January 2025

Micro Inverter Market (By Phase: Single-phase, Three-phase; By Connectivity: Stand Alone, On-grid; By Application: Residential, Commercial) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

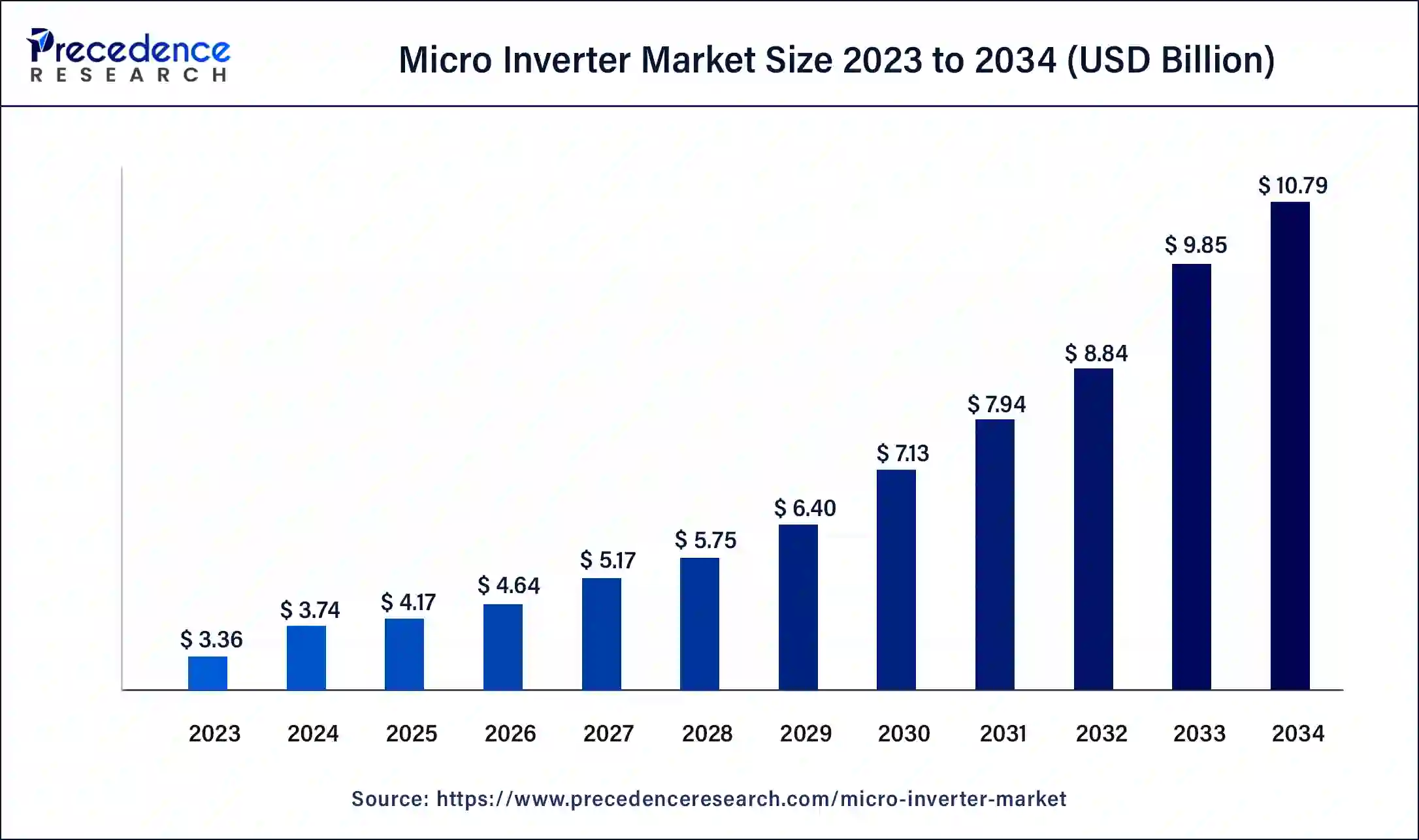

The global micro inverter market size was USD 3.36 billion in 2023, calculated at USD 3.74 billion in 2024 and is expected to reach around USD 10.79 billion by 2034, expanding at a CAGR of 11% from 2024 to 2034. The micro inverter market size reached USD 1.65 billion in 2023. The micro inverter market is driven by a greater need for monitoring at the module level.

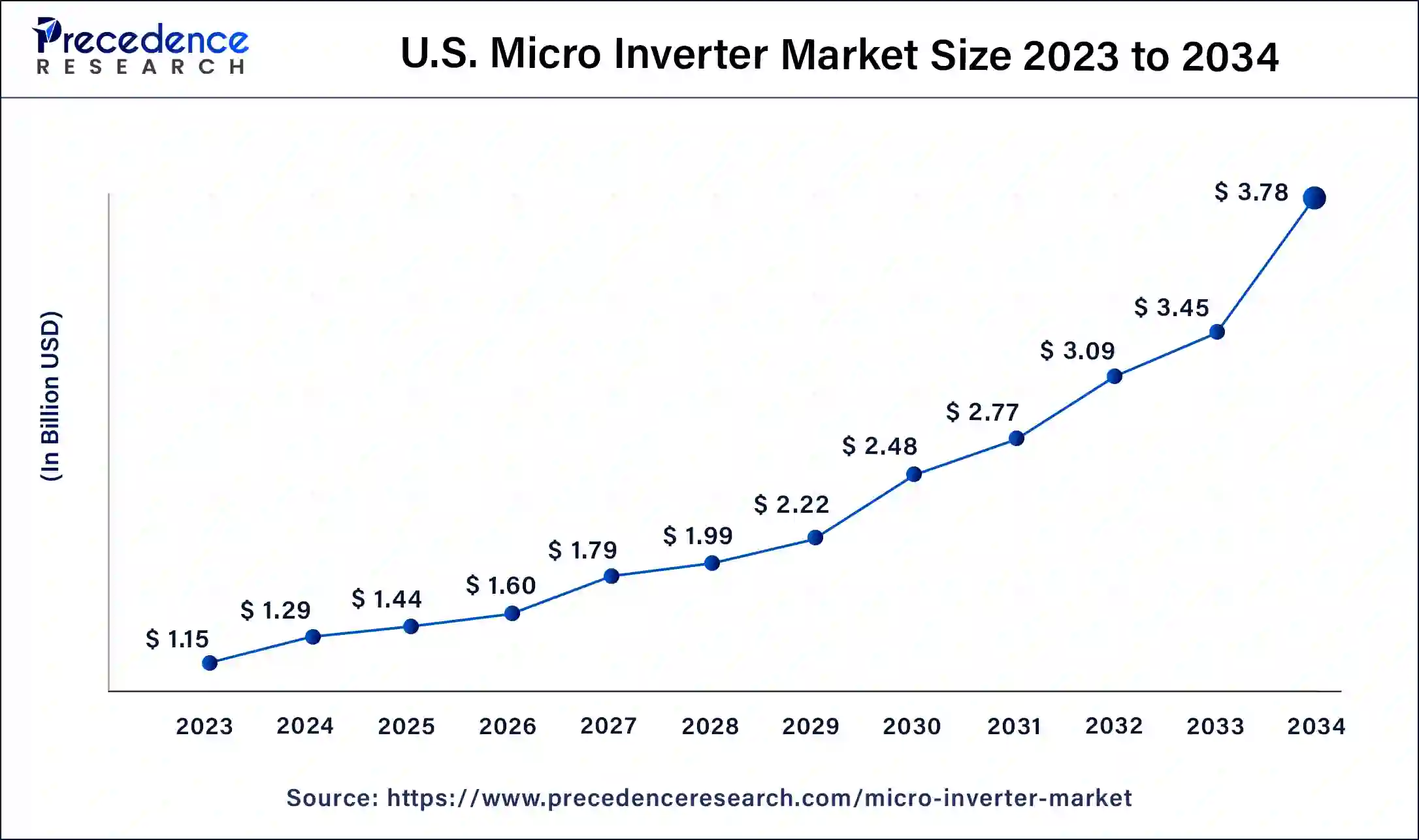

The U.S. micro inverter market size was estimated at USD 1.15 billion in 2023 and is projected to surpass around USD 3.78 billion by 2034 at a CAGR of 11.40% from 2024 to 2034.

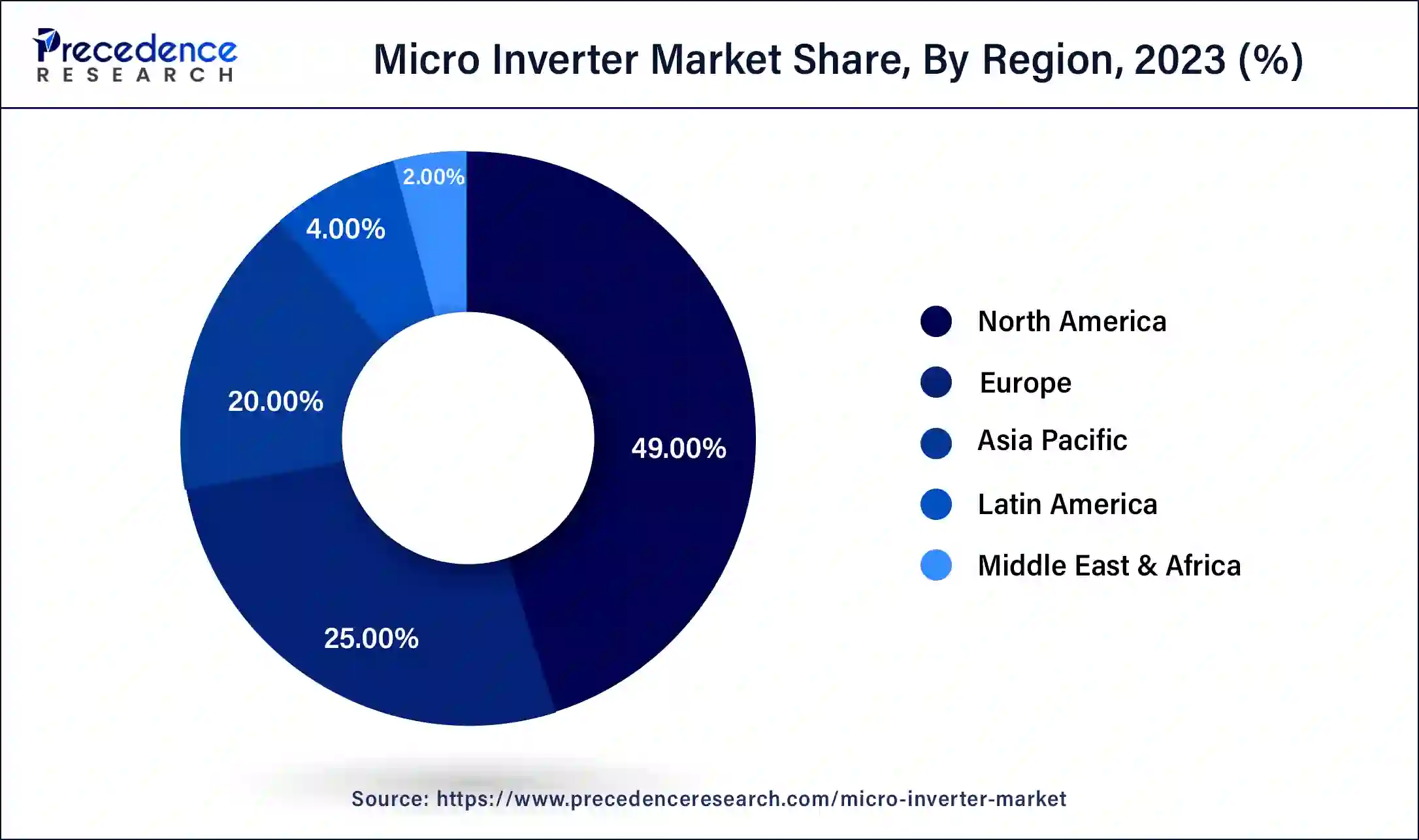

North America had the largest share in 2023 of the micro inverter market. The need for micro inverters has increased due to the growing use of solar photovoltaic (PV) systems in utility-scale, commercial, and residential settings. The need for tiny inverters rises along with the solar industry. Micro inverters are appealing to household and commercial customers who want to get the most energy out of their solar installations because they provide features like shadow tolerance, individual panel optimization, and real-time monitoring. This awareness and demand drive the region's sales of micro inverters.

Europe shows a significant growth in the micro inverter market during the forecast period. Micro inverters and other solar PV components are becoming less expensive as the solar energy sector develops. Because of economies of scale and technological developments, micro inverters are now more reasonably priced and economically viable for use in utility-scale, commercial, and residential solar installations. A growing number of organizations and people in Europe are investing in micro-inverter solar energy systems due to their affordability.

The primary objective of the micro inverter market is to offer solar photovoltaic (PV) systems dependable and effective power conversion solutions. The direct current (DC) electricity generated by solar panels is transformed into alternating current (AC) electricity by micro inverters, making it usable in residences, commercial buildings, and the electrical grid. It has improved safety features like quick shutdown times that enable solar PV systems to abide by safety rules and shield maintenance staff and firefighters in an emergency.

The worldwide demand for distributed solar energy systems drives growth in the micro inverter industry, which is essential for supplying utility-scale, commercial, and residential solar installations.

| Report Coverage | Details |

| Global Market Size by 2033 | USD 10.79 Billion |

| Global Market Size in 2023 | USD 3.36 Billion |

| Global Market Size in 2024 | USD 3.74 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 11% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Phase, Connectivity, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing positive outlook towards green energy

A growing number of people worldwide are turning to renewable energy sources like wind and solar power to lessen their carbon footprint and address climate change. Governments, corporations, and individuals are adopting renewable energy alternatives at an increasing rate to achieve sustainability goals. Micro-inverters are essential to this change because they transform DC power from solar panels into AC power for households and businesses.

The power system needs solutions that facilitate dispersed energy generation and improve grid stability, including renewable energy sources. Micro-inverters regulate voltage variations and provide a steady supply of clean energy, making it easier for solar power systems to integrate into the grid seamlessly. This makes the energy infrastructure more sustainable and resilient.

Availability of auxillary technologies

Interoperability refers to the capacity of various systems and devices to successfully interact and cooperate. Interoperability with other parts, such as energy management platforms or smart home systems, is essential in the context of microinverters. Seamless integration and data transmission might be hampered by limited availability or compatibility problems with auxiliary technologies connected to data communication protocols, such as Modbus, Zigbee, or Wi-Fi standards.

Micro inverters' whole value proposition would be diminished if there was a lack of strong interoperability, making it difficult for end users to monitor, manage, and optimize their solar power systems.

Favorable regulatory inclination toward sustainable energy

Many countries worldwide have set aggressive goals for renewable energy to lower carbon emissions and fight climate change. These objectives frequently include precise targets for solar energy generation capacity. Micro inverters are in high demand because of favorable policies that encourage people and businesses to invest in solar photovoltaic (PV) systems. These rules include subsidies, tax breaks, and feed-in tariffs. Such favorable regulations create a significant opportunity for the micro inverters market.

Governments worldwide are increasingly implementing environmental regulations aimed at reducing carbon emissions and combating climate change. Promoting the adoption of renewable energy technologies like solar power is often a key component of these regulations. Micro inverters enable solar energy systems to generate clean electricity without producing greenhouse gas emissions, aligning with the goals of environmental regulations.

Regulatory bodies often establish energy efficiency standards for electrical equipment to promote sustainability and reduce energy consumption. Micro inverters, compared to traditional string inverters, offer advantages such as individual panel-level optimization and higher efficiency under varying conditions. Regulations that incentivize or mandate the use of more efficient inverters can drive market growth for micro inverter manufacturers.

The single-phase segment dominated the micro inverter market in 2023. Regarding performance and efficiency, single-phase microinverters outperform conventional string inverters. Power losses from soiling, panel mismatch, and shading are reduced when DC to AC conversion occurs at the panel level. Higher overall system efficiency results from this individual panel optimization, ensuring each panel runs independently at its maximum power point (MPP).

Isolating the output from each solar panel from the rest of the system improves system safety and dependability. When using typical string inverter systems, the performance of the entire string might be impacted by a single panel malfunction or shade. This risk is reduced by using microinverters because continuous power generation is ensured, and the failure of one panel does not adversely affect the others.

The three-phase segment shows a significant growth in the micro inverter market during the forecast period. Improved performance in solar energy systems and grid stability are two benefits of three-phase systems. Distributing power evenly among the three phases lowers the possibility of voltage imbalances and increases system efficiency. This is especially crucial in systems connected to the grid because preserving grid stability is essential. The market for three-phase micro inverters is expanding as utilities and grid operators emphasize power quality and system dependability.

Although three-phase micro inverters were formerly thought to be more expensive, economies of scale and technical advancements have decreased their cost. A wider range of clients, including commercial and industrial project developers, are becoming more interested in three-phase micro inverters due to their cost-competitiveness and improved performance in particular applications.

The on-grid segment held a significant share of the micro inverter market in 2023. There is a noticeable spike in demand for solar energy solutions as the emphasis on renewable energy became more widespread worldwide. To adopt sustainable energy sources and lessen their carbon impact, businesses, consumers, and governments all looked for solutions. The market for micro inverters, particularly the on-grid segment, benefited directly from this increased demand because these inverters are essential to grid-connected solar photovoltaic (PV) installations.

On-grid micro inverter costs have decreased over time due to supplier rivalry, enhanced production techniques, and economies of scale. These inverters are now more affordable, making them more suitable for utility-scale projects, small companies, and home users.

The residential segment dominated the micro inverter market in 2023. Micro inverters can extract more energy from each solar panel by functioning at the panel level. This is very helpful in residential contexts, where rooftops may have different orientations, tilts, and shading patterns. Compared to string inverters, which may have performance losses due to shade or panel mismatch, micro inverters allow each panel to function to its fullest capacity, producing more energy overall. The household solar business has grown significantly due to falling solar panel prices, government incentives, and rising homeowner environmental consciousness. Micro inverters are in high demand as more homes switch to solar power.

The commercial segment is the fastest growing in the micro inverter market during the forecast period. Micro inverters provide a scalable, easily expandable solution to meet changing commercial solar power needs. Businesses that want to grow their solar installations over time or have changing energy needs would significantly benefit from this scalability. Because of their adaptability, micro inverters are an excellent option for commercial projects because they are simple to integrate into new or existing solar installations. Many micro inverter systems have sophisticated monitoring features that offer real-time data on how well each solar panel performs.

This degree of visibility is essential for commercial enterprises looking to maximize energy production, quickly detect problems, and plan maintenance as needed. Identifying issues at the panel level improves system reliability overall and decreases downtime, which is necessary for commercial applications.

Segments Covered in the Report

By Phase

By Connectivity

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

January 2025

November 2024