December 2024

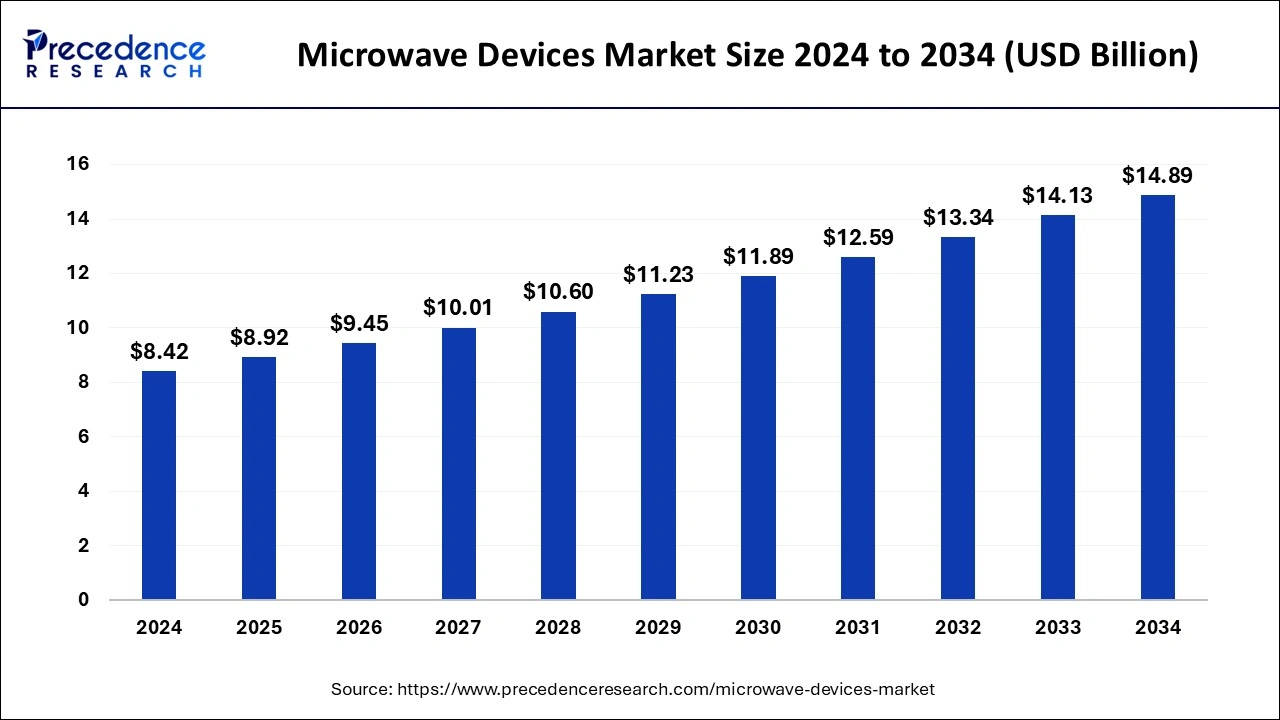

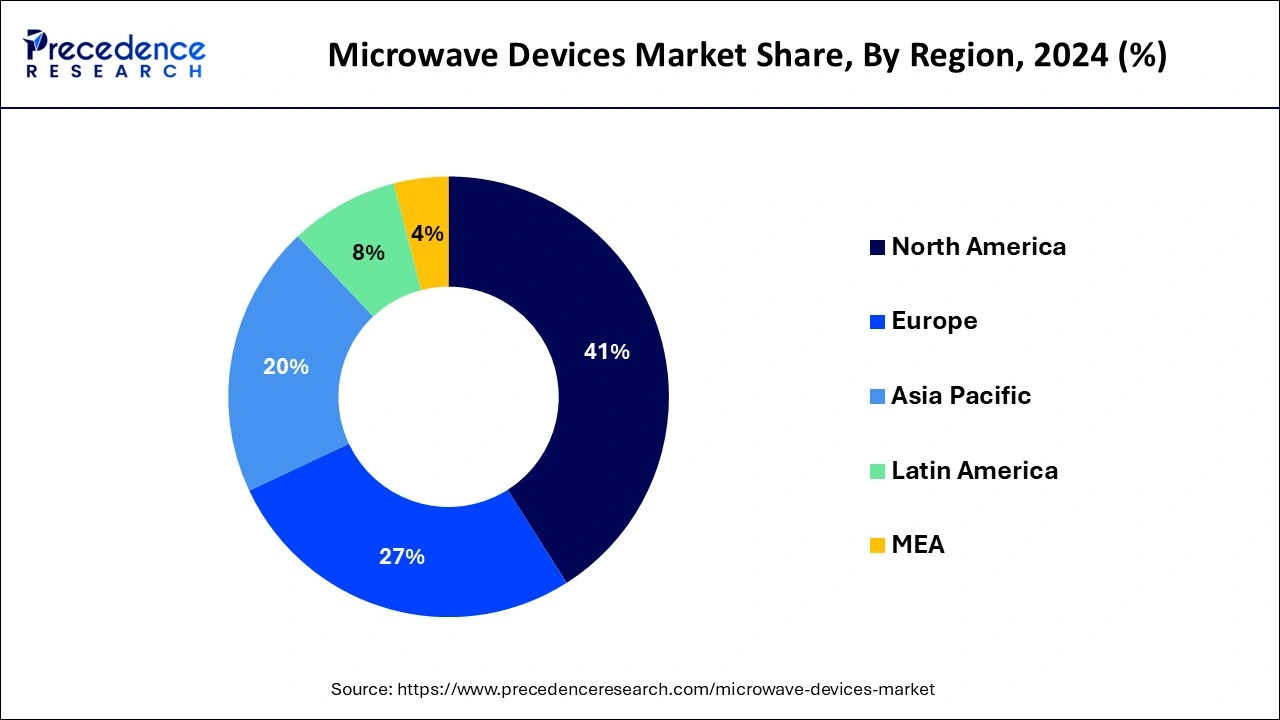

The global microwave devices market size is calculated at USD 8.92 billion in 2025 and is forecasted to reach around USD 14.89 billion by 2034, accelerating at a CAGR of 5.87% from 2025 to 2034. The North America microwave devices market size surpassed USD 2.86 billion in 2024 and is expanding at a CAGR of 5.87% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global microwave devices market size was estimated at USD 8.42 billion in 2024 and is predicted to increase from USD 8.92 billion in 2025 to approximately USD 14.89 billion by 2034, expanding at a CAGR of 5.87% from 2025 to 2034. Rising the telecom industries can boost the microwave devices market.

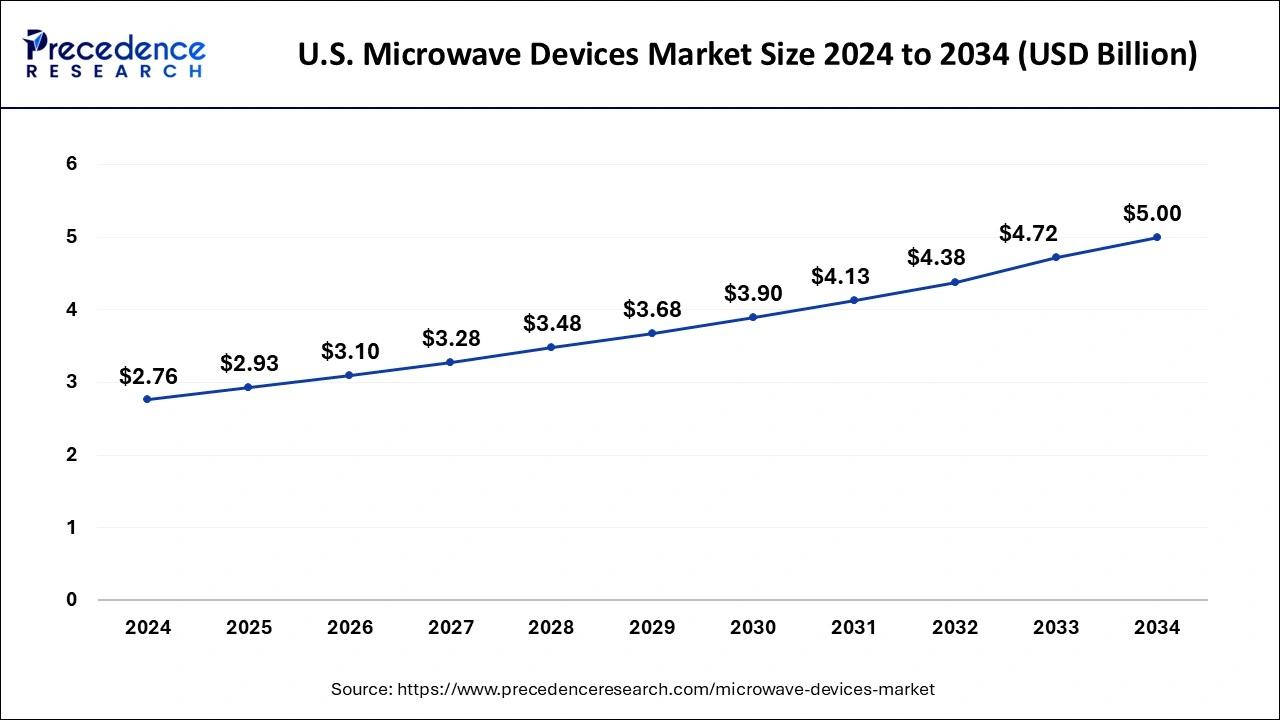

The U.S. microwave devices market size was exhibited at USD 2.76 billion in 2024 and is projected to be worth around USD 5.00 billion by 2034, poised to grow at a CAGR of 6.12% from 2025 to 2034.

North America dominated the global microwave devices market in 2024. Due to its one of the biggest defense expenditures in the world, the United States, in particular, has made huge investments in cutting-edge military technology, such as microwave devices for electronic warfare, radar, and communication infrastructure. Microwave technology is essential for the ongoing development and deployment of cutting-edge military projects like unmanned aerial vehicles (UAVs) and missile defense systems. Innovation in technology and research and development (R&D) is led globally by North America, especially the United States. Across a range of applications, this contains notable developments in microwave technology.

The microwave devices market domination is aided by the existence of top technological firms and defense contractors that are at the forefront of microwave technology development. Being among the first countries to use 5G technology, the United States and Canada needed to build a large amount of microwave devices for network infrastructure.

Asia Pacific is expected to grow at the highest CAGR in the microwave devices market during the forecast period. The rapid rollout of 5G networks in nations like China, Japan, South Korea, and India is creating a great demand for microwave equipment, particularly front haul and back haul, for the development of infrastructure. Microwave technology is being driven by some of the biggest IT businesses and manufacturers in the world, which are based in Asia Pacific.

In order to update their military capabilities, several nations in the region, including China and India, are expanding their defense budgets, which is creating a need for sophisticated microwave devices for electronic warfare, radar, and communication systems. The microwave devices market is being further stimulated by governments enhancing their defense infrastructure in response to ongoing geopolitical tensions and security concerns in the area.

The microwave devices market refers to the electronic systems and parts that function in the microwave frequency range, which is normally between 300 MHz (0.3 GHz) and 300 GHz, known as microwave devices. The applications for these devices include medical equipment, satellite communications, radar systems, telecommunications, and more.

Modern communication networks, scientific research, medical diagnosis and treatment, and a wide range of industrial uses all depend heavily on microwave technology. In many cutting-edge technologies, their capacity to tolerate high frequencies and offer fine control over signal transmission makes them important.

The microwave devices market is fragmented with multiple small-scale and large-scale players, such as Analog Devices, Inc., Teledyne Technologies, Texas Instruments, CPI International, L3 Harris Technologies, Inc., Macom, Cytec Corporation, General Dynamics, Honeywell International Inc., Mitsubishi Electric Corporation, Panasonic Corporation, Qorvo, Thales Group, Cobham Limited, Richardson Electronics, and Toshiba Corporation.

| Report Coverage | Details |

| Market Size by 2034 | USD 14.89 Billion |

| Market Size in 2025 | USD 8.92 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.87% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Band Frequency, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising demand for medical instruments equipped with microwave devices

The rising demand for medical instruments equipped with microwave devices can grow the microwave devices market. One of the main factors propelling the market's growth is the expanding application of microwave devices in medicine. Microwave devices are predicted to rise in popularity as long as these technologies keep developing and showing how valuable they are for bettering patient outcomes and healthcare efficiency.

The high price of microwave devices in terms of technology

The high price of microwave devices in terms of technology may slow down the microwave devices market. The high cost of microwaves can hinder market expansion in a number of ways, including discouraging adoption, promoting substitutes, raising operating and maintenance expenses, and erecting obstacles in the form of financial and economic hurdles for potential customers. Reducing costs, providing a positive return on investment, and maybe covering the cost of first expenditures to promote broader adoption are necessary to overcome these obstacles.

Rapid commercialization of microwave devices in the telecom industry

The rapid commercialization of microwave devices in the telecom industry can be an opportunity to boost the microwave devices market. The deployment of 5G networks requires extensive infrastructure, including microwave devices for backhaul and fronthaul to connect base stations and core networks. The microwave devices support the low latency and high-speed requirements of 5G, making them essential for widespread 5G adoption.

The exponential growth in data consumption due to streaming, gaming, and cloud services drives the need for robust and high-capacity communication networks that rely on the microwave devices market. Microwave devices provide efficient bandwidth utilization, which is crucial for managing increased data traffic in telecom networks.

The C-band segment dominated the microwave devices market in 2024 and is projected to sustain its position throughout the forecast period. The C-band (4 to 8 GHz) is perfect for high-capacity telecommunications because it provides a good balance between bandwidth and range. It is capable of supporting the coverage and data speeds needed for contemporary communication networks. Parts of the C-band spectrum have been set aside for 5G services by many nations and telecom providers. Compared to higher frequency bands, this band offers better penetration and coverage and can handle large data flow, making it essential for 5G.

In the microwave devices market, satellite communications in the C-band have been utilized for data transfer, broadcasting, and weather monitoring for a very long time. It is dependable for satellite links due to its capacity to pass through various atmospheric conditions, including rain. Satellite signals are more dependable when using C-band frequencies as they are less susceptible to rain fading than higher frequency bands (such as Ku-band and Ka-band).

The X-band segment is expected to grow at the highest CAGR in the microwave devices market during the forecast period. Military radar systems frequently employ X-band frequencies (8 to 12 GHz) because of their capacity to provide high-resolution images, which is essential for targeting, navigation, and surveillance. Because of its precision and dependability in tracking and aiming, the X-band is crucial for missile guidance systems.

Satellite communications employ X-band frequencies, especially for military and government usage in the microwave devices market. They offer dependable communication channels with fast data transmission speeds. Because the X-band balances bandwidth and antenna size well, it is frequently used in the growing constellation of tiny satellite and CubeSat deployments for a variety of uses, including communication and earth observation. Earth observation satellites utilize X-band radar to track weather patterns, climate change, and natural disasters.

The military & defense segment dominated the microwave devices market in 2024. Due to the crucial role that microwave technologies play in contemporary defense systems, rising defense spending brought on by geopolitical tensions, and the strategic significance of sophisticated radar, communication, and electronic warfare systems, the military and defense segment led the microwave devices market by application in 2023. The market for microwave devices is dominated by the military and defense industry, as these aspects together highlight.

Many nations are making significant investments to update their defense infrastructure, integrating cutting-edge microwave technology to boost efficiency and capability. Cutting-edge weaponry and advanced weapon systems, such as directed energy weapons, electronic warfare systems, and radar-guided bombs, have been developed largely thanks to microwave devices. For navigation, targeting, and surveillance, the military uses high-performance radar equipment. For these applications, excellent resolution and precision are provided by microwave frequencies, particularly those in the X-band and above. The microwave devices market plays a critical role in military operations by providing high-bandwidth, secure communication channels that are less prone to espionage and interference.

The communication segment is expected to grow at the fastest rate in the microwave devices market during the projected period. The broad availability of microwave communication equipment is necessary for the global development of 5G networks. The need for microwave devices is increased by 5G technology, which depends on higher frequency bands, such as millimeter waves, to deliver high-speed data transfer and minimal latency. The usage of microwave devices for backhaul and fronthaul networks is rising due to significant expenditures made by governments and telecom carriers in 5G infrastructure. Microwave devices are in high demand due to the increase in internet consumption caused by streaming services, online gaming, and cloud-based applications. These factors also call for improved communication infrastructure.

Strong communication networks are necessary for the widespread use of Internet of Things (IoT) devices and smart technologies, which is driving the microwave devices market to continue expanding. The global rollout of 5G networks, rising data consumption, technological advancements in telecommunications, regulatory support, and the increasing demand for reliable, high-capacity communication infrastructure in both urban and rural areas are the main drivers of the communication segment's expected high CAGR in the market.

By Band Frequency

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024

November 2024

October 2024

April 2025