December 2024

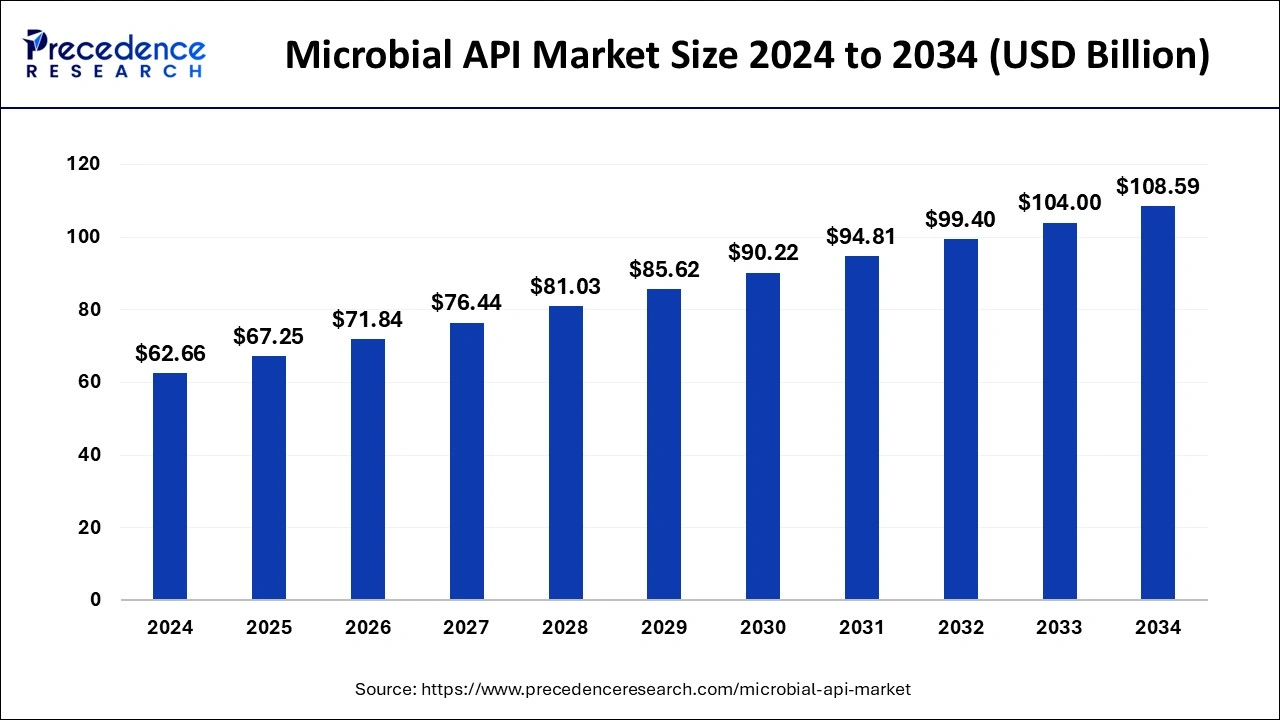

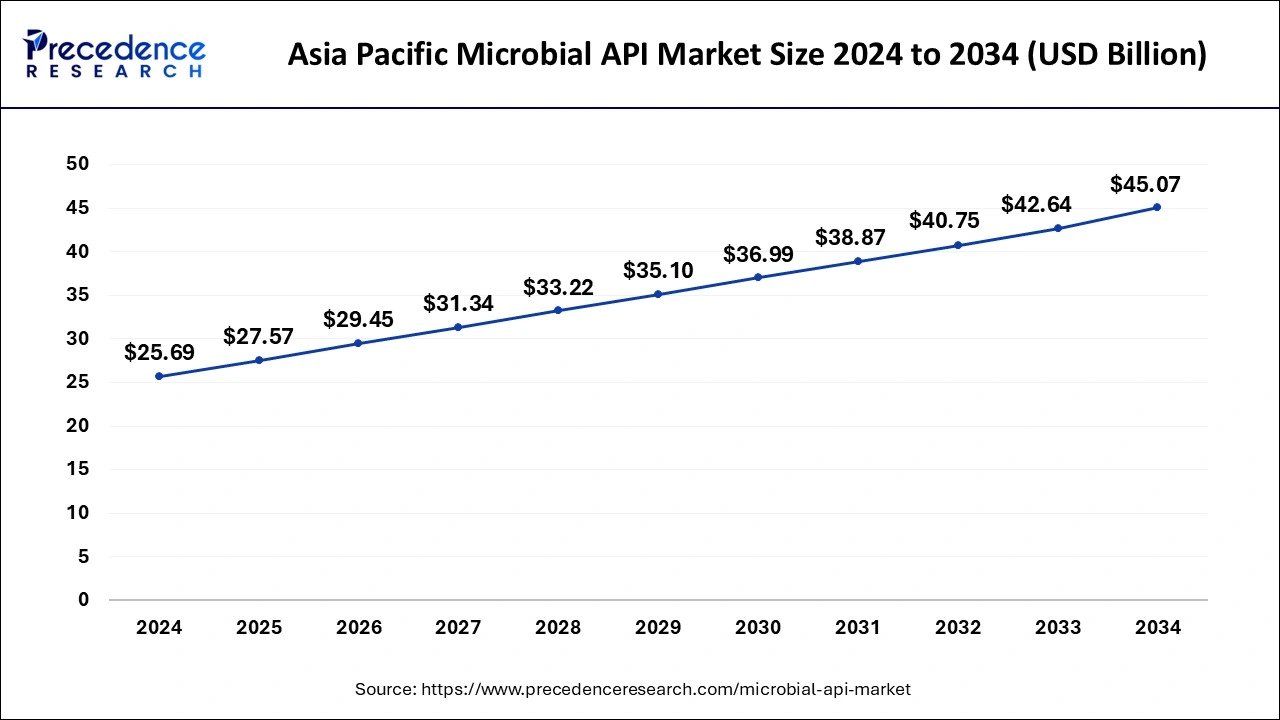

The global microbial API market size is accounted at USD 67.25 billion in 2025 and is forecasted to hit around USD 108.59 billion by 2034, representing a CAGR of 5.65% from 2025 to 2034. The Asia Pacific market size was estimated at USD 25.69 billion in 2024 and is expanding at a CAGR of 5.78% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global microbial API market size was calculated at USD 62.66 billion in 2024 and is predicted to increase from USD 67.25 billion in 2025 to approximately USD 108.59 billion by 2034, expanding at a CAGR of 5.65% from 2025 to 2034.

The Asia Pacific microbial API market size was evaluated at USD 25.69 billion in 2024 and is projected to be worth around USD 45.07 billion by 2034, growing at a CAGR of 5.78% from 2025 to 2034.

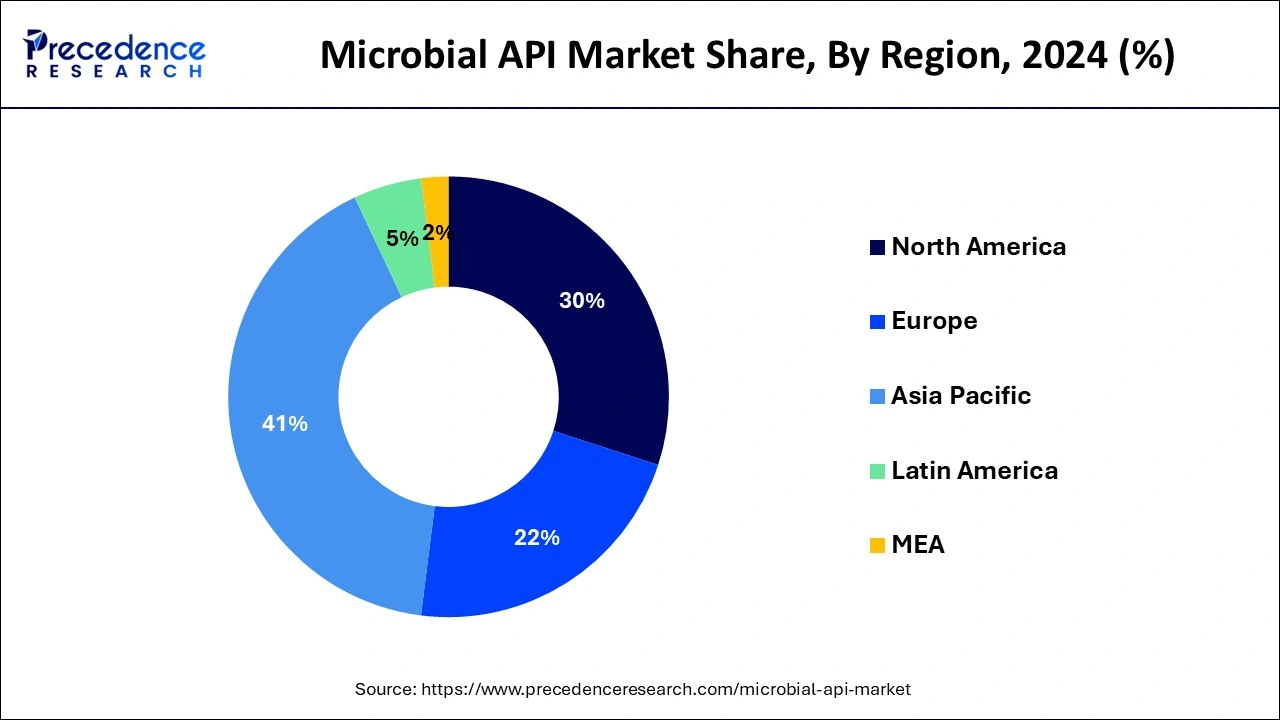

Asia-Pacific dominates the microbial API market due to several key factors. The region benefits from a robust pharmaceutical manufacturing ecosystem, cost-effective production capabilities, and a large pool of skilled labor.

Moreover, favorable government initiatives, such as 'Make in India' in India and similar programs in other countries, encourage domestic production, driving the microbial API market's growth. The rising prevalence of diseases, increasing healthcare investments, and a rapidly expanding patient population contribute to Asia-Pacific's significant share in the global microbial API market.

Europe is poised for rapid growth in the microbial API market due to several factors. The region's strong pharmaceutical industry, coupled with a favorable regulatory environment and increasing investments in research and development, creates a conducive atmosphere for market expansion. Additionally, the rising prevalence of chronic diseases and the growing emphasis on sustainable and cost-effective manufacturing processes further drive the demand for microbial APIs. With a well-established healthcare infrastructure and a proactive approach to innovation, Europe stands at the forefront of the microbial API market's anticipated growth.

Meanwhile, North America is experiencing notable growth in the microbial API market due to several contributing factors. The region benefits from a well-established pharmaceutical industry, advanced research and development capabilities, and a strong emphasis on innovation. The rising prevalence of chronic diseases, coupled with increasing investments in healthcare infrastructure, further propels the demand for microbial APIs. Additionally, a supportive regulatory environment and a focus on personalized medicine contribute to the notable rate of growth in North America's microbial API market.

Microbial APIs, essential in the pharmaceutical realm, are vital components forming the foundation of various medicines. Unlike traditional chemical methods, these APIs are crafted through fermentation processes involving tiny organisms like bacteria, yeast, or fungi. This technique is advantageous, offering cost-effectiveness, scalability, and sustainability. In the production of microbial APIs, microorganisms are carefully manipulated to generate specific therapeutic compounds, serving as active ingredients in pharmaceuticals. The microbial fermentation process enables the efficient and precise synthesis of complex molecules, contributing to a range of drugs like antibiotics, hormones, and vaccines. Embracing microbial APIs aligns with the industry's push for innovative and eco-friendly manufacturing practices. As the demand for pharmaceuticals continues to surge, microbial APIs emerge as a crucial, sustainable solution, transforming the landscape of modern drug development and production.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 5.65% |

| Market Size in 2025 | USD 67.25 Billion |

| Market Size By 2034 | USD 108.59 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Molecule, Host, and Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising incidence of chronic diseases

The increasing number of chronic diseases worldwide is spurring a higher demand for microbial active pharmaceutical ingredients (APIs). Conditions like heart diseases, diabetes, and neurological disorders have risen significantly, prompting the pharmaceutical industry to search for innovative solutions. Microbial APIs are instrumental in creating therapies for these health issues. Global health data shows that chronic diseases contribute substantially to illness and death globally, emphasizing the urgent need for effective treatments.

In response, the pharmaceutical sector is intensifying research and development, using microbial APIs to formulate medications that precisely target the complexities of chronic diseases. This growing demand underscores the vital role of microbial APIs in shaping the future of pharmaceuticals to meet the changing healthcare needs driven by the increasing prevalence of chronic conditions.

Limited infrastructure and competition from chemical synthesis

Limited infrastructure poses a significant restraint on the microbial API market as the establishment of specialized facilities for large-scale microbial fermentation proves challenging. Regions lacking the necessary infrastructure face delays in entering the market, hindering the overall growth potential. The demand for microbial APIs may be compromised in these areas due to the inability to support efficient and cost-effective production processes.

Competition from chemical synthesis methods presents another obstacle to the microbial API market. Established and widely used in the pharmaceutical industry, chemical synthesis is deeply ingrained, and some stakeholders may be hesitant to transition to microbial fermentation. Perceived as predictable and controllable, chemical methods pose a competitive challenge to microbial APIs, affecting their market demand. Overcoming this restraint requires a concerted effort to showcase the advantages of microbial APIs in terms of sustainability, efficiency, and product innovation, thereby convincing the industry of their long-term benefits.

Government initiatives for healthcare

Government initiatives for healthcare are pivotal in creating opportunities for the microbial API market—programs aimed at bolstering healthcare infrastructure and promoting domestic manufacturing.

These initiatives often include financial incentives, streamlined regulatory processes, and support for research and development, encouraging companies to invest in the development and manufacturing of microbial APIs within the country. As governments prioritize self-sufficiency in pharmaceuticals and healthcare, microbial API manufacturers stand to benefit from increased demand and a supportive regulatory framework. The alignment of government healthcare initiatives with the goals of the microbial API market not only fosters economic growth but also contributes to the resilience and sustainability of the pharmaceutical industry, offering a strategic advantage for companies operating in this space.

The innovative molecule segment dominated the microbial API market in 2024; the segment is observed to continue the trend throughout the forecast period. The innovative molecule segment in the microbial API market refers to the development of novel and groundbreaking molecules using microbial fermentation processes. This segment is characterized by the discovery and production of unique active pharmaceutical ingredients (APIs) with distinct therapeutic properties. Emerging trends indicate a surge in research and investment focused on designing microbial APIs that address unmet medical needs, ranging from advanced antibiotics to specialized biopharmaceuticals. The drive for innovation in this segment is reshaping the microbial API market, offering new avenues for pharmaceutical breakthroughs and expanded treatment options.

The generic segment is expected to grow at a significant rate throughout the forecast period. In the microbial API market, the generic molecule segment refers to the production of microbial-based active pharmaceutical ingredients used in generic drugs. This segment is characterized by the cost-effective synthesis of well-established molecules, offering pharmaceutical manufacturers affordable alternatives to brand-name medications.

In emerging economies like India and Brazil, the generic drug market is expected to experience significant growth due to the increasing acceptance of over-the-counter (OTC) medications and substantial unmet clinical needs. Generic Highly Potent Active Pharmaceutical Ingredients (HPAPI) are gaining traction in these regions, primarily driven by their cost-effectiveness. This affordability enables them to meet the healthcare requirements of a growing patient population in developing areas with lower-income demographics.

The mammalian segment is observed to hold the dominating share of the microbial API market during the forecast period. In the microbial API market, the mammalian segment refers to the production of active pharmaceutical ingredients using mammalian cell cultures. This approach is crucial for manufacturing complex biologics and therapeutic proteins. A notable trend in this segment involves continuous advancements in mammalian cell culture technology, optimizing yields and ensuring the efficient production of high-quality microbial APIs. The mammalian segment's growth is driven by the rising demand for biopharmaceuticals, including monoclonal antibodies and recombinant proteins, reflecting the industry's ongoing shift towards innovative and biologically derived therapeutic solutions.

The bacterial segment is expected to generate a notable revenue share in the market. In the microbial API market, the bacterial segment pertains to the utilization of bacteria in the production of active pharmaceutical ingredients. This segment involves leveraging bacterial fermentation processes to generate specific compounds with therapeutic properties. Recent trends indicate a growing preference for bacterial-derived APIs due to advancements in genetic engineering, allowing for the optimization of bacterial strains. This trend aligns with the industry's pursuit of efficient and sustainable manufacturing methods, contributing to the expanding role of bacterial segments in microbial API production.

The antibody segment is observed to hold the dominating share of the microbial API market during the forecast period. Within the microbial API market, the antibody segment focuses on crafting therapeutic antibodies through microbial fermentation processes. These antibodies are pivotal in combating diseases like cancer and autoimmune disorders. A noteworthy trend in this sector is the growing desire for monoclonal antibodies, prized for their precision and efficacy in targeted therapies. The antibody segment is expanding due to advancements in microbial fermentation technology, facilitating the economical and scalable production of these biopharmaceuticals. This caters to the increasing global need for inventive treatments based on antibodies.

The peptide segment is expected to generate a notable revenue share in the market. Within the microbial API market, the peptide segment pertains to active pharmaceutical ingredients produced through microbial fermentation. Peptides, key components in treating conditions like cancer and metabolic disorders, are experiencing a notable trend. This trend involves a heightened focus on creating advanced and precisely targeted peptide-based medications, spurred by biotechnological advancements. The Peptide segment is responding to the increasing demand for personalized healthcare, witnessing a rise in research and development endeavors to align with evolving healthcare requirements.

By Molecule

By Host

By Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

January 2025

August 2024

October 2024