November 2024

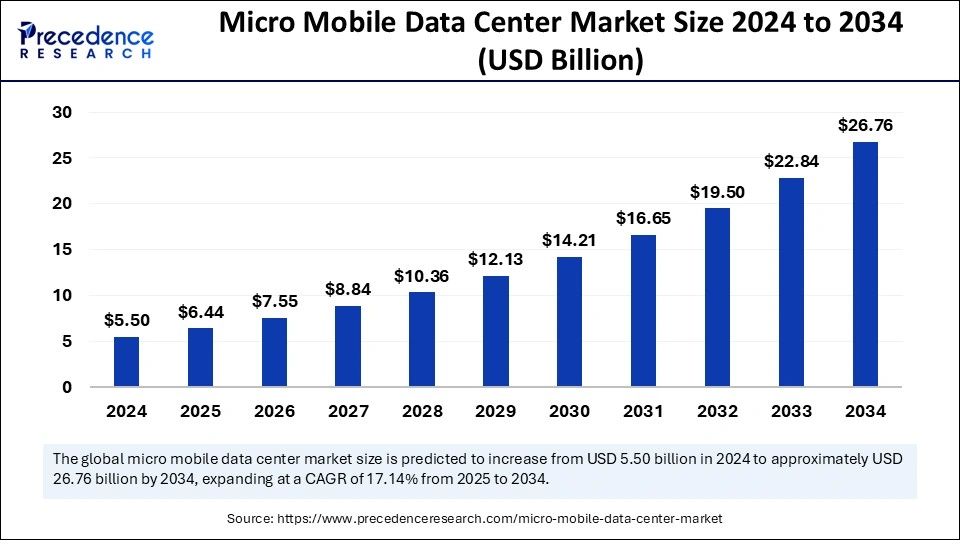

The global micro mobile data center market size is calculated at USD 6.44 billion in 2025 and is forecasted to reach around USD 26.76 billion by 2034, accelerating at a CAGR of 17.14% from 2025 to 2034. The North America market size surpassed USD 2.26 billion in 2024 and is expanding at a CAGR of 17.26% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global micro mobile data center market size was estimated at USD 5.50 billion in 2024 and is predicted to increase from USD 6.44 billion in 2025 to approximately USD 26.76 billion by 2034, expanding at a CAGR of 17.14% from 2025 to 2034. The growth of the market is driven by the increasing demand for low-latency data processing, the rising adoption of edge computing, and the rising deployment of scalable IT infrastructure across industries.

Artificial intelligence brings advancements in operational effectiveness, security enhancements, and predictive maintenance capabilities. AI-driven automation optimizes resource management, which decreases operational interruptions and boosts energy efficiency levels. Machine learning models protect micro mobile data centers from security threats through their capability to detect impending attacks before they result in system interruptions. Edge AI, a combination of edge computing and AI, helps activate instant analysis, which leads to better speed and performance outputs for remote applications. Moreover, AI optimizes power consumption and resource allocations within micro data centers.

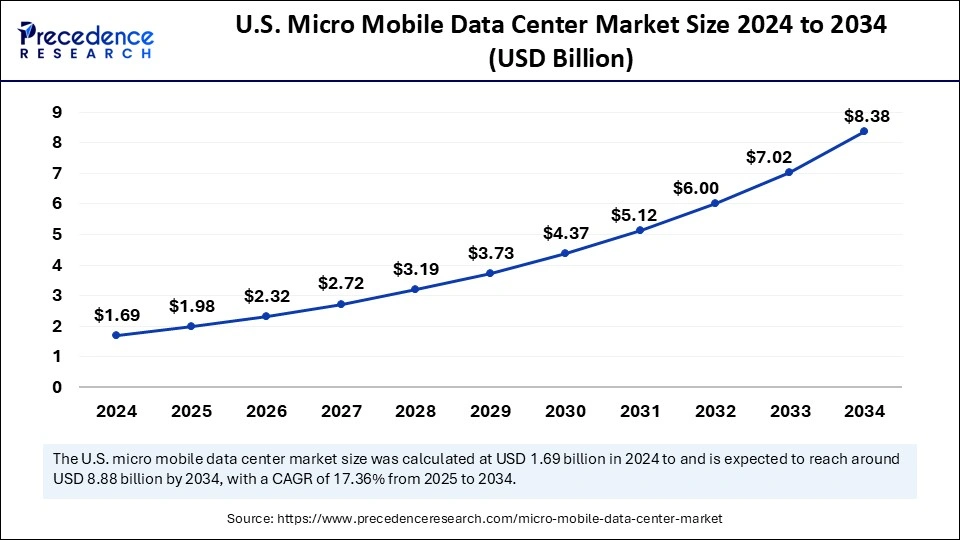

The U.S. micro mobile data center market size was exhibited at USD 1.69 billion in 2024 and is projected to be worth around USD 8.38 billion by 2034, growing at a CAGR of 17.36% from 2025 to 2034.

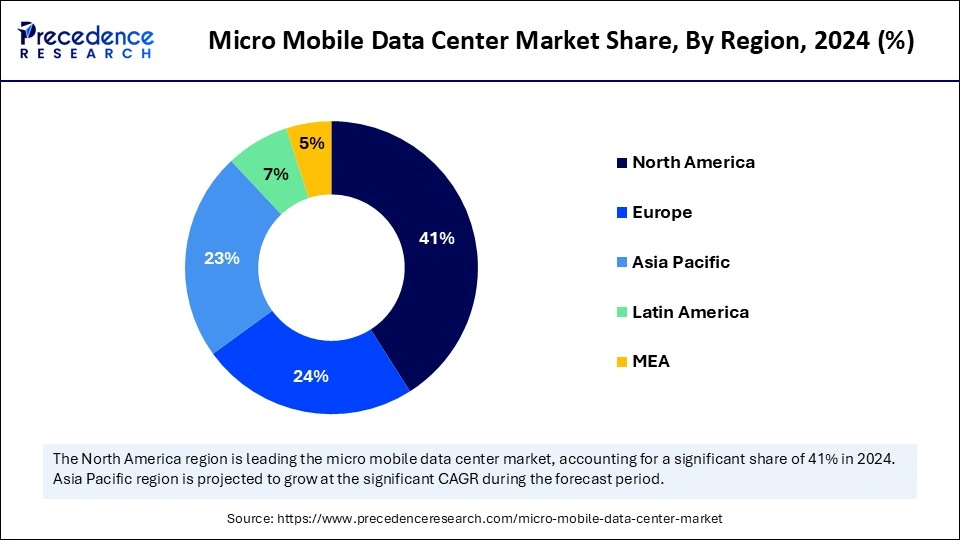

North America dominated the micro mobile data center market in 2024 by capturing the largest share. This is mainly due to its advanced IT infrastructure. The region is an early adopter of edge computing solutions. The rise in the need for data-intensive applications and Internet of Things devices boosted the need for localized data processing, which resulted in higher deployment of micro mobile data centers for fast and low-latency data processing. The rise of energy conservation goals within data centers has led industries to invest in micro mobile data centers, as they deliver adaptable solutions that combine dimensional flexibility with energy conservation advantages.

Strong national support for digital transformation and substantial cybersecurity measures encouraged industries to adopt micro mobile data centers throughout the U.S. The Federal Communications Commission (FCC) supports network expansions through its effort to encourage edge computing capabilities that depend on modular data center infrastructure. There is a high demand for micro data centers in Canada due to its smart city development and the expanding digital economy activities. Furthermore, the industry 4.0 and digitalization initiatives by the Mexican government support market expansion in this region.

Asia Pacific is expected to witness the fastest growth in the coming years. The rapid expansion of the IT sector highlights the need for micro mobile data centers. The rising government and public sector initiatives to support cloud adoption further contribute to the growth of the region's micro mobile data center market.

The Ministry of Electronics and Information Technology in India works actively to promote data localization that boosts the demand for scalable data center solutions. Furthermore, the rising usage of IoT, blockchain, and AI technologies in various industries and rising smart city projects require localized processing solutions. The proliferation of IT infrastructure further boosts the need for micro mobile data centers.

Micro mobile data center units consist of integrated all-in-one data processing units that enhance both speed and performance through localized computing solutions. These centers unite components, including computing, storage, and networking, inside one sealed container to support rapid deployments across different settings. The micro mobile data center market is expected to grow at a rapid pace due to the rising digitization in the healthcare sector. The World Health Organization (WHO) Global Strategy on Digital Health 2020-2025 report recognizes that digital health solutions with IoT technology and big data are transformative elements in healthcare service delivery. Furthermore, the increasing awareness about the importance of decentralized computing boosts the need for micro mobile data centers to serve as fundamental enablers for expanding data management needs.

| Report Coverage | Details |

| Market Size by 2034 | USD 26.76 Billion |

| Market Size in 2025 | USD 6.44 Billion |

| Market Size in 2024 | USD 5.50 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 17.14% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Rack Unit, Enterprise Size, Application, End-use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing Demand for Edge Computing

Increasing adoption of edge computing is anticipated to drive the growth of the micro mobile data center market. As enterprises seek faster data processing with lower latency, the need for mobile data centers increases. The increasing number of Internet users further highlight the need for distributed computing power to effectively deal with the intensifying data transfer. The rising adoption of Internet of Things (IoT) devices, 5G, and AI also boost the demand for micro mobile data center technology. The adoption of compact data centers by communication companies and medical and manufacturing sectors near end-user locations enables instant data analysis while reducing network bottlenecks. Furthermore, the rise of edge computing demonstrates its fundamental position in addressing the expanding needs of data-oriented technology.

High Initial Investment

Deploying micro mobile data centers requires high upfront investment in hardware and software, which creates challenges for small and medium-sized enterprises (SMEs) seeking scalable computing solutions. Building modular data centers requires substantial investments in sophisticated cooling systems, backup power systems, and enhanced security elements. Organizations facing budgetary restrictions tend to put off adopting superior data centers that operate efficiently as they maintain fundamental IT systems. Moreover, these data centers require regular maintenance, adding to operational costs. The financial difficulties and insufficient support for high-tech infrastructure development create obstacles for organizations.

High Need for Disaster Recovery Solutions

High reliance on digital infrastructure boosts the need for mobile and scalable disaster recovery solutions, creating immense opportunities for key players competing in the market. The growing dependence on digital infrastructure drives the need for mobile disaster recovery platforms, which leads to substantial business opportunities for micro mobile data centers. Organizations that encounter cyber threats, natural disasters, and system breakdowns invest in modular data centers for quick implementation and continual business operations.

There is a rising need for on-demand data center solutions as they deliver required assistance quickly when risks are high. Malicious cyber actors target enterprise networks through zero-day vulnerabilities on a growing scale, as the National Security Agency (NSA) reported in 2024, creating a strong requirement for efficient disaster recovery solutions. Furthermore, micro mobile data centers play an essential role in developing disaster recovery solutions for numerous industries with the current trends, further propelling the growth of the micro mobile data center market in the coming years.

The above 40 RU segment dominated the micro mobile data center market with the largest share in 2024. This is mainly due to the rise in the need for dense computing systems. Large data-intensive organizations, together with enterprises, employed these larger rack units as they require extensive storage and processing capacity, mainly for big data analytics and large-scale virtualization applications. Organizations chose the above 40 RU micro mobile data centers for their portability that handle heavy IT workloads effectively.

The 20 to 40 RU segment is projected to grow at the fastest rate in the coming years as organizations highly demand adaptable and efficient data center solutions. The capacity level of these units matches well with their compact design that makes them appropriate for businesses of medium size and edge computing systems. Modern data centers need to be situated near data sources because of the increasing deployment of IoT devices and the growing adoption of edge computing. This further boosts the demand for reduced latency for real-time processing possibilities. Furthermore, 20 to 40 RU units are a leading factor in developing micro mobile data centers.

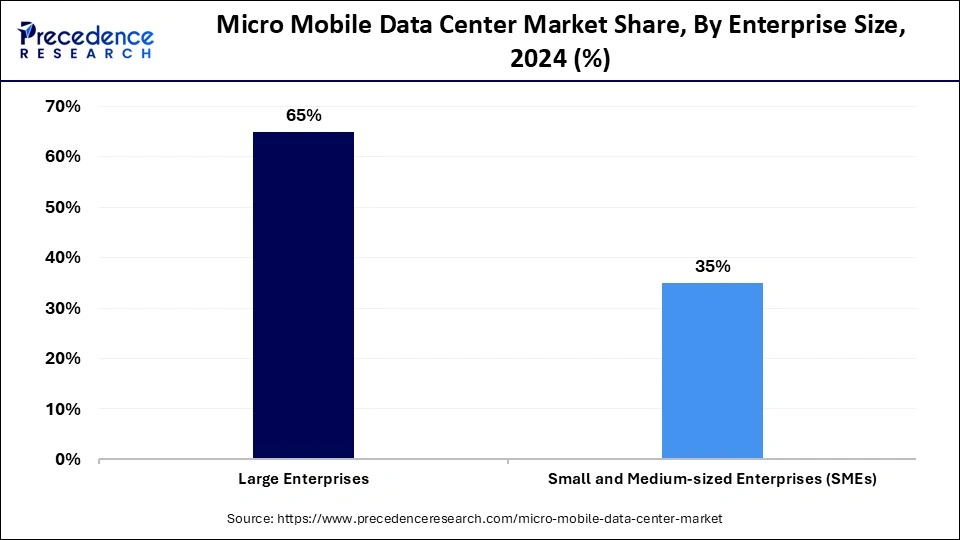

The large enterprises segment held the largest share of the micro mobile data center market in 2024, as they possess large volumes of data, requiring scalable infrastructure. These organizations often installed micro mobile data centers across their operations to ensure both high system access and resilient disaster recovery protocols. The rapid deployment and flexible features of these data centers allow large enterprises to improve operational efficiency according to requirements. Businesses requiring adaptable data solution platforms for integrating advanced technologies, including artificial intelligence and big data analytics, accelerated their adoption of modern data center capabilities. The U.S. Census Bureau showed that data center employment grew by more than 60% around the entire nation between 2016 and 2023 due to increasing dependence on data-intensive work.

The small & medium medium-sized enterprises (SMEs) segment is anticipated to grow at a significant CAGR during the studied period, as SMEs adopt advanced digital systems while searching for scalable, efficient data centers that support their business expansion. SMEs are increasingly drawn to edge computing and localized data processing needs, which compels them to implement these deployable data center solutions. Micro mobile data centers are ideal for SMEs, especially those with budget constraints. The rising adoption of IoT and edge computing in SMEs further boosts the demand for micro mobile data centers.

The edge computing segment dominated the micro mobile data center market with the largest share in 2024. This is due to the rise in the adoption of IoT devices and rising requirements for real-time data processing. Manufacturing, healthcare, and telecommunications industries often prefer edge computing solutions as they cut down on latency and boost operational performance. The strategic placement of micro mobile data centers at network edges lets organizations make better decisions faster and lessens the demand for centralized centers for data processing. Furthermore, the ITU projected that global mobile traffic would reach a staggering 6.5 ZB by 2025, indicating a need for edge computing solutions.

The disaster recovery & emergency response segment is projected to expand at a notable rate in the coming years. Many organizations prioritize disaster recovery solutions, as these solutions protect vital data while ensuring continuous business operations in the case of cyber threats, natural disasters, and system failures. The rapid deployability and the scalability of micro mobile data centers make them the perfect choice for emergency response situations that need immediate data processing together with storage capacities. Additionally, U.S. utilities saw a nearly 70% increase in cyberattacks in 2024 compared to 2023, according to data from Check Point Research. This highlights the urgent need for disaster recovery solutions to address the escalating risks.

The IT & telecom segment held the largest share of the micro mobile data center market in 2024 due to the rise in the need to process data at distributed points for cloud applications along with their role in handling increasing data transmission volumes. The expansion of 5G networks encouraged telecommunication companies to use micro mobile data centers, which helped them perform better network services while offering low-latency services. The increased cloud-based services and wireless connectivity usage expanded rapidly in the IT sector, which bolstered the segment.

The government and defense segment is expected to witness rapid growth in the near future. The rising demand for on-site data processing is encouraging the government and defense sectors to adopt micro mobile data centers. Military operations, together with homeland security agencies, utilize small mobile data centers to enhance battlefield communications while collecting intelligence information and performing immediate threat identification. The U.S. Department of Defense invests heavily in modular data centers to develop tactical cloud computing and establish safe access to vital mission data. Governments across the world are strengthening their cybersecurity standards, boosting the need for flexible data centers, such as micro mobile data centers.

In March 2025, Microsoft has reaffirmed its commitment to advancing Malaysia's cloud and AI economy with the introduction of its upcoming hyperscale cloud region, named Malaysia West. This will be Microsoft's first cloud region in the country, strategically located in Greater Kuala Lumpur, and is scheduled to go live in the second quarter of 2025. Laurence Si, Managing Director of Microsoft Malaysia, stated, "With the rapid pace of innovation in Malaysia, the upcoming Malaysia West cloud region is not just a technological infrastructure; it is essential for powering the nation's growing AI economy. Local businesses and organizations will be able to innovate faster and more securely, driving the country's progress toward becoming the hub for cloud and AI growth in Southeast Asia.".

By Rack Unit

By Enterprise Size

By Application

By End-use

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

February 2025

January 2025

August 2024