. The segment expansion is attributed to the various service launches by the key market players. For instance, in June 2022, Schneider Electric announced the "modernization" of Ecostruxure IT, its infrastructure management tool, and also introduced a faster prefabricated data center service in Europe. Under the "Easy Modular Data Center All-in-One" brand, Schneider will supply prefabricated containerized data centers ranging in power from 27kW to 80kW that are manufactured at its Barcelona facility.

Based on the enterprise size, the large enterprise segment dominated the micro data center market in 2024. The segment is observed to sustain its position throughout the forecast period. Large enterprises may have fluctuating computing needs. The modular nature of Micro cata Centers allows these organizations to scale their IT infrastructure up or down based on demand, providing a cost-effective solution for dynamic business requirements. Additionally, they often require robust networking solutions. Micro data centers equipped with edge networking capabilities ensure optimized connectivity, enabling efficient communication between the distributed data center nodes and the broader enterprise network.

Besides, the SME segment is expected to grow at a rapid rate over the forecast period. Micro data centers provide SMEs with a cost-effective entry point into data center solutions. The modular and scalable nature of micro data centers allows SMEs to start with a smaller footprint and expand as their computing needs grow.

Based on the application, the edge computing segment is expected to dominate the micro data center market over the forecast period. Micro data centers are designed to handle edge workloads effectively. They provide the necessary computing power, storage, and networking capabilities to process and analyze data locally, minimizing the need to send large volumes of data to centralized data centers. Also, they support local data processing and analytics at the edge. This is particularly beneficial for applications that require real-time insights, such as video analytics, predictive maintenance, and edge-based machine learning.

Based on the industry vertical, the BFSI segment held the largest share of the micro data center market in 2024. BFSI organizations deal with sensitive customer and financial data. Micro data centers can be equipped with advanced security features such as encryption, firewalls, and access controls to ensure data security and compliance with regulatory requirements. Moreover, the modular design of Micro data centers allows BFSI organizations to scale their IT infrastructure based on dynamic computing needs. This adaptability is essential for handling fluctuating workloads, such as during peak transaction times.

Besides, the IT and telecom segment is expected to grow at the highest CAGR during the forecast period. Telecom operators can deploy micro data centers at the edge of their networks to support Mobile Edge Computing (MEC). This enables faster processing of mobile services and applications, leading to improved performance for mobile users. Thus, this is expected to drive the market growth.

By Component

By Enterprise Size

By Rack Unit

By Application

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

March 2025

April 2025

January 2025