November 2024

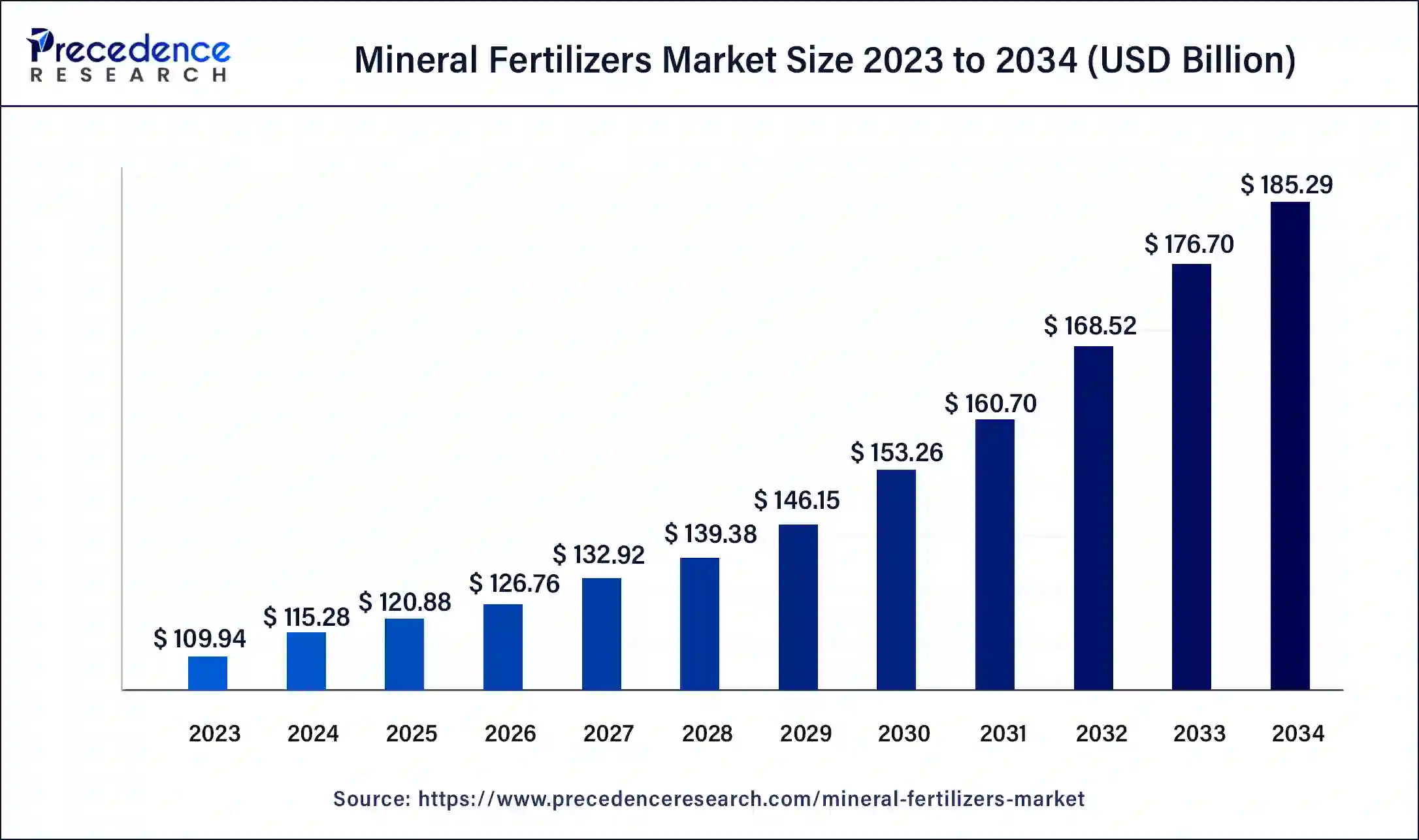

The global mineral fertilizers market size was USD 109.94 billion in 2023, calculated at USD 115.28 billion in 2024 and is expected to be worth around USD 185.29 billion by 2034. The market is slated to expand at 4.86% CAGR between 2024 and 2034.

The global mineral fertilizers market size is projected to be worth USD 115.28 billion in 2024 and is expected to reach around USD 185.29 billion by 2034, growing at a solid CAGR of 4.86% over the forecast period 2024 to 2034. The major factors driving the mineral fertilizers market are growth in emerging markets, a low-interest environment, and government support.

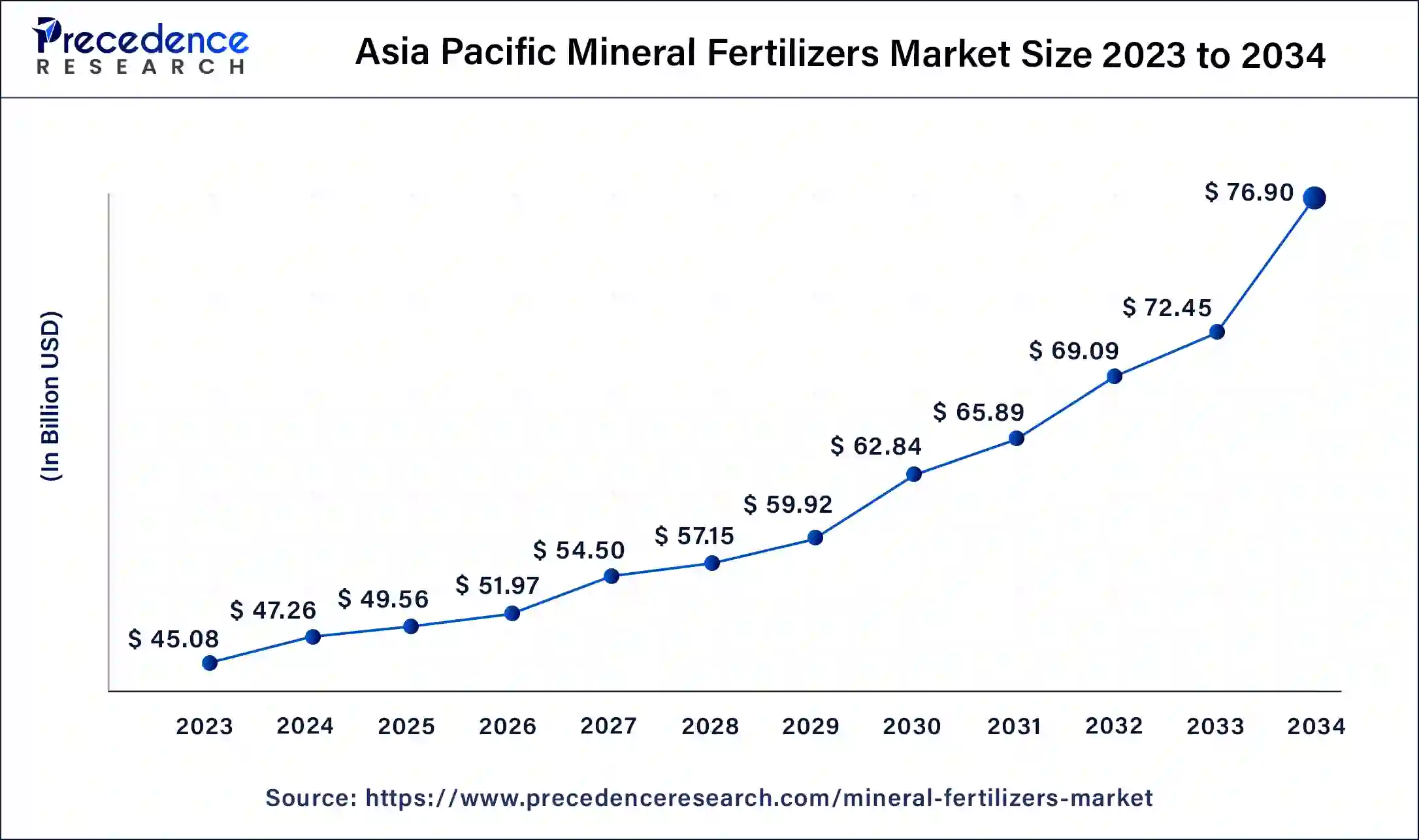

The Asia Pacific mineral fertilizers market size was exhibited at USD 45.08 billion in 2023 and is projected to be worth around USD 76.90 billion by 2034, poised to grow at a CAGR of 4.97% from 2024 to 2034.

Asia Pacific dominated the mineral fertilizers market in 2023. Asian countries such as Korea, Japan, China, and Vietnam are utilizing high nitrogen fertilizer levels per hectare for both perennial and short-term crops. Among these nations, China is anticipated to lead the market, with a projected market share. This dominance is mainly due to the rising demand for agricultural products in the region, which is propelling the growth of the mineral fertilizers market.

North America is anticipated to witness the fastest growth in the mineral fertilizers market over the period studied. The United States fertilizer industry is influenced by numerous factors, including the presence of advanced agricultural practices and the increasing adoption of technology within the sector. Crop demand and output requirements, which may be influenced by local government regulations and subsidies, play a significant role. Additionally, producers' fertilizer purchasing decisions are impacted by global price fluctuations, particularly for crops like maize and soybeans. The growing implementation of precision agricultural technologies is also driving the demand for fertilizers in the country and the region.

Mineral fertilizers are inorganic compounds, primarily salts, that supply essential nutrients to plants. Both the soil and plants can be negatively impacted by mineral fertilizers. These fertilizers undergo various transformations within the soil, affecting their permeability, nutrient solubility, and availability to plants. Chemically processed to meet crop requirements, mineral fertilizers can deliver nutrients to plants in precise, scientifically determined quantities.

Mineral fertilizers contain nutrient levels far exceeding those of organic fertilizers and are the most efficient means of improving crop quality and yield when applied properly. The number of mineral fertilizers applied per hectare is a key measure of agricultural productivity, particularly in crop cultivation, which is the most vital sector of agriculture.

| Report Coverage | Details |

| Market Size by 2034 | USD 185.29 Billion |

| Market Size in 2023 | USD 109.94 Billion |

| Market Size in 2024 | USD 115.28 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.86% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Nutrient Type, Crop Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing demand for nutrient-dense fertilizers

Mineral fertilizers are rich in nutrients and provide essential nourishment to a variety of crops. These fertilizers are made up of organic materials, including animal manure, agricultural waste, or sewage sludge, combined with minerals. The organic matter in organo-mineral fertilizers helps shield the inorganic elements through adsorption, thus slowing the release of nutrients to plants.

Additionally, mineral fertilizers contribute to higher crop yields by enhancing crop productivity and increasing the plants' water retention capacity. This is achieved by reducing nutrient leaching losses. The detrimental effects of other fertilizers caused by prolonged chemical exposure may further drive the mineral fertilizers market.

Raw material availability and cost

The fertilizer industry is currently encountering substantial challenges related to the availability and fluctuating costs of raw materials needed for fertilizer production. The primary cause of price volatility is the imbalance between supply and demand. However, Nations such as India are particularly disadvantaged due to a scarcity of natural resources essential for fertilizer manufacturing. These factors can hamper the mineral fertilizers market growth.

Utilization of high-efficacy fertilizers

High-efficiency fertilizers are increasingly gaining traction in the mineral fertilizers market, marking a notable trend. Environmental concerns such as nutrient runoff and greenhouse gas emissions are driving the adoption of sustainable agriculture practices and precision agriculture. These factors present potential market opportunities for the future.

The agriculture industry is witnessing a surge in demand driven by the growing global population and the need for improved food security. Higher agricultural output is necessary to meet this increased food production requirement, boosting the demand for nitrogen-based fertilizers, phosphates, and potash. This trend is particularly significant in developing economies and expanding agricultural sectors.

The potash-based fertilizers segment dominated the mineral fertilizers market in 2023. This can be attributed to the maturation of plants by improving their health, root strength, disease resistance, and yield rates. Advanced fertilizers, such as nitrogen-based fertilizers, phosphates, and potash, are vital for boosting crop yield and maintaining soil nutrients. These essential minerals are in high demand among developing economies and agricultural sectors. Additionally, maintaining an adequate supply of potassium in the soil is important for promoting healthy and nutritious plant growth.

The nitrogen-based fertilizer segment is expected to show the fastest growth in the mineral fertilizers market over the forecast period. Nitrogen plays a vital role in plant growth and reproduction, with pasture and crop growth frequently benefiting from increased soil nitrogen availability. This is often managed by adding nitrogen fertilizers, which primarily promote leafy growth in plants. The nitrogenous fertilizer industry also involves the production of synthetic ammonia, nitric acid, ammonium nitrate, and urea. Synthetic ammonia and nitric acid mainly serve as intermediates in producing ammonium nitrate and urea fertilizers.

The oilseed segment dominated the global mineral fertilizers market in 2023. Oilseeds are primarily grown for the extraction of edible oils. These seeds are a significant source of oils for human consumption, and they're by-products for animal feed. Major oilseeds include rapeseed, peanut, soybean, and cottonseed. However, the productivity of oilseeds is often hampered by the lack of advanced technologies, cultivation under resource-limited conditions, and challenges created by biotic and abiotic stresses.

The cereals segment is expected to grow at the fastest rate in the mineral fertilizers market over the projected Period. Seed wheat (or other cereal seeds) should be true to its specific variety and as free as possible from foreign seeds. Moreover, the surge in at-home breakfast eating and the renewed popularity of cereals for breakfast have driven consumer demand. While taste has traditionally been the top priority for consumers when choosing breakfast cereals, the pandemic has led to an increased focus on health, which can propel the segment's growth.

The table shows the countries with the largest production of cereals in 2020

| Rank | Country/Region | Cereal Production (Tonnes) |

| 1. | People's Republic of China | 615,518,145 |

| 2. | United States | 434,875,197 |

| 3. | India | 335,035,000 |

| 4. | Russia | 130,037,708 |

| 5. | Brazil | 125,568,280 |

| 6. | Argentina | 86,573,396 |

| 7. | Indonesia | 77,149,202 |

| 8. | Canada | 65,013,700 |

| 9. | Ukraine | 64,342,357 |

| 10. | Bangladesh | 59,960,399 |

The foliar spray segment led the mineral fertilizers market in 2023. Foliar spraying involves directly applying nutrients, boosters, or pesticides to a plant's leaves and stems. The liquid material is absorbed through the plant's pores, known as stomata, as well as through the epidermis. While foliar spraying is effective for building plant health in the short term, it should complement a long-term soil-building program. Although nothing can replace soil feeding, foliar applications can be beneficial at certain times of the year or as a temporary solution for nutrient deficiencies until the soil can adequately supply them.

The fertigation segment is expected to show the fastest growth in the mineral fertilizers market over the forecast period. Fertigation is an agricultural technique that involves applying water and fertilizer together through irrigation, and this method helps maximize yield while minimizing pollution. Moreover, fertigation allows farmers to distribute nutrients uniformly across their fields as needed. It is commonly used for row crops, horticultural crops, fruit crops, vegetable crops, and ornamental and flowering crops.

Segments Covered in the Reports

By Nutrient Type

By Crop Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

December 2024

November 2024

September 2024